Building blocks for economic growth

What’s your favorite car? — Week of February 17, 2025

Essential Economics

— Mark Frears

1965 Lemans

I have owned a few older, classic cars, and they have usually been convertibles. It’s not like I have to worry about the wind messing up my hair. The white Lemans with turquoise interior has to be my favorite, outside my first car, a 1970 Oldsmobile Cutlass. You felt like you were the king of the world driving one of those around, at least as long as you could keep it running.

The consumer is still in the driver’s seat as far as economic growth. Let’s see how they are doing.

Shopping

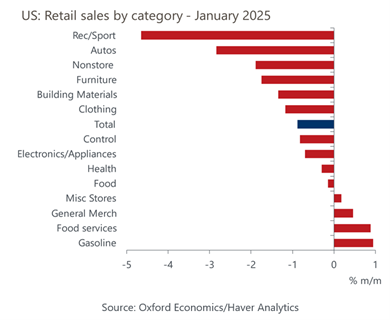

If you drove your car to the store, for a change, instead of buying online, you didn’t buy as much last month. Retail sales for January were down by 0.9%, weaker than the expected -0.1%. The breakout of what we spend our hard-earned dollars on is below.

Given the colder weather across the country and the wildfires in California, this is not surprising. We spent more on the basics and less on discretionary items. As the Retail Sales metric is weighted more heavily toward goods, the January slowdown is not unexpected. After a very strong December, we need to see further information before drawing conclusions.

In order for us to spend, we need jobs and need to feel confident that we will continue to have jobs. The January nonfarm payroll release did not show the addition of as many jobs as expected, but as you can see below, the longer-term trend is very positive.

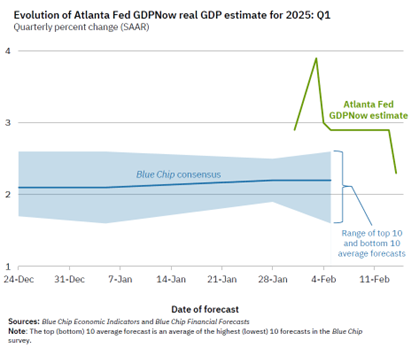

If we have jobs, we will spend, and Gross Domestic Product will continue at a good pace. The Atlanta Fed GDPNow forecast has dropped in the most recent week (see below) but remains consistent with the Blue Chip consensus.

The underlying fundamentals are still set up for a growing, vibrant economy. The business environment is positive, with earnings supporting continued growth. Tariffs are a moving target and could slow the economic engine somewhat, but recent forecasts do not expect this to derail the positive momentum.

Costs

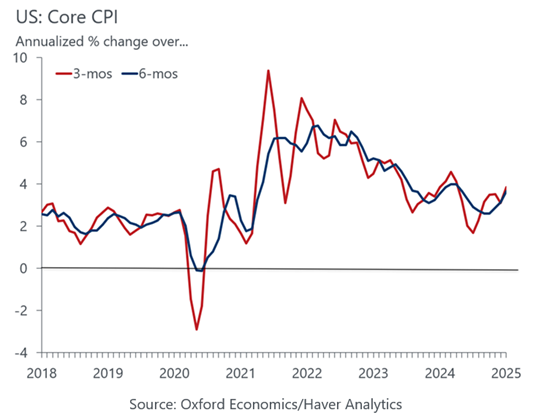

Last week we also had the Consumer Price Index (CPI) and Producer Price Index (PPI); both came in above expectations, as inflation continues to weigh on the economy.

As seen below, the core CPI rate (excluding food and energy) trend is on an uptick. I like this view as it gives a better picture by looking at the change over three- and six-month periods.

While we all know we cannot exclude food and energy from our spending and we feel the impact, the FOMC likes this perspective as it should be less volatile. Even in the core, we are seeing an upturn in costs.

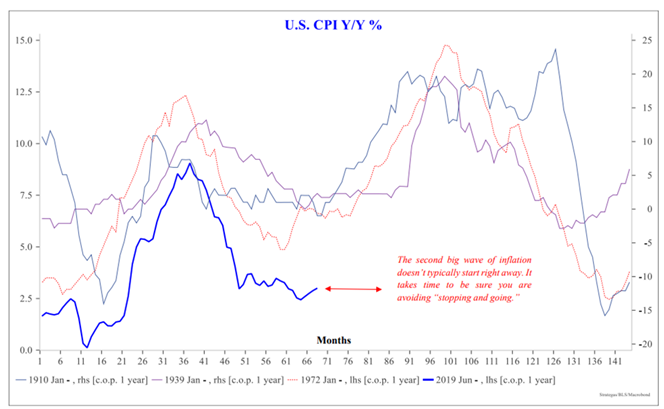

Historically inflation moves in waves. It does not simply move up and down. The chart below shows we have bottomed in the current cycle and are poised to head higher.

The FOMC has acknowledged this by not continuing to lower the target Fed Funds rate. Based on the strength of the labor market and the potential for costs to rise, they need to carefully consider their next move.

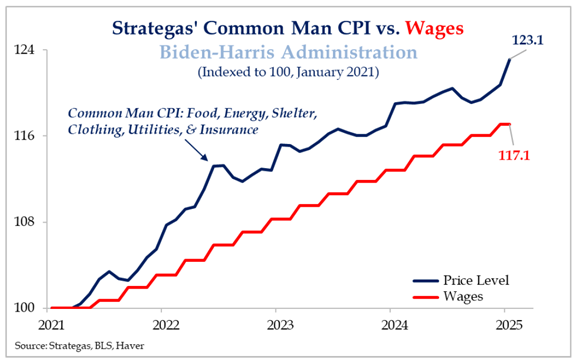

Taking this down to basics, the Strategas Research team looks at the cost of what we really need to buy versus what wages have done. The chart below shows the gap continuing to widen as ordinary households struggle to pay for what they need.

I owe, I owe

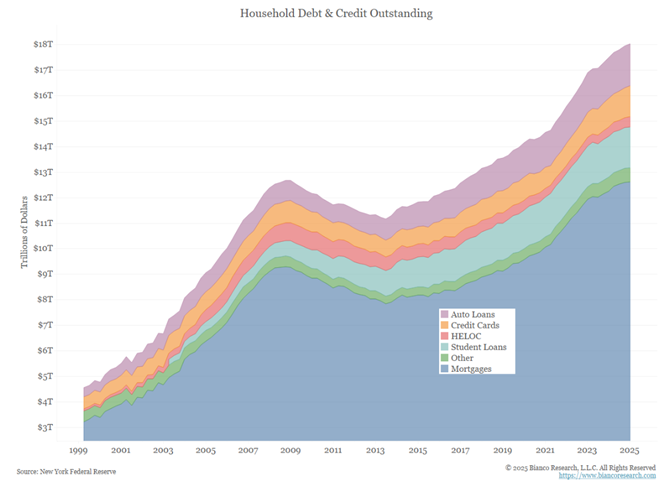

Partially due to optimism in the future and partially due to need, consumer debt is growing at an unsustainable pace. As you can see below, auto loans and credit cards are rising the fastest.

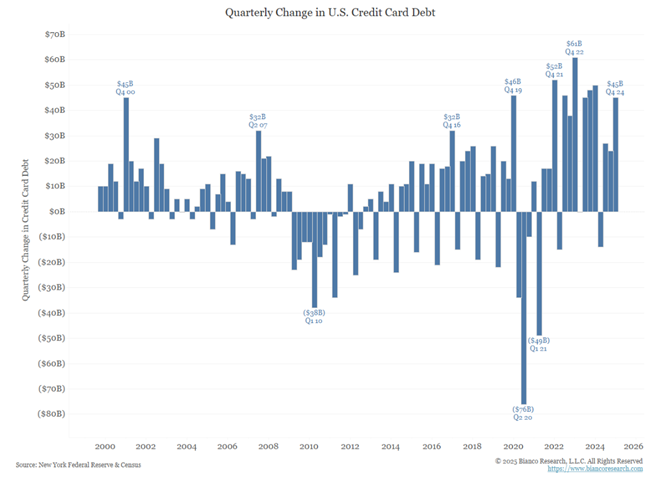

As we saw above, credit card debt is one of the fastest-growing categories. This is generally utilized when savings have run out and there is nowhere else to turn to for meeting your needs. The chart below shows that in the fourth quarter of 2024, we relied more and more on this instrument.

The other significant impact of this growing debt category is the cost. When you are paying north of 20% interest on your balances, it makes it very difficult to make meaningful payments against the principal. Sounds like the same issue the U.S. government is having.

So, while growth looks good, there are some things to keep an eye on that could slow down your drive.

Economic releases

Last week saw higher inflation and slower retail sales, although the markets were more focused on D.C. and geopolitical issues.

This week’s calendar will give us the most recent glimpse at the housing market, as well as consumer sentiment. See below for more detail.

Wrap-Up

Traveling in a convertible on a nice day is a wonderful experience. While you are enjoying the ride, always stay vigilant to potential obstacles and obstructions ahead.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 18-Feb | Empire Manufacturing | Feb | 0.0 | (12.6) |

| 18-Feb | NAHB Housing Market Index | Feb | 46 | 47 |

| 19-Feb | Building Permits | Jan | 1,460,000 | 1,482,000 |

| 19-Feb | Building Permits MoM | Jan | -1.5% | -0.7% |

| 19-Feb | Housing Starts | Jan | 1,390,000 | 1,499,000 |

| 19-Feb | Housing Starts MoM | Jan | -7.3% | 15.8% |

| 19-Feb | NY Fed Services Business Activity | Feb | N/A | (5.6) |

| 19-Feb | FOMC Meeting Minutes from Jan 28-29 | |||

| 20-Feb | Philadelphia Fed Business Outlook | Feb | 15.0 | 44.3 |

| 20-Feb | Initial Jobless Claims | 15-Feb | 215,000 | 213,000 |

| 20-Feb | Continuing Claims | 8-Feb | 1,866,000 | 1,850,000 |

| 20-Feb | Leading Index | Jan | -0.1% | -0.1% |

| 21-Feb | S&P Global US Manufacturing PMI | Feb P | 51.5 | 51.2 |

| 21-Feb | S&P Global US Services PMI | Feb P | 53.0 | 52.9 |

| 21-Feb | S&P Global US Composite PMI | Feb P | 53.0 | 52.7 |

| 21-Feb | Consumer Sentiment | Feb | 67.8 | 67.8 |

| 21-Feb | Current Conditions | Feb | N/A | 68.7 |

| 21-Feb | Expectations | Feb | N/A | 67.3 |

| 21-Feb | 1-yr inflation | Feb | 4.2% | 4.3% |

| 21-Feb | 5-10-yr inflation | Feb | 3.3% | 3.3% |

| 21-Feb | Existing Home Sales MoM | Jan | -2.6% | 2.2% |

| 21-Feb | Existing Home Sales | Jan | 4,130,000 | 4,240,000 |

| F - Final P - Preliminary |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Private Bank. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas - Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI