Texas Capital<br>Private Bank

Get the innovative solutions you need with the personalized service you’ve earned.

Texas Capital<br>Private Bank

Get the innovative solutions you need with the personalized service you’ve earned.

The Benefits of Working With Us

Our team of Private Client Advisors delivers the tools and personal

touch you need as you build and maintain your legacy.

The Right Strategies for You

Our advanced solutions offer support that can help grow and protect your assets.

Texas-based Expertise

When you invest with us, your hard-earned money helps to grow the economy of Texas and enrich our communities.

Personalized Service

We’re invested in your success and here to provide the personal attention you deserve.

Nationwide ATM Access

Simplify your spending, maximize control and access more than 55,000 surcharge-free1 ATMs with the Texas Capital debit card.

<h3>From wealth and estate planning to banking solutions, our comprehensive offerings meet your needs while building your legacy.</h3>

Texas Capital Private Bank

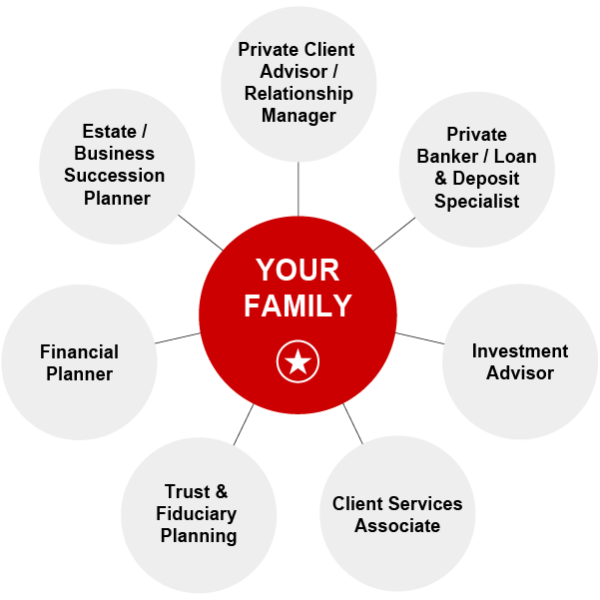

You deserve an advisory team that’s committed to helping you manage — and grow — your assets. That’s why Texas Capital Private Bank promises true collaboration and unwavering commitment as you build your legacy.

Led by a dedicated Private Client Advisor, our comprehensive team will provide expert advisory services. You’ll also have access to:

- Comprehensive financial planning

- Wealth transfer, business succession and charitable giving strategies

- The support of experienced trust specialists and estate settlement experts

- Convenient access to more than 55,000+ surcharge‑free ATMs with your Texas Capital debit card.

A New Standard in Wealth Management

Texas Capital is redefining private banking through strategic investments designed to deliver a client experience as sophisticated as those we serve. With personalized strategies, expert advisory teams and a cutting-edge digital platform, we empower individuals and families to grow, protect and preserve wealth — on their terms. Watch the video to discover this new standard in private banking.

Your Partner in Philanthropy

For more than 25 years, Texas Capital has delivered highly personalized financial services to businesses, individuals and families who have unique and inspiring goals for their philanthropic giving. The Texas Capital Charitable Gift Fund is a strategic platform that enables the greatest impact for your preferred charitable causes on a timeline of your choosing.

The transfer of assets to the Texas Capital Charitable Gift Fund is an irrevocable contribution that qualifies for an immediate tax deduction. Cash proceeds resulting from the sale of the assets transferred are held as a separate account or fund to be invested and managed by your investment advisor at Texas Capital. You serve as the fund’s “donor advisor,” recommending grants to your preferred charities.

Find Your Local Advisors <br>

Wealth Management Services

Helping you achieve your financial success.

Investment Management

We strive to create simple, efficient and transparent portfolios focused on your goals and values. Our advisors work with you to improve your portfolio’s performance with a focus on returns at the lowest risk and cost.

Financial Planning

As you navigate new life stages, financial planning should be an ongoing conversation. Our experienced Private Bank team will work with you, your family and outside advisors to understand your goals and help you achieve your vision for the future.

Insurance Solutions

We’ll collaborate with you to find the proper insurance coverage, amount and provider so you can protect yourself, your family and your legacy.

Securities-based Lending

Using cash and marketable securities managed by Texas Capital Private Bank as collateral, securities-based lines of credit provide you with a way to:

- Benefit from some of Texas Capital’s lowest interest rates

- Get advance rates based on the type of cash or marketable securities pledged

- Access lines of credit within 72 hours of your application

Custom Credit Services

We offer a suite of personalized solutions, including secured term loans and revolving lines of credit.

Estate Planning

As you move through life, wealth planning should be a recurring conversation that evolves and adapts — not something that just happens once. Ongoing wealth strategy and financial planning ensures your plan works for you, and we’ll collaborate with you, your family and your outside advisors to keep it and its implementation up to date.

Business Succession

Transferring business ownership to family can be a meaningful way to build a lasting legacy. Whether the transfer occurs during the owner’s life or after death, our team can help you navigate key considerations before documenting a plan.

Philanthropic Services

Nonprofits, endowments and foundations are increasingly recognizing the value of using outside resources to meet their goals. Our experienced advisors will partner with your organization to provide a comprehensive range of services specially designed to further your mission.

Trustee and Executor Services

You’ve worked hard to build your wealth and establish your legacy. Our team of experts can manage your trusts and estates in a variety of roles, including sole trustee, co-trustee, agency for trustee, executor, co-executor or agency for executor. We serve as a fiduciary in a variety of structures, including:

- Revocable and irrevocable trusts

- Marital trusts

- Generation-skipping transfer trusts

- Grantor retained annuity trusts

- Charitable trusts

- Estate settlement

- Bypass trusts

- Dynasty trusts

- Probate estates

Depository Services

To help you build the future you deserve and meet your evolving financial needs, we offer our Star Reserve Checking account.

We also offer:

- Star Savings

- Star Money Market

- Star Certificates of Deposit

Family Office Services

As a Family Office client of Texas Capital Private Bank, you’ll have access to an experienced team of subject matter experts who bring in additional insights and solutions as your needs change. We understand your unique needs and desires, and we will partner with you to maximize your wealth and focus on what matters most to you.

Retirement Solutions

Our Retirement Plan Services team provides comprehensive solutions, using a results-driven approach and industry expertise to help you navigate the complexities of managing a retirement plan. Our mission is to ensure fiduciary and regulatory compliance, optimize plan design, manage costs and improve participant outcomes. Texas Capital partners with you to set new standards of excellence.

Find solutions for where you are and where you’re going.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI

1Surcharge-free guarantee – Texas Capital Bank guarantees you will not pay a surcharge at any Allpoint® ATM. Some locations may have more than one ATM, not all of which are part of the Allpoint® Network. Check the ATM for the Allpoint® logo to ensure it's the right one. If you ever have a surcharge from an Allpoint® ATM, contact us at 1.877.839.2265 or [email protected] and we will refund the surcharge while we check into the error. Please note: If you're prompted to accept a surcharge, press "yes" to accept and proceed with your withdrawal. You will not be charged or we will refund your fee.