Asset-Based Lending

Unlock your business’ potential with innovative asset-based lending solutions. Maximize asset value, enhance liquidity and seize find growth opportunities beyond traditional lending structures.

Asset-Based Lending

Unlock your business’ potential with innovative asset-based lending solutions. Maximize asset value, enhance liquidity and seize find growth opportunities beyond traditional lending structures.

A Powerful Tool to Unlock Your Business’ Potential

Your business deserves financial solutions that adapt to your unique needs. Whether you are facing seasonality, growth or restructuring, your capital strategy should reflect real-world complexity. Asset-based lending can help improve cashflow, unlock liquidity and provide flexibility when traditional lending structures fall short.

Who We Serve

We finance businesses that turn assets — like receivables, inventory and equipment — into opportunity. From manufacturers to retailers, we support companies navigating seasonality, cashflow swings, leverage constraints or business cycles with flexible solutions tailored to fast-moving, asset-intensive businesses.

What We Offer

Our asset-based lending facilities adapt to your business. We provide qualified clients with temporary over-advances, stretch term loans and split lien structures — unlocking liquidity beyond traditional limits. We strive to design every solution to match your capital needs, timing and growth trajectory.

Where Your Assets Work Harder — Custom Lending for Complex Needs.

Tailored Capital for Every Stage of Growth

No two businesses follow the same path — and your financing strategy shouldn’t either. At Texas Capital, we design flexible, asset-based lending solutions that align with your vision, your timing and your next move. Our team delivers the structure, speed and certainty you need to meet the demands of your business:

- Generating liquidity from working capital to support day-to-day operations

- Financing an acquisition to accelerate growth

- Investing in expansion or capital expenditures

- Distributing capital to stakeholders

- Recapitalizing to optimize your balance sheet

- Refinancing to improve terms or unlock liquidity

- Navigating a turnaround with precision and speed

We don’t just lend — we listen, structure and execute with purpose.

Specialized Lending for Specialized Needs

Our dedicated team brings deep, hands-on experience across industries where complexity meets opportunity. We understand the operational and financial dynamics that define your sector – and we structure financing solutions designed to turn assets into strategic advantage.

We provide tailored asset-based lending solutions for both conventional and specialized industries, including:

- Distributors

- Energy, Power and Natural Resources

- Equipment Rental

- Healthcare

- Manufacturers

- Retailers

- Service Companies

- Technology and Infrastructure

- Wholesalers

- A wide range of other asset-intensive businesses

Whether you’re scaling, restructuring or navigating volatility, our team delivers asset-based lending structures that move in step with your industry — and your ambitions.

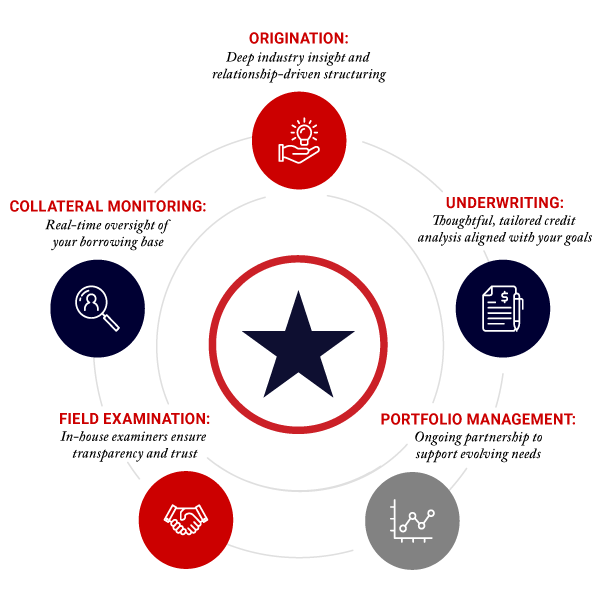

A Fully Integrated ABL Platform — Built Around You

At Texas Capital, we deliver more than capital — we deliver confidence. Our asset-based lending platform is designed as a closed-loop cycle, with every critical discipline in-house to ensure speed, precision and consistency at every stage of the relationship.

Our integrated model enables us to lead syndicated deals, integrate ABL facilities into concurrent financing and strategic transactions, deliver faster decisions and maintain a deep understanding of your business throughout the lifecycle of our relationship.

We are industry and geography agnostic, but proudly rooted in Texas. Wherever you operate, our local commitment and national capabilities move with you.

Frequently Asked Questions

What is Asset-Based Lending (ABL)?

Asset-Based Lending is a type of financing secured by a company’s assets — such as accounts receivable, inventory, equipment or real estate. It provides flexible working capital to support growth or seasonal needs or when cashflow-based credit capacity is constrained.

Who is a good candidate for Asset-Based Lending?

ABL is ideal for mid-sized to large businesses with strong asset bases, often with a seasonal or cyclical cash flow profile. ABL facilities are commonly used by companies in manufacturing, distribution, retail, healthcare, and service industries.

What types of assets can be used as collateral?

Eligible collateral typically includes accounts receivable, inventory, machinery and equipment, and, in some cases, real estate. The quality and liquidity of these assets influence borrowing capacity.

How is the borrowing base determined?

The borrowing base is calculated as a percentage of the value of eligible assets — often 70 to 90% of receivables and 50 to 70% of inventory. The borrowing base is regularly monitored and adjusted based on asset balances.

What are the advantages of Asset-Based Lending over traditional loans?

ABL offers greater flexibility, faster access to capital and borrowing power that grows with your assets. ABL facilities are especially useful during periods of rapid growth, turnaround situations or acquisitions.

How do I get started with an Asset-Based Loan?

Begin by consulting with a Texas Capital banker or ABL specialist. The process typically involves a review of your financials, asset quality and business goals to structure a customized lending solution.

Let’s Build What’s Next — Together

When your business demands a financial solution, Texas Capital can deliver. Our ABL platform is built to move with you — powered by strategic insight, deep industry expertise and a team that is invested in your success. We don’t just fund what’s now — we help power what’s next, at every stage of your business journey. Let’s turn your assets into momentum.

For credit facilities designed for ABL Lenders, please visit our Commercial Lender Finance page.

All loans subject to Texas Capital credit approval.

Connect with an expert banker.

Experience more with experienced bankers who are committed to helping you grow.