81% of businesses experienced payment fraud in 2019.

Because no organization is immune to the threat of fraud, Texas Capital Bank offers a range of solutions backed by an experienced fraud protection and securities team.

Because no organization is immune to the threat of fraud, Texas Capital Bank offers a range of solutions backed by an experienced fraud protection and securities team.

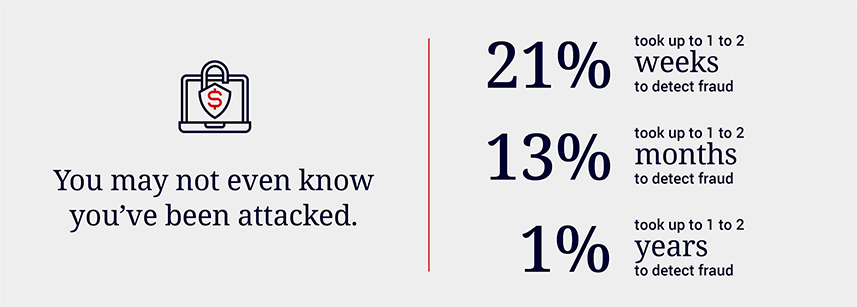

If your business accepts payments in any form, it’s at risk for payment fraud. In 2019, fraudsters attempted to embezzle funds from businesses of all sizes, targeting a range of payment methods.

Your first line of defense against fraud schemes is to make sure you have the proper policies and controls in place to educate employees on how to spot fraudulent checks or suspicious email requests for fund transfers. Your second line of defense is your bank, and proven solutions like these:

Systematically lock all incoming ACH transactions or return any transactions that are not preauthorized companies.

Compare attempted ACH debits to preauthorized profiles. Allow preauthorized profiles to post, while you review and verify unauthorized sources in real time.

Match issued checks with in clearing checks to deliver a daily online report of exceptions for you to decide to pay or return.

Self-monitor all incoming checks for potential fraud scenarios, returning checks that appear altered or counterfeit.

Reduce the risk of payee name alternations by setting up controls that compare the payee name on the check with that on your check issue file.

Automatically reject checks presented on accounts intended only for electronic transactions.

Experience more with experienced bankers who are committed to helping you grow.