Fed finally surprises — Fed Meeting of December 13, 2023

- Fed holds overnight rate range steady at 5.25% – 5.5%.

- Economy “slowed from its strong pace.”

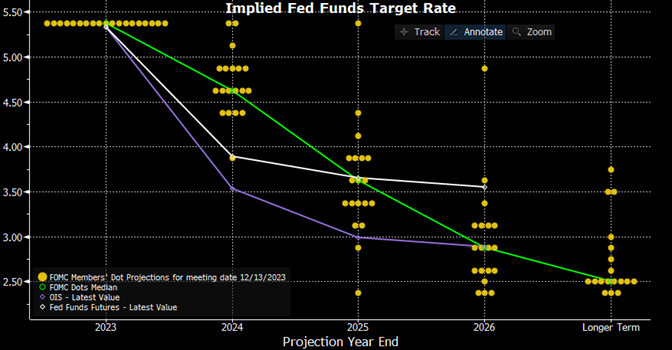

- Committee sees 2024 year-end 4.6%, implies 75bp of rate cuts next year.

- Powell: rate hike is not the base case anymore.

Doves fly

For their last meeting of the year, the Federal Open Market Committee finally surprises. The Committee meeting preliminaries: 1) no change in overnight rates for the third consecutive meeting, 2) acknowledgment that economic activity has slowed from the third quarter, and 3) a continuing commitment to reaching its 2% inflation goal.

FOMC members are sometimes labeled “hawks” or “doves.” Hawks favor “tighter” monetary policy and interest rates high enough to slow inflation. Doves are thought to be the opposite; easy money, lower rates and willingness to let inflation run a bit higher.

Press releases this year have largely been neutral to slightly hawkish. Words and phrases suggested the Committee would continue to raise rates or stood ready to act. Today’s press release and dot plot leaned surprisingly dovish.

Any

The new word for the November meeting was “financial,” as in “tighter financial conditions … likely to weigh on economic activity.” That sentence remained in the statement, suggesting leaner times in the coming quarters. This meeting, the policy sentence was changed to “In determining the extent of any additional policy firming (rate hikes*) that may be appropriate to return inflation to 2 percent over time….” The word “any” likely signals that the Fed is finished with rate increases for this cycle. In other words, rates are high enough to slow activity in the coming year and bring down employment.

The median “dot plot” of Committee members’ rate expectations moved solidly lower. There is wide dispersion around the 4.6% 2024 median, but it and the future years are nearly three-quarters of a percent lower than the September projections. The median expectation for rates at the end of 2025 is now 3.625%. Recall in September Powell was still calling for rate increases.

Source: federalreserve.gov, Bloomberg, L.P.

The Committee forecasts GDP growth of less than 2% annually for the next three years. 2024 sees the slowest growth at 1.4%. The unemployment rate rises from today’s mid 3% level to 4.1%. Both of these numbers suggest the Fed believes a “soft landing” is possible and can cut rates later next year.

Analysis

In his press conference, Chairman Powell stated that the Fed is prepared to tighten (raise rates) further if appropriate. Markets expect him to say that. However, to actually raise rates now implies that important areas of the economy have suddenly turned higher: job growth, housing and mortgage origination, and manufacturing surveys. All are either flat or moving slowly lower.

Fed history teaches us that recessions usually get underway once short-term rates fall below long-term rates. Short rates have been above long-term rates for over 300 days, typical for a rate increase cycle that inverts the yield curve. Today’s strong bond market reaction to the Fed’s projections suggest this cycle’s curve reversion may be underway. Two-year Treasury rates in the hour after the press release had dropped a quarter of a percent.

While we are no fans of recession, a more “normal” yield curve with long-term yields comfortably higher than short maturities is a positive for client portfolios and lenders. A positively sloped yield curve allows risk and future inflation forecasts to factor into investor decisions about where to invest in the bond market.

While Powell said it is far too early to declare victory, he went on to say the economy is not in recession now. He did say there needs to be more progress on inflation. Our indicators tell us the economy is definitely slowing from the fall. The Fed is correct to stay on hold and see how inflation plays out in the coming months. Base effects and moderating shelter numbers should help the consumer price index to break below 3% briefly in the coming months.

Summary

Longer term interest rates have come down from their 5% fears in the early fall. Rates are now back to the top of a channel that persisted over the last year. The chart below shows the channel between the white parallel bars. If a recession does occur in the coming quarters, we would expect the 10-year Treasury to move to the bottom of that channel, in the 3.5% area.

Source: Bloomberg, L.P.

The Committee projects lower rates by the end of 2024. It does not say when rate cuts will happen, just that they think they will cut. A rate cut would be a policy change from the last year and nine months. A change in policy from hikes to cuts within eleven months of an election would be rare indeed. If one expects the Fed to follow historical precedent, then the Fed may cut once or twice in the spring and then resume rate reductions after the election.

Please let us know how we can help you.

*Italics mine

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on X here.

The contents of this article are subject to the terms and conditions available here.