Is it true? — Week of December 18, 2023

Essential Economics

— Mark Frears

Must be true

While we are pondering the future implications of Artificial Intelligence (AI), many are looking back at the origins of the internet. We had no idea that it would get to the point where people would believe everything they saw on the world wide web. Has to be true!!

Last week, the FOMC released their quarterly Summary of Economic Projections (SEP) and the Dot Plot. From these reports and the Chair’s press conference, markets decided the “pivot” was here and inflation was vanquished. Is this really true?

It’s a job

There has been some talk about having to submit hundreds of applications to get a job, but you are still seeing lots of “employee wanted” signs around. The Job Openings and Labor Turnover Survey showed 9,300,000 jobs available as of October month-end. Also, the Nonfarm Payroll release for November showed 199,000 jobs added last month. Below you can see the Unemployment Claims and how they spike going into recessions, or economic slowdowns.

Source: Bloomberg

All these points are to say that the FOMC needs the labor market to weaken, so that wages will not continue to rise. If people are paid well, they will continue to spend and this will drive prices up; the opposite of what the FOMC wants if they think the inflation fight is done.

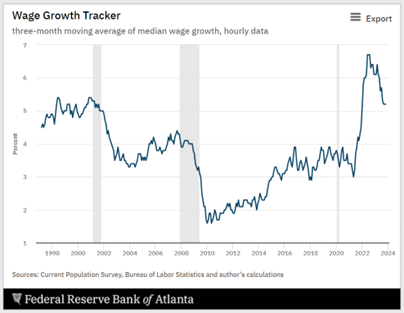

The Atlanta Fed Wage Growth Tracker, below, in their December 15 reading, shows a leveling out. The downward trend, or improvement for wage inflation, has stalled; and we are still at historically high readings.

Source: Atlanta Fed

From the very important labor market perspective, I don’t see the inflation fight being over.

What you pay

Even with the FOMC saying inflation has improved to the point that they can take their foot off the tightening accelerator pedal, we still feel the pinch whenever we go to buy things. For example, during the holiday season you may watch the Christmas classic, Home Alone, where Kevin was left at home while his family went to Paris. As you may recall, he had to go to the grocery store to stock up, and in 1990 he spent $19.83 for his basket of essentials. Fast forward to 2022, the same basket would run you $44.40, a 123.9% increase. The FOMC has been in a rate-tightening madness, trying to quell inflation, and they now cite a 3.1% Consumer Price Index as evidence of their success. If we were to buy this same basket of grocery items in 2023, it would cost you $72.28! A 62.8% increase in the last year. Somehow, I don’t see this as a victory.

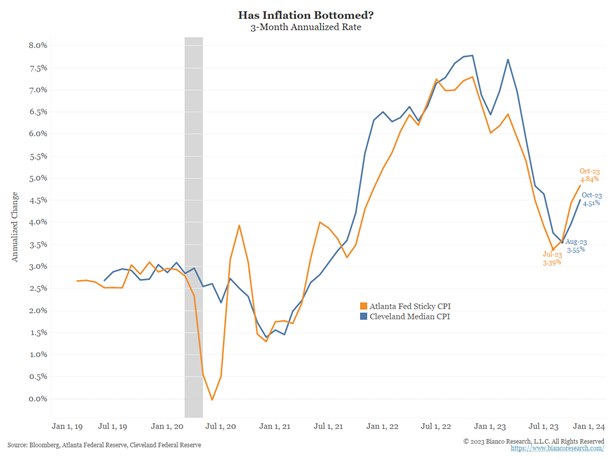

To give the FOMC credit, we have seen declining CPI and PCE inflation metrics, but they have also benefited from falling energy prices. We need to dig a little deeper to get the actual picture. The chart below shows a three-month annualized rate for two metrics that give us a better view of inflation’s trend.

Source: Bianco Research

The “sticky” Atlanta Fed’s Index tracks items that change price relatively slowly. We need to see more improvement here before we can head back to the Fed’s 2% inflation target. You can easily see that both of these trackers have bottomed already and are headed back up! This is contrary to the message the FOMC is selling.

Spending

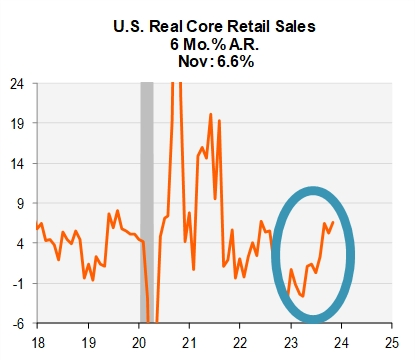

You can look at consumer spending behavior through different lenses. One, they should be slowing down spending, as this “lower inflation” environment should also signal a slowing economy, and they may feel less comfortable in their job situation. Two, they are okay with the current level of prices and are spending anyway. If the first is true, you would see slowing retail sales and this is not the case (see below). If the second view is correct, consumers still have their shopping hats on and will drive prices higher.

Source: Piper/Sandler Research

On top of this picture of retail sales as of November, we are in the middle of the busiest shopping time of the year, with close to 20% of annual sales associated with the holiday season. How will that impact prices if people are going to continue to shop? That will not drive lower inflation.

Conclusion

The FOMC made a bold statement this past week, through their metrics and Chair Powell’s comments. Historically, they do not make policy direction changes in an election year, yet lowering rates next year would be viewed as a policy change. The FOMC claims to be an independent, non-partisan organization, but rate cuts in an election year would be viewed as stimulative to the economy and positive for the current administration.

Let’s also keep in mind that the predictive power of the Fed is not without issue. If you go back to June 2021, the Dot Plot predicted rates at the end of 2022 to be 0.25%, they were actually 4.50%. Their forecast for the end of 2023 is 0.75%, and we will be at 5.50%.

Across the pond, the ECB and BOE both met this past week, and their messages were different from the FOMC, in that they do not yet feel the inflation battle has been won.

Based on the areas of the economy we looked at above, there is still concern that the economy is too strong and inflation pressures are still elevated. We will watch carefully as 2024 unfolds, and there may be extenuating circumstances, like a severe recession, that would push the FOMC to need to ease monetary conditions. One way or the other, the focus on their rate moves and “talking heads” has ramped up to a new level.

Economic releases

Last week was inflation and the FOMC. Based on the numbers released for CPI and PPI, prices seem to be coming down, and the FOMC agreed. In case you missed it, see potential pitfalls above.

This week’s calendar is full with housing, confidence, leading indicators and durable goods. Let’s see what the most recent releases show us about the strength of the economy. See below for details.

Wrap-Up

The FOMC has to dig deep into the details as they make their prognostications. The points made above may not have hit their radar and could cause revisions. Markets usually overreact to news and this seems to be the case again. Wishing you and yours a most joyous Christmas season.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 18-Dec | NY Fed Services Business Activity | Dec | N/A | (11.9) |

| 18-Dec | NAHB Housing Market Index | Dec | 37 | 34 |

| 19-Dec | Building Permits | Nov | 1,460,000 | 1,487,000 |

| 19-Dec | Building Permits MoM | Nov | -2.5% | 1.1% |

| 19-Dec | Housing Starts | Nov | 1,360,000 | 1,372,000 |

| 19-Dec | Housing Starts MoM | Nov | -0.9% | 1.9% |

| 20-Dec | Existing Home Sales | Nov | 3,770,000 | 3,790,000 |

| 20-Dec | Existing Home Sales MoM | Nov | -0.5% | -4.1% |

| 20-Dec | Conf Board Consumer Confidence | Dec | 104.0 | 102.0 |

| 20-Dec | Conf Board Present Situation | Dec | N/A | 138.2 |

| 20-Dec | Conf Board Expectations | Dec | N/A | 77.8 |

| 21-Dec | GDP Annualized QoQ | Q3 | 5.2% | 5.2% |

| 21-Dec | Personal Consumption | Q3 | 3.6% | 3.6% |

| 21-Dec | GDP Price Index | Q3 | 2.3% | 3.6% |

| 21-Dec | Initial Jobless Claims | 16-Dec | 215,000 | 202,000 |

| 21-Dec | Continuing Claims | 9-Dec | 1,880,000 | 1,876,000 |

| 21-Dec | Philadelphia Fed Business Outlook | Dec | (3.0) | (5.9) |

| 21-Dec | Leading Index | Nov | -0.5% | -0.8% |

| 21-Dec | KC Fed Manufacturing Activity | Dec | (3) | (2) |

| 22-Dec | Personal Income | Nov | 0.4% | 0.2% |

| 22-Dec | Personal Spending | Nov | 0.3% | 0.2% |

| 22-Dec | Real Personal Spending | Nov | 0.3% | 0.2% |

| 22-Dec | PCE Deflator YoY | Nov | 2.8% | 3.0% |

| 22-Dec | PCE Core Deflator YoY | Nov | 3.3% | 3.5% |

| 22-Dec | Durable Goods Orders | Nov P | 2.2% | -5.4% |

| 22-Dec | Durable Goods ex Transportation | Nov P | 0.1% | 0.0% |

| 22-Dec | Cap Goods Orders Nondef ex Aircraft | Nov P | 0.1% | -0.3% |

| 22-Dec | New Home Sales | Nov | 688,000 | 679,000 |

| 22-Dec | New Home Sales MoM | Nov | 1.3% | -5.6% |

| 22-Dec | UM (Go UW) Consumer Sentiment | Dec F | 69.4 | 69.4 |

| 22-Dec | UM (Go UW) Current Conditions | Dec F | N/A | 74.0 |

| 22-Dec | UM (Go UW) Expectations | Dec F | N/A | 66.4 |

| 22-Dec | UM (Go UW) 1-yr inflation | Dec F | N/A | 3.1% |

| 22-Dec | UM (Go UW) 5- to 10-yr inflation | Dec F | N/A | 2.8% |

| 22-Dec | KC Fed Services Activity | Dec | N/A | 1 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.