Small is mighty — Week of December 11, 2023

Essential Economics

— Mark Frears

Don’t forget the little guys

With young kids, especially boys, there is a trend to hold them back in earlier grades, so that they become one of the bigger kids in the class, instead of the smallest. This may have something to do with football in Texas! One thing a coach needs to keep an eye on, though, is that the smallest kid in middle school may become the stud by the time he reaches high school. You never know.

In the economy, small businesses are often overlooked, especially as consolidations seem to be making a few companies larger and larger. What is the impact of small businesses?

Confidence

If you don’t have a positive feeling about what you are doing, it is hard to keep going for any length of time, and with any amount of enthusiasm. The most recent NFIB Small Business Optimism Index showed a continuing decline in confidence. As seen below, the October reading is below the pandemic low in 2020, but not quite back down to lows from last year and earlier this year.

Source: Bloomberg

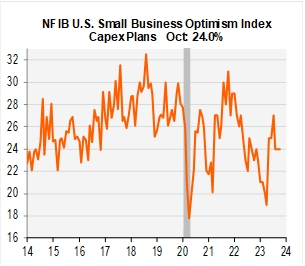

We have come off the post-pandemic high and small business owners do not have a positive outlook. They are not growing their inventories, as labor and energy costs have not come down enough. They are also not willing to put more capital into their businesses, due to the uncertain economic environment. As you can see below, capex plans have been flat the last two months, following a sharp drop in August.

Source: PSC Research

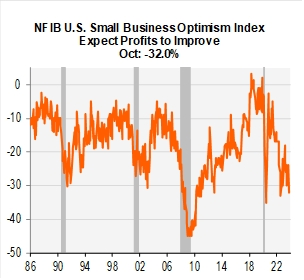

In addition, due to the higher input costs (see below), their expectations for better profits have fallen.

Source: PSC Research

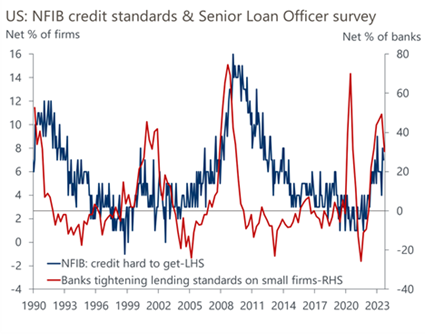

As seen in the Senior Loan Officer Survey, credit conditions are tightening overall. Higher interest rates are also curbing demand. The NFIB survey, seen below, shows this is impacting small businesses as well.

Source: Oxford Economics / Haver Analytics

Based on confidence numbers, things are not looking rosy and bright for small businesses. Should we be concerned about this trend?

Labor

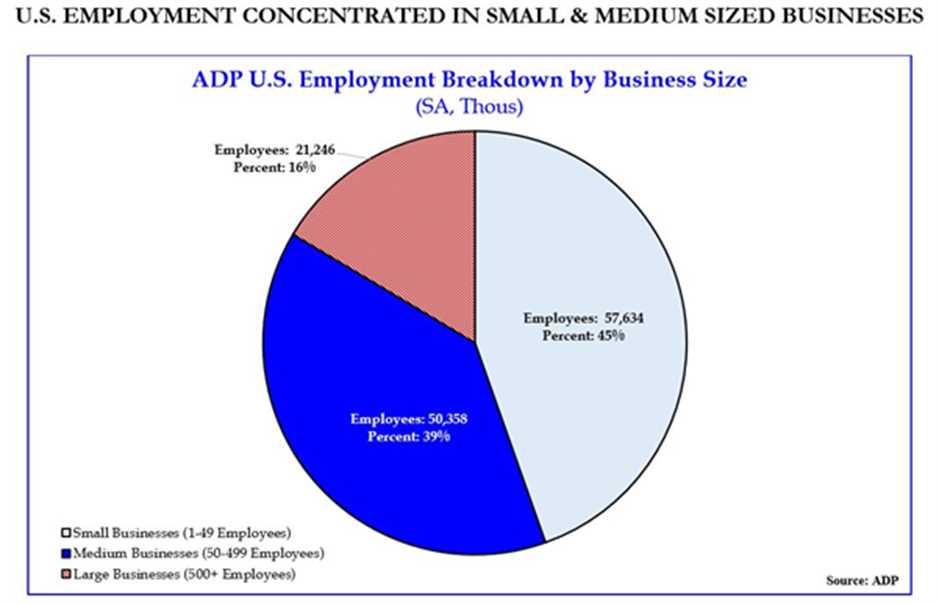

Depending on how you slice and dice the numbers, small businesses usually have less than 50 or less than 500 employees. Take a look at the chart below to see how impactful these companies are to the labor market.

Source: Strategas Research

Big impact, as 45% of workers are in companies with less than 50 employees and 84% of the workforce are in businesses with less than 500. Now what do you think about small businesses?!

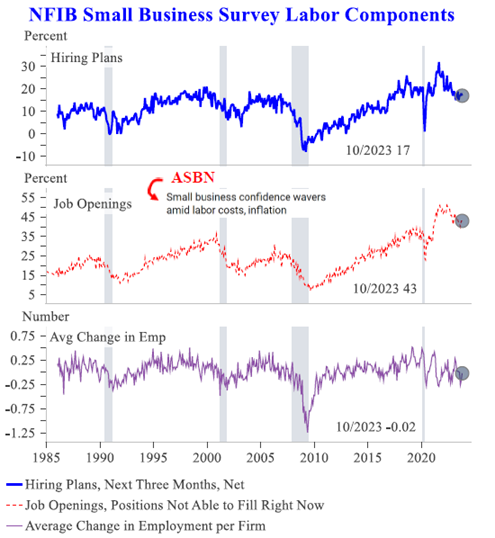

With these companies having such an impact on an already tight labor market, what are their plans for hiring? As you can see below, their hiring plans and job openings are dropping. Their total employment is staying relatively flat, but not a big upside here.

Source: Strategas Research

So, they keep a lot of us employed. How does this impact overall growth in the economy?

Bigger picture

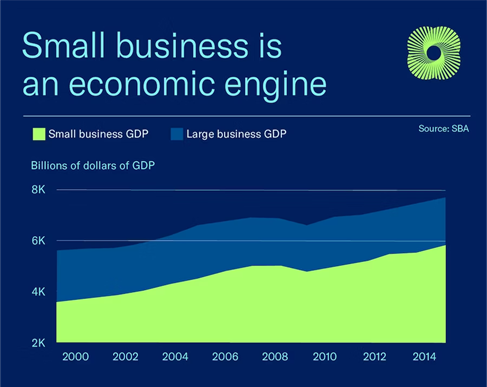

Gross Domestic Product (GDP) for the third quarter came in at a surprisingly strong 5.2%. The fourth quarter should show a slowdown to somewhere between 1% and 2% — hardly going into a recession yet. As you may have guessed, small businesses make a significant contribution here. Based on the U.S. Chamber of Commerce, 44% of GDP is powered by small businesses!

Source: 2023 SBA Office of Advocacy FAQ on Small Business

Clearly, we can see that small businesses are key to the employment and growth of the U.S. As you are out shopping, as it seems like we all are, do your part to support these essential businesses.

Economic releases

Last week was mostly about jobs. ADP was a little lower than expected, but Nonfarm Payrolls came in above expectations with the unemployment rate dropping two-tenths to 3.7%. Weekly Unemployment claims were flat, and Continuing Claims dipped. While a few cracks can be seen if you dig deeper, the strength of the labor market will keep the FOMC on hold this week.

This week’s calendar is focused on inflation and the FOMC. We have CPI and PPI out before the FOMC announcement. The key to watch from the FOMC is their revised economic projections (SEP) as well as the Dot Plot for insight into the future. See below for details.

Wrap-Up

Small packages can sometimes hold big surprises. Remember that, after all, it is the Christmas season.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 11-Nov | NY Fed 1-yr inflation expectations | Nov | N/A | 3.57% |

| 12-Dec | NFIB Small Business Optimism | Nov | 90.7 | 90.7 |

| 12-Dec | Consumer Price Index MoM | Nov | 0.0% | 0.0% |

| 12-Dec | CPI ex Food & Energy MoM | Nov | 0.3% | 0.2% |

| 12-Dec | Consumer Price Index YoY | Nov | 3.1% | 3.2% |

| 12-Dec | CPI ex Food & Energy YoY | Nov | 4.0% | 4.0% |

| 12-Dec | Real Avg Hourly Earnings YoY | Nov | N/A | 0.8% |

| 12-Dec | Real Avg Weekly Earnings YoY | Nov | N/A | 0.0% |

| 12-Dec | Monthly Budget Statement | Nov | -$301.1B | -$66.6B |

| 13-Dec | Producer Price Index MoM | Nov | 0.0% | -0.5% |

| 13-Dec | PPI ex Food & Energy MoM | Nov | 0.2% | 0.0% |

| 13-Dec | Producer Price Index YoY | Nov | 1.1% | 1.3% |

| 13-Dec | PPI ex Food & Energy YoY | Nov | 2.2% | 2.4% |

| 13-Dec | FOMC Rate Decision (Upper Bound) | 1p CT | 5.50% | 5.50% |

| 13-Dec | FOMC Rate Decision (Lower Bound) | 1p CT | 5.25% | 5.25% |

| 14-Dec | Retail Sales MoM | Nov | -0.1% | -0.1% |

| 14-Dec | Retail Sales ex Autos MoM | Nov | -0.1% | 0.1% |

| 14-Dec | Initial Jobless Claims | 9-Dec | 221,000 | 220,000 |

| 14-Dec | Continuing Claims | 2-Dec | 1,876,000 | 1,861,000 |

| 14-Dec | Import Price Index MoM | Nov | -0.8% | -0.8% |

| 14-Dec | Export Price Index MoM | Nov | -1.0% | -1.1% |

| 14-Dec | Business Inventories | Oct | 0.0% | 0.4% |

| 15-Dec | Empire Manufacturing | Dec | 2.0 | 9.1 |

| 15-Dec | Industrial Production MoM | Nov | 0.3% | -0.6% |

| 15-Dec | Capacity Utilization | Nov | 79.1% | 78.9% |

| 15-Dec | S&P Global US Manufacturing PMI | Dec | 49.3 | 49.4 |

| 15-Dec | S&P Global US Services PMI | Dec | 50.7 | 50.8 |

| 15-Dec | S&P Global US Composite PMI | Dec | 50.4 | 50.7 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.