Sour start to the year — Week of January 8, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -1.50 | -1.50 | 25.36 | 9.70 | 15.06 | 4,697.24 |

| Dow Jones Industrial Average | -0.56 | -0.56 | 16.25 | 9.43 | 12.22 | 37,466.11 |

| Russell 2000 Small Cap | -3.73 | -3.73 | 13.02 | 0.83 | 8.58 | 1,951.14 |

| NASDAQ Composite | -3.23 | -3.23 | 42.18 | 5.10 | 17.64 | 14,524.07 |

| MSCI Europe, Australasia & Far East | -1.49 | -1.49 | 16.11 | 3.85 | 8.25 | 2,202.54 |

| MSCI Emerging Markets | -1.88 | -1.88 | 5.01 | -6.10 | 3.64 | 1,004.26 |

| Barclays U.S. Aggregate Bond Index | -0.97 | -0.97 | 3.70 | -3.53 | 0.86 | 2,141.10 |

| Merrill Lynch Intermediate Municipal | -0.02 | -0.03 | 4.79 | -0.29 | 2.11 | 314.79 |

As of market close January 5, 2023. Returns in percent.

Investment Insights

— Steve Orr

In the books

Another year in the record books — a bit sad to see 2023 go. Recall 2022 was a down year for stocks (S&P 500 -18.1%) and one of the worst years on record for bonds (Barclays Aggregate -13%). 2024 is likely to be quite a ride. We will detail our roller coaster reasoning over the next couple of weeks. In the meantime, we are grateful for Fed/Treasury changes that gave assets a tremendous push the past couple of months. The S&P 500 finished above 26% and the U.S. Aggregate Bond Index a solid 5.5%. Balanced accounts finished the year between 13% and 15% depending on their equity allocations.

Overview

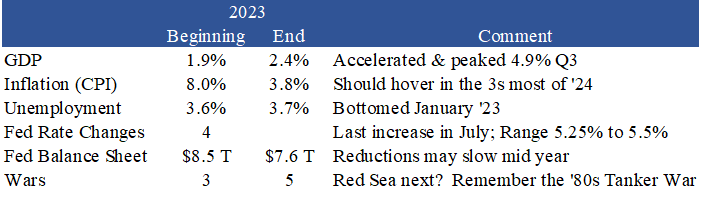

Walking into 2023, the drumbeat of recession was heard constantly around Broad & Wall. Street experts were convinced that a recession was in the cards for the second half of the year. The Fed must promptly cut rates and stop reducing its balance sheet. By December, the Fed Funds rate was supposed to be reduced to 4.5%. About the only series that fell last year was the Consumer Price Index, thanks to declining demand for goods and big-ticket items.

Source: Oxford Economics, Bloomberg

The upside surprise was the strength of the economy. No recession throughout 2023. Activity peaked in the third quarter. The fourth quarter data showed industrial activity and some services activity take a turn lower. The Fed’s stated goal at the beginning of their rate increase cycle was to throttle wage inflation by cutting jobs. The unemployment rate barely moved but the job iceberg is definitely melting underwater.

Drifting away

December’s Non-Farm Payroll report posted a headline of 216,000 net-new jobs. The economy needs to generate around 100,000 new jobs per month to absorb kids coming out of school, military, etc. Unfortunately, the headline was the high point of the data release. Part-time workers continued to increase, along with the underemployment rate.

Last month’s gains were concentrated in government and in healthcare, not exactly GDP expanders. Net private job growth over the past several months averaged out to around 40,000. The response rate from businesses for the survey continues its five-year slide. This report’s response rate was just above 49%. We wonder at what level the Bureau staff will just start throwing dice for results.

The Household Survey was more troubling. This is the series used to calculate the unemployment rate. Employment declined by 683,000 during the survey period. The Household civilian population contracts about three times per year, but rarely by an amount this large. The unemployment rate held steady at 3.7%, but that represents the same size slice of a smaller employment pie. Big-picture job openings and private hiring are drifting lower — just what the Fed said they wanted in order to tame inflation.

Start line

Employment news and business surveys show hiring is slowing around the country. ISM’s Manufacturing survey continues to show businesses pulling back each month. Weak statistics and outlook soured stock’s Santa rally and pulled the first five days of January just barely negative for the S&P 500. Until this Monday’s rally after the NY Fed inflation report, the big index’s 1.5% drop was one of the worst starts in two decades.

The other dour news for markets came in the form of the minutes from the most recent FOMC meeting. Fed members acknowledged that reductions in interest rates “would be appropriate by the end of 2024.” They believe they made “clear progress” last year toward their 2% inflation goal. As they did last year, Wall Street analysts and traders are demanding more rate cuts than the Fed is projecting. The futures market is pricing in six quarter-point cuts this year to drop short-term rates from 5.25% to 3.75%. To us, that suggests Wall Street wants a full-blown recession. Has anyone reminded those folks that earnings and stock prices fall by double digits in a recession?

Overall, the tone of the meeting suggested that Fed members desire to keep rates at these levels for some time to win the inflation battle. The next data set on inflation comes this Thursday and Friday. Consumer prices for December are expected to hold steady at 3.1% headline and 3.8%, excluding food and gasoline (the “core”). The New York Fed’s one-year ahead inflation expectations continue to trend lower. December’s reading slipped to 3.01%, the lowest since February 2021, the month before the current inflation cycle began.

Friday brings the Producer Price Index, which continues to hover just below 1.5% year-over-year. We are curious as to the possible impact the recent spike in shipping costs from Houthi drone attacks will have on PPI. Two cautions on inflation for investors. First, there never is just one wave. Cycles vary but between two and four years is typical to the next (higher) wave. Second, PPI changes correlate very well with S&P 500 member’s sales growth. This makes sense — in the early stages of an inflation cycle, companies can pass on increases. Once buyers adapt to ongoing inflation, volumes and earnings fall. Are we going to see that play out this earnings season?

Searching

Fourth quarter earnings start this Friday. As usual, Delta and the mega banks kick things off. We expect JP Morgan, Wells and Citi to talk about loan losses and increasing reserves. Street consensus is for earnings to grow around 1.5% last quarter. To date, 21 members of the S&P 500 have reported, with 19 beating analysts’ earnings estimates.

Wrap-Up

We believe that the first half of this year will be challenging for company earnings and activity in general. The positive side of our ledger shows short rates have peaked for this interest rate cycle. Corporate balance sheets are in pretty good shape. The labor force is stable but growing very slowly.

This is an election year, and the Administration has several levers to pull to juice the economy. We expect rates and stock markets to swing back and forth for several weeks until Congress can figure out what it will spend and, in turn, how much debt the Treasury will issue to pay for it all.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.