Turbulence or Thunderclouds? — Week of January 8, 2024

Essential Economics

— Mark Frears

Disruptions

Back in the Dark Ages, before cell phones, I was in Cape Flattery, Washington, when Mount Saint Helens erupted. We were approximately 300 miles away — and we felt and heard the impact! That was a serious disruption, and because we were not connected to the world 24/7, we didn’t know what it was for two days.

Speaking of things flying through the air, the markets continue to expect a soft landing, meaning little or no recession, but there are some things out there that may cause turbulence.

It’s only a small body of water

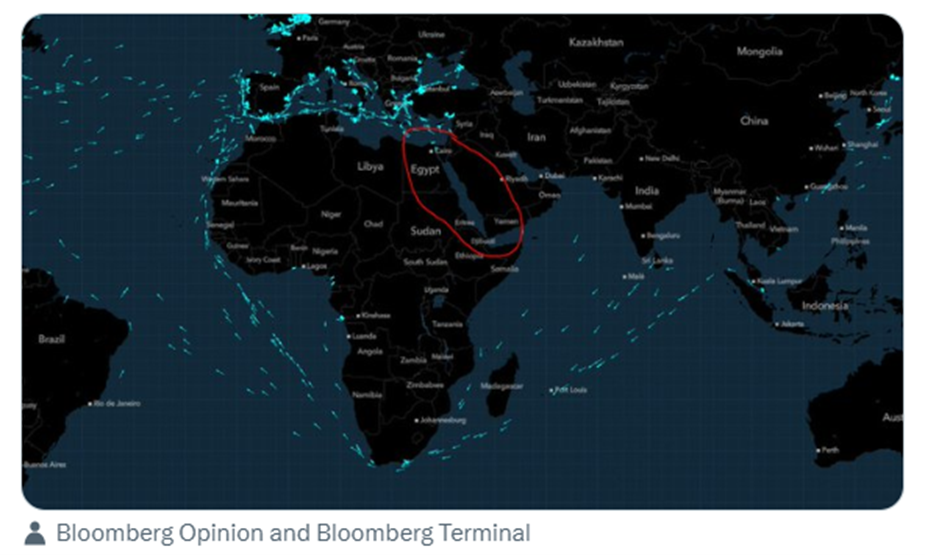

This might seem like a flashback to the pandemic, but we have the potential for supply chain constraints again. Any good coming from the Far East normally comes through the Red Sea and the Suez Canal, instead of having to traverse the southern end of Africa. This can cut off material time — and cost for the U.S. and Europe. The map below shows current container ships avoiding conflict of the Red Sea.

Source: Bloomberg

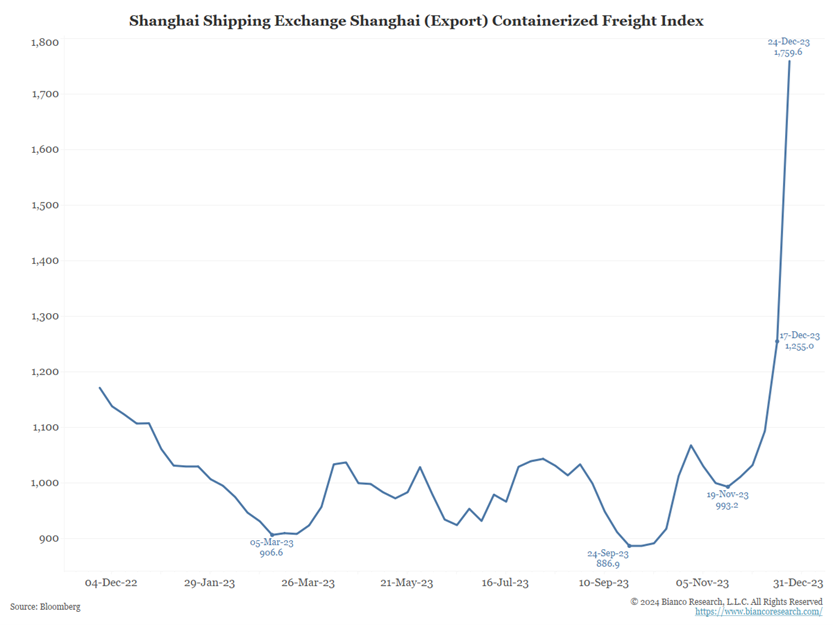

The Houthis are specifically targeting container ships, as they carry cargo valued at $100 to $200 million, versus an oil tanker with cargo valued at $72 million. As reflected in the Shanghai Containerized Freight Index, prices surged by 40% on December 29, 2023 (see below).

Source: Bianco Research

In addition, tensions in the Middle East are starting to impact energy prices. Gas prices in Dallas have gone up $0.40 per gallon in the past week. Both of these issues could only impact consumers for a short time, but it could cause confidence to fade as turbulence increases for landing.

Off to work I go

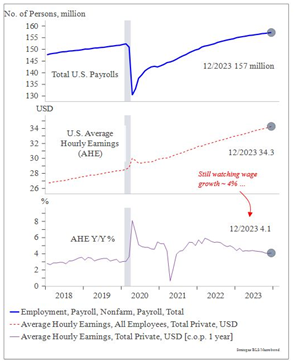

The next portion of clouds to go through may not seem like a problem, but it could be. According to the latest non-farm payroll release, wages are not going lower, and, on a year-over-year basis, they actually increased in December. So, we have the potential to see our paychecks growing; that sounds like good news. However, the FOMC will not be happy with this, as strong wages are indicative of a tight labor market, and this will lead to higher inflation. The chart below shows that the number of people added to payrolls last month was still significant, while the lower two charts show wages are still elevated.

Source: Strategas

There are some cracks in the labor market, like fewer jobs available as shown in the JOLTS survey, as well as participation rate falling. It remains to be seen how fast these will impact the broader economy.

If consumers are still very comfortable in their jobs, and what they are getting paid, they will continue to spend. With two-thirds of GDP coming from you and me, that could alter the landing of the plane.

Your tax dollars at work

The main thing you may be focused on, as far as your government, is the election in November. There are a couple of other parts that bring some fog to next year. First, fiscal policy, which most recently translates into government spending, or infusion of cash into the economy. This has been playing out partially in benefits to citizens hanging over from the pandemic, and many of these will cease this year.

Second, monetary policy continues to pull money from the markets via quantitative tightening (QT). The Federal Reserve is reducing its holdings of UST and mortgage-backed securities that it purchased during the times of economic crisis. This means they are selling securities to the market and reducing available liquidity in the system. The QT has been part of their tightening emphasis, along with increasing short-term interest rates, to fight inflation.

You may notice that they are not on the same page. This could provide some bumps on approach.

The other part of your government that will have an impact on this year is the issuance of debt. In 2023, the U.S. Treasury issued one trillion dollars in debt. This year, in order to keep up with fiscal policy noted above, and the increased interest expense on the debt, they will have to issue $1,900,000,000,000. Yes, that is a large number, and almost twice the issuance of 2023. When you are selling more, you have to make sure you have enough buyers, and you may have to make the selling price cheaper (higher rate) in order to move all of this supply. This would translate into higher long-term UST rates, potentially slowing down the housing market even more and shaking consumer confidence. Keep an eye on the clouds.

Economic releases

Last week was focused on the labor market, with more signs that this is still a potential source of inflation. In contrast, ISM Services numbers came in on the low side, indicating a slower December, but this is not unusual for the last month of the year.

This week’s calendar is focused on inflation with CPI out Thursday and PPI out Friday. The markets will be looking for more momentum on the downside. See below for details.

Wrap-Up

The markets believe we are on a smooth glide path, headed in for a soft landing. There may not be a volcanic eruption, but it could be a bit bumpy. Pay attention to the supply chain, labor market and government actions this year to determine how much to adjust your seat belt.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 8-Jan | NY Fed 1-yr inflation expectations | Dec | N/A | 3.36% |

| 8-Jan | Consumer Credit | Nov | $9.000B | $5.134B |

| 9-Jan | NFIB Small Business Optimism | Dec | 91.0 | 90.6 |

| 9-Jan | Trade Balance | Nov | -$65.0B | -$64.3B |

| 11-Jan | Consumer Price Index MoM | Dec | 0.2% | 0.1% |

| 11-Jan | CPI ex Food & Energy MoM | Dec | 0.3% | 0.3% |

| 11-Jan | Consumer Price Index YoY | Dec | 3.2% | 3.1% |

| 11-Jan | CPI ex Food & Energy YoY | Dec | 3.8% | 4.0% |

| 11-Jan | Initial Jobless Claims | 6-Jan | 210,000 | 202,000 |

| 11-Jan | Continuing Claims | 30-Dec | 1,875,000 | 1,855,000 |

| 11-Jan | Real Avg Hourly Earnings YoY | Dec | N/A | 0.8% |

| 11-Jan | Real Avg Weekly Earnings YoY | Dec | N/A | 0.5% |

| 11-Jan | Monthly Budget Statement | Dec | -$62.5B | -$314.0B |

| 12-Jan | Producer Price Index MoM | Dec | 0.1% | 0.0% |

| 12-Jan | PPI ex Food & Energy MoM | Dec | 0.2% | 0.0% |

| 12-Jan | Producer Price Index YoY | Dec | 1.3% | 0.9% |

| 12-Jan | PPI ex Food & Energy YoY | Dec | 2.0% | 2.0% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.