Are you watching signal or noise? — Week of December 9, 2024

Essential Economics

— Mark Frears

More noise?

What are you listening to or watching for your sources of information? Do you think you are getting signals or noise? It may be me, but the noise continues to increase, making it very difficult to hear/see the signals. The importance of knowing your sources has never been higher. The land of 24-hour “news” seemed to be the straw that broke the camel’s back in adding a large degree of opinion into the mix. The facetious comment at our house is, “Well it is on the world wide web, so it must be true!”

What are some signals we can look to and rely on for unbiased information?

Manufacturing: surprise!

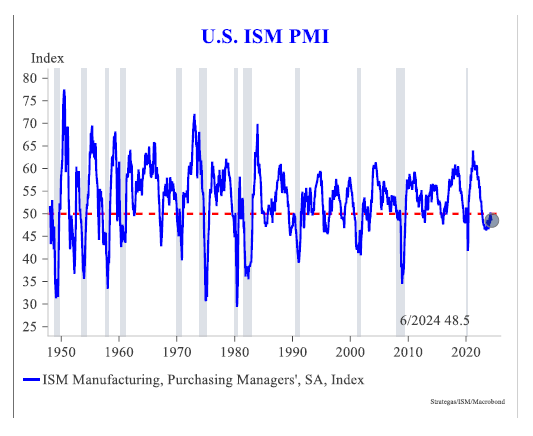

Have you noticed the broad revisions each month to significant economic indicators, like Payroll? One way to gain further insights is to look closer at surveys. The primary one we will look at is the Institute of Supply Management (ISM) Purchasing Managers Index (PMI). As this is a diffusion index, as seen below, readings above 50 indicate economic expansion, while those below 50 are aligned with contraction.

Source: Bianco Research

The headline index is made up of five components: new orders, production, employment, suppliers’ deliveries and inventories. These are equally weighted. These components are closely watched, for trends in employment, prices and forward-looking new orders.

Correlation

The reason this survey is worth following is three-fold. One, the long history dates back to 1948. Two, it has a good track record of catching cyclical turns. Three, the fact that it is released on the first day of the month makes it an early signal to watch.

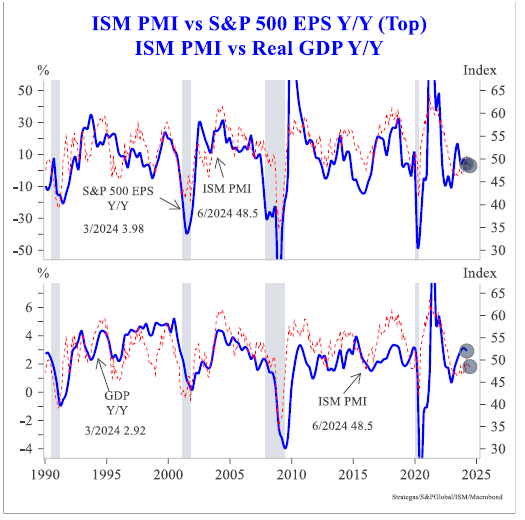

Although the manufacturing sector is no longer the driving force it once was, there are still correlations to monitor. As you can see below, there are 50-60% correlations to GDP and S&P 500 earnings.

Source: Strategas Research

Digging deeper

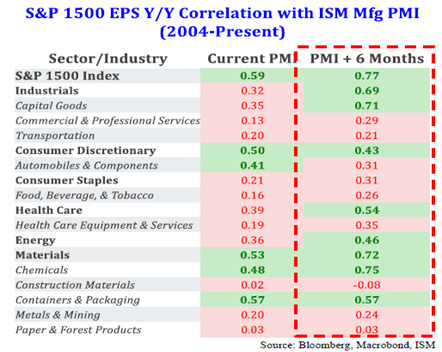

Given the correlation cited above, the next step was to see if there could be a leading indicator buried in this data. Sure enough, if we look at the S&P 1500 earnings per share (EPS), there is a 77% correlation between the ISM PMI and EPS six months in the future, as seen below.

The sub-sectors’ earnings have varied ties to the ISM PMI, but the overall correlation is very strong.

Other surveys

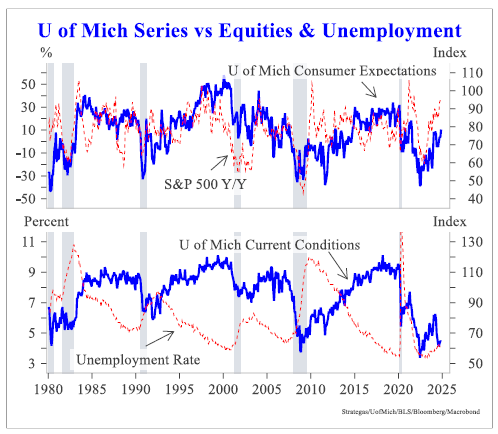

Sticking with the more reliable indicators, the UofM Consumer Sentiment Survey gives us a view into the mind of the consumer. This survey comes out early in the month, with a final release later in the month. The chart below looks at correlations to the S&P 500 level, and the unemployment rate.

The consumer expectations survey ties very close to stock prices, and the current conditions component is negatively correlated to the unemployment rate.

We can see that these surveys, that are often deemed second tier, can actually provide a solid part of your arsenal of economic indicators.

Economic releases

Last week the focus was on employment, with the headline payroll number on Friday showing the economy is doing just fine, with a few small cracks showing up in a higher unemployment rate.

This week’s calendar will be focused on inflation, with CPI and PPI. This will be the last significant release we have before the FOMC meeting on December 17-18. See below for more details.

Wrap-Up

Survey says! What are you most thankful for? What do you want for Christmas? As always on surveys, pay attention to your target audience, as this can highly influence your responses.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 9-Dec | Wholesale Inventories MoM | Oct F | 0.2% | 0.2% |

| 9-Dec | Wholesale Trade Sales MoM | Oct | N/A | 0.3% |

| 9-Dec | NY Fed 1-yr inflation expectations | Nov | N/A | 2.87% |

| 10-Dec | NFIB Small Business Optimism | Nov | 94.5 | 93.7 |

| 10-Dec | Nonfarm Productivity | Q3 F | 2.2% | 2.2% |

| 10-Dec | Unit Labor Costs | Q3 F | 1.5% | 1.9% |

| 11-Dec | Consumer Price Index MoM | Nov | 0.3% | 0.2% |

| 11-Dec | CPI ex Food & Energy MoM | Nov | 0.3% | 0.3% |

| 11-Dec | Consumer Price Index YoY | Nov | 2.7% | 2.6% |

| 11-Dec | CPI ex Food & Energy YoY | Nov | 3.3% | 3.3% |

| 11-Dec | Real Avg Hourly Earnings YoY | Nov | N/A | 1.4% |

| 11-Dec | Real Avg Weekly Earnings YoY | Nov | N/A | 1.4% |

| 11-Dec | Federal Budget Balance | Nov | -$354.0B | -$257.5B |

| 12-Dec | Producer Price Index MoM | Nov | 0.3% | 0.2% |

| 12-Dec | PPI ex Food & Energy MoM | Nov | 0.2% | 0.0% |

| 12-Dec | Producer Price Index YoY | Nov | 2.6% | 2.4% |

| 12-Dec | PPI ex Food & Energy YoY | Nov | 3.2% | 3.1% |

| 12-Dec | Initial Jobless Claims | 7-Dec | 220,000 | 224,000 |

| 12-Dec | Continuing Claims | 30-Nov | 1,878,000 | 1,871,000 |

| 13-Dec | Household Change in Net Worth | Q3 | N/A | $2,760B |

| 13-Dec | Import Price Index MoM | Nov | -0.2% | 0.3% |

| 13-Dec | Export Price Index MoM | Nov | -0.2% | 0.8% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI