Inflation vanquished? — Week of February 3, 2025

Essential Economics

— Mark Frears

Miles, kilometers or money

While the new “Top Gun” is good, the 1986 classic was better. No matter whether you are talking about the jets, cars, motorcycles, ships or relationships, this movie is all about speed. Tom Cruise’s love interest drove one of the best classic cars of all time (my opinion). The cars (usually SUVs) these days have become more and more like clones, and pretty soon we won’t even have to drive them. Boring.

Speed in the markets bears a little more attention!

Money supply

The Federal Reserve measures the amount of money at various degrees of liquidity, or spendability, and prior to 2000, these measures were watched closely as they correlated well with economic activity. Since then, it is still watched due to the influence the amount of money, and speed that it moves, can have on the overall economy.

The M1 category measures the most liquid forms, primarily currency and readily available deposits in banks. M2 is M1 plus savings accounts, smaller time deposits and balances in retail money market mutual funds. This is considered the best measure to watch, as it covers a broad spectrum of money that can have an influence on the economy.

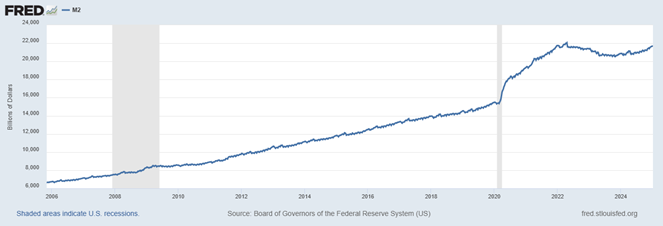

As you can see from the chart above, the amount of money in the M2 category has continued to increase as the economy has been on a long upward trend. The stimulus money had an immediate effect later in 2020, but the upward trend has continued. After a slight lull in 2023 and early 2024, we are back on an upswing.

“I feel the need, the need for speed”

We talked about the speed of cars; now let’s look at how that relates to money. The velocity is defined as the rate at which money is exchanged in the economy: the number of times one unit of money is spent to buy goods and services per unit of time.

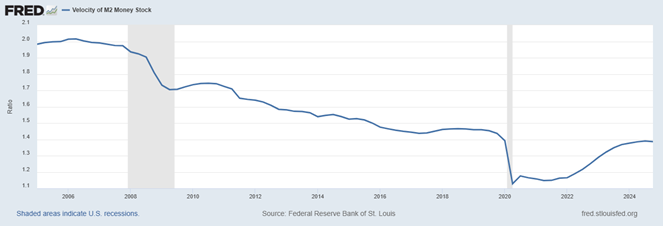

As you would expect, the velocity slows during the 2008–09 recession, shown in the shaded area to the left above. Right after this recession, due to stimulus provided to the economy, we saw the speed increase, but since then we have been gradually reducing the how fast money circulates. The primary driver of this lower velocity is the increasing amount of money in the system. As we entered pandemic time, velocity fell off a cliff as the economy was basically shuttered and money was dumped into the system to offset potential liquidity stress. Post-pandemic, we started out slow, but we have been on a solid upswing, with a small amount of flattening recently.

Pace

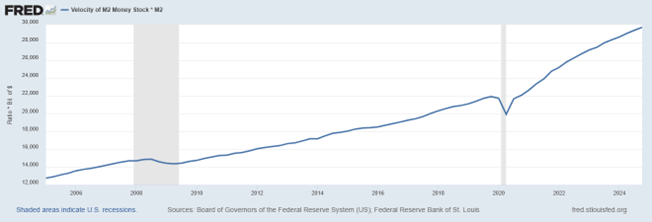

If you combine supply with velocity (inversely related to demand), you get the graph below. The faster supply growth relative to demand can be seen in the positive sloping line below.

One of the concerns of monetarists is that the accelerated growth rate of supply relative to demand could cause inflationary tendencies. At the start of the pandemic, we saw this slow significantly, but there was a sharp upturn, and it has not slowed down! As the fiscal stimulus did not slow down, even when the FOMC was lowering rates, we are still seeing a continued strong upward trend. Given the action in the long end of the UST curve and “the pause” by the FOMC, the market will continue to watch for inflationary warning signals.

Economic releases

Last week saw a Fed on hold, lower consumer confidence and PCE stalling. While the election uncertainty has passed, the markets are still treading water watching for next steps.

This week’s calendar is focused jobs, with JOLTS, ADP and nonfarm payroll. In addition, we will see preliminary February consumer sentiment and consumer credit. See below for other releases.

Wrap-Up

So, whatever pace you are traveling at, remember to keep in mind that the journey is just as important as the destination.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 3-Feb | S&P Global US Manuf PMI | Jan F | 50.1 | 50.1 |

| 3-Feb | Construction Spending MoM | Dec | 0.2% | 0.0% |

| 3-Feb | ISM Manufacturing Index | Jan | 50.0 | 49.3 |

| 3-Feb | ISM Manufacturing Prices Paid | Jan | 54.2 | 52.5 |

| 3-Feb | ISM Manufacturing Employment | Jan | 47.8 | 45.3 |

| 3-Feb | ISM Manufacturing New Orders | Jan | 52.0 | 52.5 |

| 3-Feb | Ward's Total Vehicle Sales | Jan | 16,000,000 | 16,800,000 |

| 4-Feb | JOLTS Job Openings | Dec | 8,000,000 | 8,098,000 |

| 4-Feb | JOLTS Job Openings Rate | Dec | N/A | 4.8% |

| 4-Feb | JOLTS Job Quits | Dec | N/A | 3,065,000 |

| 4-Feb | JOLTS Job Quits Rate | Dec | N/A | 1.9% |

| 4-Feb | JOLTS Job Layoffs | Dec | N/A | 1,765,000 |

| 4-Feb | JOLTS Job Layoffs Rate | Dec | N/A | 1.1% |

| 4-Feb | Factory Orders | Dec | -0.7% | -0.4% |

| 4-Feb | Factory Orders ex Transportation | Dec | N/A | 0.2% |

| 5-Feb | ADP Employment Change | Jan | 150,000 | 122,000 |

| 5-Feb | ISM Services Index | Jan | 54.1 | 54.1 |

| 5-Feb | ISM Services Prices Paid | Jan | N/A | 64.4 |

| 5-Feb | ISM Services Employment | Jan | N/A | 51.4 |

| 5-Feb | ISM Services New Orders | Jan | N/A | 54.2 |

| 6-Feb | Challenger Job Cuts YoY | Jan | N/A | 11.40% |

| 6-Feb | Nonfarm Productivity | Q4 | 1.4% | 2.2% |

| 6-Feb | Unit Labor Costs | Q4 | 3.4% | 0.8% |

| 6-Feb | Initial Jobless Claims | 1-Feb | 213,000 | 207,000 |

| 6-Feb | Continuing Claims | 25-Jan | 1,875,000 | 1,858,000 |

| 7-Feb | Change in Nonfarm Payrolls | Jan | 170,000 | 256,000 |

| 7-Feb | Change in Private Payrolls | Jan | 141,000 | 223,000 |

| 7-Feb | Unemployment Rate | Jan | 4.1% | 4.1% |

| 7-Feb | Avg Hourly Earnings MoM | Jan | 0.3% | 0.3% |

| 7-Feb | Avg Hourly Earnings YoY | Jan | 3.8% | 3.9% |

| 7-Feb | Avg Weekly Hours - All Employees | Jan | 34.3 | 34.3 |

| 7-Feb | Labor Force Participation Rate | Jan | 62.5% | 62.5% |

| 7-Feb | Underemployment Rate | Jan | N/A | 7.5% |

| 7-Feb | Consumer Sentiment | Feb P | 72.0 | 71.1 |

| 7-Feb | Current Conditions | Feb P | 73.5 | 74.0 |

| 7-Feb | Expectations | Feb P | 71.0 | 69.3 |

| 7-Feb | 1-yr inflation | Feb P | 3.2 | 3.3% |

| 7-Feb | 5-10-yr inflation | Feb P | 3.1% | 3.2% |

| 7-Feb | Consumer Credit | Dec | $14.500B | -$7.489B |

| F - Final P - Preliminary |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas - Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI