Where do you shop? — Week of January 13, 2025

Essential Economics

— Mark Frears

Where are you shopping?

Are you an Amazon junkie? Do you have Prime-nesia? Can’t open the screen door on your home because there are too many packages? It is so convenient, and prices are usually very competitive, but I feel led to put in a plug for your local businesses. A great way to do this is, when you know what good/service you are looking for, pull up Google maps for your area and plug it in. There could very well be great options close by, instead of stuffing the coffers of the Big Box stores, or Amazon.

Not saying I don’t use Amazon plenty, but if there are local small businesses, how about giving them a shot?

Significant contribution

Small businesses create two-thirds of net new jobs and drive innovation and competitiveness. A U.S Small Business Administration (SBA) study in 2019 showed that these contributed 44% of U.S. economic activity! From 1998 to 2014, the share of Gross Domestic Product (GDP) that small businesses drove was up 25%.

Growing confidence

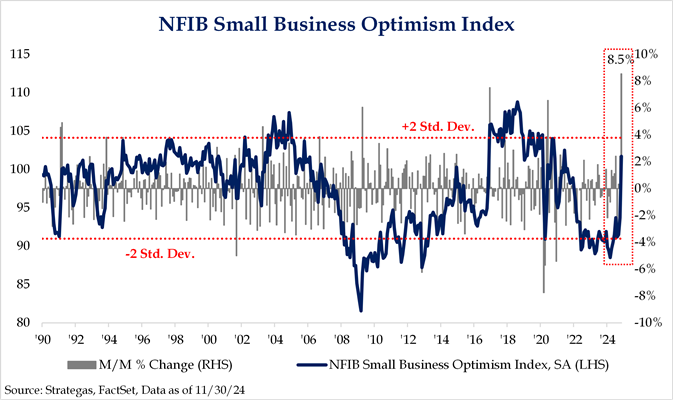

Recent surveys of confidence in the small business sector have shown an improving trend. The National Federation of Independent Business (NFIB) Optimism Index is shown below.

As you can see below, plans to create new jobs is on a nice upswing.

Source: NFIB Job Report – January 9, 2024

New businesses

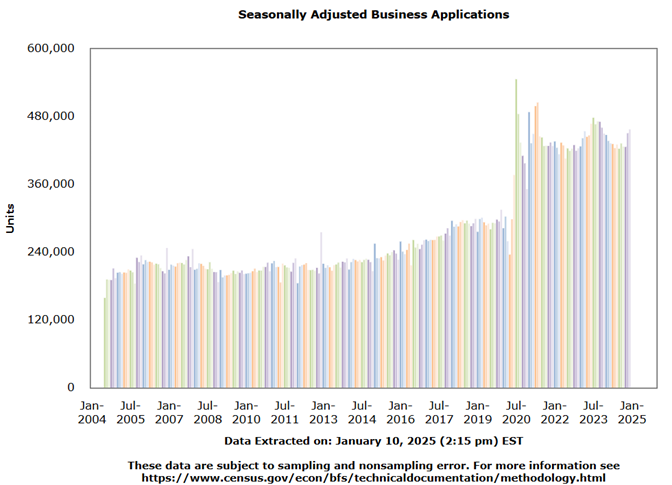

One of the best indicators for optimism in this sector, and the overall economy, are applications to start new enterprises. The U.S. Census Bureau measures these on a weekly basis, as you can see below.

The uptick at the end of 2024 is a good sign for continued growth in this vital sector going forward.

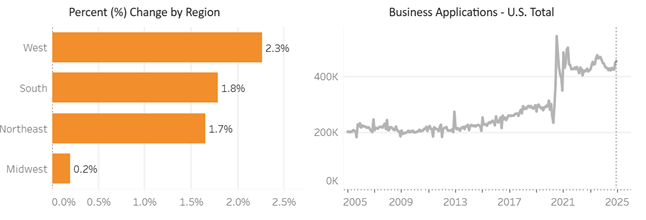

As you can see below, the new applications are doing well in most areas of the country, except for the Midwest.

Source: U.S. Census Bureau

Economic releases

Last week was all about jobs, and the news was that 2024 closed out strong. Consumer credit dropped as revolving debt decreased. Consumer sentiment showed an increase in inflation expectations.

This week’s calendar is inflation-centric. PPI and CPI will be the highlights. Also, we have Retail Sales and housing starts and permits. The next FOMC meeting is January 28–29. See below for other releases.

Wrap-Up

I would encourage you to do your part in assisting local businesses. We have gotten into the habit of driving up to the neighborhood Italian place to pick up food to bring home. Best of both worlds: not having to cook, and supporting local enterprises.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 13-Jan | NY Fed 1-yr inflation expectations | Dec | N/A | 2.97% |

| 13-Jan | Federal Budget Balance | Dec | -$73.8B | -$366.8B |

| 14-Jan | NFIB Small Business Optimism | Dec | 101.5 | 101.7 |

| 14-Jan | Producer Price Index MoM | Dec | 0.4% | 0.4% |

| 14-Jan | PPI ex Food & Energy MoM | Dec | 0.3% | 0.2% |

| 14-Jan | Producer Price Index YoY | Dec | 3.5% | 3.0% |

| 14-Jan | PPI ex Food & Energy YoY | Dec | 3.8% | 3.4% |

| 15-Jan | Empire Manufacturing | Jan | 3.0 | 0.2 |

| 15-Jan | Consumer Price Index MoM | Dec | 0.3% | 0.3% |

| 15-Jan | CPI ex Food & Energy MoM | Dec | 0.2% | 0.3% |

| 15-Jan | Consumer Price Index YoY | Dec | 2.9% | 2.7% |

| 15-Jan | CPI ex Food & Energy YoY | Dec | 3.3% | 3.3% |

| 15-Jan | Real Avg Hourly Earnings YoY | Dec | N/A | 1.3% |

| 15-Jan | Real Avg Weekly Earnings YoY | Dec | N/A | 1.0% |

| 15-Jan | Federal Reserve Releases Beige Book for Jan 28-29 FOMC | |||

| 16-Jan | Philadelphia Fed Business Outlook | Jan | (5.0) | (16.4) |

| 16-Jan | Retail Sales MoM | Dec | 0.6% | 0.7% |

| 16-Jan | Retail Sales ex Autos MoM | Dec | 0.5% | 0.2% |

| 16-Jan | Import Price Index MoM | Dec | -0.2% | 0.1% |

| 16-Jan | Export Price Index MoM | Dec | 0.1% | 0.0% |

| 16-Jan | NY Fed Services Business Activity | Jan | N/A | (5.2) |

| 16-Jan | Initial Jobless Claims | 11-Jan | 210,000 | 201,000 |

| 16-Jan | Continuing Claims | 4-Jan | 1,877,000 | 1,867,000 |

| 16-Jan | Business Inventories | Nov | 0.1% | 0.1% |

| 16-Jan | NAHB Housing Market Index | Jan | 45 | 46 |

| 17-Jan | Housing Starts | Dec | 1,325,000 | 1,289,000 |

| 17-Jan | Housing Starts MoM | Dec | 2.8% | -1.8% |

| 17-Jan | Building Permits | Dec | 1,460,000 | 1,493,000 |

| 17-Jan | Building Permits MoM | Dec | -2.2% | 5.2% |

| 17-Jan | Industrial Production MoM | Dec | 0.3% | -0.1% |

| 17-Jan | Capacity Utilization | Dec | 77.0% | 76.8% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Private Bank. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI