What stresses you? — Week of January 20, 2025

Essential Economics

— Mark Frears

Stress meter

What things get your blood pressure up? Is it driving (people on phones!), the economy, your kids, your job, too much debt, not enough hours in the day or possibly the high cost of living? A wise man once told me that worry doesn’t solve anything, but that is easier said than done. If you hang onto stress, it can come out in different ways. Mentally you might snap, probably at the worst time, and physically it will wear you down.

What is worrying the consumer? They are two-thirds of the strength of our economy, so we should pay attention.

Current picture

The Federal Reserve Bank of New York’s Center for Microeconomic Data just released the December 2024 Survey of Consumer Expectations. Their three main findings concerned inflation, labor market and household finance. These are what keep the consumer’s attention.

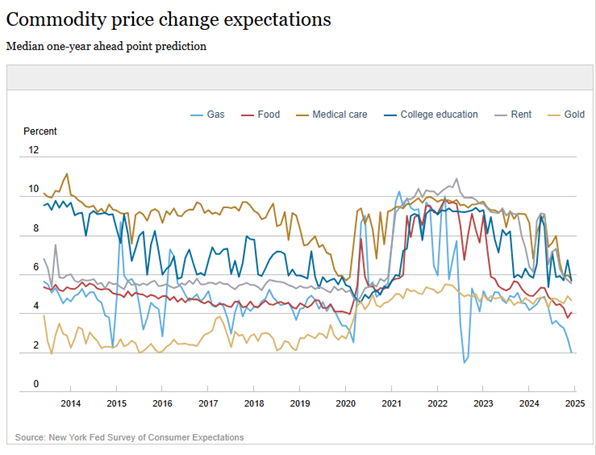

On the inflation front, while we are seeing some components improve, the overall levels for food, medical care and rent are all above 4%, as you can see below.

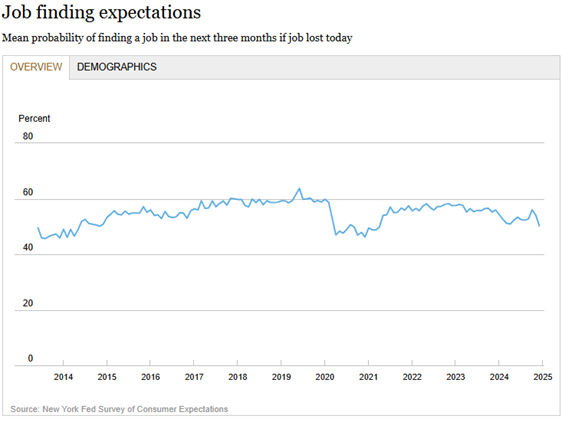

The labor market is very important, especially in the middle- to lower-income households, as their budgets are being stretched by the higher costs outlined above. As you see below, there has been a dip in the expectations for easily finding another job if needed.

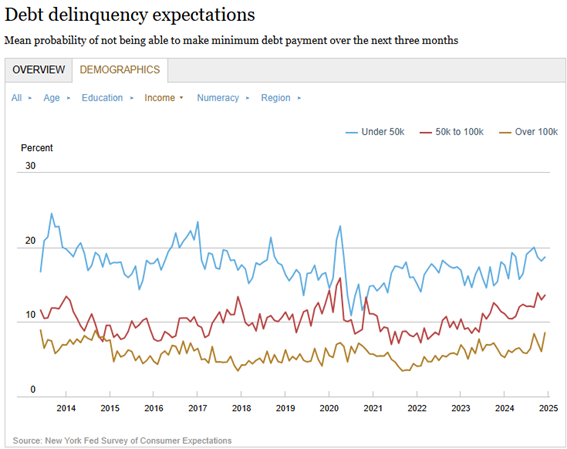

When households look at their financial picture, there is an uptick in expected inability to make debt payments. As you can see below, all household sectors are experiencing this stress.

Price improvement not as good as it looks

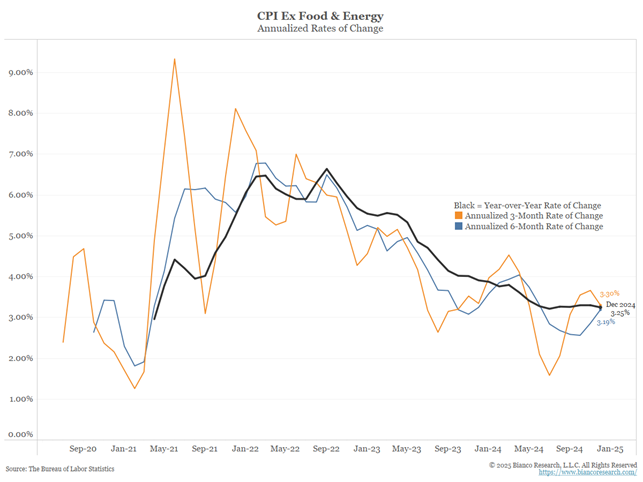

The Producer Price Index (PPI) and Consumer Price Index (CPI) this past week showed improvement, if you listened to some media channels. On a year-over-year basis, they were 3.3% and 2.9%, respectively. If you take out the volatile Food and Energy sectors, as the FOMC likes to do, they came in at 3.5% and 3.2%, respectively. The FOMC target is 2% for their preferred target, Personal Consumption Expenditure (PCE), which most recently came in at 2.4% year over year in November, and excluding Food and Energy, 2.8%.

Bottom line, while we are better than we were in the pandemic, these are still at elevated levels from target and from what the consumer was experiencing prior to the breakout.

The chart below shows CPI on an annualized change basis. This emphasizes that while the change in prices has slowed, they are still at higher levels, causing stress in household’s budgets.

Source: Bianco Research

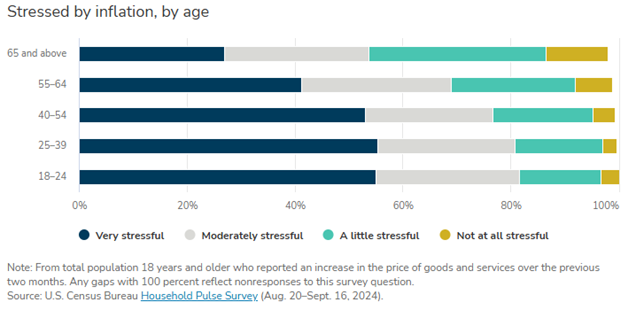

Who is feeling this stress the most? The chart below shows the most stress is felt by people under the age of 55. They are the ones having to adjust to this higher level of prices without appreciating assets to support their spending. In addition, higher housing costs are having a large impact.

Offsetting income

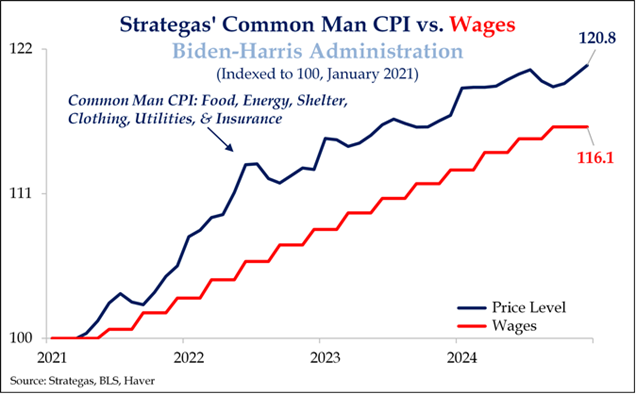

One argument for winning the battle against inflation is that wages and salaries are keeping up with higher prices. The Strategas Common Man CPI measure, seen below, is not in line with that theory.

The price component of this chart covers basic needs for households, and you can see the recent trend is actually getting worse. Inflation, by whatever name you call it, is still a major concern, and the stress associated with it will continue to have an impact.

Economic releases

Last week was mostly inflation-focused, with PPI and CPI the headliners. Both came in around expectations, but the trend is not a continuing improvement. Retail sales showed the consumer finished 2024 strong, and housing numbers showed surprising strength

This week’s calendar is lighter with Leading Index, and consumer sentiment in focus. The FOMC members will be in their blackout period for speaking, ahead of the FOMC meeting on January 28–29. See below for other releases.

Wrap-Up

How do you deal with your stress? There are a couple ways I have found. First, exercise, (I am sure it has to with chemicals being released in the bloodstream) makes me more relaxed and better able to deal with things. Second, looking at things from a long-term perspective makes the current circumstances less onerous. Hope 2025 can be a less stressful time for you.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 21-Jan | Philadelphia Fed Non-Manuf Activity | Nov | N/A | (6.0) |

| 22-Jan | MBA Mortgage Applications | 17-Jan | N/A | 33.30% |

| 22-Jan | Leading Index | Dec | -0.1% | 0.3% |

| 23-Jan | Initial Jobless Claims | 18-Jan | 220,000 | 217,000 |

| 23-Jan | Continuing Claims | 11-Jan | 1,868,000 | 1,859,000 |

| 23-Jan | KC Fed Manufacturing Activity | Jan | N/A | (4) |

| 24-Jan | S&P Global US Manufacturing PMI | Jan P | 49.9 | 49.4 |

| 24-Jan | S&P Global US Services PMI | Jan P | 56.5 | 56.8 |

| 24-Jan | S&P Global US Composite PMI | Jan P | N/A | 55.4 |

| 24-Jan | Consumer Sentiment | Jan F | 73.2 | 73.2 |

| 24-Jan | Current Conditions | Jan F | N/A | 77.9 |

| 24-Jan | Expectations | Jan F | N/A | 70.2 |

| 24-Jan | 1-yr inflation | Jan F | N/A | 3.3% |

| 24-Jan | 5-10-yr inflation | Jan F | N/A | 3.3% |

| 24-Jan | Existing Home Sales | Dec | 4,200,000 | 4,150,000 |

| 24-Jan | Existing Home Sales MoM | Dec | 1.2% | 4.8% |

| 24-Jan | KC Fed Services Activity | Jan | N/A | 2 |

| F - Final P - Preliminary |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Private Bank. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas - Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI