Creative or destructive? — Week of January 27, 2025

Essential Economics

— Mark Frears

Construction zone

Currently in the neighborhood, there is a lot of activity going on in our normally quiet residential byways. Many roads are being chopped up into smaller pieces and hauled off. After excavations, water shutoffs, mailbox removals and preparation, they get to the point where rebar is laid, forms are set and new concrete is poured. There is a significant amount of disruption and inconvenience during the process, but in the end, there is better drainage, improved plumbing and new roads. The question is: Was it worth it, and more importantly, when will I get my mailbox back?!

It can be a fine line between destroying and creating!

Historical background

In 1942, Joseph Schumpeter coined the term creative destruction, and economists have adopted it as a shorthand description of capitalism’s messy way of progress. In his initial description, Schumpeter was criticizing capitalism as he was heavily influenced by Karl Marx’ and Friedrich Engels’ communist perspective. In current times, his viewpoint has been lost as economists delve into this concept to explain trends in capitalism.

The basic premise is that progress destroys old processes and replaces them with newer, innovative ones. One of the first examples cited was Henry Ford’s assembly line in automobile manufacturing. This new way of producing cars disrupted many parts of manufacturing and put people out of work, but it created a much more efficient means of making new cars.

This theory treats economics as a dynamic process, in opposition to the traditional static mathematical models usually associated with this field. As it involves destruction, there will be winners and losers, and companies/workers associated with older technology will be left behind

Educational system

You might not think the field of education was being destroyed, but there are some serious changes underway. This has been amplified by the impact of the pandemic, causing parents to take on a larger role in primary and secondary education. In addition, college education was forced into an online means of distributing curriculum.

The declining viability of standard methods of delivery was already underway before the quarantine. Personalized education, primarily through online/hybrid channels, had been increasing, causing educators to take stock of their current model. Schools that were further down this track before the pandemic have found themselves in much better shape to deliver a better product. This will bring about winners and losers.

One part of this that could be overlooked is the social interaction in academic environments. How you learn to get along in kindergarten with others can have far-reaching impacts. Also, what I learned in college was certainly not limited to the classroom; just saying.

It used to be the big thing

Before recent years, we could say the biggest innovation in our times was the internet. It has brought about its fair share of destruction; is it for the better? I think it is safe to say that the economy would have been in much worse shape during the pandemic if we did not have this phenomenon.

At its core, the internet is a means of consolidating information and providing communication channels. This innovation has enabled significant changes in all our worlds.

In commerce, we can buy goods online without leaving our home, and this is accelerating the decline of brick and mortar businesses. As noted above, changes in the educational system have been facilitated. Entertainment at our fingertips, 24/7; no need to run to Blockbuster anymore. Churches have been able to reach broader audiences through the online platform. In business, many of us can continue our work functions without missing a beat, thanks to online systems and communications.

Like we discussed above, social interaction is changing due to online capabilities. Even before the pandemic, people were relying more on texting and FaceTime for their communication. This does not replace community, like a potluck picnic, sitting down with friends, boating with family or throwing a frisbee. We must be mindful of the limitations, even with great new innovations.

The new big thing

So, the internet was cool and did all we talked about above, but now we have Artificial Intelligence (AI). Everything else is old news.

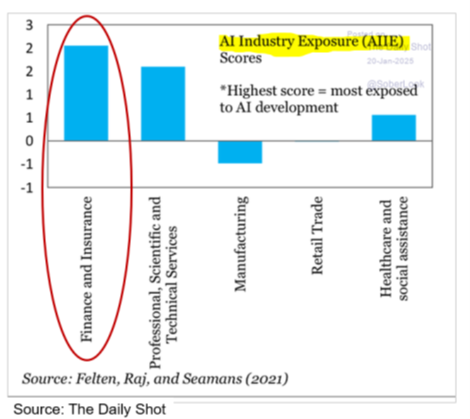

The biggest concern is that we will all be replaced by robots, and there certainly will be some of that. The chart below shows how AI will impact financial and insurance sectors the most.

In addition, the education system is in an uproar, as students use ChatGPT to create better papers than they could do themselves. How do you monitor and/or use that? It can also be used to gather immense amounts of data, in very short periods of time, potentially threatening people’s personal information.

If this is deemed destructive, then think about the things it can do better for us and allow us to do even better things! It will challenge us to get away from more mundane tasks and use our minds to think and dream big.

Economic releases

Last week was mostly focused on the inauguration and the new world of executive orders, along with lots of talk from D.C. In addition, we had lower leading indicators, and consumer sentiment worried about tariff impact on higher prices.

This week’s calendar is focused on the FOMC meeting on January 28–29. There will not be a change in interest rates, but the press conference should make for great theatre. Also, we have Consumer Confidence and PCE. See below for other releases.

Wrap-Up

So, keep your eyes open and don’t get caught up in the comfortable, way-you’ve-always-done-it mindset; you might miss out on the next great thing!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 27-Jan | Chicago Fed Natl Activity Index | Dec | (0.06) | (0.12) |

| 27-Jan | New Home Sales | Dec | 675,000 | 664,000 |

| 27-Jan | New Home Sales MoM | Dec | 2.0% | 5.9% |

| 27-Jan | Dallas Fed Manufacturing | Jan | 0.0 | 3.4 |

| 28-Jan | Durable Goods Orders | Dec P | 0.5% | -1.2% |

| 28-Jan | Durable Goods ex Transportation | Dec P | 0.4% | -0.2% |

| 28-Jan | Cap Goods Orders Nondef ex Aircraft | Dec P | 0.3% | 0.4% |

| 28-Jan | FHHA House Price Index MoM | Nov | 0.40% | 0.40% |

| 28-Jan | S&P CoreLogic 20-city YoY | Nov | 4.25% | 4.22% |

| 28-Jan | Dallas Fed Services | Jan | N/A | 9.6 |

| 28-Jan | Conf Board Consumer Confidence | Jan | 105.6 | 104.7 |

| 28-Jan | Conf Board Present Situation | Jan | N/A | 140.2 |

| 28-Jan | Conf Board Expectations | Jan | N/A | 81.1 |

| 28-Jan | Richmond Fed Manufacturing Index | Jan | (12) | (10) |

| 28-Jan | Richmond Fed Business Conditions | Jan | N/A | 14 |

| 29-Jan | Retail Inventories MoM | Dec | N/A | 0.3% |

| 29-Jan | Wholesale Inventories MoM | Dec P | 0.2% | -0.2% |

| 29-Jan | FOMC Rate Decision (Upper Bound) | 1p CT | 4.50% | 4.50% |

| 29-Jan | FOMC Rate Decision (Lower Bound) | 1p CT | 4.25% | 4.25% |

| 30-Jan | GDP Annualized QoQ | Q4 | 2.7% | 3.1% |

| 30-Jan | Personal Consumption | Q4 | 3.2% | 3.7% |

| 30-Jan | GDP Price Index | Q4 | 2.5% | 1.9% |

| 30-Jan | Initial Jobless Claims | 25-Jan | 225,000 | 223,000 |

| 30-Jan | Continuing Claims | 18-Jan | 1,910,000 | 1,899,000 |

| 30-Jan | Pending Home Sales MoM | Dec | -0.5% | 2.2% |

| 31-Jan | Employment Cost Index | Q4 | 0.9% | 0.8% |

| 31-Jan | Personal Income | Dec | 0.4% | 0.3% |

| 31-Jan | Personal Spending | Dec | 0.5% | 0.4% |

| 31-Jan | Real Personal Spending | Dec | 0.3% | 0.3% |

| 31-Jan | PCE Deflator YoY | Dec | 2.5% | 2.4% |

| 31-Jan | PCE Core Deflator YoY | Dec | 2.8% | 2.8% |

| 31-Jan | MNI Chicago PMI | Jan | 40.0 | 36.9 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Private Bank. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas - Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI