A time for every matter under heaven — Week of January 6, 2025

Essential Economics

— Mark Frears

Time

The beginning of a new year usually carries an upbeat message with a time of renewal and/or a new start. As you are contemplating your New Year’s resolutions, keep one thing in mind. You, I and Elon Musk only have 24 hours in a day. Period. It might be a good time to do an audit of how you spend your time, just like you need to track your spending when establishing a budget. Once you take out the big items of work and sleep (pay attention to this one), you only have a limited amount of time remaining. How will you spend it in order to meet your goals?!

How can we measure our efficiency in economic terms?

Output

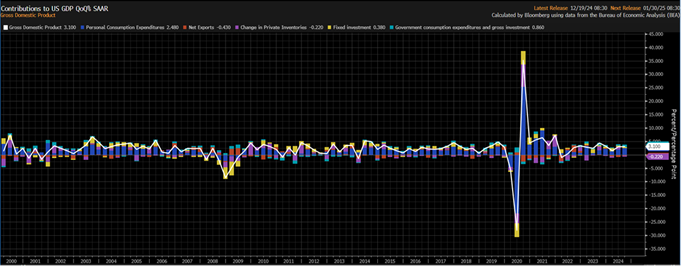

The metric used in economic efficiency for output is usually Gross Domestic Product (GDP). As you can see below, we have been running above the long-term FOMC target of 2% for nine quarters, with only one exception at 1.6% in Q1 2024.

Source: Bloomberg

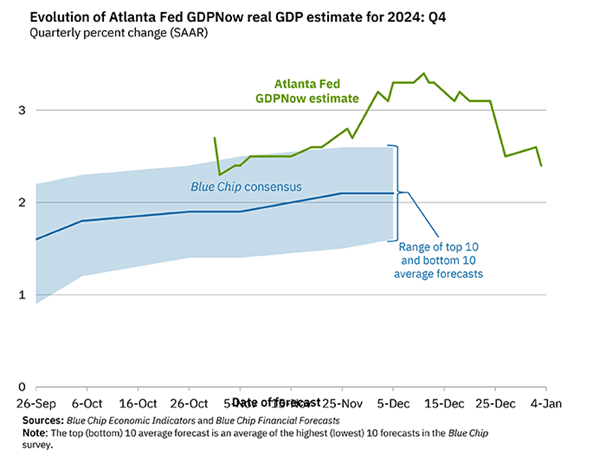

This is looking backward, but the forecast for Q4 2024 should continue the trend above 2%, as seen below in the Atlanta Fed forecast.

Source: Federal Reserve Bank of Atlanta

In addition, the December FOMC’s Summary of Economic Projections shows 2025 at 2.1%, 2026 at 2.0% and 2027 at 1.9%. The train rolls on.

Input

While raw materials can be part of the cost of doing business, given the service economy we are currently experiencing, labor costs are the primary expense.

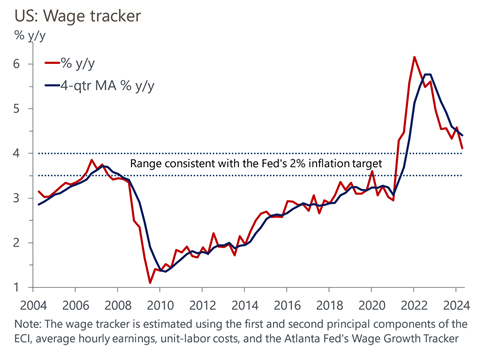

As you can see below, while wages spiked after the pandemic, they have been on a downward trend since. Although we are not yet in the range associated with the Fed’s 2% inflation target.

Source: Oxford Economics / Haver Analytics

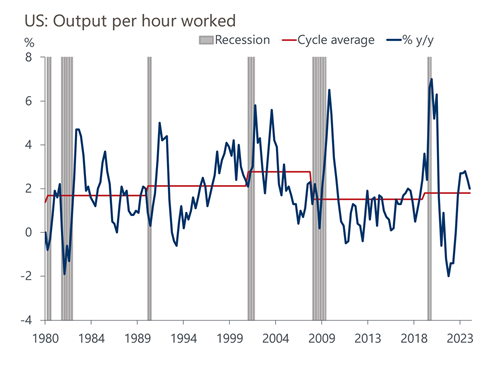

So, if wage growth is slowing, how are we able to continue to put out strong GDP growth numbers? Bottom line, the worker is more productive. The chart below shows we are running above the business cycle average, coming at 2.2% in Q3 2024.

Source: Oxford Economics / Haver Analytics

Digging deeper

Higher productivity has two sides, though. The employer loves this, as they can keep the same level, or improve, output with fewer workers. The efficient worker must show their value in order to be part of the workforce that could see better wages in the future.

Productivity is also good for inflation, as businesses can be more profitable, pay workers more and not have to raise prices.

Some of this improvement in efficiency has been driven by modifications that came out of the pandemic. While it was a tough time, there were some lessons learned. Hybrid or remote work saves employers overhead, and better means of insuring worker’s engagement have helped costs. Artificial intelligence, while still a wild card long-term, has shown its benefit to smaller businesses who are able to more with less.

Given low unemployment claims and historically low unemployment rate, the labor market still looks to be tight, or in need of workers. The shift to a more service-oriented economy needs workers with different skillsets.

If we can continue this current trend, we will keep this country booming, inflation at bay and workers employed in the best jobs for their gifts and talents.

Economic releases

Last week was kind of slow on the release front, with close out of 2024 and easing into 2025. Jobless claims were lower, and manufacturing is picking up. This week’s calendar is all mostly about the labor market. We have JOLTS, ADP and nonfarm payroll. In addition, we have consumer credit and consumer sentiment. The next FOMC meeting is January 28-29. See below for other releases.

This week’s calendar is all mostly about the labor market. We have JOLTS, ADP and nonfarm payroll. In addition, we have consumer credit and consumer sentiment. The next FOMC meeting is January 28-29. See below for other releases.

Wrap-Up

The more productive you are at work, the more money and time you have to put toward those personal goals. Do you have an accountability partner for your new resolutions? This will greatly enhance your chances. Good luck.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 6-Jan | S&P Global US Services PMI | Dec F | 58.5 | 58.5 |

| 6-Jan | S&P Global US Composite PMI | Dec F | N/A | 56.6 |

| 6-Jan | Factory Orders | Nov | -0.3% | 0.2% |

| 6-Jan | Factory Orders ex Transportation | Nov | 0.1% | 0.1% |

| 7-Jan | Trade Balance | Nov | -$78.3B | -$73.8B |

| 7-Jan | JOLTS Job Openings | Nov | 7,775,000 | 7,744,000 |

| 7-Jan | JOLTS Job Openings Rate | Nov | N/A | 4.6% |

| 7-Jan | JOLTS Quits Level | Nov | N/A | 3,326,000 |

| 7-Jan | JOLTS Quits Rate | Nov | N/A | 2.1% |

| 7-Jan | JOLTS Layoff Level | Nov | N/A | 1,633,000 |

| 7-Jan | JOLTS Layoff Rate | Nov | N/A | 1.0% |

| 7-Jan | ISM Services Index | Dec | 53.5 | 52.1 |

| 7-Jan | ISM Services Prices Paid | Dec | 57.5 | 58.2 |

| 7-Jan | ISM Services Employment | Dec | 51.1 | 51.5 |

| 7-Jan | ISM Services New Orders | Dec | 54.0 | 53.7 |

| 8-Jan | ADP Employment Change | Dec | 133,000 | 146,000 |

| 8-Jan | Fed releases FOMC Minutes from Dec 17-18 | |||

| 8-Jan | Consumer Credit | Nov | $10.500B | $19.239B |

| 9-Jan | Challenger Job Cuts YoY | Dec | N/A | 26.8% |

| 9-Jan | Initial Jobless Claims | 4-Jan | 216,000 | 211,000 |

| 9-Jan | Continuing Claims | 28-Dec | 1,863,000 | 1,844,000 |

| 10-Jan | Change in Nonfarm Payrolls | Dec | 154,000 | 227,000 |

| 10-Jan | Change in Private Payrolls | Dec | 133,000 | 194,000 |

| 10-Jan | Unemployment Rate | Dec | 4.2% | 4.2% |

| 10-Jan | Avg Hourly Earnings MoM | Dec | 0.3% | 0.4% |

| 10-Jan | Avg Hourly Earnings YoY | Dec | 4.0% | 4.0% |

| 10-Jan | Avg Weekly Hours - All Employees | Dec | 34.3 | 34.3 |

| 10-Jan | Labor Force Participation Rate | Dec | 62.5% | 62.5% |

| 10-Jan | Underemployment Rate | Dec | N/A | 7.8% |

| 10-Jan | Consumer Sentiment | Jan P | 74.0 | 74.0 |

| 10-Jan | Current Conditions | Jan P | 75.1 | 75.1 |

| 10-Jan | Expectations | Jan P | 72.7 | 73.3 |

| 10-Jan | 1-yr inflation | Jan P | 2.8% | 2.8% |

| 10-Jan | 5-10-yr inflation | Jan P | 3.0% | 3.0% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Private Bank. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI