Full picture — Week of November 18, 2024

Essential Economics

— Mark Frears

The full picture

When you are looking at a company or an individual’s assets, you might initially be impressed by what you see. An example of this was after the 2008-2009 time frame, when people who were living in beautiful homes in prime locations, no longer lived there. All you were seeing was the asset side, not the liability perspective. When you are analyzing individuals’ or companies’ finances, you need to understand the full picture.

As the consumer drives two-thirds of the economy, what does their current money story tell us?

The unseen

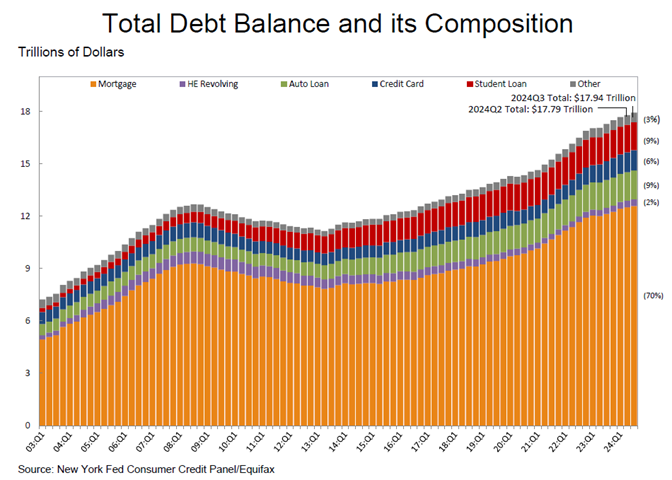

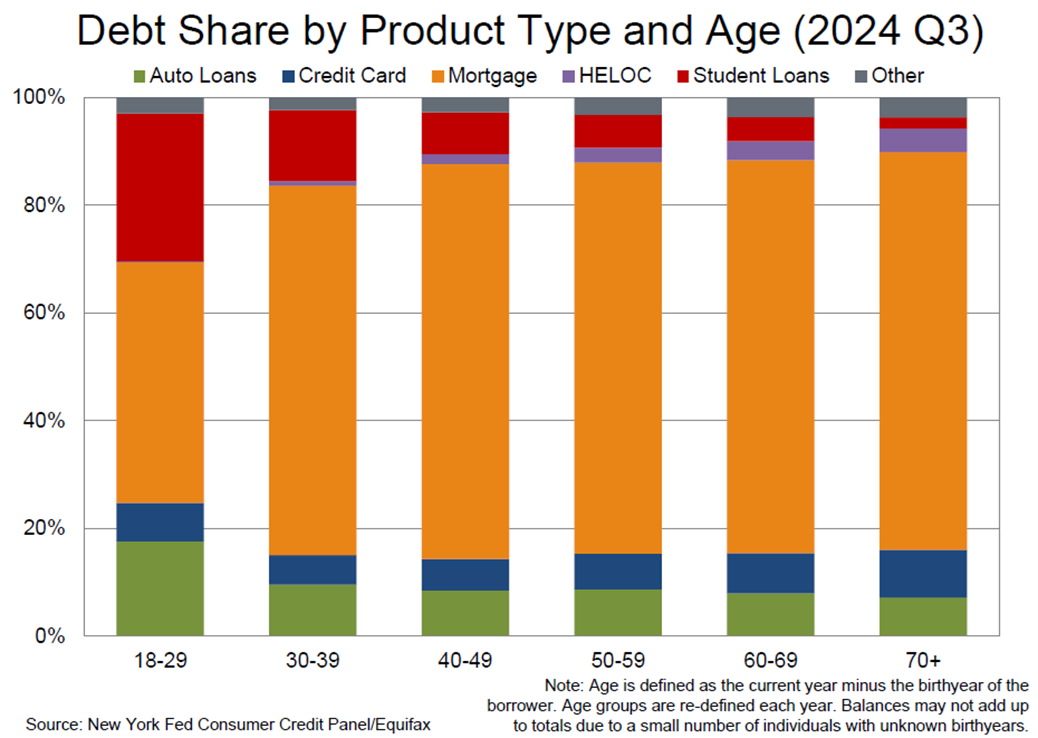

While you are looking at that fine home, or new car, or other purchases, you need to be aware of how that was purchased. Debt is a great thing, that allows us the opportunity to finance solid investments. Debt, or credit, like anything, is good in moderation. The chart below shows the makeup of current consumer debt.

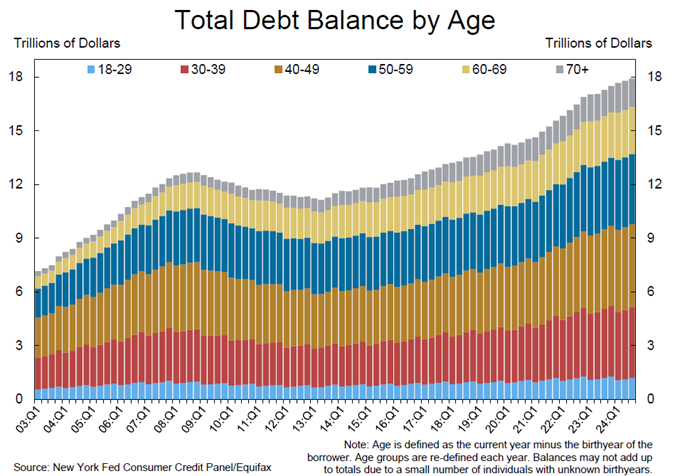

As you can see, mortgages make up the bulk, but other categories, outside of HELOCs, are expanding also. The pace, or steepness of the graph, is increasing as well.

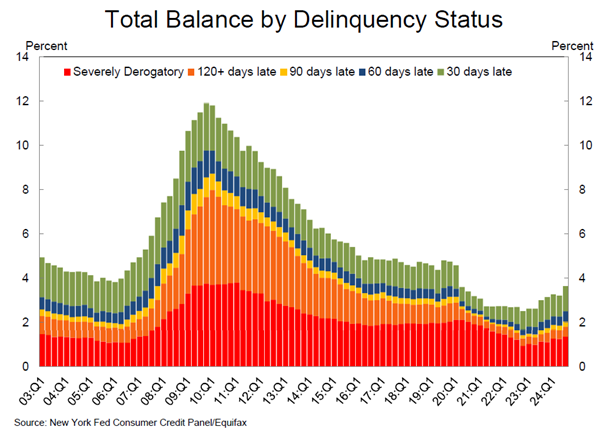

Per the chart below, most people are keeping up with their payments, but there is an uptick in 30-and 60-day late status.

These are still at historically low levels.

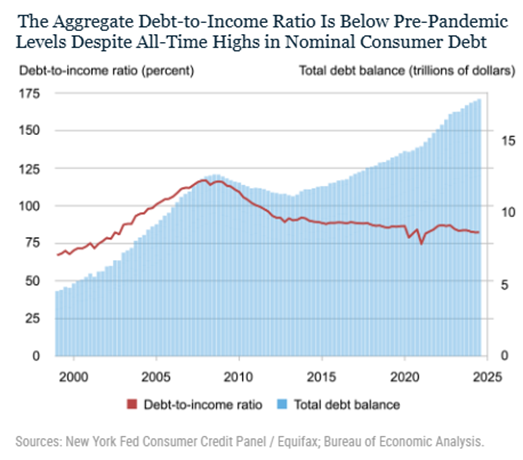

On the good news front, wages have been going up over this same time period, helping people to make their payments. As you can see in the chart below, the debt-to-income ratio is flat to decreasing, in spite of the amount of debt increasing.

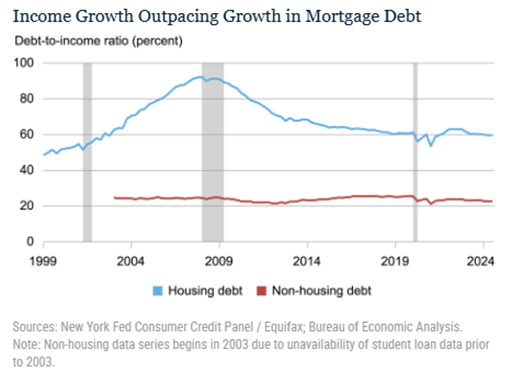

As housing makes up the largest part of household debt at 70%, it helps to break it out for a better picture. The chart below shows non-housing debt is more stable from an income-to-debt ratio, while housing spiked dramatically before the Great Recession, before coming back down to historical levels.

As a mortgage is longer term, the payment can be more manageable. A car loan, student loan, or credit card can actually have a bigger impact on the household budget at a point in time. This is where the pain point can occur if income is interrupted.

Life stages

Another way to slice and dice this is to look at it in terms of what debt you have outstanding at different ages. The chart below shows that mortgages are a big part, no matter your age.

As you would expect, car loans have a bigger percentage at a young age, and student loans are paid off as you age. This shows my misconception that most would have mortgages paid off by the time they retire. Also, credit card balances actually increase from the 30s to the 70s.

The view below shows that the 18-to-29-year-olds are not increasing their debt very much, but the other age brackets are all on an upward trajectory.

Low vs. high

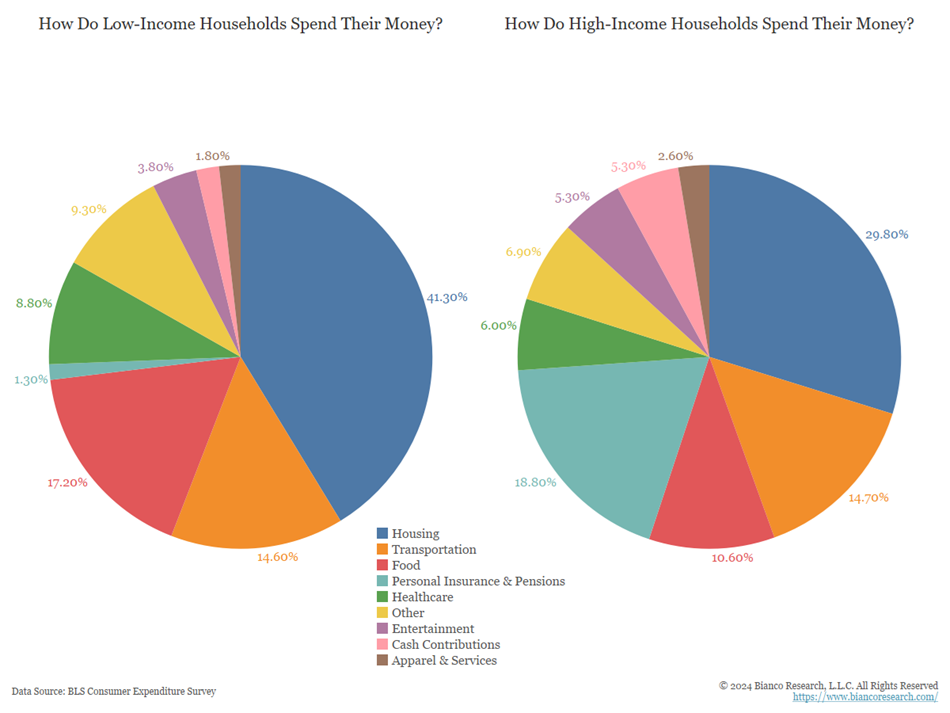

It is good to be aware of the larger trends, but it is also good to continue to dig deeper. As the chart below shows, there is a material difference on what different income levels spend their hard-earned cash on.

A low-income household spends 73.1% of their budget on housing, transportation and food, while a higher-income household spends only 55.1% of their budget. I find it interesting that transportation is about the same for both, but housing and food are a much bigger hit on low-income households.

Overall, it appears that the current level of debt is manageable. We must keep in mind the myriads of issues that are faced by different demographics, and the pressures associated with them. Debt is a great thing, and it must be properly managed, or it will not be available.

Economic releases

Last week was continued evaluation of the election, along with CPI, PPI and retail sales. All releases confirmed that the economy is humming along, and inflation is on a slight uptick.

This week’s calendar is not as full, so Washington, D.C., will continue to dominate headlines. We do have housing, PMIs, and consumer sentiment to fill in the gaps. See below for more details.

Wrap-Up

Bottom line: The borrower is servant to the lender, and there are specific responsibilities on both sides.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 18-Nov | NY Fed Services Business Activity | Nov | N/A | (2.2) |

| 18-Nov | NAHB Housing Market Index | Nov | 42 | 43 |

| 19-Nov | Housing Starts | Oct | 1,335,000 | 1,354,000 |

| 19-Nov | Housing Starts MoM | Oct | -1.4% | -0.5% |

| 19-Nov | Building Permits | Oct | 1,442,000 | 1,428,000 |

| 19-Nov | Building Permits MoM | Oct | 0.9% | -2.9% |

| 20-Nov | MBA Mortgage Applications | 15-Nov | N/A | 0.50% |

| 21-Nov | Philadelphia Fed Business Outlook | Nov | 7.5 | 10.3 |

| 21-Nov | Initial Jobless Claims | 16-Nov | 220,000 | 217,000 |

| 21-Nov | Continuing Claims | 9-Nov | 1,890,000 | 1,873,000 |

| 21-Nov | Leading Index | Oct | -0.3% | -0.5% |

| 21-Nov | Existing Home Sales | Oct | 3,950,000 | 3,840,000 |

| 21-Nov | Existing Home Sales MoM | Oct | 2.9% | -1.0% |

| 21-Nov | KC Fed Manufacturing Activity | Nov | N/A | (4) |

| 22-Nov | S&P Global US Manufacturing PMI | Nov P | 48.9 | 48.5 |

| 22-Nov | S&P Global US Services PMI | Nov P | 55.1 | 55.0 |

| 22-Nov | S&P Global US Composite PMI | Nov P | 54.5 | 54.1 |

| 22-Nov | Consumer Sentiment | Nov F | 73.9 | 73.0 |

| 22-Nov | Current Conditions | Nov F | N/A | 64.4 |

| 22-Nov | Expectations | Nov F | N/A | 78.5 |

| 22-Nov | 1-yr inflation | Nov F | N/A | 2.6% |

| 22-Nov | 5-10-yr inflation | Nov F | N/A | 3.1% |

| 22-Nov | KC Fed Services Activity | Nov | N/A

| 5 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI