Economic expectations — Week of October 14, 2024

Essential Economics

— Mark Frears

Anticipation

Take a look at your calendar for the week. What things are you looking forward to and what are you dreading? We all have them, and often they surprise us as when the actual event happens. Maybe that appointment that was on your mind, in a negative way, went pretty well, and the feeling of having it done is great. Maybe the long-awaited vacation got cancelled due to a hurricane. Unexpected outcomes, or surprises, go both ways.

Happiness is the gap between expectations and reality, or reality minus expectations. When reality is better than expectations, you are excited and happy. When reality is below expectations, you are disappointed, or unhappy.

Markets

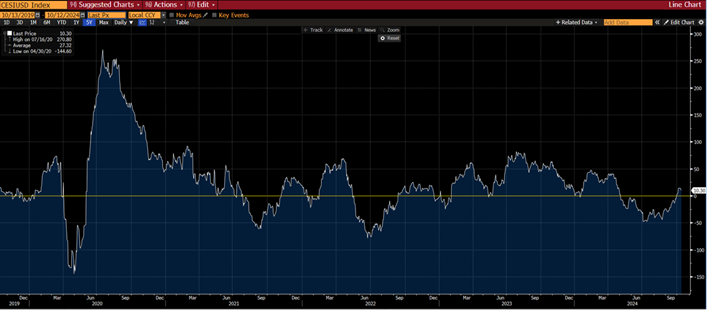

Do you think the markets like surprises? Again, positive ones should be a good thing. Yes, there is an indicator for that: the Citigroup U.S. Economic Surprise Index. As you can see below, it has been running below zero until recently.

Source: Bloomberg

To clarify, this is not measuring economic strength. This shows us how actual data compares to the analyst’s expectations/predictions for the releases. For example, if the analyst’s prediction for nonfarm payroll is an addition of 300,000 workers, and the actual is 200,000, this is a significant “surprise” or miss on the actual versus forecast. This would be a negative impact on the Index, as it is below expectations

This index turned positive on October 1, ending the longest negative streak since the 143 days ending in September 2019.

What this means is that during this long negative streak, the actual releases were below expectations. So, either the analysts are very poor at their job, or economic statistics were disappointing. This can twist in a multitude of ways. If the GDP number is below expectations, that is bad. If the CPI is below expectations, that is good. Therefore, you must dig deeper.

One thing this index can show us is momentum of the economy. If it is in a negative trend, like recently, it can show that the actuals are disappointing versus the forecast and foretell a slowing economy. As we are coming out of negative territory, it could be yet another indicator that we are not going into recession. One more thing for you to monitor as you wade through the myriads of economic news.

Economic releases

Last week was about inflation. CPI, PPI and Consumer Sentiment metrics all came in above expectations. It is one month, but inflation is still hanging around.

This week’s calendar’s highlight is retail sales on Thursday, as well as housing and manufacturing information. See below for more details.

Wrap-Up

Markets and our own financial picture are all about managing expectations. Frankly, that expands outside of finances! Don’t let your circumstances drive your happiness!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 14-Oct | NY Fed 1-yr inflation expectations | Sep | N/A | 3.00% |

| 15-Oct | Empire Manufacturing | Oct | 3.6 | 11.5 |

| 15-Oct | Monthly Budget Statement | Oct | $35.0B | -$380.1B |

| 16-Oct | NY Fed Services Business Activity | Oct | N/A | 0.5 |

| 16-Oct | Import Price Index MoM | Sep | -0.3% | -0.3% |

| 16-Oct | Export Price Index MoM | Sep | -0.6% | -0.7% |

| 17-Oct | Retail Sales MoM | Sep | 0.3% | 0.1% |

| 17-Oct | Retail Sales ex Autos MoM | Sep | 0.2% | 0.1% |

| 17-Oct | Philadelphia Fed Business Outlook | Oct | 3.5 | 1.7 |

| 17-Oct | Initial Jobless Claims | 12-Oct | 253,000 | 258,000 |

| 17-Oct | Continuing Claims | 5-Oct | 1,888,000 | 1,861,000 |

| 17-Oct | Industrial Production MoM | Sep | -0.1% | 0.8% |

| 17-Oct | Capacity Utilization | Sep | 77.8% | 78.0% |

| 17-Oct | Business Inventories | Aug | 0.3% | 0.4% |

| 17-Oct | NAHB Housing Market Index | Oct | 42 | 41 |

| 18-Oct | Housing Starts | Sep | 1,350,000 | 1,356,000 |

| 18-Oct | Housing Starts MoM | Sep | -0.4% | 9.6% |

| 18-Oct | Building Permits | Sep | 1,450,000 | 1,475,000 |

| 18-Oct | Building Permits MoM | Sep | -1.0% | 4.9% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI