Linked events — Week of October 28, 2024

Essential Economics

— Mark Frears

If, then

In our daily lives, we observe lots of linked events. For instance, if you are attending a hockey game for your favorite team, and they score a goal, most likely you will stand up and cheer. Another example is when we go out to eat on Saturday night. But we also go out to eat other nights, so this is not directly linked.

The first example is of causation, where one action is a direct result of the first event. They score, and I stand up and cheer. The second example is of correlation. While we may go out to eat on Saturday nights, it is not because it is Saturday that we go out to eat. They are related, but not one solely because of the other.

There is a lot of work done on correlation in markets, between economic events, seasonality, and different instruments. The real work though, is determining if there is a causal relationship between the two.

Federal Open Market Committee (FOMC)

One of the most closely watched, potentially causal events is the rate moves made by the FOMC on the Fed Funds (FF) target rate. Their dual mandate is to reduce high prices associated with inflation by raising the FF rate, thereby slowing the economy, and to keep unemployment low by lowering the FF rate, stimulating the economy.

Up until last month, they were keeping this rate high, due to high prices, reflected in a multitude of inflation metrics. As prices have come down from their peak, but are not yet at the 2% stated target, they lowered this rate by 0.50% (50 basis points). The thought here is that prices will continue to come down, and perhaps the economy needs stimulus to keep the unemployment rate low. Recent releases have shown the economy is not pushing toward a recession, and prices remain stagnated at above target levels.

What do they do next? Stay tuned two days after the election on November 5. It will be very difficult for them to get a consensus view of the economic future, I believe.

Causation?

There has always been a bit of head scratching about how the FOMC can influence long-term rates by changing an overnight rate. Inflation impact is seen in longer-term bonds. In addition to their FF moves, they also spend quite a bit of time “messaging” their intentions through speaking engagements. This also has an impact on market expectations for their next moves.

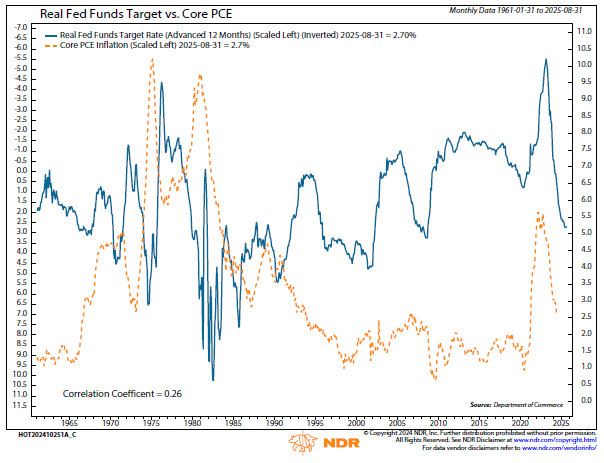

A recent paper from Ned Davis Research (NDR) is titled “"Does Monetary Policy Work?”. Pretty bold question. Their premise is that changes in the FF rate (monetary policy) is only loosely related to inflation. As the chart below shows, there doesn’t appear to be a direct link between changes in the real FF rate and subsequent inflation.

Source: Ned Davis Research

A correlation coefficient of only 26% not only shows limited correlation, but you would be hard- pressed to make a case for a causal relationship.

Labor markets

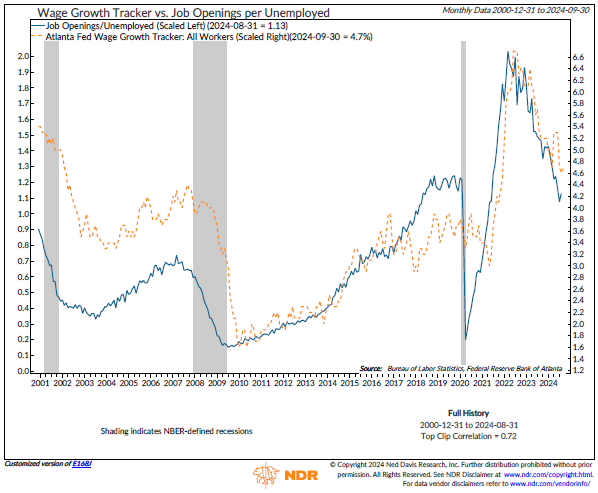

The authors did make the case to show the changes in FF rates were more closely correlated to private sector employment. The main takeaway from this relationship is the impact of wages. The chart below shows the relationship between wage growth and labor market tightness.

Source: Ned Davis Research

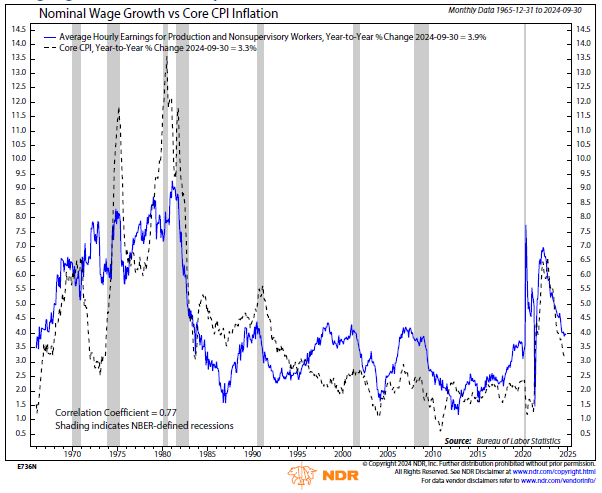

If you follow the path one more step, wage growth is closely linked to core inflation, as seen below.

Source: Ned Davis Research

Their conclusion is that monetary policy does impact wage growth, but this is only one part of inflation.

Takeaway

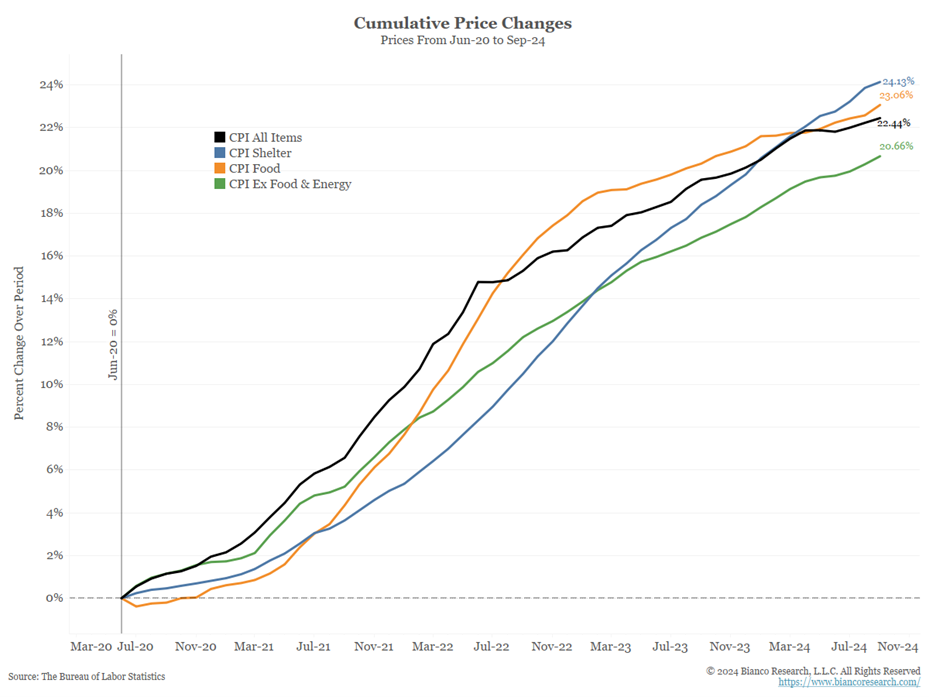

The FOMC’s premise is that they slow economic growth by raising short-term borrowing costs. That will in turn cause prices to stop rising, as demand slows. The problem this time is that demand is not slowing for a majority of consumers, and consequently prices are not coming down as fast as they would like. As you can see below, the cumulative impact of prices is still having a large impact, but the middle- and upper- income households have the means to continue to spend.

Source: Bianco Research

The FOMC will have to slow down the anticipated rate cuts, or they will be back-pedaling with rate increases by next year. That is, if their moves have a causal effect.

Economic releases

Last week, we had miscellaneous economic releases, showing the economy is still ticking along. Housing will be a drag, but that is supply- driven.

This week’s calendar’s is all about labor. We have JOLTS, ADP, and non-farm varieties. In addition, we have the FOMC’s favorite inflation metric, PCE. See below for more details.

Wrap-Up

Pay attention to what you think are causal relationships but may only be correlations. Just because one thing happens, it doesn’t necessarily mean the next must play out.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 28-Oct | Dallas Fed Manuf Activity | Oct | (9.2) | (9.0) |

| 29-Oct | Wholesale Inventories MoM | Sep P | 0.0% | 0.1% |

| 29-Oct | Retail Inventories MoM | Sep | 0.5% | 0.5% |

| 29-Oct | FHFA House Price Index MoM | Aug | 0.2% | 0.1% |

| 29-Oct | S&P CoreLogic 20-city YoY | Aug | 4.80% | 5.92% |

| 29-Oct | JOLTS Job Openings | Sep | 7,935,000 | 8,040,000 |

| 29-Oct | Conf Board Consumer Confidence | Oct | 99.3 | 98.7 |

| 29-Oct | Conf Board Present Situation | Oct | N/A | 124.3 |

| 29-Oct | Conf Board Expectations | Oct | N/A | 81.7 |

| 29-Oct | Dallas Fed Services Activity | Oct | N/A | (2.6) |

| 30-Oct | ADP Employment Change | Oct | 110,000 | 143,000 |

| 30-Oct | GDP Annualized QoQ | Q3 | 3.0% | 3.0% |

| 30-Oct | Personal Consumption | Q3 | 3.2% | 2.8% |

| 30-Oct | GDP Price Index | Q3 | 2.0% | 2.5% |

| 30-Oct | Pending Home Sales MoM | Sep | 1.3% | 0.6% |

| 31-Oct | Employment Cost Index | Q3 | 0.9% | 0.9% |

| 31-Oct | Personal Income | Sep | 0.3% | 0.2% |

| 31-Oct | Personal Spending | Sep | 0.4% | 0.2% |

| 31-Oct | Real Personal Spending | Sep | 0.3% | 0.1% |

| 31-Oct | PCE Price Index YoY | Sep | 2.1% | 2.2% |

| 31-Oct | PCE Core Price Index YoY | Sep | 2.6% | 2.7% |

| 31-Oct | Initial Jobless Claims | 26-Oct | 232,000 | 227,000 |

| 31-Oct | Continuing Claims | 19-Oct | 1,878,000 | 1,897,000 |

| 31-Oct | MNI Chicago PMI | Oct | 47.0 | 46.6 |

| 1-Nov | Change in Nonfarm Payrolls | Oct | 110,000 | 254,000 |

| 1-Nov | Change in Private Payrolls | Oct | 90,000 | 223,000 |

| 1-Nov | Unemployment Rate | Oct | 4.1% | 4.1% |

| 1-Nov | Avg Hourly Earnings MoM | Oct | 0.3% | 0.4% |

| 1-Nov | Avg Hourly Earnings YoY | Oct | 4.0% | 4.0% |

| 1-Nov | Labor Force Participation Rate | Oct | 62.7% | 62.7% |

| 1-Nov | Underemployment Rate | Oct | N/A | 7.7% |

| 1-Nov | Construction Spending MoM | Sep | 0.0% | -0.1% |

| 1-Nov | ISM Manufacturing Index | Oct | 47.6 | 47.2 |

| 1-Nov | ISM Manufacturing Prices Paid | Oct | N/A | 48.3 |

| 1-Nov | ISM Manufacturing Employment | Oct | N/A | 43.9 |

| 1-Nov | ISM Manufacturing New Orders | Oct | N/A | 46.1 |

| 1-Nov | Wards Total Vehicle Sales | Oct | 15,800,000 | 15,770,000 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas - Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI