How bad is good?— Week of January 13, 2025

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -1.92 | -0.89 | 23.56 | 8.99 | 14.03 | 5,827.04 |

| Dow Jones Industrial Average | -1.83 | -1.38 | 13.28 | 7.13 | 10.00 | 41,938.45 |

| Russell 2000 Small Cap | -3.49 | -1.82 | 13.48 | 1.37 | 7.11 | 2,189.23 |

| NASDAQ Composite | -2.34 | -0.76 | 28.95 | 9.04 | 16.80 | 19,161.63 |

| MSCI Europe, Australasia & Far East | -0.42 | -0.71 | 5.18 | 2.29 | 5.14 | 2,244.94 |

| MSCI Emerging Markets | -1.50 | -1,62 | 9.28 | -2,38 | 1.37 | 1,057.10 |

| Barclays U.S. Aggregate Bond Index | -0.87 | -1.00 | 0.74 | -2.26 | -0.61 | 2,167.06 |

| Merrill Lynch Intermediate Municipal | -0.59 | -0.37 | 0.71 | -0.09 | 0.82 | 316.67 |

As of market close on Friday, January 10, 2025 . Returns in percent.

Investment Insights

— Steve Orr

Hangover

In a bygone era, folks would party to celebrate the New Year. How long one took to recover indicated the level of fun one experienced. Or so we were told. Mr. Market’s hangover this year reminds us of a bigger hangover in 2018. The cocktail was the same: Stocks wanting to hold gains, the possibility that the Fed would lower rates and a slowing global economy. In mid-December 2018, Fed Chairman Powell declared that more rate increases were in store. The S&P 500 was holding on to a tenuous 5% gain for the year until Mr. Powell took the podium. Taking away the punch bowl of lower rates pushed the big index to a loss of 9% that December.

Flash forward to 2024. Thanks to the artificial AI boom and a 1% cut in short-term rates by the Fed, the S&P 500 entered December with a 28% gain. In his December 18 press conference, Powell indicated that fewer rate cuts were likely in the coming year. Traders and fast money types promptly turned risk off, pulling the big index down to 2.4% loss for the month. And so much for our beloved Santa Rally: From Christmas Eve through year-end, the S&P declined 2.8%. That is easily its worst decline for a year-end that we can remember. Another Powell Punch to sour markets for the New Year. Markets like two things: certainty and low interest rates.

Up next

The 2025 return of President Trump to the White House has ramped up uncertainty. Traders had been counting on lower interest rates to revive housing and mortgage trading. After December’s job report, they may well wait through all of 2025. The Bureau of Labor Statistics estimated that non-farm payrolls rose 256,000 last month. Like much of 2024, the gains were in government and education hiring. Government hiring grew at a near-4% rate last year, or almost double the inflation rate. Manufacturing hiring has barely budged, and private payrolls have grown less than 2%. The household survey showed the unemployment rate dipped by a tenth to 4.1%.

Government hiring and spending during the last administration, combined with easy monetary conditions, have kept the economy in a moderate, second-gear, growth mode. Tariffs are a popular worry about the incoming administration. We would direct your attention to maintaining the 2017 tax cuts (which the media calls “more tax cuts”), deregulation (disinflationary) and lower spending. All three must go through Congress. If spending is cut before regulations are cut, we may find ourselves with a rapidly slowing economy.

November’s and December’s 256,000 gains may include hurricane-related recovery from October’s low 43,000 job gain. December and January job reports usually have some seasonal adjustments and revisions. If the December job gains hold, then the rolling six-month average gain of 112,000 per month would represent a steady, second-gear economy that does not need rate cuts.

This week’s consumer price index report is up next. We expect the headline to rise 0.2% back to 2.9%. We were pushing the idea last summer that inflation was bottoming and heading higher. This is one forecast we would like to get wrong. September’s 2.4% was likely the cycle low for inflation.

2025 Outlook

Economy

If inflation is not going away, what effect will that have on the economy? Purchasing power, as measured by real average hourly earnings, will continue to struggle to keep up. The economy reset after shutdowns and the duration of the business cycle appear to have shortened in our view.

GDP growth in the final quarter of 2024 will likely come in around 2.4%. The Atlanta Fed’s GDPNow tracker estimates first quarter 2025 growth at 2.7%. Those levels would mean the economy averaged 2.7% growth over five quarters. Again, “second gear” in our thinking, or Goldilocks if you prefer. Not so Hot would be the second half of 2025.

We think there is a moderate-to-strong likelihood that the economy will slow later this year.

Drivers of our thinking:

Fundamental:

Duration of unemployment is rising.

Reported hiring freezes in some industries

Another round of strikes (longshoremen negotiations this month)

Weakening Purchasing Manager surveys (six-month lead)

China continued weakness

Sticky inflation: likely ends 2025 near 3.5%.

Political:

Strong dollar resulting from inflation and liquidity constraints

Uncertainty as to continuation of 2017 tax cuts

Uncertainty around scope and size of tariffs

Impact of withdrawing administration spending

Possible assistance to friendly countries dealing with Russia and China.

Capital:

Fed still in cutting mode — but what is the trigger for the next cut?

Rates overall are relatively benign — except for housing and mortgages that are too high.

Credit spreads — the rate paid by companies over Treasuries are at extreme tights.

Uncertainty over Treasury supply and deficit spending due to Congress not tackling the debt ceiling in a timely manner.

Earnings

A slowing economy means fewer opportunities to grow earnings. Nearly half of the S&P 500 earnings come from overseas, so a “too strong” dollar can affect sales. We have stayed bullish on stocks since the beginning of the current bull cycle. We continue to follow our indicator dashboard, trusting our instruments over market emotions. Earnings growth has accelerated over the past three years. Almost all sectors have participated. Energy is the outlier, with earnings largely dictated by swings in oil prices.

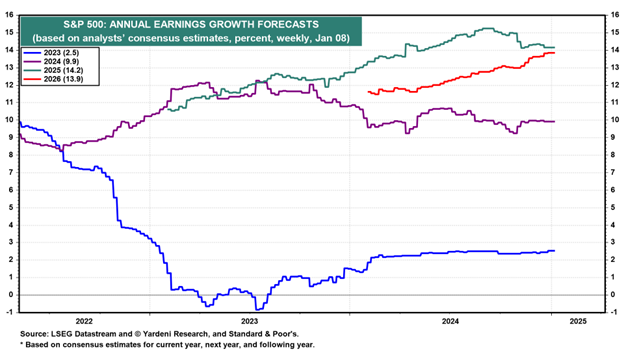

Wall Street consensus, ever the optimistic lot, believes earnings will grow 14.8% (FactSet) or 14.2% (S&P, Yardeni). Check the graph below — you can see how as earnings estimates get revised lower as companies report and the Street adjusts its forecasts.

Note the red line for 2025 has yet to come down. Be patient. How about a historical approach? In year three of Bull cycles, both price and earnings growth slow. The typical gain for this point in a cycle is around 6%. Let’s add in 1% for a slowdown from 2% in share repurchases and an additional 2% for excitement over Congress renewing tax cuts early in the year. That would put 2025 EPS growth at a healthy 9%. Yes, it’s a big drop down from current Street forecasts.

2024’s earnings may finish on a high note as those same Wall Streeters forecast fourth quarter earnings growth of 11.7% (FactSet). That would be the highest year-over-year growth since 2021. And that would be fine by us, because companies usually beat estimates. According to FactSet, the actual earnings growth rate has exceeded estimates by the end of the quarter in 37 of the past 40 quarters. Over the past five years, actual earnings have beat estimates by 8.5% and 77% of companies in the S&P 500 have beat .

The fourth quarter season ramps up this Wednesday with the big banks: JP Morgan, Citi, Wells and Goldman Sachs. Six of the Magnificent 7 report the last three days of January. Earnings reporting season lasts about seven weeks, and we have a good idea of where we will end up by the third week.

Stocks

We are not given to forecasting, as we have plenty of other ways to look bad. If S&P 500 earnings grow at 15% over a $245-ish earnings per share, that would put year-end 2025 earnings at $281. Using the (high) 22 times Price/Earnings multiple of today gives an index value of 6,200, or a roughly 7% return from today’s level. Our “historical” 9% earnings growth would produce $267 in earnings per share and at 22x, an S&P 500 level of 5,875. That would be a 1% return, a bit low for this stage of the Bull cycle (sarcasm alert).

How about some positive and minus events and trends that could push earnings? Here are some of our thoughts:

+ Reasonably strong economy fed by admin spending and, for 1H25, Yellen dumping cash into economy from the Treasury’s checking account (“TGA dump”)

+ Retail sales in good shape; auto sales turned higher the past three months.

+ ISM Manufacturing New Orders improving four straight months.

+ Earnings continue to grow: (’24 est. +9.5%, ’25 14.8%) (+8% to 9% reasonable)

- Valuations are stretched at 22x. 10s at 4.65% 10/23 and 4/24. SPX multiple dropped to 18x and 20x after those yield spikes.

- Surveys point to individuals being fully invested in stocks/coins (highest ever). Any downdraft will be exacerbated by some level of panic selling.

- Uneven and unknown D.C. drama. Debt ceiling not cured until late spring/June.

- Fed starts cutting rates again at what level of unemployment rate: 4.5%? 4.8%?

- Any bad inflation news. ISM Services Prices Paid leads PPI several months and just hit one-year high. Unexpectedly higher Tariffs, tax cut surprise would crank expectations higher.

- Bond market revolt (continues) because of inflation or D.C. drama.

- Any slowdown in AI capex will make Mag 7 go wobbly.

Rates

Markets of all stripes waited through most of 2024 for the Fed to start cutting short-term rates. Since September 18, the Fed has cut its overnight Fed Funds range by a full 1%. In contrast, Treasury yields started climbing that day. As of this writing, longer-term interest rates have risen over 1.25%. What gives? The outgoing administration continues to “dump” dollars on the economy, spending on programs and grants, trying to drain the Treasury. Traders rightly fear continued spending and future inflation from three years of deficits that are 5% or more of GDP each year.

The 10-year Treasury Note closed last Friday at 4.75%, and from a technician’s perspective, it has the momentum to rise higher. In October 2023 and April 2024, longer-term rates ran to and through this level. Both times stocks went through a correction, shedding 6% to 10% from their recent highs. Both lasted less than three months. There are echoes of those periods today: Fed indecisiveness, Congress stagnant, sticky inflation worries.

We see two positives over the next several months that should stall the rate rise and may even cause rates to drop. First, the debt ceiling was reached on January 1. Until Congress passes a higher debt ceiling, no new Treasury debt can be issued. Second, deregulation efforts by the new administration should be deflationary and may cause spending to either slow or be redirected into more economically efficient areas.

So good

It’s bad again. Stocks and bonds both sold off last Friday after the strong December jobs report. Some of the selling appeared to be “long longs” — traders who have held profits well past their long-term capital gain threshold. The new year is a good time to “take out the trash” in portfolios. We note that January and February job reports tend to have low response rates and seasonal adjustments in the spring. Do not be surprised if this jobs number is not quite as strong as the first print. Consumer inflation and industrial production numbers later this week should support the job report that our economy remains in second gear.

Regardless, the Fed has little reason to cut in the next six months, and that worry drove some fast money to cut bait. The stock Bull cycle has room to run, and long-term support is still intact. Internals, especially the percent of stocks making new lows and below their 20-day moving average, were actually worse a week or two ago. This suggests that we are near a trading low, and a bottoming process may be developing. The intermediate trend is your friend, and all our indicators remain green.

Wrap-Up

2025 is off to a blah start, reminding us of 2022, 2021, 2020 — oh and 2016 or 2015’s -3% start. Need we go on? Oh, and three of those five years finished with solid gains. In fact, 2016’s +9.5% was the lowest of the winners. Let’s not make too much bad news out of a rather average consolidation to start the year.

Regardless of interest rate levels, financial conditions remain supportive of markets. Easy credit, lots of private equity cash, companies buying back stock and low credit spreads make for a reasonable performance backdrop. The first year of a new administration typically holds down returns and investor sentiment until policy directions become clear.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Private Bank. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2026 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com NASDAQ®: TCBI