Choices — Week of December 5, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.19 | -13.28 | -9.62 |

11.38 |

10.95 | 4,071.70 |

| Dow Jones Industrial Average | 0.41 | -3.30 | 1.51 | 10.06 | 9.64 | 34,429.88 |

| Russell 2000 Small Cap | 1.32 | -14.64 | -13.04 | 7.01 | 5.58 | 1,892.84 |

| NASDAQ Composite | 2.12 | -26.15 | -24.85 | 11.33 | 11.89 | 11,461.50 |

| MSCI Europe, Australasia & Far East | 1.70 | -11.70 | -7.97 | 3.69 | 3.15 | 1,995.94 |

| MSCI Emerging Markets | 3.98 | -18.21 | -18.25 | 0.76 | 0.13 | 978.30 |

| Barclays U.S. Aggregate Bond Index | 1.20 | -11.74 | -11.92 | -2.37 | 0.35 | 2,078.64 |

| Merrill Lynch Intermediate Municipal | 0.93 | -6.76 | -6.67 | -0.31 | 1.49 | 298.46 |

As of market close December 2, 2022. Returns in percent.

Essential Economics

— Mark Frears

Eeny, meeny...

How are you at making choices, especially if they could have significant meaning or financial impact? Having time to consider may make it easier, or not. Do you put “pencil to paper” and make a list of positives and negatives or go with your first instinct?! Some things are just too good to pass up, so you grab the ring, but sometimes passing something up might be the best option.

Which one?

Depending on your source of information, you could be hearing about an overheating economy, or one that is two breaths away from collapsing. Which one do you believe?

Now that we are through the election, there should not be a political bent trying to portray something that may or may not be true. Markets usually like a split government with one party controlling the administration and the other holding the congressional advantage. The stalemate should lead to fewer actions from the government and markets like taking away that uncertainty.

Heating up

The latest evidence of an economy that is doing just fine was the payroll numbers for November. We added 263,000 jobs, the unemployment rate stayed at a low 3.7%, and wages actually increased last month. Employers are still having trouble finding new workers, given the Job Openings and Labor

Turnover Survey (JOLTS) showed there are over ten million job openings. This is 1.75 jobs for every unemployed person.

Consumers are in the driver’s seat and are demanding more pay to stay in their current job because they feel confident they can get another job if the boss won’t pay. Given the low interest rates available for borrowing for most of the last decade, consumers were also able to lock in low mortgage rates and low-rate car loans.

Recent short-term rate increases by the Federal Open Market Committee (FOMC) have been good for savers. Pandemic government stimulus helped consumers save more, and higher rates give them a bit more income. Personal income was higher than expected in October, although much of the increase was driven by state rebate checks, in particular from California, as well as Social Security benefits. Gross Domestic Product for Q4 will be around 1.5%; not running hot, but still very positive.

One primary offshoot of an economy that is running well is prices are increasing. Consumer Price Index and Personal Consumption Expenditures (PCE) seem to have peaked and are declining, but we won’t be back to the 2% Fed target for some time.

Prices are higher, but are you having to change any spending decisions based on economic conditions? Many are not, and do not see a slowing economy.

Going cold

Looking at the opposite perspective, a very strong indicator of a weakening economy comes from the regional Fed business surveys. Metrics from Philadelphia, Kansas City, Richmond and Dallas are all in negative territory. In addition, the Economic Cycle Research Institute (ECRI) Leading Index is well into recession territory.

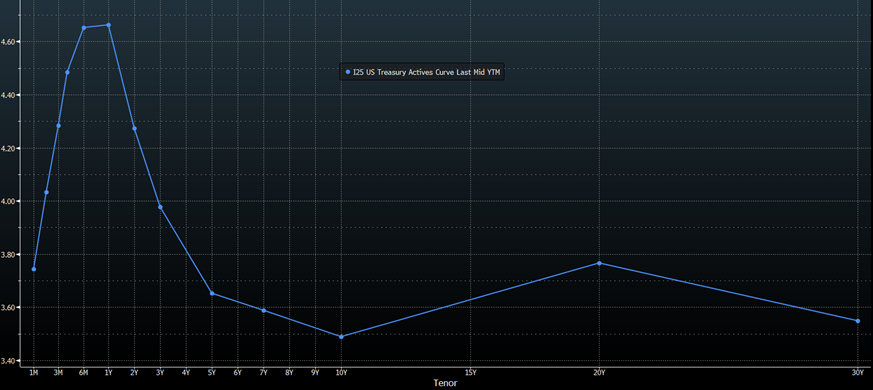

The bond market’s yield curve, which rates along a curve from short-term out to long-term also gives us strong indication of a coming recession. The current U.S. Treasury curve below shows 10-year rates below three-month and two-year rates.

Source: Bloomberg

This is telling us one of two things, either the market is very confident that the Fed will control inflation and rates will be lower in the future, or we are going into a recession. When the 10-year is below the three-month rate, a recession is expected in the next six to 12 months.

Higher inflation is eating into people’s budgets, especially in the low and lower-middle income sectors. Rent, gas and food prices are up materially, and they have less to spend in other areas, unless they start to use credit. We have seen credit usage increase and so far there has not been increased delinquencies.

Higher rates have also made it more expensive to buy a house, and with more people looking for places to rent, monthly rates are rising. The uncertainty in the economy is causing builders to slow down home construction, exacerbating the supply-demand dilemma.

Companies are seeing their costs increase due to wages paid to employees, higher shipping costs, and short-term borrowing rates increasing. Some businesses can pass these higher costs onto consumers, but some are starting to have margins squeezed.

Fed response

So, the trillion-dollar question is, what is the Fed going to do about this? Are they more scared about an overheating economy and inflation, or pushing us into a recession?

Bottom line, the Fed has to push short-term rates above the inflation rate. Fed Funds (FF) rate is currently at 3.75–4% and PCE is running at 6%, with the core at 5%. The projected terminal rate for the short-term FF rate is around 5%, expected about mid-2023. If that is truly the high rate, then inflation needs to drop below that by mid-year, too.

Last week FOMC Chairman Powell shared with all of us that they would start to slow the pace of rate hikes, as they need to evaluate the potential lag effect their 375 basis points (3.75%) have already done. We have seen the impact on mortgage rates, yet the rest of the economy is not slowing down enough, evidenced by the hot labor market.

Services inflation is running hotter than goods inflation, primarily due to higher wages. Services make up almost 60% of CPI, so the Fed is very concerned about cooling off the labor market. How will he do this?

Based on what they are saying and doing, they are committed to a restrictive monetary policy through maintaining higher short-term rates for longer and continuing their policy of pulling reserves from the banking system.

They say they will do this until inflation is whipped, but will they continue if the economy goes into a steep nosedive?

Wrap-up

Decisions, decisions. One of my best choices was to move to Texas as many good things came from that. Equity markets have a choice to make. Are they seeing a strong economy or being distracted by the Fed and inflation concerns. Is more attention paid to increasing prices or the possibility of having no goods or services to buy?

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 5-Dec | S&P Global US Services PMI | Nov | 46.1 | 46.1 |

| 5-Dec | S&P Global US Composite PMI | Nov | 46.3 | 46.3 |

| 5-Dec | Factory Orders | Oct | 0.7% | 0.3% |

| 5-Dec | ISM Services Index | Nov | 53.5 | 54.4 |

| 7-Dec | Nonfarm Productivity | Q3 | 0.5% | 0.3% |

| 7-Dec | Unit Labor Costs | Q3 | 3.2% | 3.5% |

| 7-Dec | Consumer Credit | Oct | $26.000B | $24.976B |

| 8-Dec | Initial Jobless Claims | 3-Dec | 230,000 | 225,000 |

| 8-Dec | Continuing Claims | 26-Nov | 1,615,000 | 1,608,000 |

| 9-Dec | Producer Price Index MoM | Nov | 0.2% | 0.2% |

| 9-Dec | PPI ex Food & Energy MoM | Nov | 0.2% | 0.0% |

| 9-Dec | Producer Price Index YoY | Nov | 7.2% | 8.0% |

| 9-Dec | PPI ex Food & Energy YoY | Nov | 5.9% | 6.7% |

| 9-Dec | Wholesale Inventories MoM | Oct | 0.8% | 0.8% |

| 9-Dec | UM (Go MSU) Consumer Sentiment | Dec | 56.8 | 56.8 |

| 9-Dec | UM (Go MSU) Current Conditions | Dec | 58.0 | 58.8 |

| 9-Dec | UM (Go MSU) Expectations | Dec | 54.3 | 55.6 |

| 9-Dec | UM (Go MSU) 1-yr inflation | Dec | 4.8% | 4.9% |

| 9-Dec | UM (Go MSU) 5- to 10-yr inflation | Dec | 3.0% | 3.0% |

| 9-Dec | Household change in net worth | Q3 | N/A | -$6,100B |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.