Consumer in control — Week of February 6, 2023

Essential Economics

— Mark Frears

People flow

We are now into the second month of the year, how are those New Year’s resolutions going? If you are still going strong, you have made a successful habit change. Once you get a habit ingrained, your activities will change, resulting in moving toward a desired outcome. This can apply to good habits you are trying to improve, or bad habits you are trying to stop. Consumer behavior is a result of habits manifested in actions. How is the consumer behaving in the current economic environment?

Fifty-thousand-foot view

The most common measure of economic activity is Gross Domestic Product (GDP), and the consumer contributes two-thirds of this total. As you can see below, after the huge swings around the pandemic, we have trended back towards the long-term average of two percent. We did have negative GDP growth in the first half of 2022. Did anyone notice that?

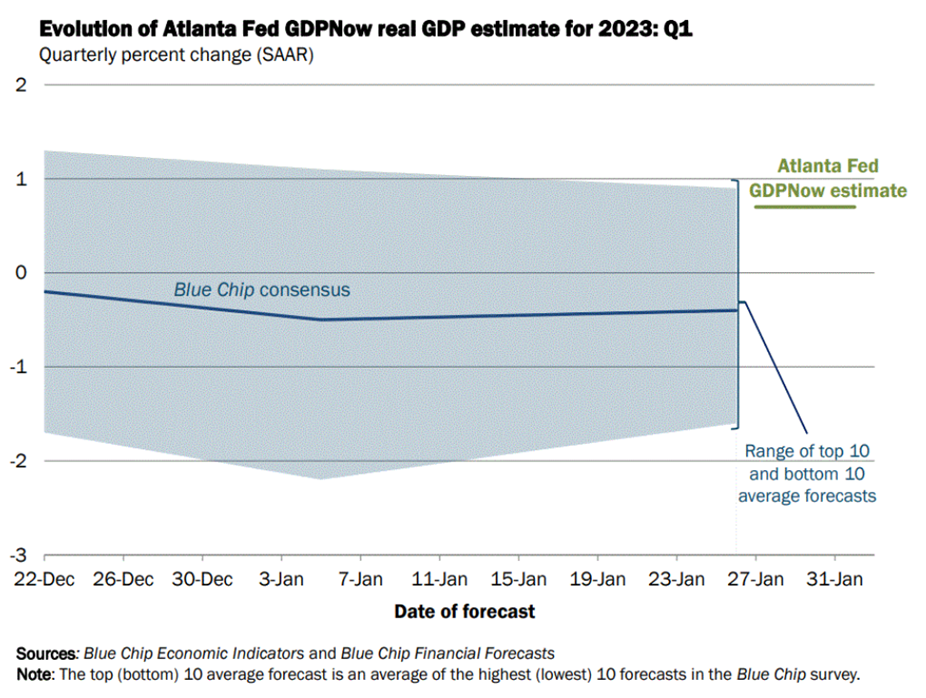

This is history, with fourth quarter GDP at 2.9%. The question is how do we look going forward, are we headed to the most anticipated recession with a soft landing, or a hard one? The Atlanta Fed produces a running estimate of the next quarter’s GDP, showing that, along with other estimates.

As you can see above, the range of top and bottom ten estimates bracket around zero. The Atlanta Fed estimate is 0.7%, continuing growth from fourth quarter, at a slower pace. This was last updated on February first, so does not consider the significant payroll number that came out on February third. That could take this estimate higher.

What is impacting the so-important consumer that would change their habits, activities, behaviors?

Work

The current job environment is still in a state of flux post pandemic. The workforce is smaller, given early retirements, lower legal immigration and the impact on individuals and families from the pandemic. This wasn’t an issue when the economy was running slower in early 2022, but as consumers continue to buy goods and fill the services desires that were restricted by the pandemic, employers are having a harder time finding workers.

The most recent evidence of this was the Nonfarm Payroll release that Steve Orr discussed in his comments. More workers continue to be hired and the unemployment rate dropped to a low not seen since 1969. In addition, the Job Openings and Labor Turnover Survey (JOLTS) release last week showed an increase in job openings to over eleven million. Based on the definition of unemployed workers, there are two jobs available for each one.

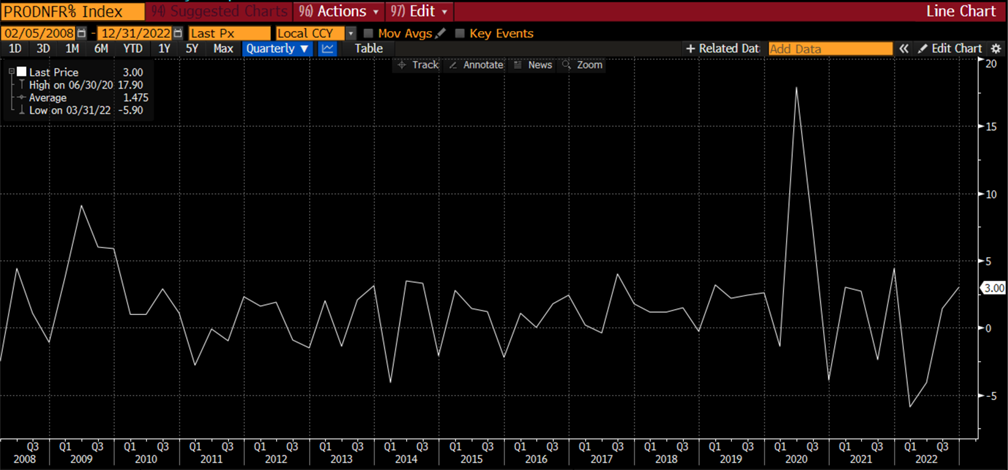

What does this mean for consumer behavior? First, most are not concerned about losing a job, as they see other jobs are readily available. The Conference Board’s Consumer Confidence measure confirms this trend. Second, more options exist for remote and hybrid work environments. This adds to the worker’s influence on hiring. Third, as you can see below, despite recent talk of lack of worker engagement, productivity is on an upswing. This makes the worker more valuable in the eyes of the employer.

Spending

Given what we have seen above regarding employment and employers’ need to obtain and retain workers, they must pay more. This is exactly what keeps Chair Powell up at night. He is winning the battle against inflation when you look at trends in Consumer Price Index and Personal Consumption Expenditures, but if the consumer continues to experience better wages, they will continue to buy. In the Fed’s eyes, this can cause prices to rise if demand does not slow down, making it harder for them to control inflation.

While inflation has reduced the buying power of the individual, their behavior has not materially changed. There are some signs of disruption in the makeup of sources of income. First, the abnormally high level of savings that was built up during the pandemic is back down to lower levels, so that is no longer available. Second, credit cards are seeing usage increase, but without an increase in defaults.

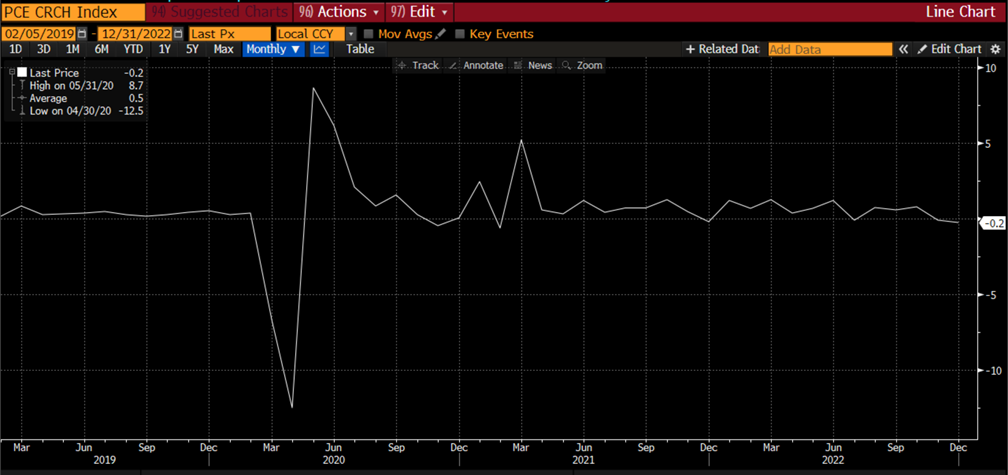

We are seeing a bit of slowdown in spending as you can see below with the Personal Spending release for December showing a slight negative.

The next release for this very important indicator is on February 24. Will a downward trend continue, or will we see a bounce back?

Takeaways

As you can see, the consumer is in pretty good shape. In addition, their balance sheets are in better condition, with lower levels of debt. This will help their confidence level if we dip into a minor slowdown.

Economic news

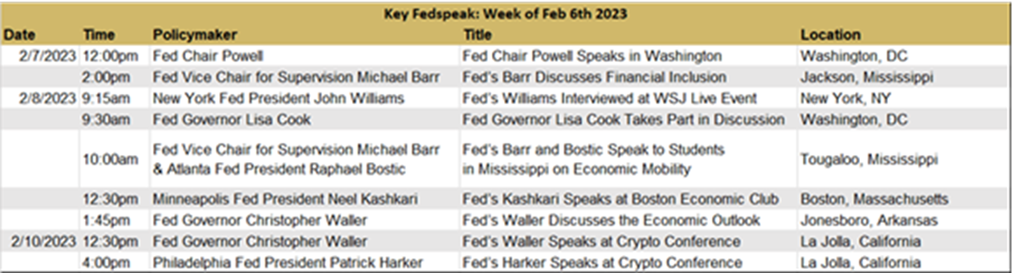

A light calendar for economic news, but the Fed talking heads will be back out in force. Let’s see how they will build on or break down Chair Powell’s message after the February meeting.

Wrap-up

Consumers are not materially changing their habits regarding spending, which drives GDP. While they know the Fed is trying to slow the economy in order to get inflation under control, they really aren’t paying attention. Therefore, the Most Anticipated Recession Ever will wait a bit longer. Pay attention to consumer behavior for clues to the future.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 7-Feb | Trade Balance | Dec | -$68.5B | (12.9) |

| 7-Feb | Consumer Credit | Dec | $25.000B | $27.962B |

| 8-Feb | MBA Mortgage Applications | 3-Feb | N/A | -9.0% |

| 8-Feb | Wholesale Inventories MoM | Dec | 0.1% | 0.1% |

| 9-Feb | Initial Jobless Claims | 4-Feb | 190,000 | 183,000 |

| 9-Feb | Continuing Claims | 28-Feb | 1,660,000 | 1,655,000 |

| 10-Feb | UM (Go MSU) Consumer Sentiment | Feb | 65.0 | 64.9 |

| 10-Feb | UM (Go MSU) Current Expectations | Feb | 68.0% | 68.4 |

| 10-Feb | UM (Go MSU) Expectations | Feb | 63.0% | 62.7 |

| 10-Feb | UM (Go MSU) 1-yr inflation | Feb | 4.0% | 3.9% |

| 10-Feb | UM (Go MSU) 5- to 10-yr inflation | Feb | 2.9% | 2.9% |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.