Employees are in control of the job market — Week of January 9, 2023

Essential Economics

— Mark Frears

Occupation

One of my most interesting jobs, outside of banking, was working for National Marine Fisheries Service in their U.S. Observer program. Observers are placed on foreign vessels that fish inside the U.S. maritime border of 12 nautical miles from shore. I spent one month on a Japanese trawler north of the Aleutian Islands observing all they caught. Currently there are more jobs available than people to work them, not just aboard ships, but throughout the U.S. Let’s observe how this is impacting the economy and the Fed.

Availability

When you start looking for a job, whether you are already employed, or new to the search, you need to know where, how many, and in what fields jobs are available. A very broad indicator of how many is the Job Openings and Labor Turnover Survey (JOLTS). As you can see below, we are off the peak of job openings, but still over three million above the pre-pandemic level.

Source: Bloomberg

Bottom line, there are jobs available, while they may not be in your desired field, employers are looking for bodies. In addition, voluntary job quits by employees remain elevated as of November, which is generally a sign of a still-strong labor market.

This begs the question, where are the workers? The three categories that have been cited are early-retiring baby boomers, lack of legal immigration, and people impacted by long-term effects of the pandemic. This, along with mis-matched skillsets, and pandemic-induced job switches helps us to understand the gap.

The Fed sees this as an imbalance with too many jobs available for too few workers, causing wages to have to increase. A concern in their inflation-fighting battle.

Out of work

In our search for workers to help with the imbalance, we look to Jobless Claims, or insurance paid by the appropriate government office, for people who are out of work. This represents the inflow of unemployed workers, filing for the first time. As you can see in the chart below, we are back down to historical lows in claims, another indicator of a strong labor market.

Source: Bloomberg

The Fed has stated they would ideally like to eliminate job openings (see JOLTS above) instead of actually eliminating jobs. So far, they are not showing progress on either of these fronts.

Nonfarm payrolls

One of the most watched monthly economic releases is the Nonfarm Payroll and Unemployment Rate. It has taken on added significance given the Fed’s focus on inflation and the labor market’s continued strength.

The addition of 223,000 workers last month was close to expectations, but still shows a need for workers. The unemployment rate came down to match the five-decade low of 3.5%, from 3.7% previously. Both of these show a vibrant labor market, and in the current Fed-focused view, should have caused a selloff in equities and buying of bonds, given the Fed would have to continue to raise rates to combat this inflationary trend.

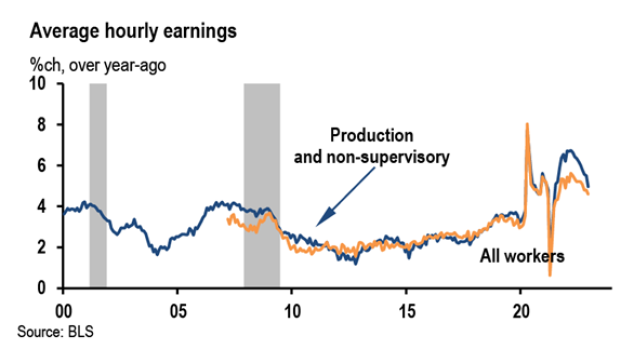

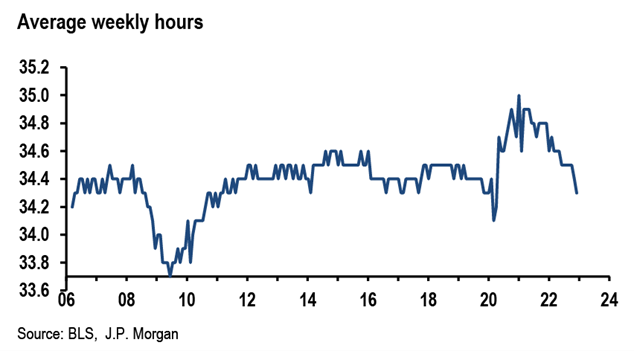

So, what happened? The markets chose to focus on a lower-than-expected hourly earnings (by 0.1%!) and lower hours worked.

They view this as progress towards the Fed’s goals of easing inflation, and we had a significant move day with equities up over 2% and two-year U.S. Treasuries (UST) down 20 basis points (0.20%) and ten-year UST down 15 basis points.

If the waters weren’t muddy enough, the Federal Reserve Bank of Philadelphia has determined that the Bureau of Labor Statistics (BLS), who release the monthly data, have overestimated the number of workers added to the workforce. The Philly Fed’s estimates incorporate more comprehensive, accurate measures, and have determined that the actual number of jobs added in the period March to June of 2022 was 10,500 versus the BLS count of 1,047,000. That is huge! If this is the case, then the labor market is nowhere as strong as previously thought.

What to watch

The main thing that the Fed is watching is price inflation is peaking, but wage inflation looks sticky. We are seeing decelerating year-over-year (YoY) Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) metrics. This is a good sign, but these are still above the long-term goals for the Fed and weigh heavily on consumers, especially with limited budgets.

The Fed would also like to see a change in the spending behavior of consumers, as this would help to reduce price pressures. If demand slows, prices will have to come down in order to move goods and services. As can be seen below in the Personal Spending metric, while spending has fallen from the post-pandemic peak, it is not falling below long-term trends.

Source: Bloomberg

Until consumer spending slows, prices will stay elevated.

In the coming week we will have the CPI release, and expectations are for this to continue to fall. Later this month, the PCE release should continue to show improvement.

Wrap-up

Twenty-seven-foot seas could be a deterrent to working on the high seas, but employers are still looking to hire. The imbalance between supply and demand will keep the Fed’s foot on the pedal until they, at least, see CPI on a YoY basis fall below the Fed Funds target rate.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 9-Jan | Consumer Credit | Nov | $25.0000B | $27.078B |

| 10-Jan | NFIB Small Business Optimism | Dec | 91.5 | 91.9 |

| 11-Jan | MBA Mortgage Applications | 6-Jan | N/A | -10.3% |

| 12-Jan | Consumer Price Index MoM | Dec | 0.0% | 0.1% |

| 12-Jan | CPI ex Food & Energy MoM | Dec | 0.3% | 0.2% |

| 12-Jan | Consumer Price Index YoY | Dec | 6.5% | 7.1% |

| 12-Jan | CPI ex Food & Energy YoY | Dec | 5.7% | 6.0% |

| 12-Jan | Initial Jobless Claims | 7-Jan | 215,000 | 204,000 |

| 12-Jan | Continuing Claims | 31-Dec | 1,718,000 | 1,694,000 |

| 12-Jan | Real Avg Hourly Earnings YoY | Dec | N/A | -1.9% |

| 13-Jan | Export Price Index MoM | Dec | -0.7% | -0.3% |

| 13-Jan | Import Price Index MoM | Dec | -0.9% | -0.6% |

| 13-Jan | UM (Go MSU) Consumer Sentiment | Jan | 60.5 | 59.7 |

| 13-Jan | UM (Go MSU) Current Conditions | Jan | 59.5 | 59.4 |

| 13-Jan | UM (Go MSU) Expectations | Jan | 58.5 | 59.9 |

| 13-Jan | UM (Go MSU) 1-yr inflation | Jan | 4.4% | 4.4% |

| 13-Jan | UM (Go MSU) 5- to 10-yr inflation | Jan | 2.9% | 2.9% |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.