What are your financial goals? — Week of April 29, 2024

Essential Economics

— Mark Frears

What’s a checkbook?

When I had the paper route, as we discussed last week, there had to be a way to track the incoming and outgoing cash flows. There was no app for me to use! My father took me down to the local bank and opened me a checking account. He then proceeded to teach me about how to track the income and expenses, through deposits and check writing. These concepts and the money management tools that go along with them are sadly lacking in our country.

April is financial literacy month, and an Experian study found that 60% of adult Americans believe that their limited understanding of credit and personal finance has caused them to make financial mistakes. Let’s take a look at this vital area.

Basics

Financial literacy involves concepts like budgeting, managing credit/debt, saving and investing. If you can understand and manage these areas, you will be on your way to achieving a goal of financial freedom. Many people are just afraid of dealing with the issue of money: too many unknowns, too many pitfalls and hard to understand. I beg to differ. When my nephew started his first real job, he asked me what to know about finances. I told him the best place to start was to spend less than you make. Sounds simple, but that is the basic goal!

Budgeting

Let’s face it, people don’t like to live with a budget. So, let’s call it a spending plan. If you start with your financial goals, it can show you how a budget will help you achieve them. We offer an awesome finanical planning process as part of our Private Wealth services.

The first thing you need to do when starting the budgeting process is find out where your money goes. Sounds simple, but after you look back at where your money went and aggregate it in categories, you might be surprised. If you are overspending your income, or not able to meet your short- and long-term saving/investing goals, this is where you need to start. Whichever app, spreadsheet or bar napkin method you use, make sure it is one you will actually stick with.

Credit/Debt

In order to have a credit score, or be able to borrow for a house or car, you have to go into debt, to prove you can repay. This can be done slowly with a low balance credit card that you pay off monthly; then you can work your way up. The most important part of your credit score is paying your bills on time. Length of credit history, credit utilization ratio and debt-to-income ratios will also impact your score.

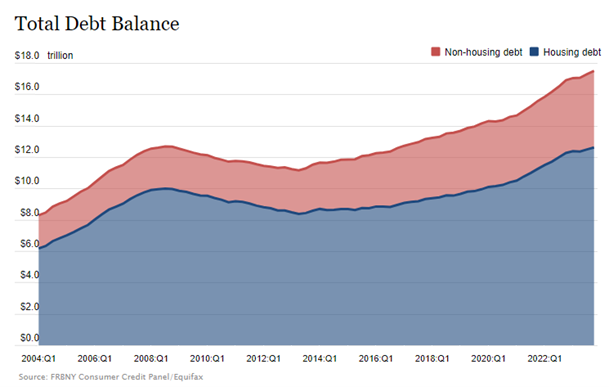

As you can see below, the amount of consumer debt continues to rise, so it is important to make sure you have the means to repay what you borrow. Again, common sense, but “wants” can start to push out “needs” if you are not careful.

Saving

This is the magic bullet to make your budget work. You might have your spending plan running great, feeling good about getting things on track, and then your car breaks down, rent goes up or a major appliance goes on the blink. If you don’t have some short-term savings set aside, you will have to borrow to take care of that expense. Start with a month’s worth of expenses and try to build this up to three to six months. Then, when those unforeseen things happen, you can handle them.

Investing

Once you have the budget working, debt under control and savings in place, it is time to start putting money aside for short- and long-term goals. People often start saving for retirement first, especially if your employer has 401K, with matching funds. Don’t turn down free money!

Retirement is a fine long-term goal, but there are many other reasons to invest. This should be in line with your financial goals, whether it is to be debt-free, give a certain percentage, pay for college tuition or travel with family. Once you have a plan in place, you can start to evaluate the time horizon of meeting your goals and the amount of risk you want to take.

This is the exciting part, as you now understand how all this works, and you are looking forward to achieving your financial goals.

Economic releases

Last week was lower GDP, higher inflation and a consumer that continues to earn and spend. Quiet with no Fed speakers, looking forward to the meeting this week.

This week’s calendar is all about the labor market and the FOMC. ADP, JOLTS and nonfarm payroll will give us the update on employment. The FOMC will not change rates, and they don’t update their projections until June, so watch the press conference. See below for details.

Wrap-Up

When I budget coach with people, it might take them a few sessions to start to understand, but after that it is all about putting the plan to work and executing! Your financial goals will start to come into view, and the stress of the unknown will fade away.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 29-Apr | Dallas Fed Manuf Activity | Apr | (11.3) | (14.4) |

| 30-Apr | Employment Cost Index | Q1 | 1.0% | 0.9% |

| 30-Apr | FHFA House Price Index MoM | Feb | 0.1% | -0.1% |

| 30-Apr | S&P CoreLogic 20-city YoY | Feb | 6.70% | 6.59% |

| 30-Apr | MNI Chicago PMI | Apr | 45.0 | 41.4 |

| 30-Apr | Conf Board Consumer Confidence | Apr | 104.0 | 104.7 |

| 30-Apr | Conf Board Present Situation | Apr | N/A | 151.0 |

| 30-Apr | Conf Board Expectations | Apr | N/A | 73.8 |

| 30-Apr | Dallas Fed Services Activity | Apr | N/A | (5.5) |

| 1-May | ADP Employment Change | Apr | 180,000 | 184,000 |

| 1-May | Construction Spending MoM | Mar | 0.3% | -0.3% |

| 1-May | JOLTS Job Openings | Mar | 8,680,000 | 8,756,000 |

| 1-May | ISM Manufacturing Index | Apr | 50.1 | 50.3 |

| 1-May | ISM Manufacturing Prices Paid | Apr | 55.2 | 55.8 |

| 1-May | ISM Manufacturing Employment | Apr | N/A | 47.4 |

| 1-May | ISM Manufacturing New Orders | Apr | N/A | 51.4 |

| 1-May | FOMC Rate Decision (Upper Bound) | 1p CT | 5.50% | 5.50% |

| 1-May | FOMC Rate Decision (Lower Bound) | 1p CT | 5.25% | 5.25% |

| 1-May | Ward's Total Vehicle Sales | Apr | 15,700,000 | 15,490,000 |

| 2-May | Challenger Job Cuts YoY | Apr | N/A | 0.7% |

| 2-May | Nonfarm Productivity | Q1 P | 0.8% | 3.2% |

| 2-May | Unit Labor Costs | Q1 P | 3.3% | 0.4% |

| 2-May | Initial Jobless Claims | 27-Apr | 210,000 | 207,000 |

| 2-May | Continuing Claims | 20-Apr | 1,798,000 | 1,781,000 |

| 2-May | Factory Orders | Mar | 1.6% | 1.4% |

| 2-May | Factory Orders ex Transportation | Mar | N/A | 1.1% |

| 3-May | Change in Nonfarm Payrolls | Apr | 250,000 | 303,000 |

| 3-May | Change in Private Payrolls | Apr | 198,000 | 232,000 |

| 3-May | Unemployment Rate | Apr | 3.8% | 3.8% |

| 3-May | Avg Hourly Earnings MoM | Apr | 0.3% | 0.3% |

| 3-May | Avg Hourly Earnings YoY | Apr | 4.0% | 4.1% |

| 3-May | Labor Force Participation Rate | Apr | 62.7% | 62.7% |

| 3-May | Underemployment Rate | Apr | N/A | 7.3% |

| 3-May | ISM Services Index | Apr | 52.0 | 51.4 |

| 3-May | ISM Services Prices Paid | Apr | N/A | 53.4 |

| 3-May | ISM Services Employment | Apr | N/A | 48.5 |

| 3-May | ISM Services New Orders | Apr | N/A | 54.4 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI