Tightness — Week of August 12, 2024

Essential Economics

— Mark Frears

How tight?

Working quality control in a salmon cannery on Kodiak Island might sound glamorous, but it is mostly about using a micrometer. There is part of the job that involves checking the salmon when it comes in off the boats to make sure it is fresh, but mostly it’s about the cans. Samples must be taken from different parts of the assembly line and taken back to the office for examination. Then, it is tearing apart the containers and measuring, with a micrometer, to ensure the cans are properly sealing. Are they tight enough, or is adjustment necessary? While the views out the window are amazing, the job, not so much.

How tight are financial conditions? How is this different from monetary conditions?

Monetary conditions

When you talk about monetary conditions, think about the supply of money, and the demand for it.

All the talk about this Fed is focused on monetary policy, as this is their responsibility. Their primary tool in achieving their goals of price stability and full employment is the Fed Funds Target rate. Right now, you hear lots of talking heads pointing to the next Fed moves, and expectations are for rate cuts (stimulative for the economy). The prevailing thought is that inflation is headed lower and no longer a concern.

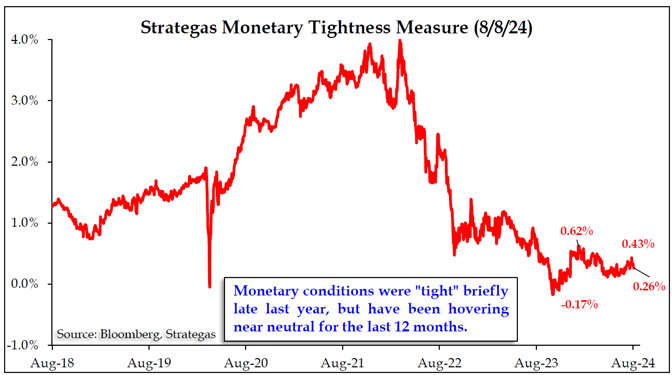

The chart below indicates that monetary policy has achieved a close to neutral level. Given that inflation is falling, and the unemployment rate is still low, they are sitting in a good position.

Source: Strategas Research

This sums up the monetary condition. Now, how about financial conditions?

Financial conditions

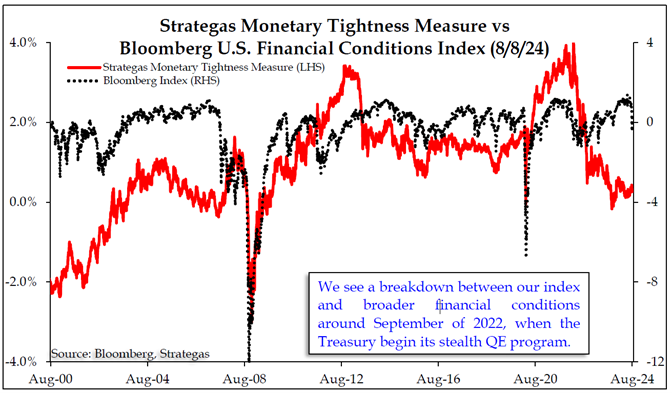

Financial conditions have to do with capital and the ability to obtain loans versus the people willing to lend. So, even if monetary conditions are loose, capital is not always easy to obtain. In theory, if monetary conditions are tight, then capital/credit should be hard to find, and vice versa. As an example, think about that during the pandemic, the Fed made money very available, but people did not want to lend in the uncertain times.

As the chart below shows, we are currently in a time when these two have diverged. Capital is still very available, to some borrowers.

Source: Strategas Research

Uneven playing field

As the FOMC tightened monetary conditions to fight inflation, through an unprecedented increase in short-term rate, this did not impact everyone’s financial conditions equally. There has been some question as to if their actions have actually been the cause of decreasing price levels, or whether this was the supply chain loosening following the pandemic.

On one hand, lower- and middle-income households and small businesses have been impacted more due to rising food, housing, labor and insurance expenses. On the other hand, the upper income sectors and large businesses still had access to capital due to rising asset values and capital markets that continued to flow.

For cash poor households and businesses, money and capital are the same, but not so for the other part of the economy.

The recent sell off in the equity market has brought financial conditions for all down significantly. We will see if this current situation with monetary and financial conditions both closer to neutral continues.

Economic releases

Last week was pretty quiet, following the spike in volatility from the monthly payroll numbers. Initial Jobless Claims came in lower and defused some of the concerns about the labor market.

This week’s calendar is packed with PPI, CPI, Retail Sales and Consumer Sentiment, along with some housing metrics. The markets will be focused on CPI. See below for more details.

Wrap-Up

I did get some nice cuts tearing down those cans to check on tightness, but they have all healed. The tightening of monetary conditions has not gone smoothly, and there still may be some deeper cuts ahead.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 12-Aug | NY Fed 1-yr inflation expectations | Jul | N/A | 3.02% |

| 13-Aug | NFIB Small Business Optimism | Jul | 91.5 | 91.5 |

| 13-Aug | Producer Price Index MoM | Jul | 0.2% | 0.2% |

| 13-Aug | PPI ex Food & Energy MoM | Jul | 0.2% | 0.4% |

| 13-Aug | Producer Price Index YoY | Jul | 2.3% | 2.6% |

| 13-Aug | PPI ex Food & Energy YoY | Jul | 2.7% | 3.0% |

| 14-Aug | Consumer Price Index MoM | Jul | 0.2% | -0.1% |

| 14-Aug | CPI ex Food & Energy MoM | Jul | 0.2% | 0.1% |

| 14-Aug | Consumer Price Index YoY | Jul | 3.0% | 3.0% |

| 14-Aug | CPI ex Food & Energy YoY | Jul | 3.2% | 3.3% |

| 14-Aug | Real Avg Hourly Earnings YoY | Jul | N/A | 0.8% |

| 14-Aug | Real Avg Weekly Earnings YoY | Jul | N/A | 0.6% |

| 15-Aug | Empire Manufacturing | Aug | (5.5) | 13.9 |

| 15-Aug | Retail Sales MoM | Jul | 0.4% | 0.0% |

| 15-Aug | Retail Sales ex Autos MoM | Jul | 0.1% | 0.4% |

| 15-Aug | Philadelphia Fed Business Outlook | Aug | 5.0 | 13.9 |

| 15-Aug | Initial Jobless Claims | 10-Aug | 236,000 | 233,000 |

| 15-Aug | Continuing Claims | 3-Aug | 1,870,000 | 1,875,000 |

| 15-Aug | Import Price Index MoM | Jul | -0.1% | 0.0% |

| 15-Aug | Export Price Index MoM | Jul | 0.0% | -0.5% |

| 15-Aug | Industrial Production MoM | Jul | -0.3% | 0.6% |

| 15-Aug | Capacity Utilization | Jul | 78.5% | 78.8% |

| 15-Aug | Business Inventories | Jun | 0.3% | 0.5% |

| 15-Aug | NAHB Housing Market Index | Aug | 42 | 42 |

| 16-Aug | Housing Starts | Jul | 1,337,000 | 1,353,000 |

| 16-Aug | Housing Starts MoM | Jul | -1.2% | 3.0% |

| 16-Aug | Building Permits | Jul | 1,425,000 | 1,446,000 |

| 16-Aug | Building Permits MoM | Jul | -1.5% | 3.4% |

| 16-Aug | NY Fed Services Business Activity | Aug | N/A | (4.5) |

| 16-Aug | UM Consumer Sentiment | Aug P | 66.9 | 66.4 |

| 16-Aug | UM Current Conditions | Aug P | 63.3 | 62.7 |

| 16-Aug | UM Expectations | Aug P | 69.0 | 68.8 |

| 16-Aug | UM 1-yr inflation | Aug P | 2.9% | 2.9% |

| 16-Aug | UM 5-10-yr inflation | Aug P | 2.9% | 3.0% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI