What’s your perspective? — Week of August 19, 2024

Essential Economics

— Mark Frears

Can you see the future from here?

The day-to-day hustle and bustle will keep you focused on the here and now, if you let it. With constant stimulus at your fingertips, or on your wrist, you can’t get away from it. Why do people not put away 5-10% in a savings plan for future needs, versus spending it now, even though that makes more sense? Long term is hard to see.

The September Federal Open Market Committee (FOMC) is right in front of us. What is the longer-term outlook for the Fed, the economy and inflation?

FOMC

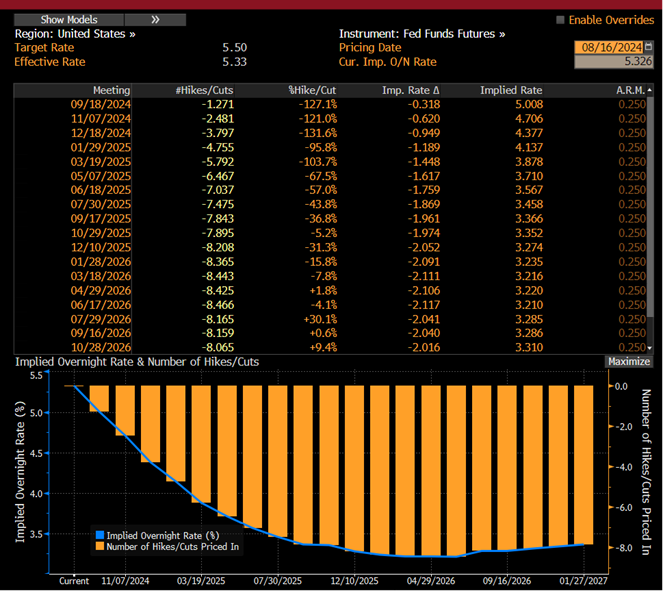

The near-term noise in financial markets is focusing on the Fed, and whether they will cut rates at their September meeting. This is all about a 25 basis point (0.25%) interest rate move for the overnight rate. Talk about short-term, less than substantial. The chart below, based on Fed Funds futures, shows a 127.1% chance of this move. Based on history, if we get within two weeks of the meeting and we still show a 90%-plus chance of a move, then the Fed will move, so as to not disrupt the market.

Source: Bloomberg

As a review of the Fed’s dual mandate, they will lower rates to stimulate the economy when activity is slowing. They will increase rates to slow the economy when prices are rising, so that a cooling economy will slow inflationary effects.

Let’s look at the above chart from a longer-term perspective. Based on the graphical representation in the lower part, futures expect the Fed Funds target to hit approximately 3.2% in mid-2026, and then start back higher.

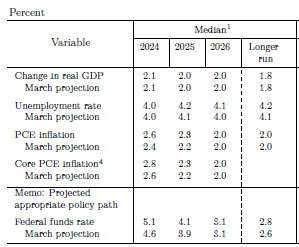

The FOMC publishes a longer-term projection of economic metrics on a quarterly basis. The most recent one, from the June 2024 meeting, is shown below.

Source: Federal Reserve

This confirms their long-term inflation target (PCE) at 2%, as the chair and others have been saying. Their long-term projection for Federal Funds rate is at 2.8%; this is up from the 2.5% that had been in place from June 2019 through December 2023. Federal Funds are currently at 5.25-5.50%. The chart above also shows projections for year-ends 2024, 2025 and 2026. This shows Federal Funds at 5.1% at 12/31/2024; this is quite a way from the futures market prognostication of 4.38%.

Economy

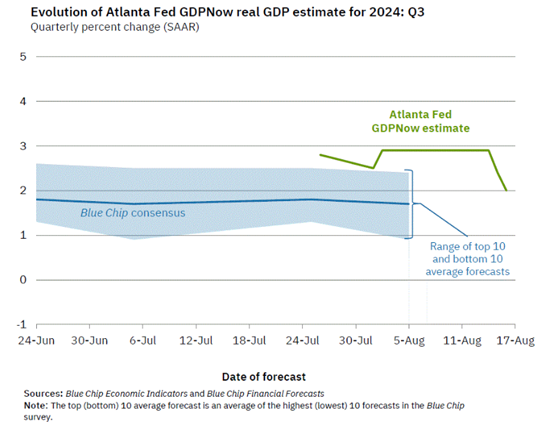

The Atlanta Fed GDP estimate for Q3 is running at 2%, as seen below. There are starting to be a few cracks in the economic strength, but we are still chugging along.

Source: Atlanta Fed

Recall again, the Fed should ease monetary conditions, by lowering rates, if there is a need for stimulus. We don’t seem to need immediate stimulus as the economy is doing OK, and, frankly, as we will see below, inflation is still a concern.

Over the past two years, while the FOMC has been raising short-term rates to fight inflation, they have also been battling against stimulus coming from the administration and legislature. Some of this is left over from the pandemic, and some has come about as more people depend on the government for sustenance.

The FOMC needs to take into consideration that in an election year, this stimulus is not going to slow down. For example, the IRS will restart the Employee Retention Tax Credit (ERTC) over the next few weeks. This is a program that was halted a year ago due to rampant fraud. This will potentially add stimulus of $5 billion in early September, with another $20 billion by year-end. In addition, the administration continues to look for ways to cancel student loans, despite the ruling by the Supreme Court. Bottom line, the FOMC doesn’t need to cut rates to stimulate the economy. If they cut, it would be a short-term move, with potential long-term consequences.

Inflation

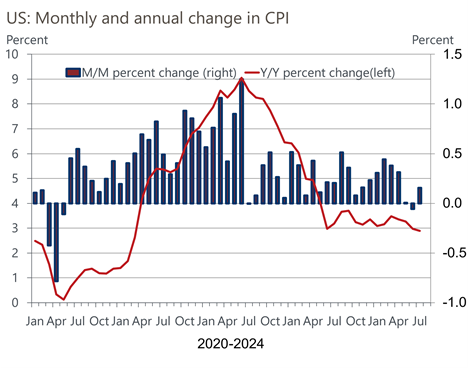

While we have seen significant improvement in bringing down prices, the job is not complete. The chart below shows CPI on a year-over-year basis (red line), and this has fallen to just below 3%, but we are not back to the desired target, or approaching levels before pandemic and supply chain constraints kicked in.

Source: Oxford Economics/Haver Analytics

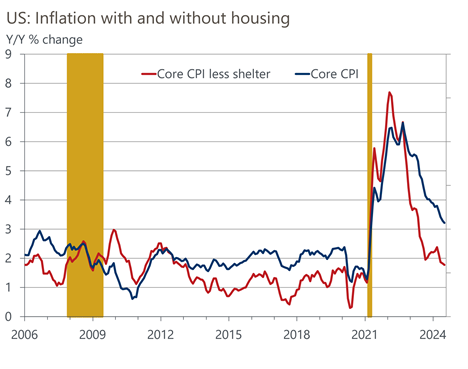

Progress is being made. If we slice this up into the core metric, as seen below, the core CPI is below 2% if we take out housing. I don’t know about you, but I still need a place to sleep.

Source: Oxford Economics/Haver Analytics

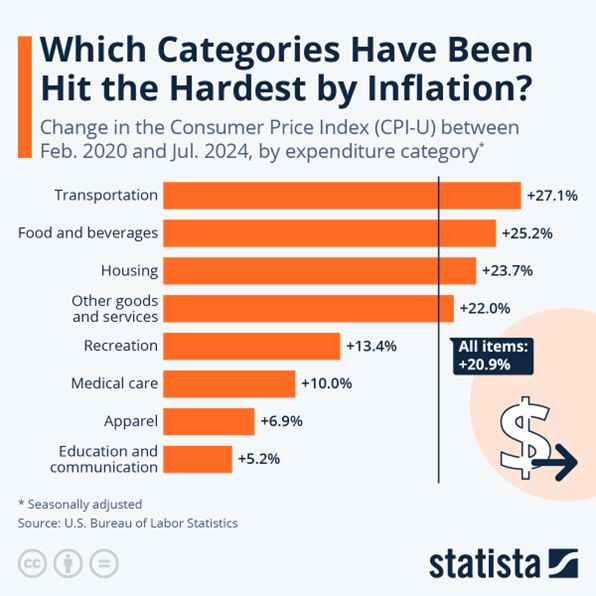

The other impact of inflation that is not captured by these metrics is the cumulative impact of higher prices on households and businesses. While the prices may be stabilizing, or not going up as fast, I personally have not seen anyone cut prices! The chart below shows we have had an overall impact of 20.9% since February 2020. Transportation, Food and Beverage and Housing are the biggest gains, and we all deal with those on a daily basis.

In addition, the long end of the UST curve (think mortgages) has already built in the next Fed eases of the overnight rate, so do not expect to see continued lowering of mortgage rates until the economy slows materially (think recession).

The FOMC meeting on September 17-18 will be closely watched, and expectations are for a 25bp cut. Will we get it, and will it matter?

Economic releases

Last week we had inflation, sales and sentiment releases. They showed slowing inflation, consumer still spending and sentiment that improved. Next big number will be the payroll release on September 6.

This week’s calendar is pretty light. Focus will be on FOMC chair Powell’s speech on Friday, in Jackson Hole. See below for more details.

Wrap-Up

Don’t let the short-term noise distract you from the right things to do from a long-term perspective.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 19-Aug | Leading Index | Jul | -0.4% | -0.2% |

| 20-Aug | Philadelphia Fed Non-Manuf Activity | Aug | N/A | (19.1) |

| 21-Aug | MBA Mortgage Applications | 16-Aug | N/A | 16.8% |

| 21-Aug | FOMC Meeting Minutes from Jul 30-31 | |||

| 22-Aug | Chicago Fed Natl Activity Index | Jul | 0.03 | 0.05 |

| 22-Aug | Initial Jobless Claims | 17-Aug | 232,000 | 227,000 |

| 22-Aug | Continuing Claims | 10-Aug | 1,869,000 | 1,864,000 |

| 22-Aug | S&P Global US Manufacturing PMI | Aug P | 49.8 | 49.6 |

| 22-Aug | S&P Global US Services PMI | Aug P | 54.0 | 55.0 |

| 22-Aug | S&P Global US Composite PMI | Aug P | 53.3 | 54.3 |

| 22-Aug | Existing Home Sales | Jul | 3,930,000 | 3,890,000 |

| 22-Aug | Existing Home Sales MoM | Jul | 1.0% | -5.4% |

| 22-Aug | KC Fed Manufacturing Activity | Aug | (9.0) | (13.0) |

| 23-Aug | Powell Presentation at Jackson Hole | |||

| 23-Aug | New Home Sales | Jul | 625,000 | 617,000 |

| 23-Aug | New Home Sales MoM | Jul | 1.3% | -0.6% |

| 23-Aug | KC Fed Services Activity | Aug | N/A | (4.0) |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI