Watch what they do — Week of August 5, 2024

Essential Economics

— Mark Frears

Time out

When my boys were young, there were occasions when we use the “time out” strategy. We would set up a chair in a corner, theoretically to have them sit there and ponder what grievous violation they had done. I am sure that was far from their mind, or perhaps they were figuring out how to get away with it next time. This is a form of behavior modification, and it can be used in many other circumstances, but not usually with the chair in the corner.

The behavior of the consumer drives the economy, as they count for two-thirds of gross domestic product (GDP). How are they behaving lately?

GDP

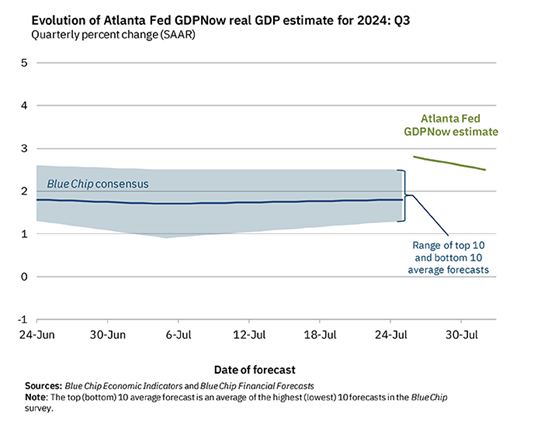

Second quarter GDP came in stronger than expected at 2.8%. The consumer is still doing OK. Initial guess at Q3 GDP is a bit slower. As you see below, the forecast is hovering a bit below 2%, and this was before the disappointing Payroll number last Friday.

In light of weaker job prospects and fewer chances to change jobs to increase wages, what is the consumer doing?

Consumer behavior

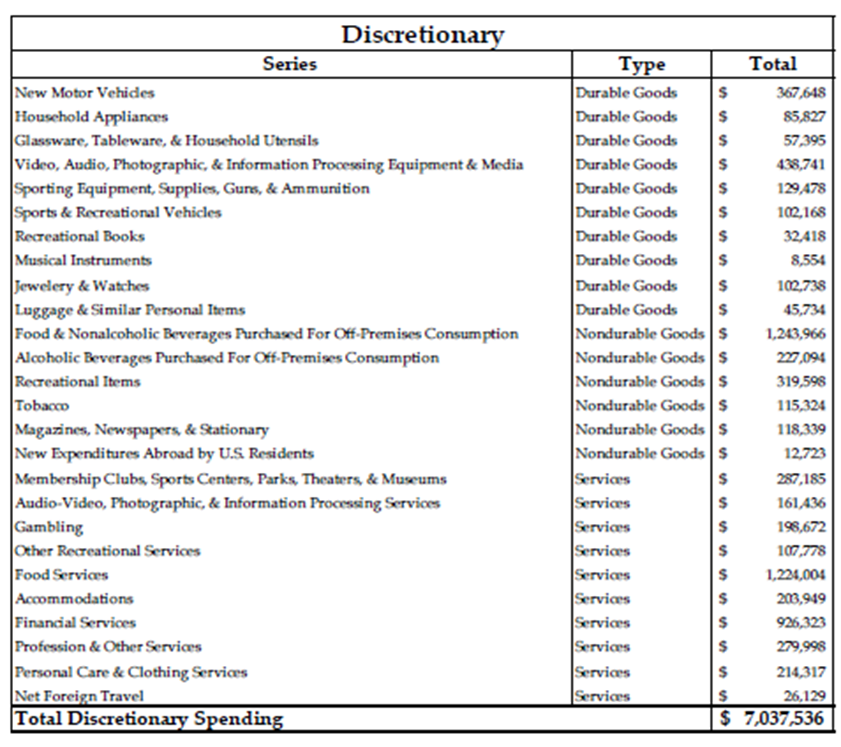

We have choices, every day, on where to spend our hard-earned income. When things are going well, you have a job that gives you a good income, and prospects for another job, or promotion, are strong, you feel confident in your spending. As the table below shows, you might have more discretion with your spending and might buy a new car or new appliances.

Source: Strategas Research

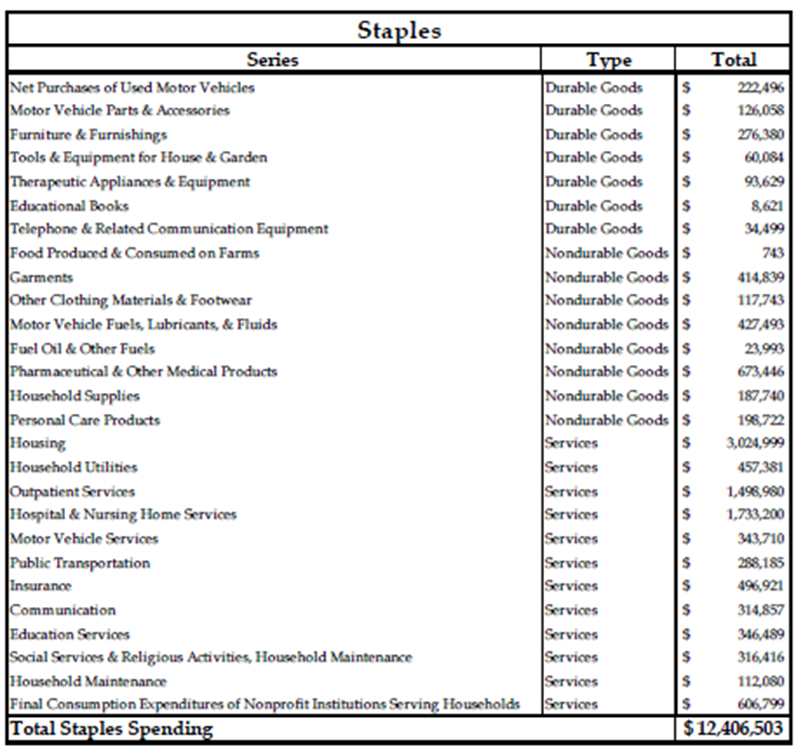

If things are starting to look not so good, you might pull back on that spending and focus more on needs. The table below shows what you might purchase in this mode. For example, you might look for a used car versus a new one. Under the services designation, you have gone from spending money on eating out and hotels to hospitalization and insurance.

Source: Strategas Research

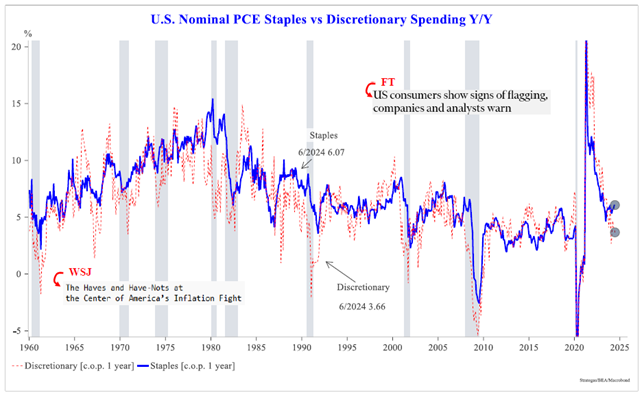

One thing we have been watching closely is the difference in spending behavior of the lower- and middle-income households versus the upper-income. Thus far, we have not seen material changes in upper-income spending, despite higher prices. As they provide more of the fuel for economic growth, the FOMC was not getting the impact from higher rates that they wanted to see.

We may have finally reached that point. As you can see below, staples spending is now on an uptrend, while discretionary is falling. This will give the FOMC confidence that inflation will fall back to their target of 2%.

Source: Strategas Research

Another area the FOMC is watching closely is the labor market, as the continued strength in hiring caused wages to stay elevated. Higher wages lead to higher spending, keeping prices higher.

This past week saw a few cracks in the labor market, with claims inching up, JOLTS quit rate falling and unemployment rate increasing by 0.2% to 4.3%. Not large chasms by any means, but enough to make the markets feel the FOMC’s potential rate cut in September was a done deal.

Recession fears

After Friday’s Payroll release, many of the largest financial firms ramped up their calls for 2024 FOMC rate cuts to 3! One each in September, November and December.

The FOMC’s other primary goal is full employment. With the unemployment rate only up to 4.3%, jobs still being created each month and inflation still impacting households, why the rush to cut? If they know something we don’t about the job market and see extremely bad conditions ahead, it might be justified. Possibly they are feeling political pressure. An ease in interest rates, seen as stimulative to the economy, would be appreciated by the current administration and questioned by the challenger. Do they want to go there?

We might be gearing down from second to first gear, but the economy is still chugging along. Keep in mind there is still one more employment report, and two more CPI reports before the September FOMC meeting. As you have seen this past week, volatile markets can change direction in the flash of an eye.

Economic releases

Last week was all about labor and the FOMC. Payrolls were weaker than expected, and the market decided this was the tipping point for a reversal. Probably overdone.

This week’s calendar is very light with ISM, Loan Officer survey, consumer credit and jobless claims. See below for details.

Wrap-Up

Behavior is the thing to watch. People will talk all day long, but what do their actions say?! Keep a close eye on the consumer for hints as to economic strength and direction. What do your actions say about you? Are you walking the talk, or just talking?!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 5-Aug | ISM Services Index | Jul | 51.0 | 48.8 |

| 5-Aug | ISM Services Prices Paid | Jul | 56.0 | 56.3 |

| 5-Aug | ISM Services Employment | Jul | 46.4 | 46.1 |

| 5-Aug | ISM Services New Orders | Jul | 49.8 | 47.3 |

| 5-Aug | Senior Loan Officer Opinion Survey | |||

| 7-Aug | Consumer Credit | Jun | $10.000B | $11.3544B |

| 8-Aug | Initial Jobless Claims | 3-Aug | 243,000 | 249,000 |

| 8-Aug | Continuing Claims | 27-Jul | 1,876,000 | 1,877,000 |

| 8-Aug | Wholesale Trade Sales MoM | Jun | N/A | 0.4% |

| 8-Aug | Wholesale Inventories MoM | Jun F | 0.2% | 0.2% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI