How do you measure that? — Week of February 26, 2024

Essential Economics

— Mark Frears

Slicing and dicing

My parents were both born in Canada; therefore, we have had multiple opportunities to travel there. If you are driving, one of first things you will notice is the speed limit. On the 401, it is usually posted at 100. Whoa, this is not the wide-open spaces of Montana! Let’s take a closer look. They are on the metric system, so this is in kilometers per hour, approximately 62 miles per hour. How you measure things can make all the difference.

The strength of the economy is under scrutiny right now, given the focus on what the FOMC will do next. If the economy slows down, they will have more room to cut rates and provide stimulus.

GDP

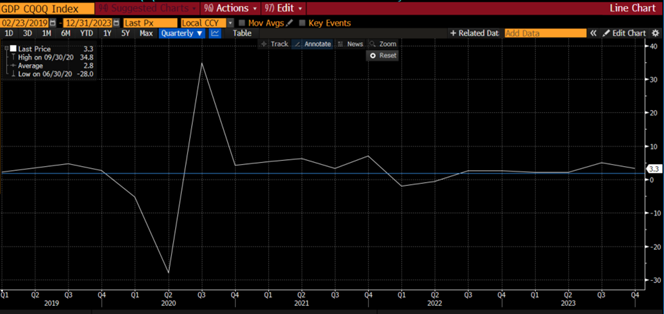

Gross Domestic Product (GDP) is the usual measure of economic strength used by economists. The last measurement we had was for fourth quarter 2023, and it came in at a solid 3.3%, above market expectations. The Fed’s long-term goal for GDP, per their quarterly Summary of Economic Projections, is 1.8%. The blue line, below, shows this benchmark, and the economy has been above that for more than a year.

Source: Bloomberg

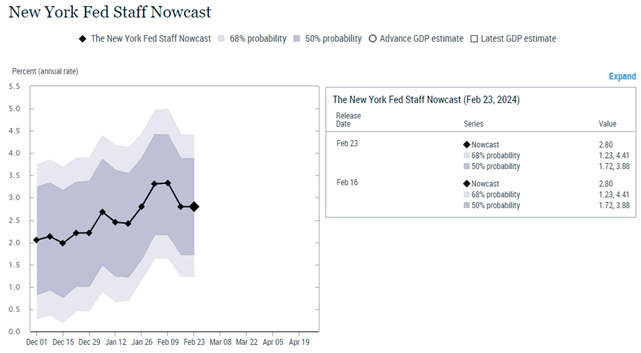

Looking forward, the NY Fed, see below, projects GDP to be running at a 2.8% rate for the first quarter. Still above the long-term trend desired by the Fed.

Source: NY Fed

GDI

Can one letter make a difference? As we will see with Gross Domestic Income (GDI), the answer is yes. Both of these metrics show the value of goods and services produced in the economy for a given period of time. Theoretically, they should come out very close to each other. GDP measure expenditures, and GDI measures income to support the output/expenditures.

Semantics

There are a few uncertainties in the economic world right now. First, the recession that won’t come to pass. Second, an unemployment rate and jobless claims that don’t reflect layoffs. Third, the AI phenomenon that has captured everyone’s attention. Fourth, GDP and GDI are at odds.

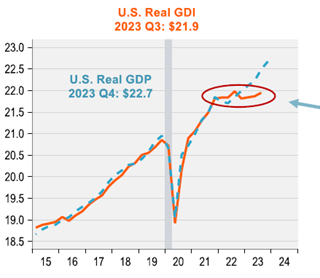

As you can see below, while GDP continues to climb, GDI has stalled out.

Source: Piper Sandler Research

So, is the economy growing, or not?!

History repeats?

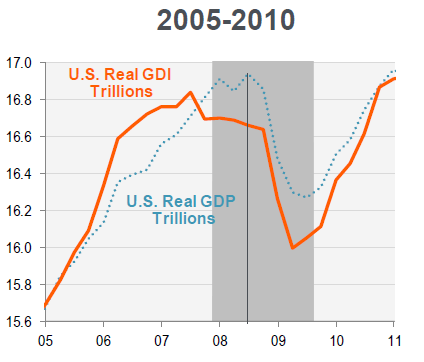

As these two measures usually track very closely, let’s look back at the last time they did not. We only have to look back to the Great Financial Crisis (GFC) to see a similar pattern. As you can see below, in 2008, GDP kept on an upward trajectory while GDI flatlined ahead of the recession.

Source: Piper Sandler Research

We will not get the fourth quarter’s GDI until late March, as companies are still reporting their revenues for that period.

Even with the Fed “talking heads” singing from the same patience songbook last week, the speculation for cuts this year is still around four. If the GDI metric is a better indicator, this will make that scenario more likely.

Economic releases

Last week was slow on the economic release front. FOMC minutes from Jan. meeting and Leading Index were the highlights. NVDA earnings and Fed speakers took up most of the headlines.

This week’s calendar is full to the brim. We have Durable Goods Orders for January, Consumer Confidence for Feb, Personal Income and Spending for January and PCE inflation reading for January. There is the possibility for a government shutdown on March 1. See below for details.

Wrap-Up

How are you doing on measuring progress on your 2024 goals? Measurements can take different forms, but it is always good to stay aware of quantifiable things. Take the subjectiveness out and dig deeper into those numbers!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 26-Feb | New Home Sales | Jan | 684,000 | 664,000 |

| 26-Feb | New Home Sales MoM | Jan | 3.0% | 8.0% |

| 26-Feb | Dallas Fed Manuf Activity | Feb | (14.0) | (27.4) |

| 27-Feb | Durable Goods Orders | Jan P | -5.0% | 0.0% |

| 27-Feb | Durable Goods ex Transportation | Jan P | 0.2% | 0.5% |

| 27-Feb | Cap Goods Orders Nondef ex Aircraft | Jan P | 0.1% | 0.2% |

| 27-Feb | House Price Purchase Index QoQ | Q4 | N/A | 2.1% |

| 27-Feb | FHFA House Price Index MoM | Dec | 0.3% | 0.3% |

| 27-Feb | S&P CoreLogic 20-City YoY NSA | Dec | 6.00% | 5.40% |

| 27-Feb | Richmond Fed Manufacturing Index | Feb | (8) | (15) |

| 27-Feb | Conf Board Consumer Confidence | Feb | 115.0 | 114.8 |

| 27-Feb | Conf Board Present Situation | Feb | N/A | 161.3 |

| 27-Feb | Conf Board Expectations | Feb | N/A | 83.8 |

| 27-Feb | Richmond Fed Business Conditions | Feb | N/A | (3) |

| 27-Feb | Dallas Fed Services Activity | Feb | N/A | (9.3) |

| 28-Feb | GDP Annualized QoQ | Q4 | 3.3% | 3.3% |

| 28-Feb | Personal Consumption | Q4 | 2.7% | 2.8% |

| 28-Feb | GDP Price Index | Q4 | 1.5% | 1.5% |

| 28-Feb | Retail Inventories MoM | Jan | 0.4% | 0.8% |

| 28-Feb | Wholesale Inventories MoM | Jan P | 0.2% | 0.4% |

| 29-Feb | Personal Income | Jan | 0.4% | 0.3% |

| 29-Feb | Personal Spending | Jan | 0.2% | 0.7% |

| 29-Feb | Real Personal Spending | Jan | -0.1% | 0.5% |

| 29-Feb | PCE Deflator YoY | Jan | 2.4% | 2.6% |

| 29-Feb | PCE Core Deflator YoY | Jan | 2.8% | 2.9% |

| 29-Feb | Initial Jobless Claims | 24-Feb | 210,000 | 201,000 |

| 29-Feb | Continuing Claims | 17-Feb | 1,874,000 | 1,862,000 |

| 29-Feb | MNI Chicago PMI | Feb | 48.0 | 46.0 |

| 29-Feb | Pending Home Sales MoM | Jan | 1.1% | 8.3% |

| 29-Feb | KC Fed Manufacturing Activity | Feb | N/A | (9) |

| 1-Mar | Construction Spending MoM | Jan | 0.2% | 0.9% |

| 1-Mar | ISM Manufacturing | Feb | 49.5 | 49.1 |

| 1-Mar | ISM Manufacturing Prices Paid | Feb | 54.5 | 52.9 |

| 1-Mar | ISM Manufacturing New Orders | Feb | N/A | 52.5 |

| 1-Mar | ISM Manufacturing Employment | Feb | N/A | 47.1 |

| 1-Mar | UM (Go UW) Consumer Sentiment | Feb F | 79.6 | 79.6 |

| 1-Mar | UM (Go UW) Current Conditions | Feb F | N/A | 81.5 |

| 1-Mar | UM (Go UW) Expectations | Feb F | N/A | 78.4 |

| 1-Mar | UM (Go UW) 1-yr inflation | Feb F | 3.0 | 3.0% |

| 1-Mar | UM (Go UW) 5-10-yr inflation | Feb F | N/A | 2.9% |

| 1-Mar | KC Fed Services Activity | Feb | N/A | (2) |

| 1-Mar | Ward's Total Vehicle Sales | Feb | 15,400,000 | 15,000,000 |

Mark Frears is an Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.