Hearing through the noise — Week of February 5, 2024

Essential Economics

— Mark Frears

Clarity

How do you see through the fog and distractions of daily life? Some like to do a “time audit” to see where their hours are spent. Is time spent in line with your bigger goals? Do you know your bigger goals? Another way to dig into your time is to evaluate whether you are spending more minutes on urgent tasks versus important ones! Urgent things can eat up your time but may not be in line with your important priorities. Lots of noise out there.

The economic, rates, Fed and election news have been coming fast and furious. Is there a metric out there that will help us see through the fog and gain insight? Let’s take a look.

Insight?

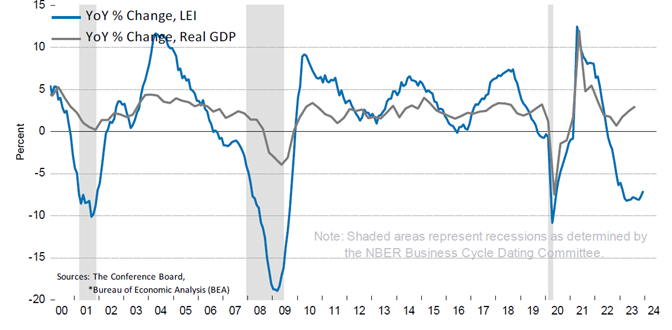

The Conference Board puts out a monthly release that captures forward-looking metrics, called the Leading Economic Index (LEI). As you can see below, in 2001, 2008 and 2020, recessions were preceded by downward trends in the LEI.

Source: Bureau of Economic Analysis

It has an uncanny ability to forecast recessions, and the current 22-month streak of negative numbers has caused us to speculate on a coming recession. While economic growth continues to surprise as to its strength, we need to pay attention to the crystal ball. While these are period end estimates, we don’t see any negatives in there.

Unpacking

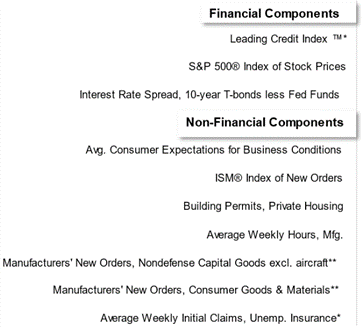

The components of the index cover rates, credit, stocks, manufacturing, housing and unemployment, as you see in the chart below.

Source: The Conference Board

* Inverted series; a negative change in this component makes a positive contribution

**Statistical Imputation

LEI change might not equal sum of its contributions due to application of trend adjustment factor

There have been tweaks to the index components since the 1950s when this originated. Commodities have been de-emphasized, and credit got more focus after the 2008 recession. One tweak you may see coming out of the current economic cycle is to add a services metric; as in the post-pandemic world, this is a larger focus of consumers.

GDP

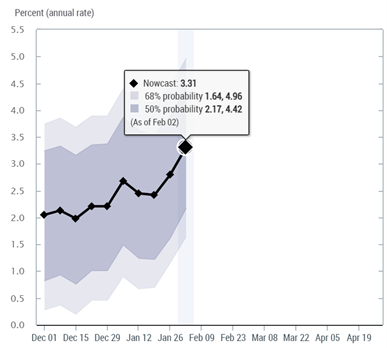

A recession is defined as two consecutive quarters of negative Gross Domestic Product (GDP). Expectations for Q4 2023 GDP were for a 2% rate, and it came in at 3.3%. Not the slower pace the LEI would portend. Will we see a slower pace in Q1 2024? Based on the NY Fed’s Nowcast, as seen below, we are going to stay above 3% growth.

Source: New York Fed

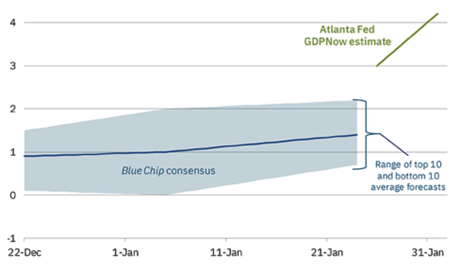

Looking further south, the Atlanta Fed’s GDPNow is looking for a reading north of 4%. As shown below, the consensus is closer to 1%, and that would encourage the recession talk.

Source: Atlanta Fed

Possible disrupters

Last week, we heard from Chair Powell that a March rate cut was not being considered due to the strength of the economy and potential inflationary flare-ups. If they leave the overnight rate higher for longer, this could send the economy into a tailspin.

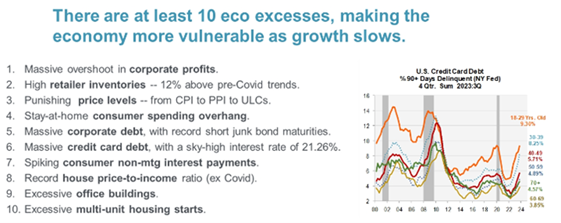

In addition, Piper Sandler lays out below 10 potential economic excesses that could derail growth.

Source: Piper Sandler

These are all valid areas to monitor, with debt, commercial real estate and future consumer spending getting the most attention.

While it doesn’t appear that a recession is imminent, confidence of consumers and lenders can turn on a dime.

Economic releases

Last week saw the Fed communicating a pause, as well as confidence and employment topping expectations.

This week’s calendar will be slower from a release perspective. ISM Services, Consumer Credit and Senior Loan Officer’s Survey top the list. Friday’s annual CPI revisions will be the wild card. See below for details.

Wrap-Up

What is the biggest source of “noise” in your life? How are you doing at managing that? It is worth taking a moment to consider the important, while not getting caught up in the urgent. Balance keeps the economy humming along, and it doesn’t seem to be faltering, for now.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 5-Feb | ISM Services Index | Jan | 52.0 | 50.6 |

| 5-Feb | ISM Services Prices Paid | Jan | N/A | 57.4 |

| 5-Feb | ISM Services Employment | Jan | N/A | 43.3 |

| 5-Feb | ISM Services New Orders | Jan | N/A | 52.8 |

| 5-Feb | Fed Senior Loan Officer Survey | 1p CT | ||

| 7-Feb | MBA Mortgage Applications | 2-Feb | N/A | -7.2% |

| 7-Feb | Trade Balance | Dec | -$62.2B | -$63.2B |

| 7-Feb | Consumer Credit | Dec | $15.9000B | $23.751B |

| 8-Feb | Initial Jobless Claims | 3-Feb | 220,000 | 224,000 |

| 8-Feb | Continuing Claims | 27-Jan | 1,873,000 | 1,898,000 |

| 8-Feb | Wholesale Trade Sales MoM | Dec | N/A | 0.0% |

| 8-Feb | Wholesale Inventories MoM | Dec | 0.4% | 0.4% |

| 9-Feb | Annual CPI Revisions for years 2019 through 2023 | |||

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.