Are you confident? — Week of July 1, 2024

Essential Economics

— Mark Frears

Mastery

Is there something you do very well? Have a lot of assurance in this skill/talent? We are about to have the pleasure of watching the Olympics and the Tour de France. These are people who have amazing talent and have done the work to get there. Malcolm Gladwell contends that it takes 10,000 hours to achieve mastery. If you spent eight hours a day, that is 1,250 days, and at five days a week, that is 250 weeks. Any way you do the math, that is a long time, with an extreme focus!

The consumer is the driving factor in the economy, providing two-thirds of the input. What are they focused on?

GDP

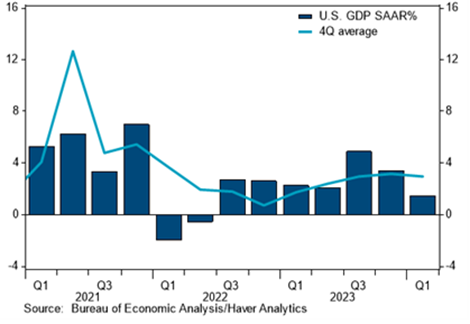

Gross Domestic Product (GDP) is the measure of how strong the economy is. We had the most recent revision/guess to Q1 2024, as you can see below, and it came in at 1.4%.

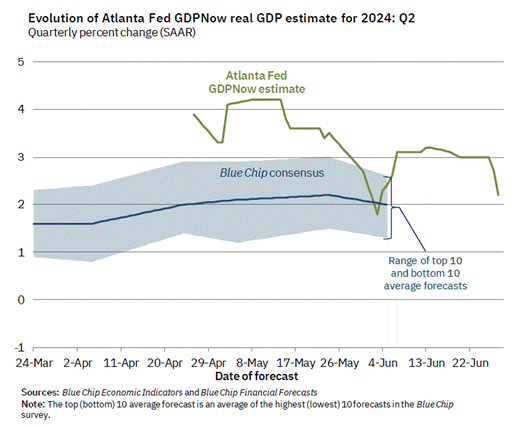

This is down from the rapid pace of the past two quarters but is far from the recession talk of earlier in the year. The chart below shows the estimates for Q2 2024, and it looks like 2% is the consensus.

Per the FOMC’s Summary of Economic Projections (below), they expect to see 2024 end with a 2.1% GDP and look for 2% growth in 2025 and 2026.

Source: FOMC Summary of Economic Projections – June 12, 2024

You and me

So, if the economy is going to chug along a bit faster than last quarter and sustain that through year-end, the consumer must be engaged and spending. What is the consumer watching?

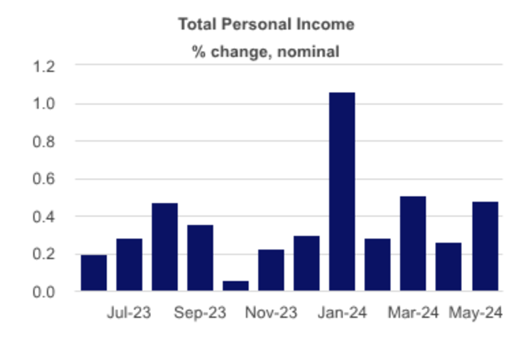

Theoretically, it helps to have a job to continue to spend. As you can see below, the Personal Income in the U.S. increased again in May.

Source: Moody's Analytics

We will get the latest update on payrolls and job openings this week (see the table at the bottom for details). The labor market continues to drive solid gains in personal income. In addition, the household balance sheet continues to be strong, with much of the debt locked in at lower interest rates.

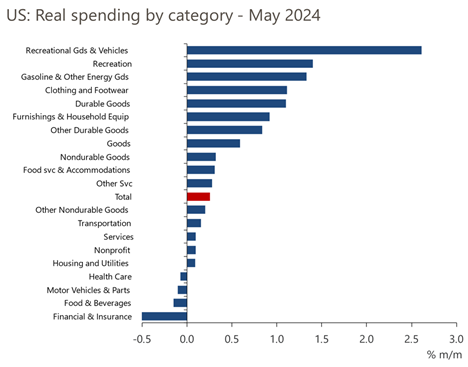

In May, spending shifted to purchasing more goods, which has not been the case recently. The chart below shows where people put their hard-earned dollars this past month.

Source: Oxford Economics / Haver Analytics

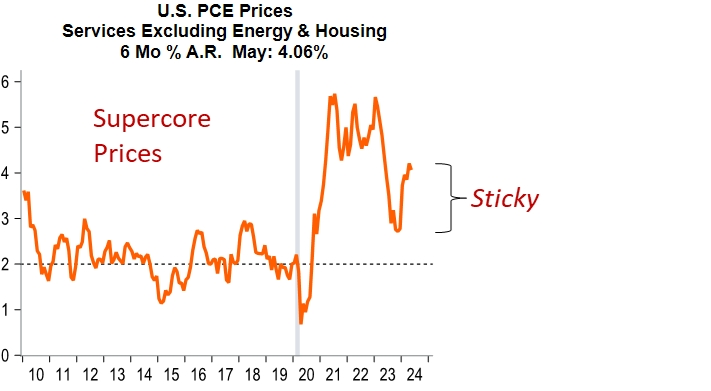

While spending is continuing, due to wages that keep on coming, the amount of what people are buying is not the same. By some measures, income is keeping up with higher prices, but we are now at higher price levels that are weighing on the consumer. As you see below, core service prices continue to bounce off their recent low.

Source: Piper Sandler Research

Two categories that are impacting all income levels are food and insurance. You can’t even drive by a grocery store without leaving a Benjamin behind. Eating out has gotten even pricier, especially with costs of labor staying high. Most people have cars, and many have homes. The cost of insuring both of those has increased 20 to 50%, based on my own experience.

Where does this leave the consumer?

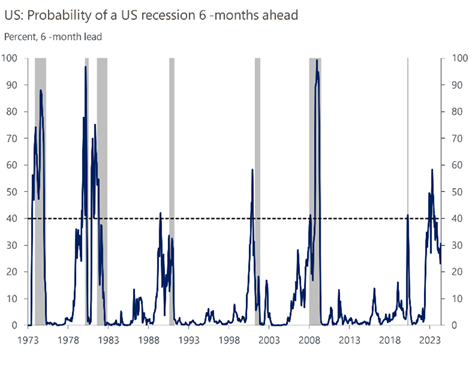

If you are focused on economic forecasts, the odds of recession continue to fall, as you can see below.

Source: Oxford Economics / Haver Analytics

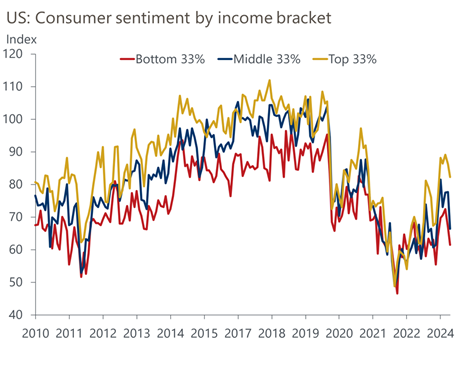

Some individuals may be paying attention to that, but more are focused on their own wallet and personal situation. The latest consumer sentiment metrics out of the University of Michigan are not painting a bright picture. The chart below lays this out by income level.

Source: Oxford Economics / Haver Analytics

We do not like uncertainty. Higher prices, global unrest and election turmoil will cause many to postpone spending plans. While we currently see continued spending, like fiscal spending, this will not be sustainable.

Economic releases

Last week we had a plethora of information updates. Confidence was up a bit, but at lower levels. Durable Goods Orders were a bit below expectations. PCE inflation metric was right on expectations.

This week’s calendar is mostly about jobs. JOLTS, ADP, nonfarm payrolls. In addition, we have FOMC minutes from June, and the celebration of our great country’s birth. Happy 4th! See below for details.

Wrap-Up

Mastery of a skill is an amazing thing, only accomplished by a select few. Walking a daily life can sometimes take even more confidence than these experts have. Will your confidence come from continued spending, or by fully evaluating your personal situation?

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 1-Jul | S&P Global US Manuf PMI | Jun F | 51.7 | 51.7 |

| 1-Jul | Construction Spending MoM | May | 0.2% | -0.1% |

| 1-Jul | ISM Manufacturing Index | Jun | 49.1 | 48.7 |

| 1-Jul | ISM Manufacturing Prices Paid | Jun | 55.8 | 57.0 |

| 1-Jul | ISM Manufacturing Employment | Jun | 50.0 | 51.1 |

| 1-Jul | ISM Manufacturing New Orders | Jun | 49.0 | 45.4 |

| 2-Jul | JOLTS Job Openings | May | 7,864,000 | 8,059,000 |

| 2-Jul | Ward's Total Vehicle Sales | Jun | 15,800,000 | 15,900,000 |

| 3-Jul | Challenger Job Cuts YoY | Jun | N/A | -20.3% |

| 3-Jul | ADP Employment Change | Jun | 158,000 | 152,000 |

| 3-Jul | Initial Jobless Claims | 29-Jun | 235,000 | 233,000 |

| 3-Jul | Continuing Claims | 22-Jun | N/A | 1,839,000 |

| 3-Jul | Factory Orders | May | 0.3% | 0.7% |

| 3-Jul | Factory Orders ex Transportation | May | N/A | 0.7% |

| 3-Jul | ISM Services Index | Jun | 52.5 | 53.8 |

| 3-Jul | ISM Services Prices Paid | Jun | N/A | 58.1 |

| 3-Jul | ISM Services Employment | Jun | N/A | 47.1 |

| 3-Jul | ISM Services New Orders | Jun | N/A | 54.1 |

| 3-Jul | FOMC Minutes from June 11-12 meeting | |||

| 5-Jul | Change in Nonfarm Payrolls | May | 190,000 | 272,000 |

| 5-Jul | Change in Private Payrolls | May | 163,000 | 229,000 |

| 5-Jul | Unemployment Rate | May | 4.0% | 4.0% |

| 5-Jul | Avg Hourly Earnings MoM | May | 0.3% | 0.4% |

| 5-Jul | Avg Hourly Earnings YoY | May | 3.9% | 4.1% |

| 5-Jul | Avg Weekly Hours - All Employees | May | 34.3 | 34.3 |

| 5-Jul | Labor Force Participation Rate | May | 62.6% | 62.5% |

| 5-Jul | Underemployment Rate | May | N/A | 7.4% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI