Squirrel!! — Week of July 15, 2024

Essential Economics

— Mark Frears

Squirrel?!

Continuing on the habit track this week. For the most part, our current culture has a very short attention span. We are usually satisfied with headlines, or soundbites, while the full story takes more digging. We are distracted so easily that we usually don’t follow through on the meat behind the headline.

Let’s take a look at a few of the current headlines that are capturing the attention of the financial markets.

Fed

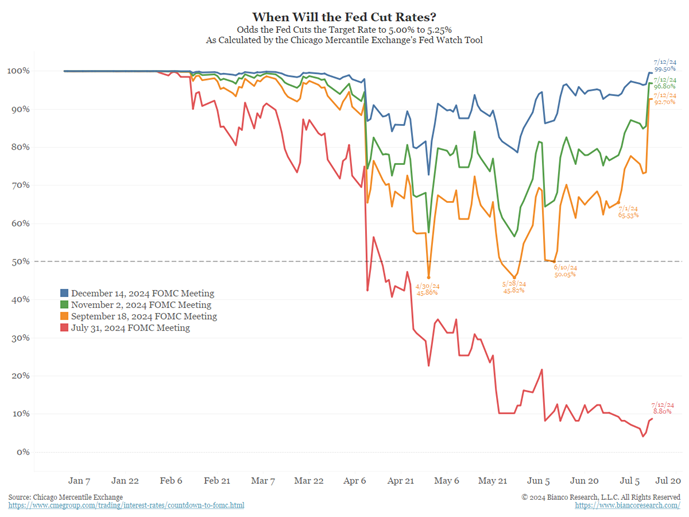

The 10,000-pound gorilla in the market is the Fed, or Federal Open Market Committee, and the speculation as to when they will start to lower rates. After the lower-than-expected Consumer Price Index (CPI) last week, the odds of a September 18 rate cut are up to 92.7%, as you can see below.

Source: Bianco Research

The point when these futures become even more relevant is within two weeks of the meeting, as the Fed does not usually go against the market convention.

The Fed has left rates higher for longer because they want to make sure inflation is really headed back to their 2% target before they start to ease monetary conditions. Their task is accomplished through slowing of the economy, but with their main lever being overnight rates, they have less influence on the longer end of the curve. They attempt to do that by their speaking engagements and forward looking Summary of Economic Projections.

So, if the Fed is going to cut rates, they must be satisfied with the direction of inflation. In addition, their other mandate of full employment is going just fine, and we continue to add 200,000 jobs per month and the unemployment rate is barely above 4%. So, what’s the rush to cut? Let’s take a look at the actual impacts of a rate cut.

First, if the Fed cuts rates 0.25%, it will cause SOFR, primary corporate loan benchmark, to come down 25 basis points as well. The impact of that on a client that borrows $1,000,000 is only $2,500. That’s right, it really doesn’t move the needle. Second, housing is a big focus, in that it is not affordable. If the Fed cuts short-term rates, that does not necessarily mean that long-term, or mortgage, rates will decline. In addition, the lack of supply in housing is the cause of higher prices, not the mortgage rates. So, they won’t help that sector by cutting rates.

Equity markets think this rate cut would make monetary conditions easier and would boost earnings. Again, not a direct causal relationship there. If you were more of a glass-half-empty person, you might wonder why the Fed is cutting rates if inflation is working lower and the employment situation is ok. What do they know that we don’t? Is there something coming down the pipe that is worse than we know? That would spook markets, causing stocks to sell off and flight to quality in UST.

Producers

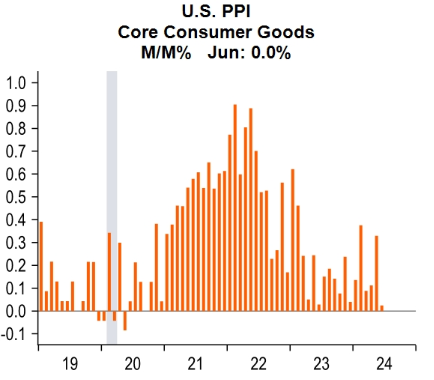

Lost in the euphoria over lower-than-expected CPI was a slightly higher PPI, but on a year-over-year basis it is only 2.6%. If you look at core consumer goods (see below) the costs had a significant decline.

Source: Piper Sandler Research

On the digging deeper side of this release, lower prices for some goods that companies are accessing is a good thing. The other side is that services and wages are not declining as fast, and this could lead to margin squeeze. We are entering prime earnings announcement season, so we shall see if there are any cracks appearing here.

Sentiment

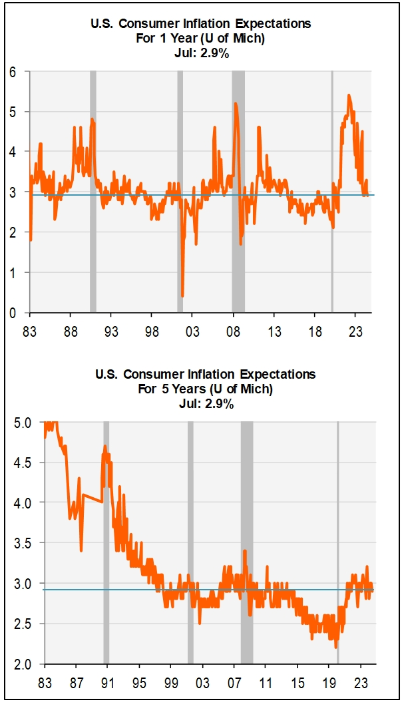

The preliminary consumer sentiment release for July came out last Friday, and the headline focused on the inflation portion. As seen below, both the one- and five-year inflation expectations are below 3%.

Source: Piper Sandler Research

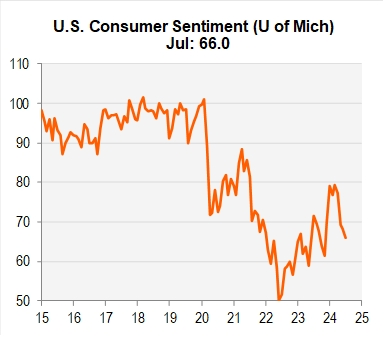

These are both above pre-pandemic levels, but headlines that want to push for a rate cut by the Fed focused on the 2% handle. If we dig deeper, the overall sentiment (see below) as well as current sentiment and expectations are all headed lower.

Source: Piper Sandler Research

Just possibly, the consumer thinks inflation will be lower in the future because they see a slowdown in the economy coming.

These are three examples of how you need to look past the headlines and learn the full story. We are all aware that many “news” stories are actually opinions. Know your sources and pay attention to their “bent.”

Economic releases

Last week was all about inflation, with the news mostly positive. How positive is the question. Consumer Credit was higher than expected, as was Small Business Optimism.

This week’s calendar is a mishmash with Retail Sales, Housing Starts, Building Permits and Beige Book for the July FOMC meeting, and the (mis) Leading Index. See below for details.

Wrap-Up

Soundbites can be great to get a glimpse of what is happening. Don’t be afraid to fight the crowd, slow down and take a deep look. You never know what you might find!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 15-Jul | Empire Manufacturing | Jul | (7.6) | (6.0) |

| 16-Jul | NY Fed Services Business Activity | Jul | N/A | (4.7) |

| 16-Jul | Retail Sales MoM | Jun | -0.3% | 0.1% |

| 16-Jul | Retail Sales ex Autos MoM | Jun | 0.1% | -0.1% |

| 16-Jul | Import Price Index MoM | Jun | -0.2% | -0.4% |

| 16-Jul | Export Price Index MoM | Ju | -0.1% | -0.6% |

| 16-Jul | Business Inventories | May | 0.5% | 0.3% |

| 16-Jul | NAHB Housing Market Index | Jul | 43 | 43 |

| 17-Jul | Building Permits | Jun | 1,400,000 | 1,386,000 |

| 17-Jul | Building Permits MoM | Jun | 0.1% | -3.8% |

| 17-Jul | Housing Starts | Jun | 1,300,000 | 1,277,000 |

| 17-Jul | Housing Starts MoM | Jun | 1.8% | -5.5% |

| 17-Jul | Industrial Production MoM | Jun | 0.3% | 0.9% |

| 17-Jul | Capacity Utilization | Jun | 78.4% | 78.7% |

| 17-Jul | Fed releases Beige Book for Jul 30-31 FOMC Meeting - 1p CT | |||

| 18-Jul | Philadelphia Fed Business Outlook | Jul | 2.9 | 1.3 |

| 18-Jul | Initial Jobless Claims | 13-Jul | 230,000 | 222,000 |

| 18-Jul | Continuing Claims | 6-Jul | 1,856,000 | 1,852,000 |

| 18-Jul | Leading Index | Jun | -0.3% | -0.5% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI