Who are they? — Week of July 29, 2024

Essential Economics

— Mark Frears

A lot of pressure

What are you known as? Introvert, extrovert, passive, combative, book-smart, street-smart or a combination of many?! There are lots of tests out there to evaluate; used to be Myers Briggs and DISC, and now the Enneagram is very popular. Don’t ask me my number (never took it) but I sure heard my kids talking about it. I think you know what type of person you are, but it does have some benefits in seeing what other people are, and how to understand them better.

It would be interesting to be a fly on the wall to see the interactions of people in the Federal Open Market Committee (FOMC) this week. What exactly are they talking about?

Fed Funds

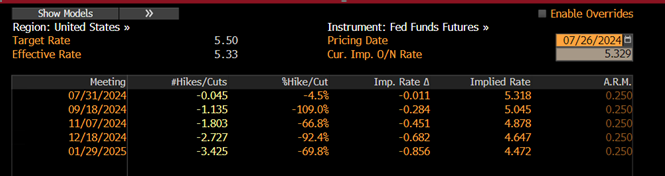

The primary tool that the FOMC uses is the overnight fed funds rate. This is the rate at which banks trade money between themselves and is considered the benchmark for riskless overnight trading. As you can see below the Fed Funds futures are predicting the Implied Rate to be 4.647% by the December 18 FOMC meeting. The current rate is 5.33%, so they expect 2.727 25 basis point (bp) rate cuts by then. Keep that in mind as we discuss the makeup of this independent body.

Source: Bloomberg

Who is the FOMC

This group, from the U.S. Federal Reserve System, is a very important part of the economic landscape. The makeup of the committee is as follows:

Seven Board of Governors of the Federal Reserve System (including Chair Jerome Powell)

President of the Federal Reserve Bank of New York

Four Reserve Bank Presidents (four of the remaining 11 rotate on an annual basis)

Their dual responsibility is to: one, ensure full employment (keep rates low to stimulate economic activity) and two, keep inflation under control (raise rates to levels that will make borrowing more difficult and therefore slow the economy).

Their means of executing this responsibility is by setting open market operations. The primary method of influencing interest rates and the economy is the overnight Fed Funds Target. This is the rate that money is transacted among banks on an overnight basis. Secondarily, they also execute purchases of longer-term U.S. Treasury debt (UST), and mortgage-backed securities (MBS) to influence longer-term rates.

As you can see, they have a huge amount of influence on the interest rate markets, and their actions are closely watched by all markets, including equities and foreign exchange.

Hawks and Doves

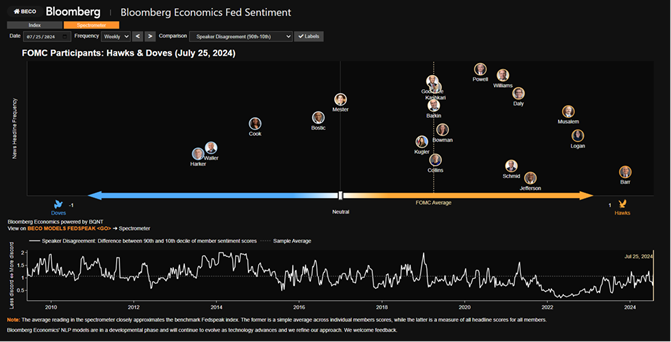

The members of the FOMC may or may not take personality tests, but the economic community has done that for them! Based on their bias toward reducing inflation (Hawks) or reducing unemployment (Doves), they have a known opinion. The chart below summarizes the current makeup of the committee.

Source: Bloomberg

As you can see, in 2024, the average member is over toward the Hawk side, with only five members at neutral or on the Dove side. Not all of these members have votes in 2024.

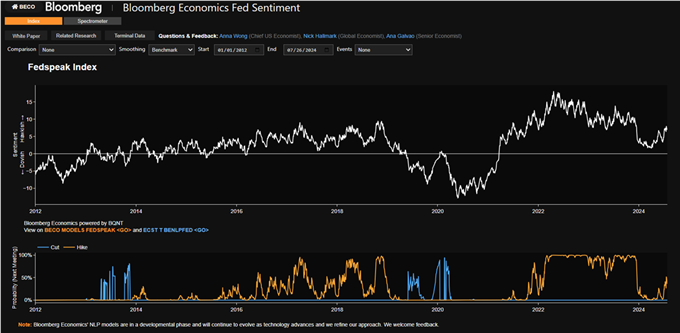

The Fedspeak index, shown below, indicates we have come back down close to neutral, but recently spiked back toward a hawkish mode. Recent speakers have been conveyed by the media as leaning more dovish, as the media really wants to sell the story of a near-term rate cut.

Source: Bloomberg

Bottom line

While one rate cut of 25bp would not have a material impact, this would show markets that the FOMC believes inflation has been vanquished and are willing to lower rates to stimulate the economy. This is really driving positive momentum in the equity market and could be overdone.

The current strength of the economy, demonstrated in a 2.8% Q2 GDP, is a reason to not cut rates. The economy does not appear to need stimulus. Perhaps the FOMC could be proactive in lowering rates, but they are usually late to the party.

Another complicating aspect is the upcoming Federal election. In the past, there has never been a change in direction in policy actions within 11 months of the election. If they were to cut rates before the election, that could be construed as benefiting the current administration as it would be stimulative to the economy. The FOMC likes to proclaim their political independence, so this could get dicey.

The meeting this week begins on the 30th, culminating in a press release and press conference with Chair Powell on the 31st. No rate cut or hike is expected at this meeting, but all eyes will be looking for clues as to timing of the first cut. Futures would tell you that will happen in September, but we still have two payroll releases and two CPI releases before that meeting. Much could change. Stay tuned.

Economic releases

Last week was Housing, GDP, Pesonal Income and Spending, as well as the PCE inflation metric. All came in a bit stronger than expected, without any big surprises.

This week’s calendar is employment and the FOMC. Period. Press conference on Wednesday at 1 p.m. CT will be more closely watched than the Olympics. See below for details.

Wrap-Up

We are all different people, from different backgrounds, families and other circumstances. Members of the FOMC are people too. Some of this is out of your control, but you have the ability to forge your own identity. Make the most of all you are!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 29-Jul | Dallas Fed Manuf Activity | Jul | (14.2) | (15.1) |

| 30-Jul | FHFA House Price Index MoM | May | 0.3% | 0.2% |

| 30-Jul | S&P CoreLogic 20-city YoY | May | 6.50% | 7.20% |

| 30-Jul | JOLTS Job Openings | Jun | 8,055,000 | 8,140,000 |

| 30-Jul | Conf Board Consumer Confidence | Jul | 99.5 | 100.4 |

| 30-Jul | Conf Board Present Situation | Jul | N/A | 141.5 |

| 30-Jul | Conf Board Expectations | Jul | N/A | 73.0 |

| 30-Jul | Dallas Fed Services Activity | Jul | N/A | (4.1) |

| 31-Jul | ADP Employment Change | Jul | 150,000 | 150,000 |

| 31-Jul | Employment Cost Index | Q2 | 1.0% | 1.2% |

| 31-Jul | MNI Chicago PMI | Jul | 45.0 | 47.4 |

| 31-Jul | Pending Home Sales MoM | Jun | 1.1% | -2.1% |

| 31-Jul | FOMC Rate Decision (Upper Bound) | 1p CT | 5.50% | 5.50% |

| 31-Jul | FOMC Rate Decision (Lower Bound) | 1p CT | 5.25% | 5.25% |

| 1-Aug | Challenger Job Cuts YoY | Jul | N/A | 19.8% |

| 1-Aug | Nonfarm Productivity | Q2 P | 1.8% | 0.2% |

| 1-Aug | Unit Labor Costs | Q2 P | 1.8% | 4.0% |

| 1-Aug | Initial Jobless Claims | 27-Jul | 236,000 | 235,000 |

| 1-Aug | Continuing Claims | 20-Jul | 1,855,000 | 1,851,000 |

| 1-Aug | Construction Spending MoM | Jun | 0.2% | -0.1% |

| 1-Aug | ISM Manufacturing Index | Jul | 48.8 | 48.5 |

| 1-Aug | ISM Manufacturing Prices Paid | Jul | N/A | 52.1 |

| 1-Aug | ISM Manufacturing Employment | Jul | N/A | 49.3 |

| 1-Aug | ISM Manufacturing New Orders | Jul | N/A | 49.3 |

| 1-Aug | Ward's Total Vehicle Sales | Jul | 16,200,000 | 15,290,000 |

| 2-Aug | Change in Nonfarm Payrolls | Jul | 175,000 | 206,000 |

| 2-Aug | Change in Private Payrolls | Jul | 150,000 | 136,000 |

| 2-Aug | Unemployment Rate | Jul | 4.1% | 4.1% |

| 2-Aug | Avg Hourly Earnings MoM | Jul | 0.3% | 0.3% |

| 2-Aug | Avg Hourly Earnings YoY | Jul | 3.7% | 3.9% |

| 2-Aug | Labor Force Participation Rate | Jul | 62.6% | 62.6% |

| 2-Aug | Underemployment Rate | Jul | N/A | 7.4% |

| 2-Aug | Factory Orders | Jun | -3.1% | -0.5% |

| 2-Aug | Factory Orders ex Transportation | Jun | N/A | -0.7% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI