Is the Fed effective? — Week of July 31, 2023

Essential Economics

— Mark Frears

Are We There Yet?

Are you a goal setter, or a go-with-the-flow person? Even if you do set goals, are they measurable? Trying to lose weight or save money for a trip will most likely not be achieved without specifics and accountability. My latest goal is to try to stay cool in the Texas heat; even with a measurable value, I don’t think that is going to happen.

The Fed has two primary goals, full employment and price stability; what did its latest 0.25% move do for it?

Rates

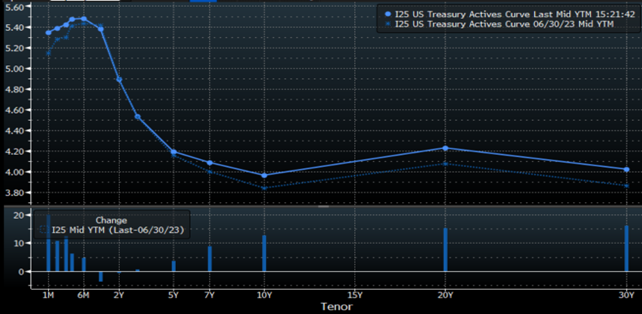

The Fed’s rate moves are for overnight transactions, the Fed Funds (FF) target. Moving this short-term rate up 25 basis points (bp) does not move mortgage rates up 25bp. Keep that in mind as we discuss the actual impact of this latest move. As you can see below, the U.S. Treasury (UST) yield curve has the highest rates in the very short end and lower rates further out. This would indicate the market does not think inflation is out of control and a long-term issue.

Source: Bloomberg

Consumer

The purpose of the Fed’s latest set of moves is to slow the economy, to bring prices back to the 2% level. Will this have an impact on the consumer? From a depositor’s view, this is a good thing, because they can earn more on their short-term investments. Is 25bp enough to cause them to spend less and save more? Most likely not. On the loan side of their balance sheet, only 11% of household debt is based on a floating rate, per a Wall Street Journal article last week. Most people smartly locked in a fixed rate on their mortgage or car loan and are not impacted by increases in the FF target.

Given the stronger than expected Gross Domestic Product (GDP) for the second quarter, it does not appear the Fed is slowing consumer demand or spending with its rate hikes.

Business

How about the impact of rate hikes on the commercial side of the economy? Most businesses borrow funds at a floating interest rate. This used to be based on the London Interbank Offering Rate (LIBOR), but with its June 30 demise, the Secured Overnight Financing Rate (SOFR) has taken center stage. As you can see below, the one-month term rate has gone from very close to zero to 5.32% over the past year and a half.

Source: Bloomberg

This is a direct cost hit to businesses. On a one-million-dollar loan, this is an increase of over $50,000 in interest payments each year. If we look at this past week’s 25bp move, that is only an increase of $2,500 annually on this same loan. Will that one move cause a business to change anything? Probably not.

On the sales side of the equation, given the consumer’s continued demand, they have been able to raise prices enough to offset their higher costs. While earnings have decreased, they have not dipped as much as expected.

Fiscal vs monetary

The Fed is in a tightening mode, making money harder to obtain, to slow the economy. It has been doing this through making borrowing more expensive and through selling securities on its balance sheet, or quantitative tightening (QT).

Given the tools the Fed has, it is doing what it can through monetary means. Unfortunately, it is battling its own government, which is providing stimulus though fiscal spending. Increases over 2022 levels total over $400 billion. This encompasses social security, Medicare, Medicaid, interest on public debt and outlays from the Federal Deposit Insurance Company (FDIC). This is not helping the Fed reach its goal of price stability.

Future

After the Fed’s most recent move, there has been much talk about this being its last rate hike. FF futures market shows a 19% chance of a hike in September and 37% chance of one by November.

I don’t want to give the impression that the Fed is not having success at moving toward their goal. As you can see below, the Core Personal Consumption Expenditure (PCE) metric has been improving.

Source: Bloomberg

We have come down from a peak of 5.42% in February 2022 and are currently at 4.10%. The Fed’s Summary of Economic Projections (SEP) forecast this measurement will be at 3.9% at year-end 2023, 2.6% at year-end 2024 and 2.2% at year-end 2025. They have said they are still “data dependent,” so we will need to see continued improvement for them to rest their case.

If we look further in the future, we may or may not get that most anticipated recession, which could help the Fed move toward lower prices. The anticipatory nature of markets has it wondering when the first rate cut could happen. For that to be a possibility, the economy would have to be headed toward slower growth. One very important thing to keep in mind is that next year is a presidential election year (maybe you were trying to forget) and the Fed will not make rate cuts as we approach the election as this would be stimulative to the economy. It wants to protect its political independence.

Economic releases

Last week we saw multiple releases confirming the economy is chugging right along, in addition to the Fed announcement.

This week, we have the all-important labor numbers. Job openings on Tuesday, ADP on Wednesday, and Non-farm Payroll on Friday. See below for details.

Wrap-Up

For now, the economy is doing just fine, and inflation is declining. Maybe the Fed will achieve its goal without pushing us into a recession!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 31-Jul | Dallas Fed Manufacturing Activity | Jul | (22.5) | (23.2) |

| 31-Jul | Senior Loan Officer Survey on Bank Lending Practices @ 1p CT | |||

| 1-Aug | Construction Spending MoM | Jun | 0.6% | 0.9% |

| 1-Aug | JOLTS Job Openings | Jun | 9,600,000 | 9,824,000 |

| 1-Aug | ISM Manufacturing | Jul | 46.9 | 46.0 |

| 1-Aug | ISM Prices Paid | Jul | 43.0 | 41.8 |

| 1-Aug | ISM Employment | Jul | N/A | 48.1 |

| 1-Aug | ISM New Orders | Jul | N/A | 45.6 |

| 1-Aug | Dallas Fed Services Activity | Jul | N/A | (8.2) |

| 1-Aug | Wards Total US Vehicle Sales | Jul | 15,700,000 | 15,680,000 |

| 2-Aug | ADP Employment Change | Jul | 183,000 | 497,000 |

| 3-Aug | Challenger Job Cuts YoY | Jul | N/A | 25.2% |

| 3-Aug | Nonfarm Productivity | Q2 | 2.2% | -2.1% |

| 3-Aug | Unit Labor Costs | Q2 | 2.5% | 4.2% |

| 3-Aug | Initial Jobless Claims | 29-Jul | 227,000 | 221,000 |

| 3-Aug | Continuing Claims | 22-Jul | 1,723,000 | 1,690,000 |

| 3-Aug | Factory Orders | Jun | 2.1% | 0.3% |

| 3-Aug | ISM Services Index | Jul | 53.0 | 53.9 |

| 3-Aug | ISM Services Prices Paid | Jul | N/A | 54.1 |

| 3-Aug | ISM Services Employment | Jul | N/A | 53.1 |

| 3-Aug | ISM Services New Orders | Jul | N/A | 55.5 |

| 4-Aug | Change in Nonfarm Payrolls | Jul | 200,000 | 209,000 |

| 4-Aug | Change in Private Payrolls | Jul | 175,000 | 149,000 |

| 4-Aug | Unemployment Rate | Jul | 3.6% | 3.6% |

| 4-Aug | Avg Hourly Earnings MoM | Jul | 0.3% | 0.4% |

| 4-Aug | Avg Hourly Earnings YoY | Jul | 4.2% | 4.4% |

| 4-Aug | Labor Force Participation Rate | Jul | 62.6% | 62.6% |

| 4-Aug | Underemployment Rate | Jul | N/A | 6.9% |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.