Needs vs. Wants — Week of July 8, 2024

Essential Economics

— Mark Frears

This or that?

We are made up of our choices, and we make hundreds of them every day. You may not even be aware you are making the choice as you are. If they become habits, then you don’t have to think. Is that a good or bad thing?! It depends on whether you are happy with the consequences of that choice, and if you want to change.

One of the ways to look at broader consumer choice is through their spending habits.

Outlays

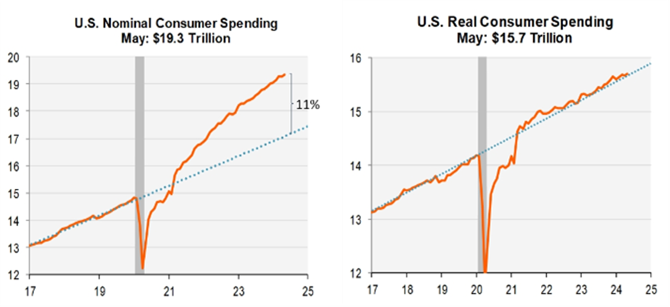

One thing that has not been in question over the past few years is that the consumer continues to spend. Some theories say it is pent-up demand following the pandemic, but this has continued on well past that. The chart below shows nominal, dollars spent and real, adjusted for inflation and spending.

Source: Piper Sandler Research

While you can see that some of the headline spending numbers are because things cost more, there is still a strong, positive trend in U.S. consumer spending.

Choices

If we have money in our bank account, or availability on our credit card, we are going shopping. What are we going to buy? One broad distinction we can make is whether it is a want, or a need. Some people have trouble discerning this difference. The chart below distinguishes the nuances of staples (needs) versus discretionary (wants).

Source: Marketbeat

The reason for tracking spending in these categories is because it can be a signal to shifts in consumer behavior. If you and I are confident in our jobs and the prospects of earning a good wage, we will be comfortable spending some of our income on discretionary items. If we are worried about the future, or there is too much uncertainty, we will pull back spending in this category and staying primarily in staples purchases.

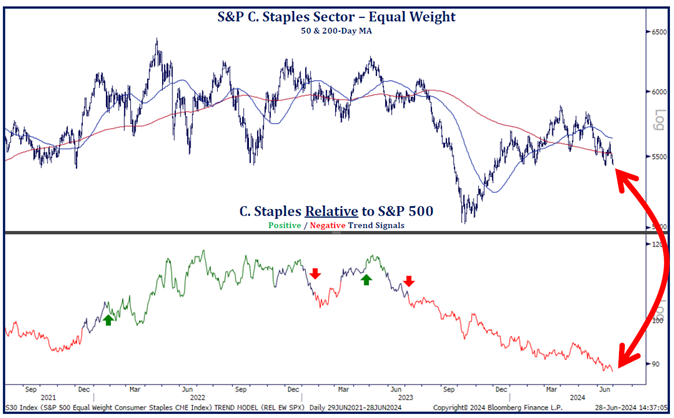

The chart below tracks companies in the S&P 500 associated with discretionary products versus staples products.

Source: Strategas Research

This confirms the consumer is not feeling much stress, as their discretionary spending, relative to staples, continues unabated. Technicians will be watching the current level to see if it breaks above, or if it bounces off once again.

If you break out staples by themselves (see below) they are in a downward trend, as consumers spend as if they are optimistic.

Source: Strategas Research

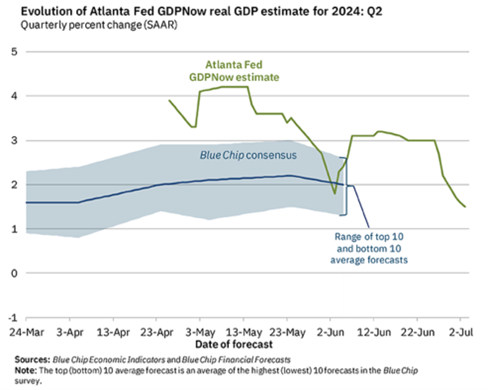

There continue to be many uncertainties in the economy, the presidential election, the UK and France elections, persistent inflation and high home prices, and a waffling Fed highlights the issues. While consumer spending choices do not reflect a slowing economy, we are starting to see some cracks. The Atlanta Fed GDPNow Q2 estimate, as well as the Blue Chip forecasts, as seen below, reflect that.

Economic releases

Last week was all about the labor market. Still hanging in there, as hiring continues and there are jobs available. That being said, we need to wait on the revisions.

This week’s calendar is titled “inflation.” CPI and PPI both out, as well as consumer credit, sentiment and small business optimism. See below for details.

Wrap-Up

Intentional or unintentional choices define us. As a consumer and an individual, you have an impact. Think carefully as you go through your day: What do your choices say about you?

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 8-Jul | NY Fed 1-yr inflation expectations | Jun | N/A | 3.17% |

| 8-Jul | Consumer Credit | May | $9.000B | $6.403B |

| 9-Jul | NFIB Small Business Optimism | Jun | 90.2 | 90.5 |

| 10-Jul | Wholesale Trade Sales MoM | May | N/A | 0.1% |

| 10-Jul | Wholesale Inventories MoM | May F | 0.6% | 0.6% |

| 11-Jul | Consumer Price Index MoM | Jun | 0.1% | 0.0% |

| 11-Jul | CPI ex Food & Energy MoM | Jun | 0.2% | 0.2% |

| 11-Jul | Consumer Price Index YoY | Jun | 3.1% | 3.3% |

| 11-Jul | CPI ex Food & Energy YoY | Jun | 3.4% | 3.4% |

| 11-Jul | Real Avg Hourly Earnings YoY | Jun | N/A | 0.8% |

| 11-Jul | Real Avg Weekly Earnings YoY | Jun | N/A | 0.5% |

| 11-Jul | Initial Jobless Claims | 6-Jul | 239,000 | 238,000 |

| 11-Jul | Continuing Claims | 29-Jun | 1,855,000 | 1,858,000 |

| 11-Jul | Monthly Budget Statement | Jun | N/A | -$347.1B |

| 12-Jul | Producer Price Index MoM | Jun | 0.1% | -0.2% |

| 12-Jul | PPI ex Food & Energy MoM | Jun | 0.2% | 0.0% |

| 12-Jul | Producer Price Index YoY | Jun | 2.3% | 2.2% |

| 12-Jul | PPI ex Food & Energy YoY | Jun | 2.5% | 2.3% |

| 12-Jul | UM Consumer Sentiment | Jul P | 68.2 | 68.2 |

| 12-Jul | UM Current Conditions | Jul P | N/A | 65.9 |

| 12-Jul | UM Expectations | Jul P | N/A | 69.6 |

| 12-Jul | UM 1-yr inflation | Jul P | 3.0% | 3.0% |

| 12-Jul | UM 5-10-yr inflation | Jul P | N/A | 3.0% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI