How much will you bid? — Week of June 10, 2024

Essential Economics

— Mark Frears

Auctions

Do you like to attend auctions? Perhaps it depends on what you are bidding on and/or what cause the event is benefitting. It can be a win/win if you are going after something you really want, and the proceeds will go toward a good cause. One of the funniest auctions I can recall is from the movie Groundhog Day when Bill Murray is the “prize” being bid for!

We have very high-profile auctions each week, as the U.S. government tries to stay funded.

U.S. Treasury debt

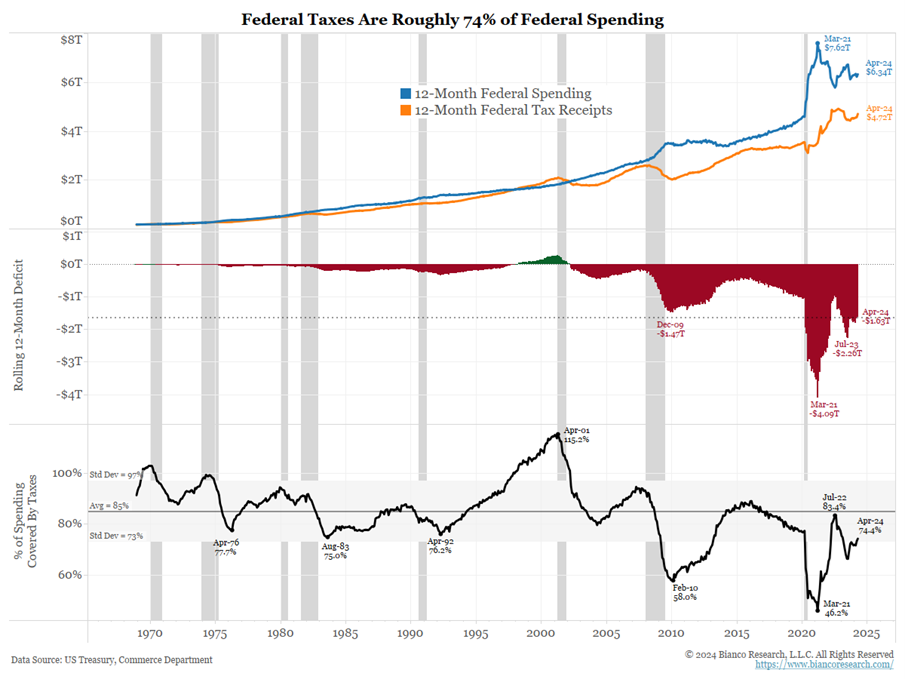

Each week, there are auctions run by the U.S. Treasury, offering U.S. debt. Traditional income to fund the government comes from taxes paid by individuals, companies and other forms of revenue. If this is not enough to support all the programs/expenses, they must issue debt. Just like if your expenses are more than your income, you must get a loan or use your credit card. As you can see below, currently non-debt only supports 74% of fiscal spending.

Source: Bianco Research

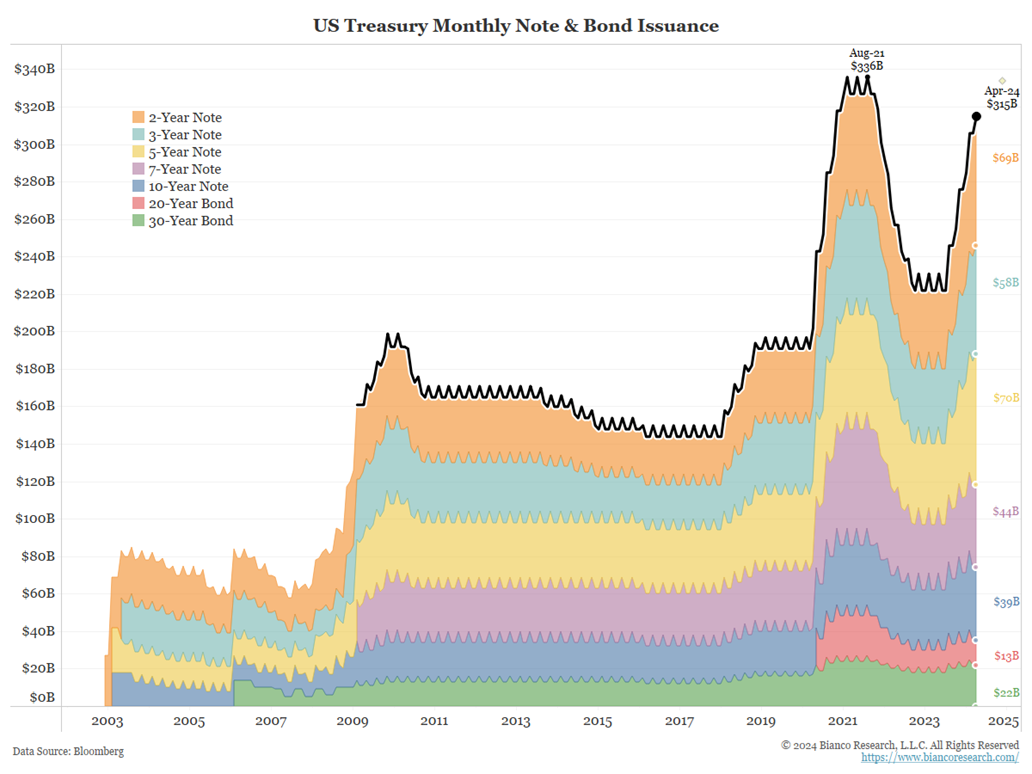

The other interesting thing to watch in these auctions is how much is “new” money versus replacing debt that is maturing. If the new is continuing to grow, that would tell you that our expenses continue to outpace our income and we need to borrow more.

On a recent announcement from the Treasury, they did not elevate the amount of long-term issuance, and that was seen as a big deal, but the total amount of debt is only increasing, as you can see below.

Source: Bloomberg

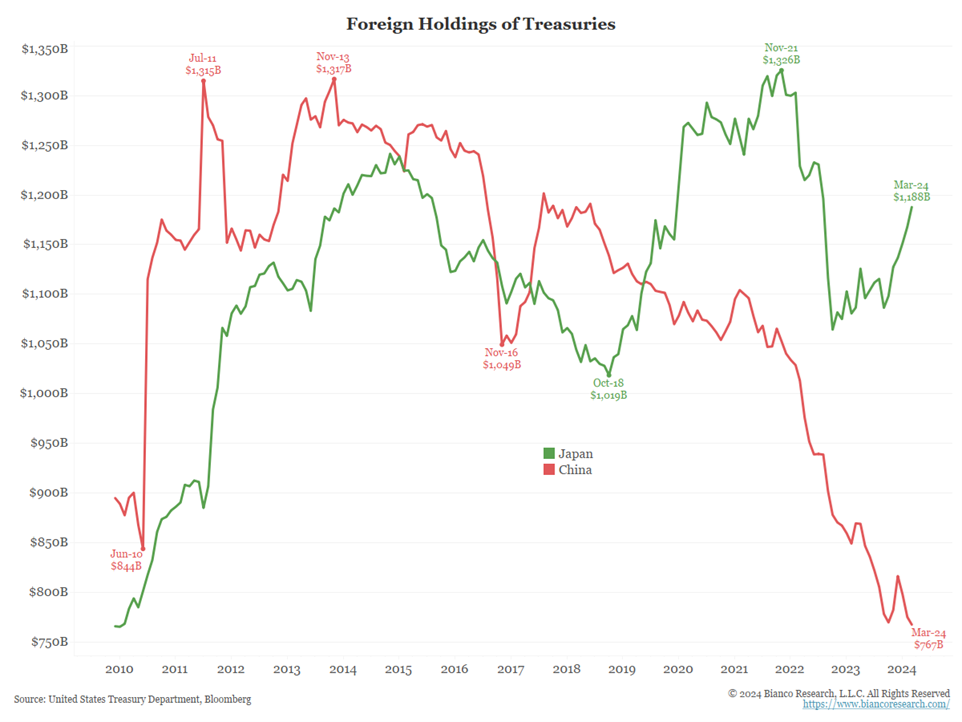

Even if you are considered the lowest-risk issuer on the planet, the amount of issuance can still test your buyers. One of the reasons the long-term debt issuance was not raised is that there is less demand for this, as opposed to short-term debt, higher-yielding debt. As you can see below, we are dependent on foreign buyers of U.S. debt.

Source: Bianco Research

The concern here is that China is less of a buyer now, and if Japan is successful in raising their rates, they will not be as interested.

On the short end of the U.S. Treasury (UST) curve, there is still lots of demand, due to attractive rates. As the Fed has not lowered the target Fed Funds rate, the short end of the curve has higher rates, with the curve still inverted. As you see below, the UST curve tells you we are still expecting a recession at some point, and they are anticipating the FOMC to lower short-term rates.

Source: Bloomberg

Buyers of short-term UST debt include money funds, commercial paper issuers and individuals. This is a nice return for sitting on cash.

Cost

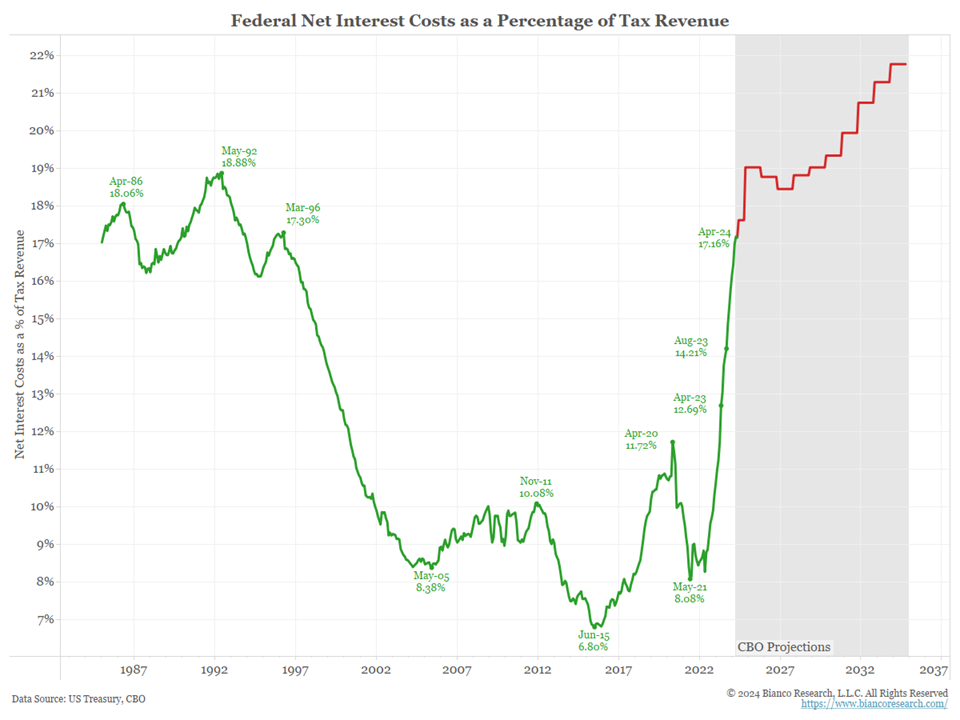

The other side of that coin is this is an interest expense for D.C. There doesn’t seem to be that much concern, and there won’t be as long as there are buyers. Interesting that we are watching credit card and commercial real estate debt like a hawk, but UST debt doesn’t move the needle. The chart below shows the rising cost as a percentage of revenue.

Source: Bianco Research

One thing to watch on the auctions is if there is a higher rate of issueance versus the same maturity existing debt. This would indicate there was not as much demand for the debt and the U.S. had to pay a more attractive rate to lure investors. This is commonly called a “tail,” and the longer the tail, the less demand for the issue.

Current interest expense is higher than defense spending in the budget. At some point, buyers for this high level of debt will no longer be easy to find, and then rates will have to go even higher. Too much debt is the sign of poor fiscal stewardship and cannot last indefinitely.

Economic releases

Last week was packed with ISM releases and employment data. Overall, they showed the economy was doing fine, and the Fed is still on hold.

This week’s calendar will be focused on inflation, with CPI and PPI out. In addition, the FOMC meeting ends on June 12, and we will get updated SEP. Watch for any changes in the Dot Plot and other forecasts. See below for details.

Wrap-Up

The thing about auctions is that the value can vary widely among different bidders. So, if you are faced with bidding for an item you really want, make sure you know the true value and who your competition is!

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 10-Jun | NY Fed 1-yr inflation expectations | May | N/A | 3.26% |

| 11-Jun | NFIB Small Business Optimism | May | 89.8 | 89.7 |

| 12-Jun | Consumer Price Index MoM | May | 0.1% | 0.3% |

| 12-Jun | CPI ex Food & Energy MoM | May | 0.3% | 0.3% |

| 12-Jun | Consumer Price Index YoY | May | 3.4% | 3.4% |

| 12-Jun | CPI ex Food & Energy YoY | May | 3.5% | 3.6% |

| 12-Jun | Real Avg Hourly Earnings YoY | May | N/A | 0.5% |

| 12-Jun | Real Avg Weekly Earnings YoY | May | N/A | 0.5% |

| 12-Jun | FOMC Rate Decision (Upper Bound) | 1p CT | 5.50% | 5.50% |

| 12-Jun | FOMC Rate Decision (Lower Bound) | 1p CT | 5.25% | 5.25% |

| 12-Jun | Monthly Budget Statement | May | -$275.0B | $209.5B |

| 13-Jun | Initial Jobless Claims | 8-Jun | 225,000 | 229,000 |

| 13-Jun | Continuing Claims | 1-Jun | 1,800,000 | 1,792,000 |

| 13-Jun | Producer Price Index MoM | May | 0.1% | 0.5% |

| 13-Jun | PPI ex Food & Energy MoM | May | 0.3% | 0.5% |

| 13-Jun | Producer Price Index YoY | May | 2.5% | 2.2% |

| 13-Jun | PPI ex Food & Energy YoY | May | 2.5% | 2.4% |

| 14-Jun | Import Price Index MoM | May | 0.0% | 0.9% |

| 14-Jun | Export Price Index MoM | May | 0.1% | 0.5% |

| 14-Jun | UM Consumer Sentiment | Jun P | 72.5 | 69.1 |

| 14-Jun | UM Current Conditions | Jun P | N/A | 69.6 |

| 14-Jun | UM Expectations | Jun P | N/A | 68.8 |

| 14-Jun | UM 1-yr inflation | Jun P | 3.2% | 3.3% |

| 14-Jun | UM 5-10-yr inflation | Jun P | 3.0% | 3.0% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI