FOMC — Week of June 12, 2023

Essential Economics

— Mark Frears

Characteristics

What are you known as? Introvert, extrovert, passive, combative, book-smart, street-smart or a combination of many?! There are lots of tests out there to evaluate; used to be Myers-Briggs and DISC, now the Enneagram is very popular. Don’t ask me my number, never took it. I think you know what type of person you are, but it does have some benefits in seeing what other people are, and how to understand them better.

This week we have the always important Federal Open Market Committee (FOMC) meeting. Markets will be watching carefully as to their current actions as well as future direction. Who are these people?

FOMC

This group, from the U.S. Federal Reserve System, has a large influence on the economic landscape. The makeup of the committee is as follows:

Seven Board of Governors of the Federal Reserve System (including Chair Jerome Powell)

President of the Federal Reserve Bank of New York

Four Reserve Bank Presidents (four of the remaining 11 bank presidents rotate on an annual basis)

Their dual responsibility is to: One, ensure full employment (keep rates low to stimulate economic activity) and two, keep inflation under control (raise rates to levels that will make borrowing more difficult and therefore slow the economy).

Their means of executing this responsibility is by setting open market operations. The primary method of influencing interest rates and the economy is the overnight Fed Funds (FF) Target. This is the rate that money is transacted among banks on an overnight basis. Secondarily, they also execute purchases or sales of longer-term U.S. Treasury debt (UST), and mortgage-backed securities (MBS) to influence longer term rates.

They have a huge amount of influence on the interest rate markets, and their actions are closely watched by all markets, including equities and foreign exchange.

Hawks–Doves

The members of the FOMC may or may not take personality tests, but the economic community has done that for them! Based on their bias toward reducing inflation (Hawks) or reducing unemployment (Doves), they have a known opinion. The chart below summarizes the current makeup of the committee, as well as looking forward to 2024–25.

Source: InTouch Capital Markets

As you can see, in 2023, the Hawks have a slight majority, but the current higher inflation environment has kept them focused on that goal. At all meetings since June 15, 2022, we have seen unanimous decisions among the voters as to the rate change. As we approach the potential end of this tightening cycle, we will start to see some more dissension, as individual views will become more prevalent.

Not only do they vote on rate moves and policy, but they also have an extensive speaking circuit. This allows them to voice their opinions between meetings and is closely watched for clues to the next rate move

What’s next

The committee meets this week on June 13–14, and will make their announcement about any rate move at 1:00 p.m. Central Time on Wednesday. This will be followed by a closely watched press conference with Chair Powell at 1:30 p.m., as the media tries to wrestle any further clues about Fed policy from him.

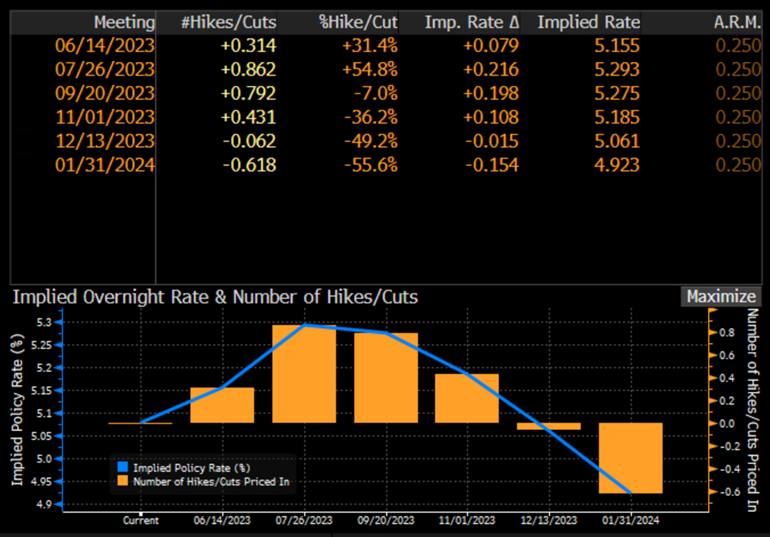

As you can see below, based on FF futures, there is a 31.4% chance they will raise rates at this meeting. The committee historically moves as futures markets predict this close to the event, to not disrupt markets too much. Therefore, we do not expect a move at this meeting, but the tone of the press release and press conference will be most interesting.

Source: Bloomberg

If we look ahead to the July meeting, there is a 54.8% chance they will hike rates, and futures predict the first possibility of a rate cut in December of this year. As markets do not like uncertainty, they will be looking for indications of when the rate cuts will start, especially as that would be stimulative to the economy.

In addition, at this meeting we will have the release of the DOT plots, indicating the members’ individual views on future rates, and the Summary of Economic Projections, detailing expected future levels for GDP, inflation target and unemployment rate.

Economic releases

The past week was light on new information for the economy, although Jobless Claims ticked up significantly.

This week, on top of the FOMC meeting, we have a heavy slate of releases. Most watched will be the Consumer Price Index (CPI), and we also have inflation at the producer level, as well as retail sales. See below for details.

Wrap-Up

The Hawks and Doves will soon start to show their true colors. What does your personality say about you?

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 13-Jun |

NFIB Small Business Optimism |

May | 88.4 | 89.0 |

| 13-Jun | Consumer Price Index MoM | May | 0.2% | 0.4% |

| 13-Jun | CPI ex Food & Energy MoM | May | 0.4% | 0.4% |

| 13-Jun | Consumer Price Index YoY | May | 4.1% | 4.9% |

| 13-Jun | CPI ex Food & Energy YoY | May | 5.2% | 5.5% |

| 13-Jun | Real Avg Hourly Earnings YoY | May | N/A | -1.1% |

| 13-Jun | Real Avg Weekly Earnings YoY | May | N/A | -0.5% |

| 14-Jun | Producer Price Index MoM | May | -0.1% | 0.2% |

| 14-Jun | PPI ex Food & Energy MoM | May | 0.2% | 0.2% |

| 14-Jun | Producer Price Index YoY | May | 1.5% | 2.3% |

| 14-Jun | PPI ex Food & Energy YoY | May | 2.9% | 3.2% |

| 15-Jun | FOMC Rate Decision (Upper Bound) | 1p | 5.25% | 5.25% |

| 15-Jun | FOMC Rate Decision (Lower Bound) | 1p | 5.00% | 5.00% |

| 15-Jun | Retail Sales MoM | May | -0.1% | 0.4% |

| 15-Jun | Retail Sales ex Autos MoM | May | 0.1% | 0.4% |

| 15-Jun | Import Price Index MoM | May | -0.5% | 0.4% |

| 15-Jun | Export Price Index MoM | May | -0.3% | 0.2% |

| 15-Jun | Initial Jobless Claims | 10-Jun | 250,000 | 261,000 |

| 15-Jun | Continuing Claims | 3-Jun | 1,787,000 | 1,757,000 |

| 15-Jun | Empire Manufacturing | Jun | (15.1) | (31.8) |

| 15-Jun | Philadelphia Fed Business Outlook | Jun | (13.0) | (10.4) |

| 15-Jun | Industrial Production MoM | May | 0.1% | 0.5% |

| 15-Jun | Capacity Utilization | May | 79.7% | 79.7% |

| 15-Jun | Business Inventories | Apr | 0.2% | -0.1% |

| 16-Jun | NY Fed Services Business Activity | Jun | N/A | (16.8) |

| 16-Jun | UM (Go MSU) Consumer Sentiment | Jun | 60.1 | 59.2 |

| 16-Jun | UM (Go MSU) Current Conditions | Jun | N/A | 64.9 |

| 16-Jun | UM (Go MSU) Expectations | Jun | N/A | 55.4 |

| 16-Jun | UM (Go MSU) 1-yr inflation | Jun | 4.1 | 4.2% |

| 16-Jun | UM (Go MSU) 5- to 10-yr inflation | Jun | 3.1% | 3.1% |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.