How hard do you work? — Week of June 17, 2024

WFH

The concept of working remotely, or a hybrid schedule, was uncommon before the pandemic. It remains to be seen if this is a long-term change, or a knee jerk reaction. Disconnection from your coworkers will not work if you are coordinating toward a common goal. The debate continues as to whether you are more productive working in your sweats, or in the office in business attire.

The labor market continues to be a major focus of the FOMC and the markets. Productivity of workers makes a huge difference in wages, and consequently in the inflation outlook for our economy.

U.S. productivity

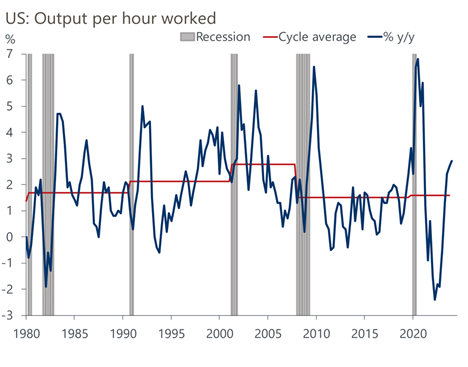

The standard method of calculating workers’ efficiency is output per hour worked. The chart below shows that first quarter 2024 is continuing the upward trend of the past couple of years. The pace of improvement since the pandemic is not slowing down.

Source: Oxford Economics/Haver Analytics

The labor market continues to show strength, with 272,000 jobs added in May. The Federal Open Market Committee (FOMC) is watching this very carefully, as high labor demand will potentially lead to higher wages. This is one of the things that is forcing them to leave rates higher for longer.

They are watching productivity very closely as well. Productivity growth means that wages can run higher without being inflationary. The productivity impact will hold down unit labor costs.

Global picture

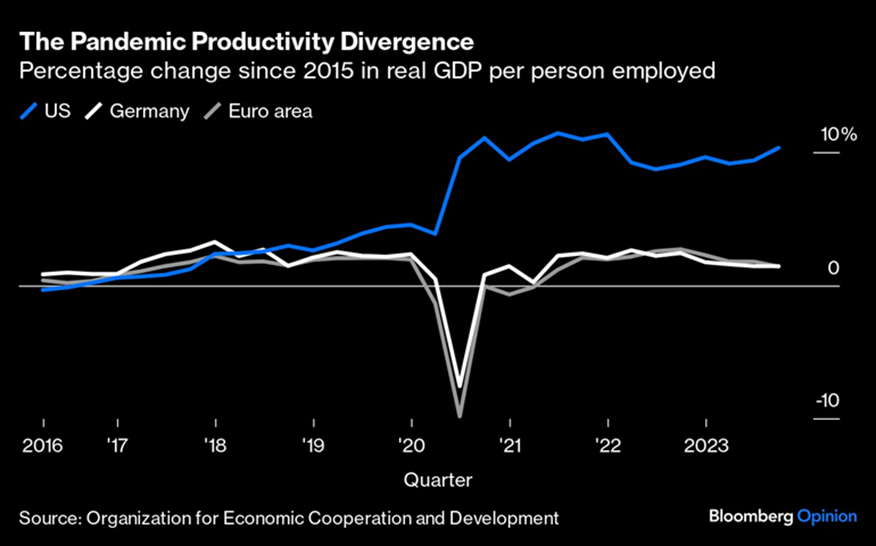

Productivity is a focus around the world, and, of course, you must compare countries to see who is better! This is a different calculation than we saw above; globally, we are looking at change in GDP per person employed. As you can see below, post-pandemic, the U.S. has significantly outperformed Germany and the Euro area.

One explanation for this phenomenon is that U.S. GDP has been outpacing other countries over this time period. The underlying strength of the economy continues to surprise economists, and this is one of the factors keeping the FOMC on hold longer. In general, they would be lowering rates to stimulate the economy to grow faster, but they don’t need to!

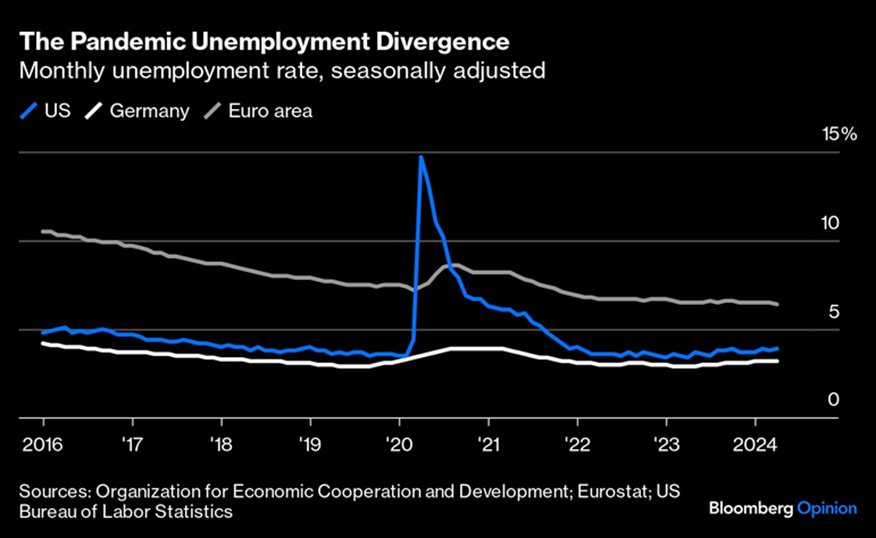

Another twist on the global picture is how job losses were handled during the pandemic. While the U.S. did provide fiscal stimulus to employers, there were still significant job losses. As you can see below, Germany and the Euro area provided much more assistance and the jobs were retained.

While this may have helped workers during the pandemic, this could be one of the factors explaining lower productivity coming out of the crisis. Either they were not as productive, or the GDP did not measure up to the U.S.

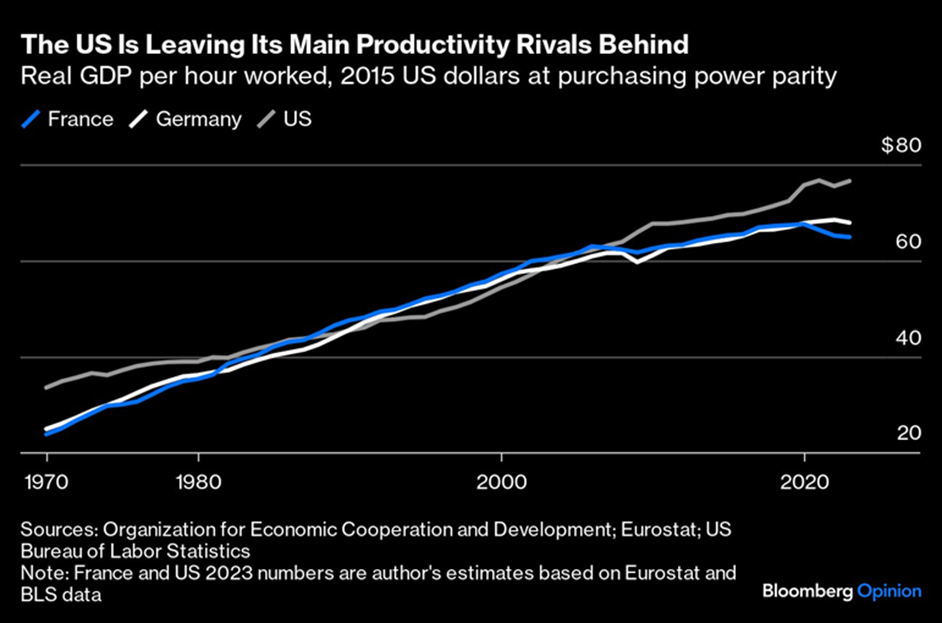

If we dig deeper and look at productivity from the more granular approach of hours worked, will we see a difference? The chart below shows that the U.S. is still significantly outperforming France and Germany.

The U.S. is still the place to be for a strong economy with plenty of opportunities.

Economic releases

Last week had inflation news and the FOMC announcement. While the inflation metrics seem to be improving, the FOMC sent the message that they are not in a hurry to lower the Fed Funds target rate.

This week’s calendar will give us retail sales and the start of housing numbers. In addition, the Fed talking heads will be back on the circuit. See below for details.

Wrap-Up

We all go about being productive in different ways and at different times of the day. What motivates you makes all the difference in the world!

| Upcoming Economic Releases | Period | Expected | PREVIOUS | |

|---|---|---|---|---|

17-Jun | Empire Manufacturing | Jun | (10.0) | (15.6) |

| ||||

18-Jun | NY Fed Services Business Activity | Jun | N/A | 3.0 |

18-Jun | Retail Sales MoM | May | 0.3% | 0.0% |

18-Jun | Retail Sales ex Autos MoM | May | 0.2% | 0.2% |

18-Jun | Industrial Production MoM | May | 0.3% | 0.0% |

18-Jun | Capacity Utilization | May | 78.6% | 78.4% |

18-Jun | Business Inventories | Apr | 0.3% | -0.1% |

| ||||

19-Jun | NAHB Housing Market Index | Jun | 45 | 45 |

| ||||

20-Jun | Initial Jobless Claims | 15-Jun | 235,000 | 242,000 |

20-Jun | Continuing Claims | 8-Jun | 1,802,000 | 1,820,000 |

20-Jun | Building Permits | May | 1,450,000 | 1,440,000 |

20-Jun | Building Permits MoM | May | 0.7% | -3.0% |

20-Jun | Housing Starts | May | 1,375,000 | 1,360,000 |

20-Jun | Housing Starts MoM | May | 1.1% | 5.7% |

20-Jun | Philadelphia Fed Business Outlook | Jun | 4.8 | 4.5 |

| ||||

21-Jun | S&P Global US Manufacturing PMI | Jun P | 51.0 | 51.3 |

21-Jun | S&P Global US Services PMI | Jun P | 53.4 | 54.8 |

21-Jun | S&P Global US Composite PMI | Jun P | N/A | 54.5 |

21-Jun | Leading Index | May | -0.4% | -0.6% |

21-Jun | Existing Home Sales | May | 4,090,000 | 4,140,000 |

21-Jun | Existing Home Sales MoM | May | -1.2% | -1.9% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Private Banking is provided by Texas Capital Bank (the “Bank”). Advisory services are offered through Texas Capital Bank Wealth Management Services, Inc. d/b/a Texas Capital Bank Private Wealth Advisors (“PWA”), a wholly owned subsidiary of the Bank and an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. Brokerage services are offered through Kingswood Capital Partners, LLC (“Kingswood”), Member FINRA/SIPC. Texas Capital Bank Private Wealth Advisors and Texas Capital Bank are not registered broker/dealers and are independent of Kingswood. Investments and insurance products are not insured by Bank insurance, the FDIC or any other government agency; are not deposits or obligations of the Bank; are not guaranteed by the Bank; and are subject to risks, including the possible loss of principal. Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2024 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI