Not a sustainable trend — Week of June 24, 2024

Water

I learned to swim at a very early age. The swim team was a possibility in high school, but I stuck with teaching swimming. The trend continued in college as I majored in a field related to the water and worked as a lifeguard to partially fund my experience. Our boys were both on the swim team in high school and one in college. Great experiences that continue to this day.

In the finances of the United States, we are watching a trend that is not favorable.

Basics

When I budget counsel people, they need to understand one fundamental: Spend less than you make. This will help get you through many trying circumstances and come out fine on the other side. The U.S. administration and congress do not understand this basic truth.

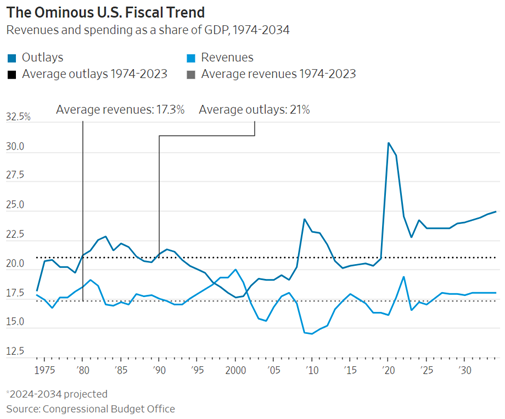

As you can see below, the trend is not favorable.

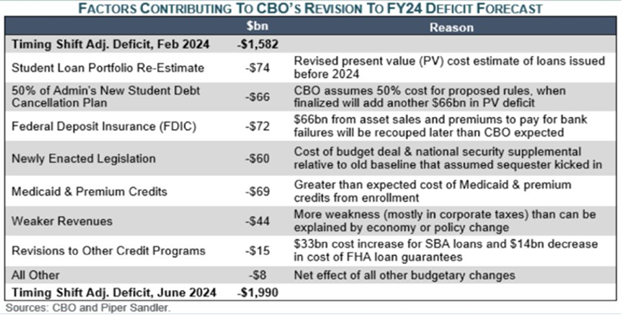

The Congressional Budget Office revised their projections last week, and as you can see, revenues are expected to stay flat at historical averages, while outlays will continue to rise, well above average. These revisions also included an increase of $400 billion (with a B) for this year’s deficit! My savings account would not cover that. The factors contributing to this year’s revision are outlined below.

Headlining the list are Student Loan repayments that all taxpayers will be on the hook for. Money fact: When you forgive a debt, the money still has to come from somewhere.

Debt issuance

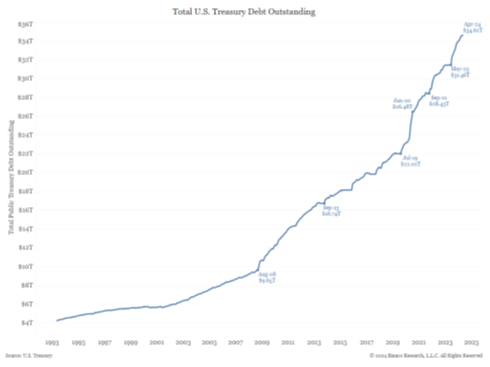

Back to Budgeting 101, when you don’t have enough revenue to cover expenses, you have to borrow. The chart below shows U.S Treasury debt outstanding. Can this continue?

Source: Bianco Research

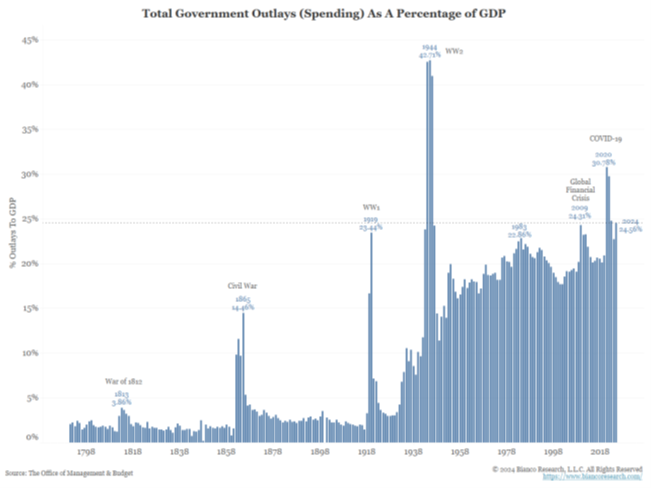

Another way to look at this is if your budget is increasing, and you can show borrowing as a lower percentage of the budget, there is a way to get out of this hole, potentially. As you see below, spending as a percentage of GDP is at the highest levels, outside of the Great Depression and the pandemic. In a strong economy, why is there still growing debt?

Source: Bianco Research

Who will buy it?

If you and I take on more and more debt, cracks will start appearing. First, we may not be able to get as much debt, or from multiple sources, as lenders will look at their exposure to one counterparty, even if it is the “safest debt on the planet.” Next, you will have to pay a higher rate to the lender, commensurate with the additional risk they are taking on.

So far, this is not happening to the U.S., but keep in mind that the economic world is not a static place, and another economy could become stronger. This will take some time, but the more debt you issue, the harder it will be to reverse the trend.

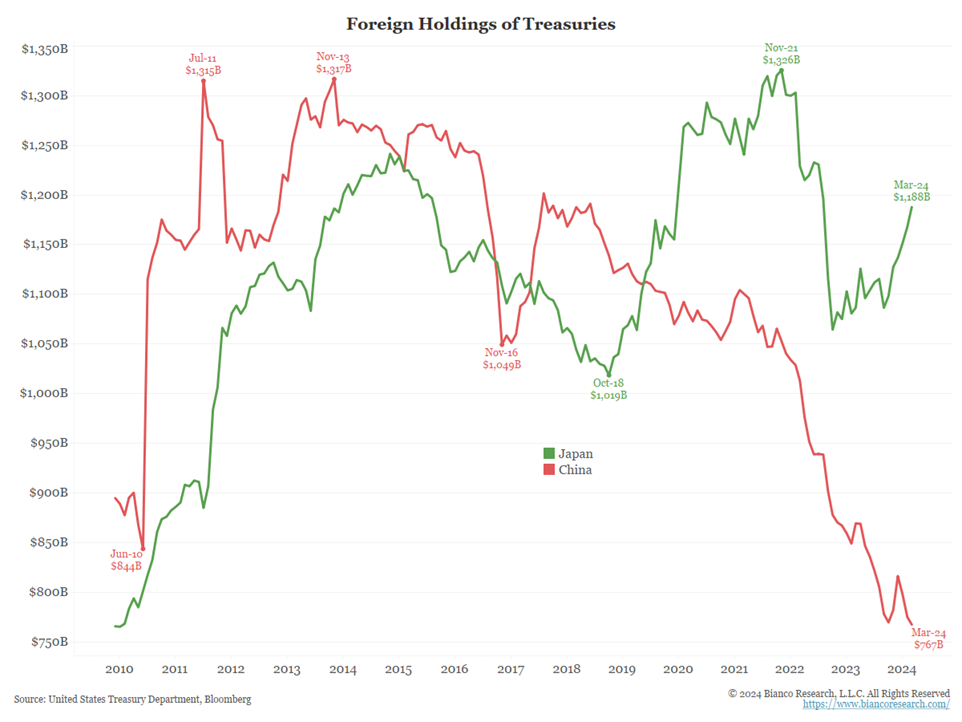

One buyer of U.S. debt to keep an eye on is Japan. As you can see below, they are now, by far, the largest buyer of our debt.

Source: Bianco Research

China has become much less of a factor, but $1.2 billion is a big number. One thing that could help is the unrest we are seeing in Europe. This will make their debt less attractive, at least for now.

Also, the U.S. Treasury is issuing more short-term bills that have an attractive rate, compared to other fixed income investments, so they are finding buyers. One consequence of short-term issuance is the cost.

How much will it cost?

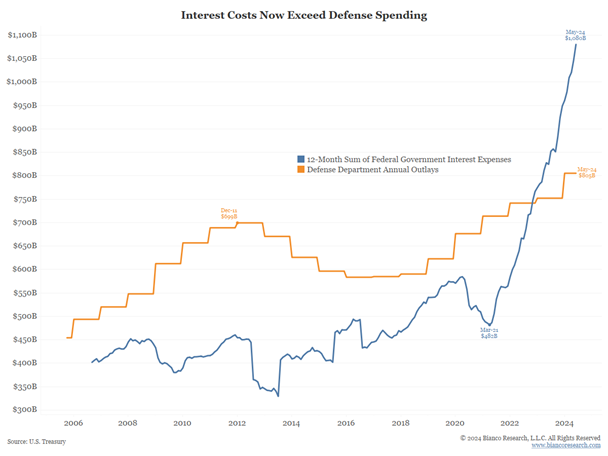

With an inverted yield curve, the short end is the most attractive for buyers, but most costly for issuers. The higher rate attracts buyers, until the Fed starts lowering short-term rates. So, we are already seeing the U.S. having to pay higher rates to fund the deficit. As you can see below, the interest expense on an annual basis is now considerably higher than defense spending. Is this where we want to see our money going?

Source: Bianco Research

Kick the can

Niall Ferguson, noted historian, stated, “My sole contribution to the statute book of historiography — what I call Ferguson’s Law — states that any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long.”

Economic releases

Last week, we had moderating economic news from Retail Sales and Housing. Will this trend continue?

This week’s calendar will give Consumer Confidence, Durable Goods Orders, PCE and Consumer Sentiment. See below for details.

Wrap-Up

On, or in, the water is a great place to be. Always helps to remember: Water skiing is like life; if you are not moving forward, you are sinking.

| Upcoming Economic Releases | Period | Expected | previous | |

|---|---|---|---|---|

24-Jun | Dallas Fed Manufact Activity | Jun | (15.0) | (19.4) |

| ||||

25-Jun | Philadelphia Fed Non-Manuf Activity | Jun | N/A | (0.6) |

25-Jun | Chicago Fed Nat Activity Index | May | (0.25) | (0.23) |

25-Jun | FHHA House Price Index MoM | Apr | 0.30% | 0.10% |

25-Jun | S&P CoreLogic 20-city YoY | Apr | 7.00% | 7.38% |

25-Jun | Conf Board Consumer Confidence | Jun | 100.0 | 102.0 |

25-Jun | Conf Board Present Situation | Jun | N/A | 143.1 |

25-Jun | Conf Board Expectations | Jun | N/A | 74.6 |

25-Jun | Richmond Fed Manufacturing Index | Jun | (3) | 0 |

25-Jun | Richmond Fed Business Conditions | Jun | N/A | (9) |

25-Jun | Dallas Fed Services Activity | Jun | N/A | (12.1) |

| ||||

26-Jun | New Home Sales | May | 645,000 | 634,000 |

26-Jun | New Home Sales MoM | May | 1.7% | -4.7% |

| ||||

27-Jun | GDP Annualized QoQ | Q1 | 1.4% | 1.3% |

27-Jun | Personal Consumption | Q1 | 2.0% | 2.0% |

27-Jun | GDP Price Index | Q1 | 3.0% | 3.0% |

27-Jun | Retail Inventories MoM | May | 0.5% | 0.7% |

27-Jun | Wholesale Inventories MoM | May P | 0.1% | 0.1% |

27-Jun | Initial Jobless Claims | 22-Jun | 235,000 | 238,000 |

27-Jun | Continuing Claims | 15-Jun | 1,824,000 | 1,828,000 |

27-Jun | Durable Goods Orders | May P | -0.2% | 0.6% |

27-Jun | Durable Goods ex Transportation | May P | 0.1% | 0.4% |

27-Jun | Cap Goods Orders Nondef ex Aircraft | May P | 0.1% | 0.2% |

27-Jun | Pending Home Sales MoM | May | 1.1% | -7.7% |

27-Jun | KC Fed Manufacturing Activity | Jun | N/A | (2) |

| ||||

28-Jun | Personal Income | May | 0.4% | 0.3% |

28-Jun | Personal Spending | May | 0.3% | 0.2% |

28-Jun | Real Personal Spending | May | 0.2% | -0.1% |

28-Jun | PCE Deflator YoY | May | 2.6% | 2.7% |

28-Jun | PCE Core Deflator YoY | May | 2.6% | 2.8% |

28-Jun | MNI Chicago PMI | Jun | 40.0 | 35.4 |

28-Jun | UM Consumer Sentiment | Jun F | 66.0 | 65.6 |

28-Jun | UM Current Conditions | Jun F | N/A | 62.5 |

28-Jun | UM Expectations | Jun F | N/A | 67.6 |

28-Jun | UM 1-yr inflation | Jun F | N/A | 3.3% |

28-Jun | UM 5-10-yr inflation | Jun F | N/A | 3.1% |

28-Jun | KC Fed Services Activity | Jun | N/A | 11 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Private Banking is provided by Texas Capital Bank (the “Bank”). Advisory services are offered through Texas Capital Bank Wealth Management Services, Inc. d/b/a Texas Capital Bank Private Wealth Advisors (“PWA”), a wholly owned subsidiary of the Bank and an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. Brokerage services are offered through Kingswood Capital Partners, LLC (“Kingswood”), Member FINRA/SIPC. Texas Capital Bank Private Wealth Advisors and Texas Capital Bank are not registered broker/dealers and are independent of Kingswood. Investments and insurance products are not insured by Bank insurance, the FDIC or any other government agency; are not deposits or obligations of the Bank; are not guaranteed by the Bank; and are subject to risks, including the possible loss of principal. Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2024 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI