A job or an adventure — Week of March 18, 2024

Essential Economics

— Mark Frears

Kodiak

Have I told you about the summer working quality control for a salmon cannery on Kodiak Island? It was a pretty good job, with good people, food and room supplied, and beautiful environment. The one thing that made it difficult sometimes was that as long as the boats brought in fish, we had to run the cannery. That sometimes went on for days!

The current environment seems to have all the jobs that people want, keeping the economy swimming right along. Will this continue?

Current state

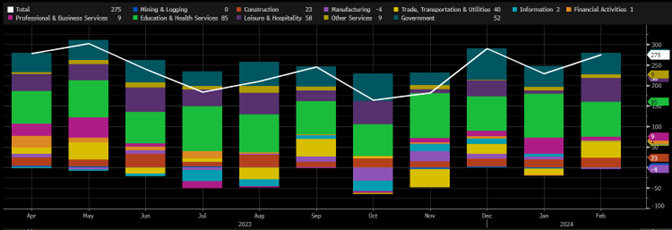

The non-farm payroll release comes out each month on the first Friday, showing us how many new jobs were added in the previous month. As you can see below, the past three months have averaged 265,000 jobs, and the past six months’ average is 231,000. This is far from recessionary.

Source: Bloomberg

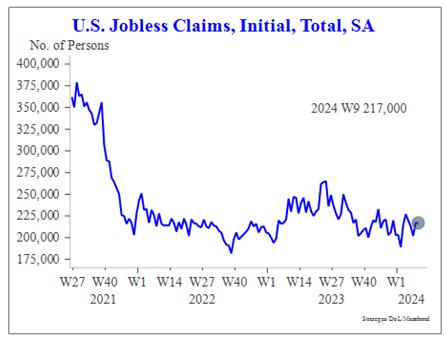

The number of workers hired shows strength in the labor market. How about the number of people unemployed? The weekly Jobless Claims release shows new people filing for unemployment benefits. The chart below shows we continue to run just over 200,000 per week. This is not showing weakness.

Source: Strategas

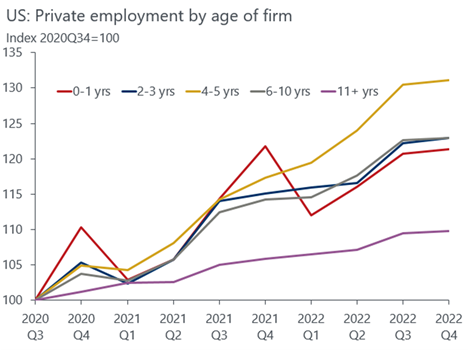

Another positive for the job market is the businesses that were created during the pandemic and in the aftermath. Metrics show that firms in the earlier stages of growth hire more workers, as you can see below.

Source: Oxford Economics / Census Bureau

This trend should help the economy and job market stay strong for the next few years.

Wild card

The economy is growing at a faster pace than most people predicted. Earnings at companies are doing just fine, and consequently, companies are hiring to meet demand from consumers. If we have a larger part of the population reaching retirement age, causing a decreasing workforce, where are these workers coming from?

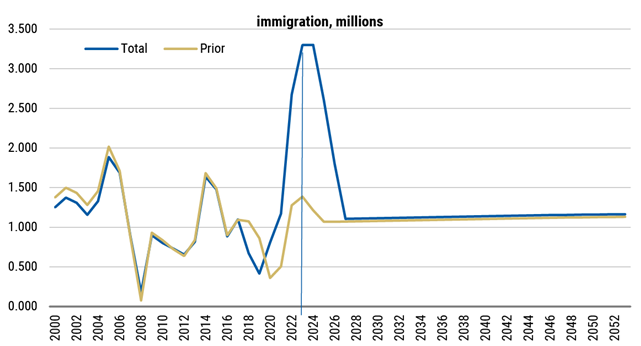

On February 7, the Congressional Budget Office (CBO) published new population estimates showing faster population growth, due to an increase in immigration (see below).

Source: CBO, Morgan Stanley

This is a huge adustment, adding significantly to the workforce. The impact to 2023 was major, and this could have impact into 2024 and 2025.

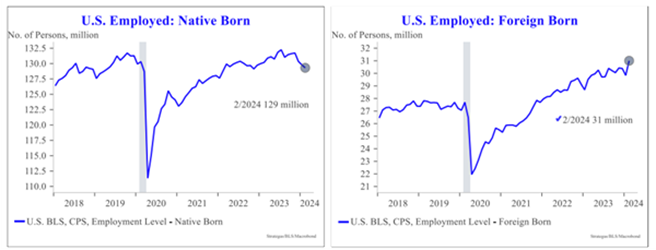

As the chart below shows, while native born employment is dropping, foreign born is more than taking up the slack.

Source: Strategas

Bad news?

There are some areas where cracks might be seen in the labor market. Let’s take a look at a few of them. First, we are starting to see headlines about job cuts. The Challenger U.S. Job Cut tracker (below) shows an uptick that bears keeping an eye on.

Source: Bloomberg

Second, the number of hours worked by employees can be an indicator of how the employer sees demand for their product. As you can see below, workers’ hours have been dropping since peaking in March of 2021.

Source: Bloomberg

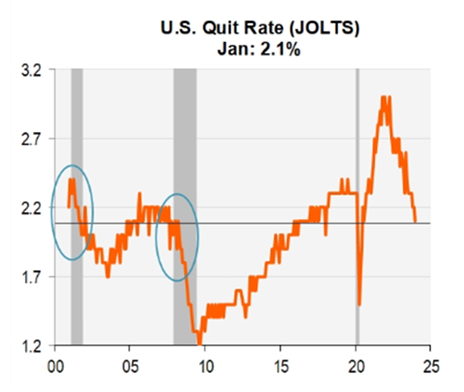

Third, while the Job Openings and Labor Turnover Survey (JOLTS) continues to show plentiful jobs available, there is some concern that these are not “real” jobs, but ones posted because they had to, and ones that are to fill up a pipeline of resumes. In addition, from this monthly release, we also get the “quits rate” that shows people voluntarity leaving jobs. In the chart below, we can see this stat has been dropping materially, back to levels not seen since we entered the recession in 2008.

Source: Piper Sandler Research

The thought behind this metric is that if the employee feels confident they will easily get another job, they will potentially leave their current one. This is showing that workers’ perception of the job market is changing.

FOMC

The FOMC meeting this week will have the updated quarterly Summary of Economic Projections (SEP), including the unemployment rate, GDP and inflation estimates. Pay attention to see how the Fed is looking at the complex labor market.

Economic releases

Last week, we had higher CPI and PPI, along with lower Retail Sales. The consumer sentiment numbers were about flat, but we have seen more concern about higher interest costs on loans starting to dampen enthusiasm.

This week’s calendar is full of housing numbers, and we also have the Leading Indicators out. This will not be the focus though, as the Fed concludes their March meeting on Wednesday, and all eyes will be on the Dot Plot and the news conference. See below for details.

Wrap-Up

Your job doesn’t have to be an adventure, but it sure helps if you work with good people and are constantly challenged to learn new skills. What is your dream job?

| Upcoming Economic Releases: | Period | Expected | Previous | |

| 18-Mar | NY Fed Services Business Activity | Mar | N/A | (7.3) |

| 18-Mar | NAHB Housing Market Index | Mar | 48 | 48 |

| 19-Mar | Building Permits | Feb | 1,500,000 | 1,470,000 |

| 19-Mar | Building Permits MoM | Feb | 2.0% | -1.5% |

| 19-Mar | Housing Starts | Feb | 1,430,000 | 1,331,000 |

| 19-Mar | Housing Starts MoM | Feb | 7.4% | -14.8% |

| 20-Mar | FOMC Rate Decision (Upper Bound) | 1p CT | 5.50% | 5.50% |

| 20-Mar | FOMC Rate Decision (Lower Bound) | 1p CT | 5.25% | 5.25% |

| 21-Mar | Philadelphia Fed Business Outlook | Mar | (2.3) | 5.2 |

| 21-Mar | Initial Jobless Claims | 16-Mar | 215,000 | 209,000 |

| 21-Mar | Continuing Claims | 9-Mar | 1,824,000 | 1,811,000 |

| 21-Mar | S&P Global US Manufacturing PMI | Mar P | 51.8 | 52.2 |

| 21-Mar | S&P Global US Services PMI | Mar P | 52.0 | 52.3 |

| 21-Mar | S&P Global US Composite PMI | Mar P | 52.1 | 52.5 |

| 21-Mar | Leading Index | Feb | -0.2% | -0.4% |

| 21-Mar | Existing Home Sales | Feb | 3,940,000 | 4,000,000 |

| 21-Mar | Existing Home Sales MoM | Feb | -1.5% | 3.1% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities. Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment. Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank. ©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved. Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank. www.texascapitalbank.com Member FDIC NASDAQ®: TCBI