Are you giving your best effort? — Week of March 4, 2024

Essential Economics

— Mark Frears

Efficiency

Over time, I have become a morning person. Annoying for many, I know. Through college and while working in restaurants, I rarely saw the sunrise, unless it was the end of long night. Now I am on the other end of the spectrum and think people who don’t get up early are missing out. My most productive time is before the rest of the world hits their snooze button. What about you?

Working efficiently is quantified as productivity. How do the individual efforts of you and me impact the larger economy?

Output per input

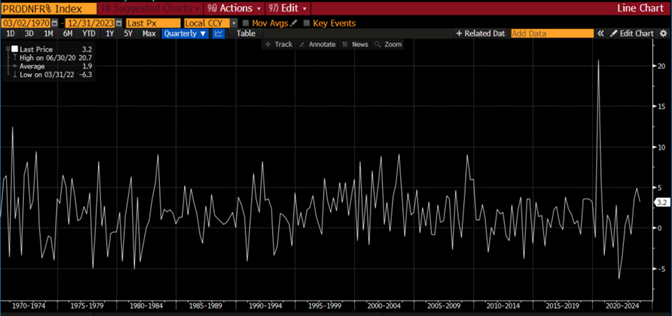

Productivity is the rate of output, per a given amount of input — also known as effectiveness of productive effort. As you can see below, going back to 1970, the measure of U.S. productivity has averaged 1.9%. This is a broad metric taking total real gross domestic product, divided by total hours worked.

Source: Bloomberg

This indicator came in at 3.2% in the fourth quarter of 2023, well above the average. There has been much debate about how to improve this number, especially as the longer-term average did not seem to make much progress. The recent upturn is bouncing off a low of -6.3% in the first quarter of 2022.

Some say that artificial intelligence will be the magic bullet to cure this issue, but will the cost be the number of workers?

Reward

If you paid workers more, would they be more productive? To some degree, but in actuality, wage increases have short-lived impact to behavior. So, as an employer, you will have to increase prices, or suffer lower profitability.

The recent higher inflation environment has forced employers to increase wages to retain and attract quality employees. Have these higher wages benefited the worker? Not to a great degree, as prices have generally risen higher than wages, until recently.

Bigger picture

Economists postulate that in order to have an efficient economy, there is a relationship between productivity, wages and inflation. That is, wage growth is equal to productivity growth plus inflation.

So, wages go up with inflation, but that leaves productivity unchanged. If that is the case, the offset doesn’t help either employers or employees. But, if you increase productivity, with inflation staying flat, or declining, the wages will go up. This benefits employers/producers as consumers will have more money to purchase goods/services and employees will have more income.

Wages have been coming down, along with inflation, so there is an opportunity for productivity to kick in and benefit both sides. The problem I can see that if inflation stays higher for longer, and wages do not keep up, productivity will suffer.

Productivity leaders

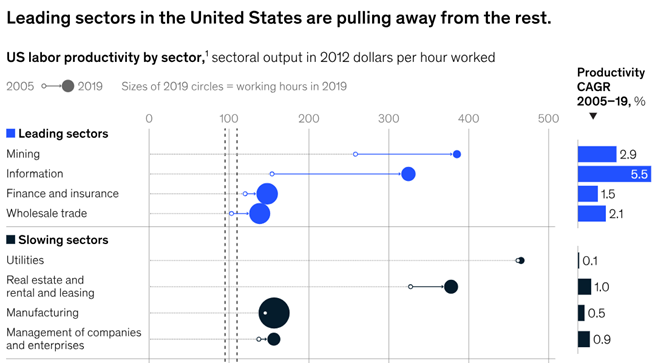

How can you make your company more productive, or how can you be more productive to benefit your company, and yourself? As you can see below, some sectors are pulling ahead, and some are being left in the dust. Advances in digital technology and an advantageous place in global industries is important, but there is huge opportunity here.

Source: McKinsey and Company

Unfortunately, as you might imagine, the most successful companies at embracing the new digital technology (think AI) employ disproportionally fewer workers. Choose your place of employment carefully.

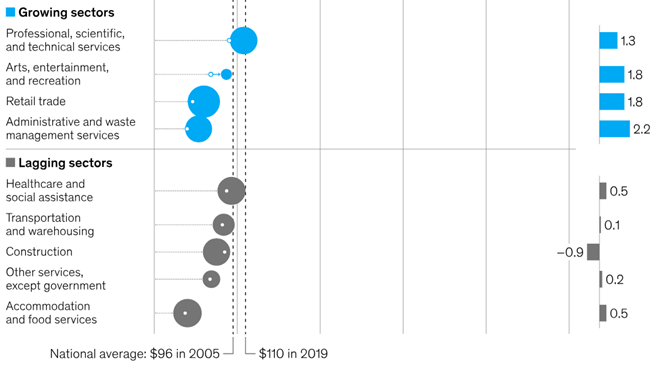

Measurements

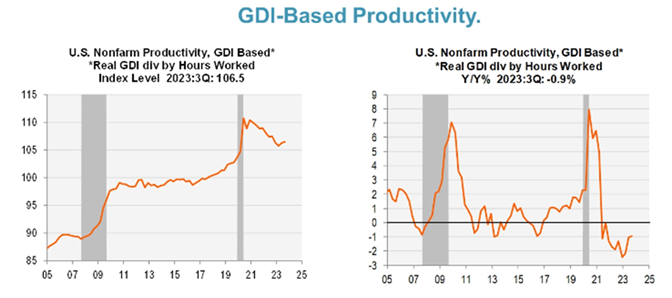

As a final point, and a follow-up to last week — you should have been keeping up — if Gross Domestic Income (GDI) is the measurement of economic growth that is more accurate, our productivity picture looks grimmer. As you can see below, if we measure output from GDP, productivity looks positive.

Source: Piper Sandler Research

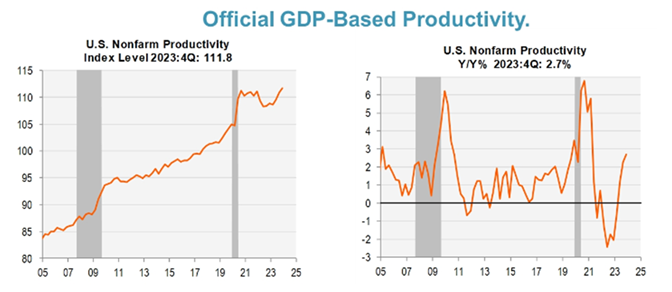

But if you believe GDI is more accurate, the picture below is not so encouraging.

Source: Piper Sandler Research

If the GDI picture is more accurate, this could be a headwind for profits and margins. In addition, weaker productivity will lead to higher unit labor costs and stickier inflation. With the stickier/higher inflation, the Fed will need to leave rates higher for longer.

Economic releases

Last week was full of economic releases, from lower consumer confidence to slowly moderating PCE inflation. The Fed speakers kept us busy as well. Also, congress kicked the can down the road again, keeping the U.S. government open.

This week’s calendar will focus on the labor market. We will have ADP, JOLTS and nonfarm payroll releases. In addition, the latest revisions for Q4 Productivity and Labor Costs will be out. See below for details.

Wrap-Up

As you can see, you and I can have an impact, on our companies and on the U.S. economy. Think about ways you can improve your efficiency and effectiveness, and you will hear the words: “well done.”

| Upcoming Economic Releases: | Period | Expected | Previous | |

| 5-Mar | Factory Orders | Jan | -2.9% | 0.2% |

| 5-Mar | Factory Orders ex Transportation | Jan | -0.1% | 0.4% |

| 5-Mar | ISM Services Index | Feb | 53.0 | 53.4 |

| 5-Mar | ISM Services Prices Paid | Feb | N/A | 64.0 |

| 5-Mar | ISM Services Employment | Feb | N/A | 50.5 |

| 5-Mar | ISM Services New Orders | Feb | N/A | 55.0 |

| 6-Mar | ADP Employment Change | Feb | 150,000 | 107,000 |

| 6-Mar | JOLTS Job Openings | Jan | 8,890,000 | 9,026,000 |

| 6-Mar | Fed releases Beige Book for March 19-20 FOMC meeting @ 1p CT | |||

| 7-Mar | Challenger Job Cuts YoY | Feb | N/A | -20.0% |

| 7-Mar | Nonfarm Productivity | Q4 | 3.1% | 3.2% |

| 7-Mar | Unit Labor Costs | Q4 | 0.7% | -1.2% |

| 7-Mar | Initial Jobless Claims | 2-Mar | 218,000 | 215,000 |

| 7-Mar | Continuing Claims | 24-Feb | 1,870,000 | 1,905,000 |

| 7-Mar | Household Change in Net Worth | Q4 | N/A | -$1,312B |

| 7-Mar | Consumer Credit | Jan | $10.000B | $1.561B |

| 8-Mar | Change in Nonfarm Payrolls | Feb | 200,000 | 353,000 |

| 8-Mar | Change in Private Payrolls | Feb | 160,000 | 317,000 |

| 8-Mar | Unemployment Rate | Feb | 3.7% | 3.7% |

| 8-Mar | Avg Hourly Earnings MoM | Feb | 0.2% | 0.6% |

| 8-Mar | Avg Hourly Earnings YoY | Feb | 4.3% | 4.5% |

| 8-Mar | Avg Weekly Hours - All Employees | Feb | 34.3 | 34.1 |

| 8-Mar | Labor Force Participation Rate | Feb | 62.6% | 62.5% |

| 8-Mar | Underemployment Rate | Feb | N/A | 7.2% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.