Money flows like a river — Week of May 20, 2024

Essential Economics

— Mark Frears

Flow

While up at the cottage in Canada, I was reminded of the power of the ice as it is breaking up. Water can be pretty innocuous when it is in a glass, but if you freeze it and then melt it, look out. Watching a river will also show you two sides of H2O. A broad area has lazy flows, but if you restrict it, rapids and all their craziness will result.

Money flows make up the broader economy. “Follow the money” will provide insight into what is working and what needs help.

Inflation

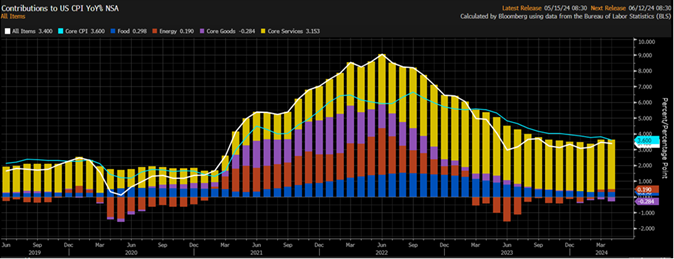

The largest uncertainty in the economy right now is inflation. The Fed is committed to bringing it down to their target level of 2%, but prices continue to be restrictive on the economy. As you can see below, the Consumer Price Index (CPI) on a year-over-year basis has bottomed and is moving higher.

Source: Bloomberg

Services continue to be the largest component, and these higher prices restrict the amount consumers have to spend. Think of it as rapids on a river, where the flow is not moving as smoothly. This causes turbulence, or volatility, forcing the consumer to face tough decisions.

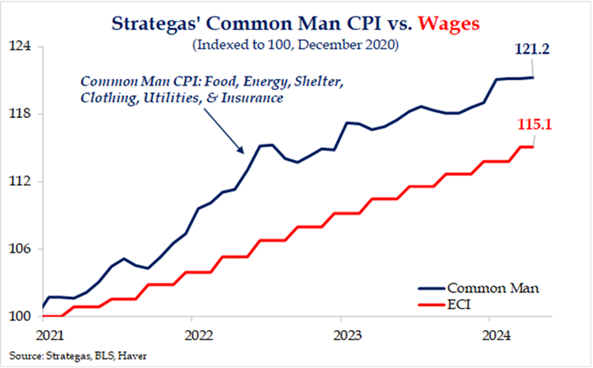

The chart below shows costs of basic needs versus wages (Employment Cost Index), and prices continue to outpace income gains.

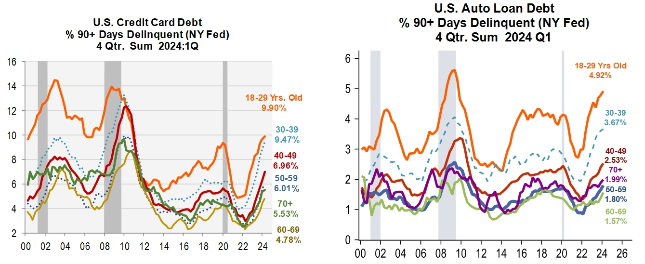

If someone is restrcted in their cash flow due to continued higher prices, there will not be enough flow to meet all the obligations. The chart below shows how prices are having an impact in keeping up with other payments.

Source: Piper Sandler

Despite commentaries stating this is only happening to lower- and middle-income households, you can see this is an issue across all demographics.

Looking ahead

There are a few areas that could point to a less restricted flow of money for consumers. First, in the housing sector, the New Tenants Repeat Rent Index (NTRR) for first quarter of 2024 suggests a slower pace of shelter inflation in the second half of this year. As shelter makes up 43% of CPI, this could be significant. Second, goods inflation was a driver in the first quarter, and with a smoother supply chain, this could give us a break.

Fed and fiscal

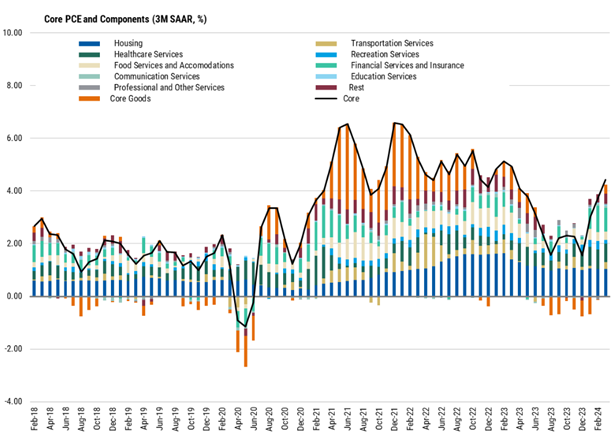

The Fed’s stated current goal is to bring prices back down to a 2% level, per the core Personal Consumption Expenditure (PCE) metric. Their means of doing this is by raising short-term interest rates, causing money to be less available, and thereby slowing the economy. Unfortunately for them, the uncertainty from the rapids is lasting longer than they would like. While we may not be in a class V area anymore, we still are dealing with class III rapids.

As you can see below, the three-month average for core PCE, taking out the seasonal variations, is accelerating, not moving down to the target level of 2%.

Source: BEA, Morgan Stanley Research

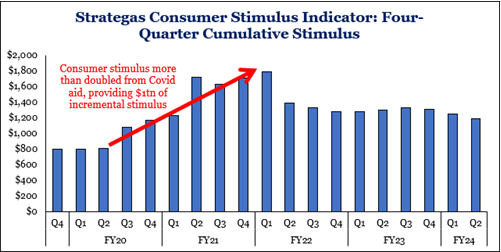

Complicating the Fed’s mission is the continued spending by the government, known as fiscal stimulus. The chart below shows how stimulus continues post-pandemic, and this serves to add more money flow to the economy, not helping us to get to calmer waters.

Source: Strategas Research

The economy continues to plug along, and we agree that some level of inflation is healthy, but the longer that this level of higher prices continues, the more likely we are to run into a spiraling eddy.

Economic releases

Last week’s news was focused on inflation. PPI came in hotter than expected, but the lower-than-expected CPI gave the markets some hope. This is one month, not an established trend!

This week’s calendar will give us some housing news and durable goods, as well as an update on consumer sentiment. Recent sentiment numbers are starting to show some angst. See below for details.

Wrap-Up

River rapids can be a lot of fun, but you need to have an outstanding guide. Make sure you have the best-in-class at the rudder of your boat.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 21-May | Philadelphia Fed Non-Manuf Activity | May | N/A | (12.4) |

| 22-May | Existing Home Sales | Apr | 4,220,000 | 4,190,000 |

| 22-May | Existing Home Sales MoM | Apr | 0.6% | -4.3% |

| 22-May | FOMC Meeting Minutes from 5/1 | 1p CT | ||

| 23-May | Chicago Fed Natl Activity Index | Apr | 0.13 | 0.15 |

| 23-May | Initial Jobless Claims | 18-May | 220,000 | 222,000 |

| 23-May | Continuing Claims | 11-May | 1,791,000 | 1,794,000 |

| 23-May | S&P Global US Manufacturing PMI | May P | 49.9 | 50.0 |

| 23-May | S&P Global US Services PMI | May P | 51.4 | 51.3 |

| 23-May | S&P Global US Composite PMI | May P | N/A | 51.3 |

| 23-May | New Home Sales | Apr | 679,000 | 693,000 |

| 23-May | New Home Sales MoM | Apr | -2.1% | 8.8% |

| 23-May | KC Fed Manufacturing Activity | May | (7) | (8) |

| 24-May | Durable Goods Orders | Apr P | -0.7% | 2.6% |

| 24-May | Durable Goods ex Transportation | Apr P | 0.1% | 0.2% |

| 24-May | Cap Goods Orders Nondef ex Aircraft | Apr P | 0.1% | 0.1% |

| 24-May | UM Consumer Sentiment | May F | 67.7 | 67.4 |

| 24-May | UM Current Conditions | May F | N/A | 68.8 |

| 24-May | UM Expectations | May F | N/A | 66.5 |

| 24-May | UM 1-yr inflation | May F | N/A | 3.5% |

| 24-May | UM 5-10-yr inflation | May F | N/A | 3.1% |

| 24-May | KC Fed Services Activity | May | N/A | 9 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI