Boating, summer fun or fueling inflation? — Week of May 27, 2024

Essential Economics

— Mark Frears

Nothing, absolutely nothing

As summer is almost officially here, it is boat time. Doesn’t matter if it is a cruise ship or a kayak — there is something about being out on the water.

Following up on last week, there is a link between boats and inflation as well. Given that inflation is the current focus of the Fed, giving them pause, and that the equity markets do not like higher rates and uncertainty from the Fed, we should continue to examine the area of prices.

Is it working?

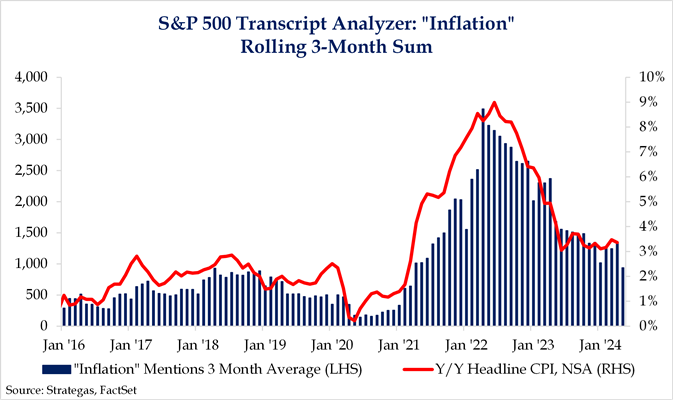

Consumer Price Index (CPI) on a year-over-year (YoY) basis was running 8.5% in March 2022. The Fed raised their target Fed Funds rate by 5.25% from March 2022 to July 2023, at the fastest pace ever. Their purpose is to make money less accessible and thereby slow down the economy. CPI YoY has improved to 3.4%, but I would propose that this had less to do with the Fed and more with easing supply chain pressures.

Consumers

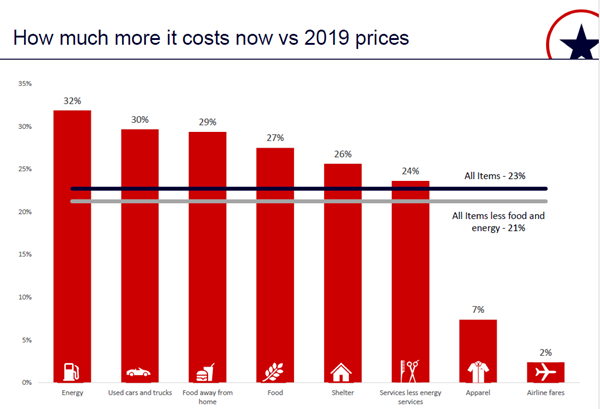

In addition, consumer demand has not slowed materially from the pent up post-pandemic surge. Consumers are definitely noticing their dollar is not going as far, and the categories shown below bear this out.

Source: Bureuan of Labor Statistics (as of April 2024)

While we have seen very good improvement from the peak prices, there are still significantly higher costs hitting you and me.

Producers

When you look at inflation from the producer’s perspective, they are happy increasing prices, as long as they can control costs, such as labor. As you can see below, while inflation improvement has flattened out, the concern expressed in company’s earnings calls has diminished.

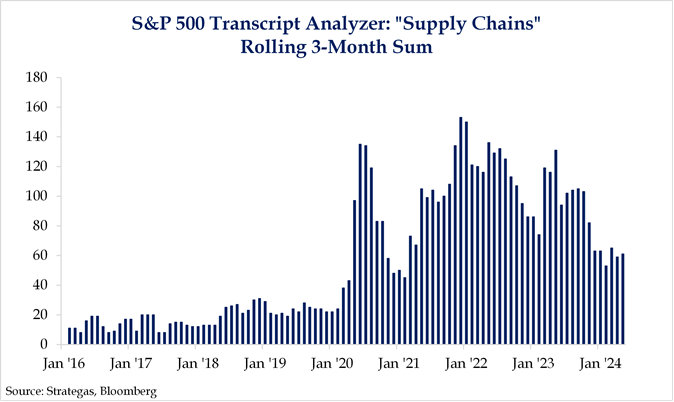

One place they are seeing a rising concern is supply chain. It’s back! The chart below shows the increasing talk of this issue.

Areas of concern

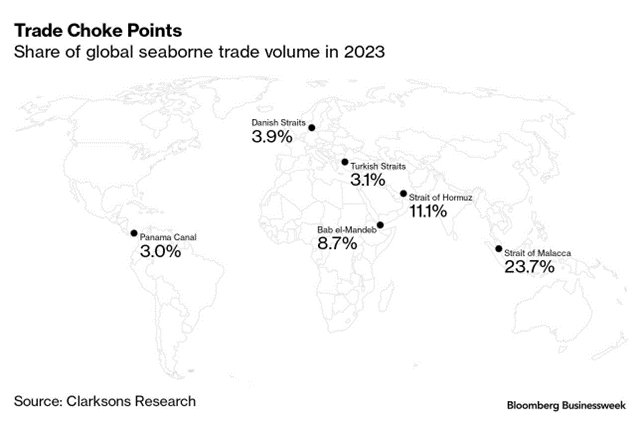

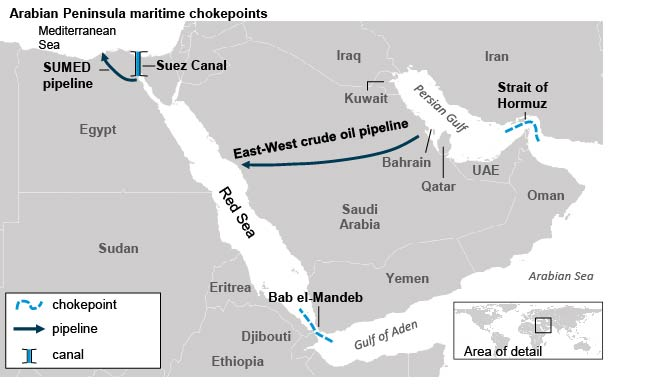

The pandemic supply chain issues caused us to pay attention to an area that, frankly, was taken for granted. Global shipping by water improved after the pandemic, but now, due to wars, China and lower water levels, the concern is rising. As you can see below, there are six identified potential choke points, due to the amount of trade that travels through these.

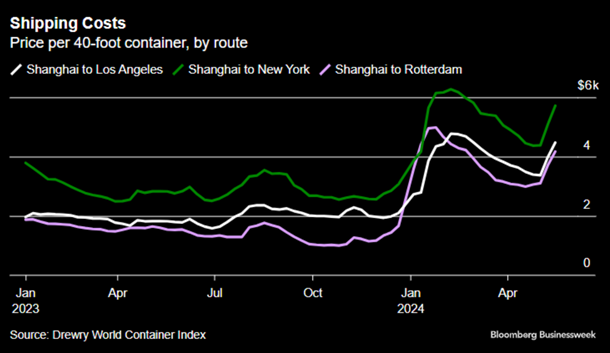

In each of these areas pointed out above, there are specific risks that have the potential to disrupt normal flows. The chart below shows costs are increasing again on major shipping routes.

Strait of Malacca

This area saw the passage of 23.7% of global seaborne trade volume in 2023. This provides a link between the Indian Ocean and the Pacific, and is the most important single maritime choke point. Oil, natural gas and other commodities pass through on the way to China and Asia’s major countries, while finished goods move in the opposite direction. There are potential issues with pirates, as ships have to slow to make the passage, as well as possible volcanic activity.

Strait of Hormuz

11.1% of world maritime shipping passed through this area in 2023. In prior years when this strait has been restricted, the cost of oil doubled. Its proximity to Iran is probably the biggest risk, and the shallow depth makes mines a viable weapon.

Bab el-Mandeb

You may not have heard the name of this passage, but you have heard about the Red Sea and the Suez Canal recently (see chart below). There has been considerable focus on this area due to the Houthis pirates, and geopolitical ramifications from them. The very real threat here has forced shipping companies to divert all the way around the Southern tip of Africa, increasing costs dramatically.

Source: American Journal of Transportation

The economy continues to chug right along, driven by consumer spending. Some households are already feeling the impact of inflated prices, and given the elevated risks in critical areas of maritime shipping, this could become a much larger issue.

Economic releases

Last week saw stronger economic data from the ISM surveys and durable goods orders. Also, the consumer sentiment bounced back in the second half of May. Fed talking heads continued the “higher for longer” mantra.

This week’s calendar has consumer confidence, inventories, personal income and spending. Also, we have the PCE metric for April. This is the Fed’s benchmark for inflation. See below for details.

Wrap-Up

I love being in boats, no matter the size. Something about being close to the water. The potential supply chain choke points may not be as peaceful and need our continued attention.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 28-May | House Price Purchase Index QoQ | Q1 | N/A | 1.5% |

| 28-May | FHFA House Price Index MoM | Mar | 0.5% | 1.2% |

| 28-May | S&P CoreLogic 20-city YoY | Mar | 7.30% | 7.29% |

| 28-May | Conf Board Consumer Confidence | May | 96.0 | 97.0 |

| 28-May | Conf Board Present Situation | May | N/A | 142.9 |

| 28-May | Conf Board Expectations | May | N/A | 66.4 |

| 28-May | Dallas Fed Manuf Activity | May | (12.5) | (14.5) |

| 29-May | Richmond Fed Manuf Index | May | (6) | (7) |

| 29-May | Richmond Fed Business Conditions | May | N/A | (6) |

| 29-May | Dallas Fed Services Activity | May | N/A | (10.6) |

| 29-May | Federal Reserve Releases Beige Book for June 11-12 Meeting | |||

| 30-May | GDP Annualized QoQ | Q1 | 1.3% | 1.6% |

| 30-May | Personal Consumption | Q1 | 2.2% | 2.5% |

| 30-May | GDP Price Index | Q1 | 3.1% | 3.1% |

| 30-May | Initial Jobless Claims | 25-May | 217,000 | 215,000 |

| 30-May | Continuing Claims | 18-May | 1,795,000 | 1,794,000 |

| 30-May | Wholesale Inventories MoM | Apr P | 0.1% | -0.4% |

| 30-May | Retail Inventories MoM | Apr | 0.3% | 0.3% |

| 30-May | Pending Home Sales MoM | Apr | 0.3% | 3.4% |

| 30-May | Personal Income | Apr | 0.3% | 0.5% |

| 31-May | Personal Spending | Apr | 0.3% | 0.8% |

| 31-May | Real Personal Spending | Apr | 0.0% | 0.5% |

| 31-May | PCE Deflator YoY | Apr | 2.7% | 2.7% |

| 31-May | PCE Core Deflator YoY | Apr | 2.8% | 2.8% |

| 31-May | MNI Chicago PMI | May | 41.0 | 37.9 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI