More than a simple curve — Week of May 6, 2024

Essential Economics

— Mark Frears

Curves

The road into our family cottage has the potential to make you nauseated if you are not ready for it. It is partly pavement, some dirt and winding, almost like a switchback in places. The glimpses of the lake entice you to speed up in order to reach the destination sooner. Once you are in the boat, it is usually more relaxing!

A significant twisting line in the financial markets is the yield curve. This is made up of rates from an overnight term out to a 30-year bond maturity. Interest rates along this curve have impacts on different parts of the economy and are driven by a variety of factors.

Just a line

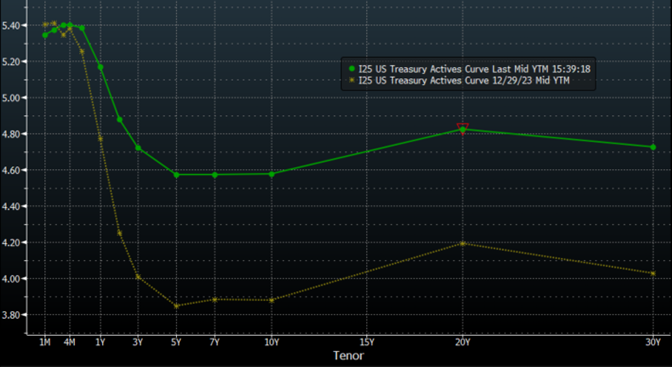

The chart below shows the UST yield curve as of 12/29/23 (yellow line) and today (green line). Along the horizontal axis, this extends from one month out to 30 years. There is not always this much change over a four-month period, but we are expericing some volatility.

Source: Bloomberg

Short end

The primary influence on rates under two years in maturity is the Federal Open Market Committee (FOMC) and their manipulation of the overnight Fed Funds target rate. The “dot plots” are the members’ forecast of future movements in this rate, and it is under severe scrutiny. Other short-term rates, such as SOFR, commerical paper and UST bills all price based on where this rate is going. They use this rate to communicate to the markets whether they are being stimulative (lowering rate) or restrictive (raising rate).

Mid to long end

It always drives me crazy when people make a broad statement like “rates are going up.” Which rates?! You need to be specific as the term of the issue and the counterparty can make a huge difference. We are mostly talking about U.S. Treasury rates here, as they are the “risk-free” rates, and other issuances have more risk and therefore should have a higher rate than UST.

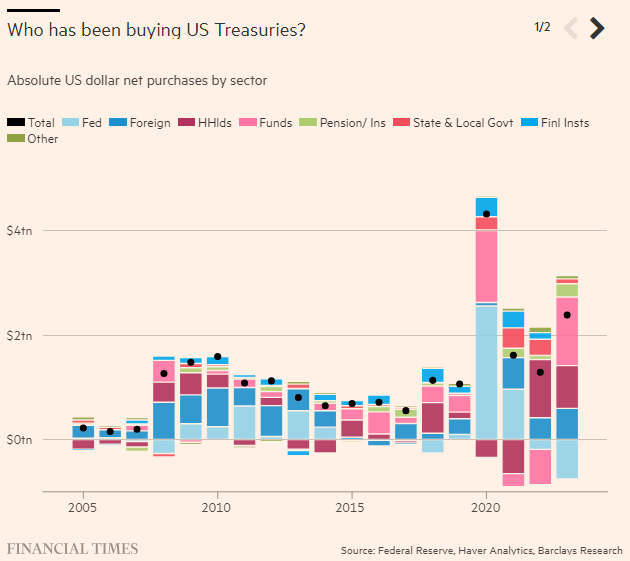

What are the influences that drive longer-term rates? First, the future, and speculation as to what that holds. If you are an investor and think the economy is improving, or inflation is headed higher, you will demand a higher rate for lending your money further out the curve. This future view can be guided by economic and Fed forecasts. Second, do you need a refresher on economics? The good old supply-demand curve. The more bills, notes and bonds the UST wants to issue, the more they could potentially have to pay to sell them. This is a very real concern now, as fiscal spending, as well as higher interest costs, are forcing more issuance. As you can see below, since 2020, the amount of debt is increasing.

The Federal, and state and local governments have been big buyers since 2020, and the Federal sector is about to pull back on their purchases. This potentially could lead to the Treasury having to pay higher interest rates to attract buyers. If they have to pay higher rates, this will lead to more issuance to cover this cost. Not a good trend.

The current curve is inverted, meaning longer-term rates are lower than short-term. This would traditionally indicate that a slowdown in the economy is coming. Many economists have been predicting a recession (waiting on Godot) for some time, and it could still happen. On the other hand, given the economic uncertainty in the rest of the world, there is more demand for UST, pushing rates lower. In addition, the FOMC is keeping their target rate higher for longer, hoping to quell the inflation dragon. Keep watching.

Who cares?

Who do these rates impact, and what decisions are being made based on this current rate environment? The higher short-term rates are providing income for investors who are parking cash. These rates are impacting businesses that borrow on a floating rate basis though, and their costs are higher.

The highest profile long-term rate is a home mortgage. This impacts a lot of people. Many were able to lock in historically low rates during the period following the Great Recession, and the current higher rate environment is not helping potential buyers. In addition, prices are higher, given limited supply in the face of good demand. Also, higher rates are seen as an alternative to equity investments, especially in an uncertain economy. The 10-year UST probably has to get back over 5% before it becomes a strong alternative. Finally, as discussed above, higher rates cause issuers, like the UST, to have higher costs.

In closing, it behooves you to pay attention to the yield curve and understand what behaviors different interest rates drive.

Economic releases

Last week was full of news, from Consumer Confidence (lower), FOMC meeting (more dovish) and Payrolls (lower with lower wages). Economy still doing OK, but with a few potential upcoming hiccups.

This week’s calendar is very quiet with consumer credit and sentiment the highlights. We will have Fed talking heads back out in force following the meeting. Will they stick to Powell’s bent or veer off? See below for details.

Wrap-Up

It may look like a line on a screen, but when we did deeper, the yield curve holds many clues. Whether it is the curves in the road, or the curves that life throws at you, stay grounded in what matters.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 6-May | Senior Loan Officer Survey | 1p CT | ||

| 7-May | Consumer Credit | Mar | $15.000B | $14.125B |

| 8-May | Wholesale Trade Sales MoM | Mar F | 0.9% | 2.3% |

| 8-May | Wholesale Inventories MoM | Mar F | -0.4% | -0.4% |

| 9-May | Initial Jobless Claims | 4-May | 214,000 | 208,000 |

| 9-May | Continuing Claims | 27-Apr | 1,785,000 | 1,774,000 |

| 10-May | UM Consumer Sentiment | May P | 76.2 | 77.2 |

| 10-May | UM Current Conditions | May P | 78.9% | 79.0 |

| 10-May | UM Expectations | May P | 75.4% | 76.0 |

| 10-May | UM 1-yr inflation | May P | 3.3% | 3.2% |

| 10-May | UM 5-10-yr inflation | May P | 3.0% | 3.0% |

| 10-May | Monthly Budget Statement | Apr | $262.5B | -$236.5B |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI