Do you hate mornings? — Week of November 6, 2023

Essential Economics

— Mark Frears

The importance of when

Are you a morning person? There is nothing worse than being around one if you are not. For much of my early life I was the antithesis; working in the restaurant business did not help. Once I started at the bank, I saw the benefit of being up early and all you could get accomplished with fewer people around. It was a battle for many years, but I would now say that I am a morning person. What is your most productive time of the day?

The labor market is of primary focus for the FOMC and economists right now. How does worker productivity impact this area?

Work

Productivity is hard to measure, especially in the new world of work from home (WFH). According to a recent study, the WFH population has leveled off at 35%. While this is much higher than pre-pandemic, it is not as widespread as media would lead you to believe. The challenge for managers is to insure their employees are productive, even when they can’t see them!

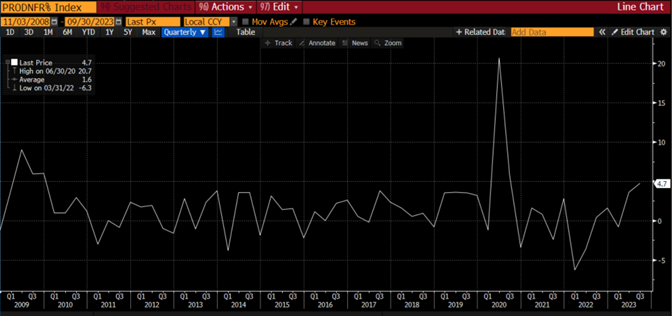

Per the quarterly Nonfarm Productivity metric below, we have been on a nice, increasing trend since early 2022.

Source: Bloomberg

This measure tracks the total output produced with a given input of labor. The work ethic of the U.S. employee has always been something this country has been proud of that has given us unprecedented economic growth. You may hear that the workforce — especially in the younger cohort — is not as productive as it was, but I think that is something that every generation deals with.

Another area that significantly contributes to employers’ consideration when looking at their workforce is the labor force participation rate. The chart below shows total participation going back to 1980.

Source: Bloomberg

As you can see, we are not even back up to pre-pandemic levels, and significantly below highs from the 1990s. This shows that employers are having a harder time finding employees and are forced to pay up to attract workers. The reasons for this decline are more than the pandemic, as this slide started before. More able-bodied workers are not pursuing employment. You could do a serious study on that, which most likely would encompass more than jobs. It is a change in the work ethic of this country.

This increase in wages is not good for inflation, as businesses have to raise prices to offset their higher labor costs. The result is hopefully only a breakeven for the workers, but in some cases their incomes are not keeping up. If productivity increases, this helps offset higher labor costs, as you are getting more output for a level of input.

Pay

The wage portion of the equation for the third quarter came in at a negative 0.8%, as seen below. While wages are not falling significantly, it does put the Unit Labor Costs below the recent trend.

Source: Bloomberg

The strength in productivity is helping hold down labor costs. Hourly compensation rose at a 3.9% annualized rate, faster productivity pushed costs down for the quarter and up only 1.9% over the past year. This is in line with pre-pandemic and services inflation — the fastest growing sector — should start to slow as well. This is great news for employers and the FOMC.

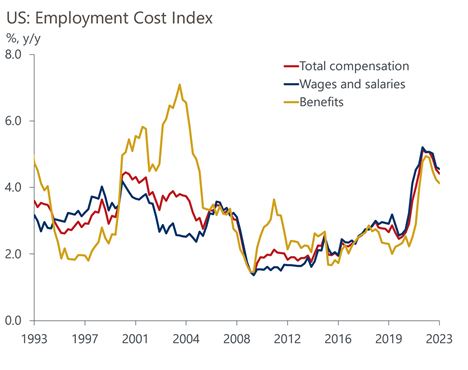

Employers’ total labor cost is better captured in the Employment Cost Index (ECI). As you can see below, the year-over-year change for the third quarter showed a decline, again helping to keep the FOMC on pause.

Source: Oxford Economics/Haver Analytics

We still need a sustained downtrend in wages/compensation for the FOMC to feel they have arrested the upwards trend of inflation. In addition, the JOLTS quit rate is falling, and this is a precursor to decreasing ECI.

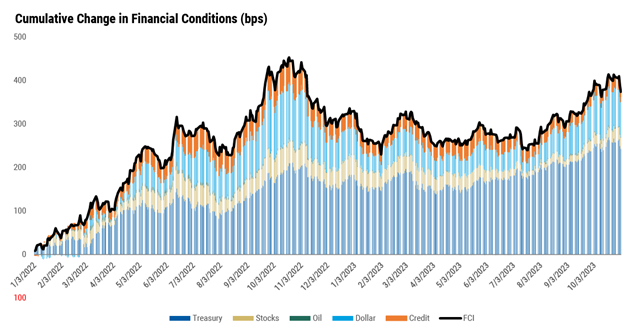

The overall tightness of financial conditions has eased a bit, as you can see below, due to lower UST rates, but there is still enough restriction to help the FOMC slow down the economy and inflation.

Source: Bloomberg / Morgan Stanley Research

Economic releases

Last week’s calendar was jam packed. As the week went along, a positive vibe developed for the soft landing scenario. A lower-than-expected quarterly refunding announcement, perceived pivoting FOMC announcement and moderating payroll release fueled the momentum.

This week’s calendar is very light with Consumer Credit, Jobless Claims and Consumer Sentiment providing information. See below for details.

Wrap-Up

I know that post lunch is my lowest point of productivity during the day, so it is good to plan meetings or events that don’t require me to have absolute focus. Not to say meetings are non-productive, as long as they have a solid purpose and goal. The market’s goal will involve determining the impact of productivity on labor costs and that impact on the overall economy.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 7-Nov | Trade Balance | Sep | -$60.0B | -$58.3B |

| 7-Nov | Consumer Credit | Sep | $9.000B | $15.628B |

| 7-Nov | MBA Mortgage Applications | 3-Nov | N/A | -2.1% |

| 8-Nov | Wholesale Trade Sales MoM | Sep | N/A | 1.8% |

| 8-Nov | Wholesale Inventories MoM | Sep | 0.0% | 0.0% |

| 9-Nov | Initial Jobless Claims | 4-Nov | 220,000 | 217,000 |

| 9-Nov | Continuing Claims | 28-Oct | 1,830,000 | 1,818,000 |

| 10-Nov | UM (Go UW) Consumer Sentiment | Nov | 63.5 | 63.8 |

| 10-Nov | UM (Go UW) Current Conditions | Nov | N/A | 70.6 |

| 10-Nov | UM (Go UW) Expectations | Nov | N/A | 59.3 |

| 10-Nov | UM (Go UW) 1-yr inflation | Nov | N/A | 4.2% |

| 10-Nov | UM (Go UW) 5-10-yr inflation | Nov | N/A | 3.0% |

| 10-Nov | Monthly Budget Statement | Oct | -$29.5B | -$171.0B |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.