Tight enough? — Week of October 9, 2023

Essential Economics

— Mark Frears

How tight?

Something I learned at an early age that is still with me is “righty tighty, lefty loosey.” In case you are not familiar with the phrase, it refers to turning a screw, bolt, or nut to the right (clockwise) to tighten and turning it to the left (counterclockwise) to loosen. This has so many applications, like opening a jar, or tightening a garden hose — most anything with threads.

Monetary policy can also be tight or loose, and you need something other than a socket wrench or a screwdriver to address this.

Tight

Monetary policy is considered to be in a tightening mode when the Fed is increasing rates. They are attempting to make financial conditions tighter and make money less available. The purpose is to slow the economy down, as they are concerned about inflation. We have seen unprecedented tightening by the Fed. As you can see below, the pace of tightening has never been faster.

Source: Bloomberg

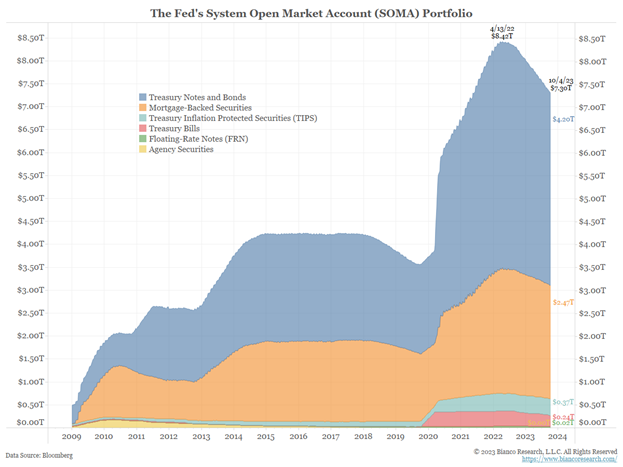

At the same time that they have been raising short-term rates, they have been unwinding the Quantitative Easing, or dumping of money into the system, that happened during the pandemic. They are selling the securities on their balance sheet, effectively pulling money out of the system. As you can see below, while they have pulled out over one trillion dollars, they still have a long way to go to get back down to historical normal levels.

Source: Bloomberg

While these two measures show that conditions are tightening, and we have seen price improvements with inflation measures falling, we don’t seem to be done yet. The Fed has an inflation target of 2% on Core Personal Consumption Expenditures (PCE), currently running at 3.9%. It is down from a peak of 5.57%, but not to the 2% target yet.

One of the biggest questions left out there is whether the Fed has done enough. They need to let the impact of their moves work their way into the monetary system. One thing that makes money less available is higher rates, and while the Fed controls the overnight rate, the U.S. Treasury rates are market driven. With the Fed on the sidelines, the longer end of the market has decided to believe that the Fed may keep rates higher for longer, and we have seen a dramatic shift up in rates, as you can see below.

Source: Bloomberg

The dark green curve is current rates, and the lower line is rates a month ago. What do higher rates do to the economy? First of all, mortgage rates are higher by at least 0.50%. This makes home even less affordable and will slow down this market. Second, this makes the debt of the U.S. government more expensive to service. On top of political shenanigans, the debt of the country continues to rise and costs more. Third, as companies roll over debt, they have to deal with higher payments.

Other things contributing to tighter conditions are student loan payments kicking back in and shrinking savings of consumers. One thing to note in the first chart above is that recessions usually follow tightening cycles.

Fed funds futures seem to think the Fed has done enough and there is enough restriction in monetary policy to leave short-term rates alone. This will be highly dependent on future data, and we have our next glimpse into inflation with Consumer Price Index and Producer Price Index this week.

Loose

The other side of the coin is loosening monetary policy, and this is when the Fed is concerned about stimulating the economy, by making money more available. One way they have put more money into the economy is through Quantitative Easing as they did during the recession. They were forced to do this as short-term interest rates (their primary tool) were already at zero and they needed to find other creative ways to loosen monetary conditions. You can see in the chart above showing the Fed’s portfolio that they really dumped a lot of money into the system, and this has facilitated the inflationary environment we are experiencing. They have a very delicate job with no manual, especially given the unusual economic circumstances we have experienced.

In the current environment, the Fed has made it very clear that conquering inflation has to happen before they stop “righty tighty.”

Employment

One very significant area the Fed is watching is the labor market. As consumers make up two-thirds of the Gross Domestic Product (GDP), the employment status and wage information are significantly monitored. Last Friday we had the latest picture of the labor market, and employers are still hiring!

Expectations were for 170,000 jobs to be added in September, and the number came in at 336,000 — lots of people being hired. In prior months, we have seen downward revisions to previous releases, but this time we saw an upward revision of over 100,000, making this an even bigger surprise to the upside.

While this is good economic news, the markets are still concerned about an overheating economy and inflation that won’t go quietly into the still night. Initially the reaction was negative for equities, but someone poured more water in the glass and perception changed with a positive finish to the day. The wage component did not go up as much as expected, so that is positive for continued decline in inflation.

Economic releases

Last week’s calendar was highlighted by employment releases, and we also saw continued slowing in ISM metrics, especially New Orders.

This week we have Producer Price Index and Consumer Price Index highlighting the show. In addition, FOMC minutes from the September meeting will be released, as will the UM Consumer Sentiment. See below for details.

Wrap-Up

While tight monetary policy is meant to be restrictive, we are still seeing continued growth, especially in Texas. There should be slowing ahead. Something to be said about all those small things you learned as a child still working today.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 10-Oct | NFIB Small Business Optimism | Sep | 91.0 | 91.3 |

| 10-Oct | Wholesale Inventories MoM | Aug | -0.1% | -0.1% |

| 10-Oct | NY Fed 1-yr inflation expectations | Sep | N/A | 3.63% |

| 11-Oct | Producer Price Index MoM | Sep | 0.3% | 0.7% |

| 11-Oct | PPI ex Food & Energy MoM | Sep | 0.2% | 0.2% |

| 11-Oct | Producer Price Index YoY | Sep | 1.6% | 1.6% |

| 11-Oct | PPI ex Food & Energy YoY | Sep | 2.3% | 2.2% |

| 11-Oct | FOMC Meeting Minutes from Sep 20 released at 1p CT | |||

| 12-Oct | Consumer Price Index MoM | Sep | 0.3% | 0.6% |

| 12-Oct | CPI ex Food & Energy MoM | Sep | 0.3% | 0.3% |

| 12-Oct | Consumer Price Index YoY | Sep | 3.6% | 3.7% |

| 12-Oct | CPI ex Food & Energy YoY | Sep | 4.1% | 4.3% |

| 12-Oct | Real Avg Hourly Earnings YoY | Sep | N/A | 0.5% |

| 12-Oct | Real Avg Weekly Earnings YoY | Sep | N/A | 0.3% |

| 12-Oct | Initial Jobless Claims | 7-Oct | 210,000 | 207,000 |

| 12-Oct | Continuing Claims | 30-Sep | 1,675,000 | 1,664,000 |

| 13-Oct | Import Price Index MoM | Sep | 0.5% | 0.5% |

| 13-Oct | Export Price Index MoM | Sep | 0.5% | 1.3% |

| 13-Oct | UM (Go UW) Consumer Sentiment | Oct | 67.0 | 68.1 |

| 13-Oct | UM (Go UW) Current Conditions | Oct | 70.5 | 71.4 |

| 13-Oct | UM (Go UW) Expectations | Oct | 65.7 | 66.0 |

| 13-Oct | UM (Go UW) 1-yr inflation | Oct | 3.3% | 3.2% |

| 13-Oct | UM (Go UW) 5- to 10-yr inflation | Oct | 2.9% | 2.8% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.