Is inflation gone? — Week of September 16, 2024

Essential Economics

— Mark Frears

Not done yet

It is now September, and the summer heat is over, right? We had some nice 60-degree mornings earlier this month, but that was just a tease. We are back up to 90-degree days with 70-degree nights; summer is not done yet. I recall many years when we were sweltering at the Texas State Fair, late in September.

The talk from the “hair spray pundits” (thank you Steve Orr), is that inflation is conquered, and the Federal Open Market Committee (FOMC) can now focus on their other mandate of full employment. Chair Powell has assisted in this froth based on his Jackson Hole comment. Are we really done with the inflation fight?

Current state

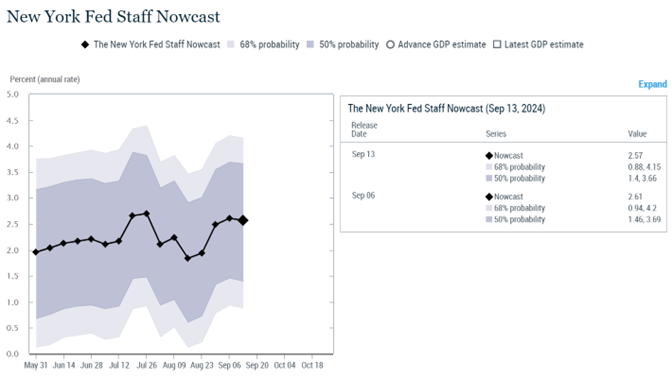

The primary reason the FOMC should be easing, or cutting, interest rates is to stimulate the economy. This is accomplished by adding more fuel to the economy through lower borrowing costs and causing business investment to ramp up. We are starting to see some cracks in the strong economic story, such as slower vehicle sales, tougher credit conditions for small business, manufacturing new orders and pending home sales. Does this signal a recession is imminent, or simply a slow down? The most recent N.Y. Fed estimate of Q3 GDP is seen below. We are up from earlier estimates, due to recent inputs, and 2.5% is still solid.

Source: New York Federal Reserve Bank

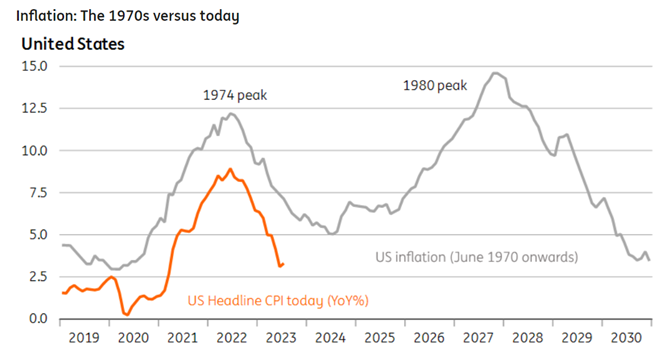

On the FOMC’s other mandate, price control, we have seen material progress, as can be seen in the orange line below. The trillion dollar question is whether we will continue this downward trend, or have an upswing, as the chart shows happened in the 1970s.

Source: ING.com

What are the areas we need to keep an eye on where prices could heat back up?

Labor

We have heard the pundits hyping the improved labor market, meaning it is not as tight, and hiring is slowing. The uptick in the unemployment rate is only to 4.2%, and that is not a level associated with layoffs and no jobs available. The JOLTS, or jobs available, metric has declined but the higher level that was achieved was suspect at best. So, are we really seeing hiring slowing, and layoffs coming, enough to cause the FOMC to worry about stimulating the economy?

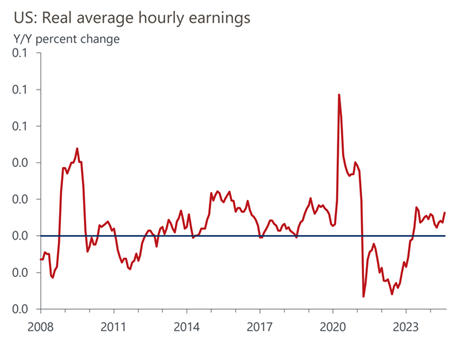

Wages are one of the primary things they are monitoring, as if people continue to get paid, they will continue to spend, possibly enough to keep prices firm. The chart below shows wages, on a year-over-year basis, are trending back up.

Source: Oxford Economics/Haver Analytics

The other concern on the labor front is strikes. You can look at this from both sides. One, they could slow the economy, causing the need for stimulus, or two, due to the continued demand for products, they will be settled with workers gaining higher wages. Number two seems to be more likely.

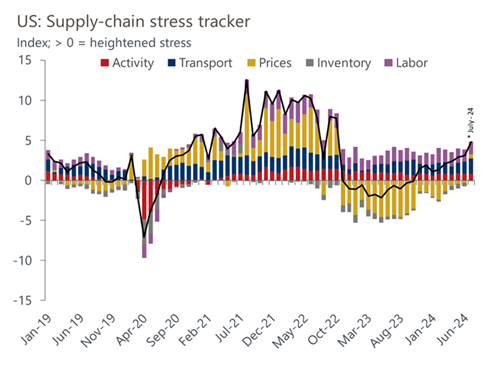

Supply chain

Remember this from the pandemic? It has not gone away. The chart below shows the stress tracker is heating back up, with all four components contributing.

Source: Oxford Economics/Haver Analytics

Orders for Christmas are backing up ports, and labor issues are adding to the stress. A brief strike on the two major Canadian railroads last month is still reverberating. In addition, potential strikes on the East and West coasts for the International Longshoreman's Associate (ILA) could impact 60% of shipping traffic. This strike is tentatively scheduled for October 1 and if allowed to go on for two weeks, this could disrupt supply chains into 2025.

These disruptions could cause prices to increase again, like the 1970s scenario shown above.

Housing

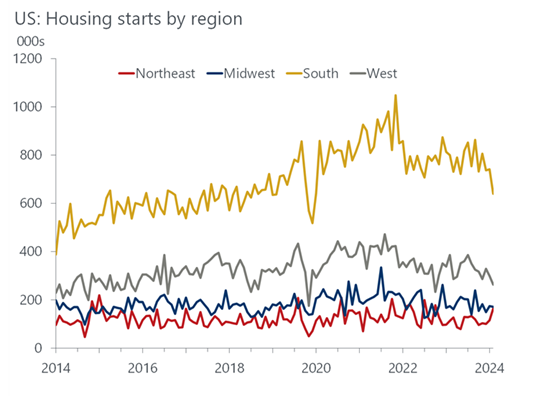

If the FOMC lowers rates, will this help housing costs? Not necessarily. Mortgages, usually associated with the 10-year U.S. Treasury rate, have already priced in the FOMC potential cut for this week, so no help there. The primary issue with unaffordable housing is supply. As you can see below, there are not enough homes being built and the demand is only growing.

Source: Oxford Economics/Haver Analytics

The one place that a short-term rate cut could help is borrowing costs for home builders. One cut for 25 basis points (0.25%) is not going to move that needle. This is a longer-term problem, and continued tight supply will keep housing prices higher than desired.

FOMC

The futures markets have a 25 basis point cut priced in for this week, and there is even a possibility for a 50 basis point cut out there. This is a big decision for the FOMC. If they cut too soon, and prices ramp back up, they will have to pause on cuts and perhaps increase rates again. Maybe they are seeing more economic strife than we are aware of and that could cause them to make a cut now. Waiting for Wednesday!

We will also get new Summary of Economic Projections, so the pontification for the next move can start immediately.

Economic releases

Last week we had CPI, PPI and consumer sentiment. Some good, some not so good, but no material changes.

This week’s calendar is all about the FOMC on Wednesday. In addition, we have some housing numbers and retail sales. See below for more details.

Wrap-Up

Seventy degrees will sound nice when we have a freeze in February, but I am ready for cooler temperatures. Is the FOMC locked in for this cut? Will it backfire on them? Stay tuned. Same bat channel, same bat time.

Upcoming Economic Releases: | Period | Expected | Previous | |

| 16-Sep | Empire Manufacturing | Sep | (4.0) | (4.7) |

| 17-Sep | Retail Sales MoM | Aug | -0.2% | 1.0% |

| 17-Sep | Retail Sales ex Autos MoM | Aug | 0.2% | 0.4% |

| 17-Sep | NY Fed Services Business Activity | Sep | N/A | 1.8 |

| 17-Sep | Industrial Production MoM | Aug | 0.2% | -0.6% |

| 17-Sep | Capacity Utilization | Aug | 77.9% | 77.8% |

| 17-Sep | Business Inventories | Jul | 0.3% | 0.3% |

| 17-Sep | NAHB Housing Market Index | Sep | 41 | 39 |

| 18-Sep | Building Permits | Aug | 1,412,000 | 1,440,000 |

| 18-Sep | Building Permits MoM | Aug | 1.1% | -3.0% |

| 18-Sep | Housing Starts | Aug | 1,316,000 | 1,360,000 |

| 18-Sep | Housing Starts MoM | Aug | 6.3% | 5.7% |

| 18-Sep | FOMC Rate Decision (Upper Bound) | 1p CT | 5.25% | 5.50% |

| 18-Sep | FOMC Rate Decision (Lower Bound) | 1p CT | 5.00% | 5.25% |

| 19-Sep | Philadelphia Fed Business Outlook | Sep | (1.0) | (7.0) |

| 19-Sep | Initial Jobless Claims | 14-Sep | 230,000 | 230,000 |

| 19-Sep | Continuing Claims | 7-Sep | 1,855,000 | 1,850,000 |

| 19-Sep | Leading Index | Aug | -0.3% | -0.6% |

| 19-Sep | Existing Home Sales MoM | Aug | -1.3% | 1.3% |

| 19-Sep | Existing Home Sales | Aug | 3,900,000 | 3,950,000 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI