Are you a borrower or a lender? — Week of September 23, 2024

Essential Economics

— Mark Frears

Two sides

Are you a borrower or a lender? Depending on which side you are on, the Federal Open Market Committee’s (FOMC) rate cutting move will impact you differently.

Twenty-five or 50 finally had a conclusion last week. Kind of. We did find out the FOMC cut short-term rates by 50 basis points (bp), or 0.50%, but what did this accomplish?

Current state

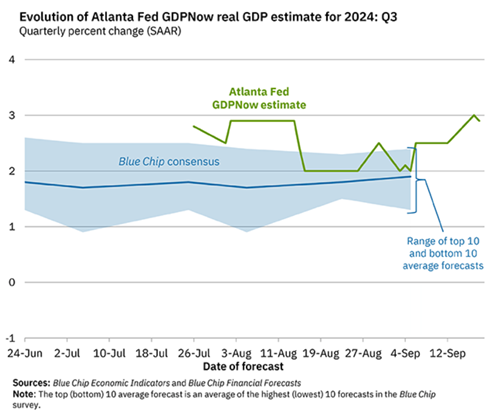

The move by the FOMC is a change in policy, signaling they need to move toward stimulating the economy, versus the inflation fight they had been focusing on. As you can see below, the Atlanta Fed’s estimate for Q3 Gross National Product (GDP) is approximately 3%. If you went with the Blue Chip consensus, this is closer to 2%.

Source: Atlanta Federal Reserve Bank

If the Atlanta Fed is correct, then Q4 GDP would have to be 0.7% to be in line with the FOMC’s Summary of Economic Projections (SEP) forecast of 2%. If the Blue Chip consensus is correct, that would make Q4 GDP of 1.7%. Both of these seem like a significant slowdown from the current economy. What does the Fed know that we don’t?

Borrowers

The rate the FOMC cut was the Fed Funds (FF) target rate. They lowered it from a range of 5.25-5.50% to a 4.75-5.00%. The primary market this rate is involved in is trading overnight funds between banks. This will not move the needle on the economy. They also lowered the rate paid by the Fed on excess funds left at the Federal Reserve Bank, hurting bank earnings.

The rate the FOMC cut was the Fed Funds (FF) target rate. They lowered it from a range of 5.25-5.50% to a 4.75-5.00%. The primary market this rate is involved in is trading overnight funds between banks. This will not move the needle on the economy. They also lowered the rate paid by the Fed on excess funds left at the Federal Reserve Bank, hurting bank earnings.

As far as impact to the broader economy, this rate cut will lower Prime Rate by 50bp, from 8.50 to 8%, which is the benchmark for smaller businesses to borrow against. In addition, the term Secured Overnight Funding Rate (SOFR), which became the reference rate for most LIBOR-based loans when LIBOR was discontinued in June 2021, will adjust down by approximately 50bp. Larger corporation loans are benchmarked off this rate, at a spread above, based on their creditworthiness.

In dollars and cents, this would lower their borrowing costs, on a 1 million dollar loan by $5,000 annually, or $417 per month. That really doesn’t sound like that much stimulus.

On the consumer side, over the past few weeks, mortgage rates have moved down, in anticipation of a Fed more concerned about the economy. Now that the Fed has moved, the longer end of the curve (mortgage rates) will look further at inflation expectations and longer-term economic expectations. As this rate is NOT tied to the Fed’s manipulated rate, this will be driven by market conditions.

Lenders

On the other side of the coin, lenders would see their income/payment drop by that same amount. They will have to adjust funding or another part of their income statement to maintain consistent margins.

Now let’s move to the consumer side. One nice impact of higher prices over the past few years is that the Fed drove short-term rates up in their quest to fight inflation. This has given savers the benefit of earning interest on their cash balances. Someone with $100,000 was able to earn $5,000 per year when rates were at 5%. This is in contrast to the extended period when the Fed held short-term rates down to zero, when these savers could earn virtually nothing. If the Fed continues to lower rates, this will continue to impact short-term U.S. Treasuries (UST) and bank Certificates of Deposit, taking away income from the consumers.

Expectations

While this was only one move, it was significant. First, providing stimulus to the economy this close to a presidential election is unprecedented. The Fed promotes itself as an independent organization, and this could show support for the current administration. When Powell was asked about this, he stated that they do not consider election cycles in their determinations. Second, the discussion soon shifted to “What is next?”. Markets are trying to determine if this is the first of a number of moves lower, or a one-time change. People assume it will be the start of a series, and the next question is, “How fast?”.

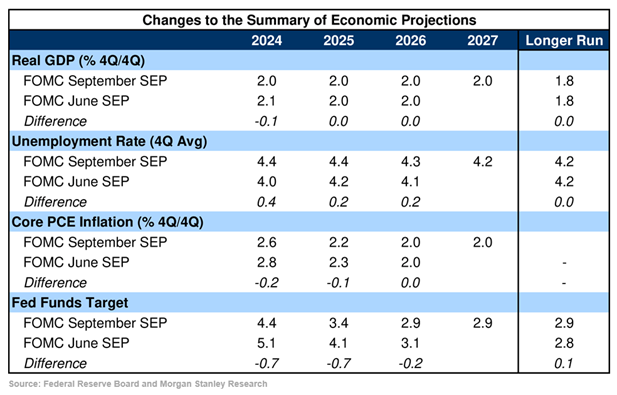

The SEP is published quarterly and is the best place to look for forward guidance. As the chart below shows, the FF target at the end of 2024 is now expected to be 4.4%. After the move last week, the average target is now approximately 4.8%, indicating another 75bp of easing left this year.

Source: Atlanta Federal Reserve Bank

The primary takeaway from this is that the Fed is no longer concerned about inflation, as they have stated multiple times. They believe it is headed back to their long-term target of 2%, and they have issues with the ongoing strength of the economy. Given the potential headwinds on the inflation side we highlighted last week, the “data dependent” Fed may have to redirect its course.

Whether this is a recalibration to moving to an easier monetary policy, or a shot across the bow, we will have to stay tuned.

Economic releases

Last week was fully focused on the FOMC meeting, and they did not disappoint.

This week’s calendar is full, with consumer confidence, second guess at Q2 GDP, durable goods, personal income and spending and ending with consumer sentiment on Friday. See below for more details.

Wrap-Up

While the immediate impacts of the FOMC move are not material, the change in direction for policy is significant. The winds of change can change quickly and dramatically, so they had best keep a strong hand on the tiller and be prepared to change tack.

| Upcoming Economic Releases: | Period | Expected | Previous | |

| 23-Sep | Chicago Fed Natl Activity Index | Aug | (0.20) | (0.34) |

| 23-Sep | S&P Global US Manufacturing PMI | Sep P | 48.6 | 47.9 |

| 23-Sep | S&P Global US Services PMI | Sep P | 55.2 | 55.7 |

| 23-Sep | S&P Global US Composite PMI | Sep P | 54.3 | 54.6 |

| 23-Sep | Philadelphia Fed Non-Manuf Activity | Sep P | (9.3) | (25.1) |

| 24-Sep | FHHA House Price Index MoM | Jul | 0.20% | -0.10% |

| 24-Sep | S&P CoreLogic 20-city YoY | Jul | 6.10% | 6.47% |

| 24-Sep | Conf Board Consumer Confidence | Sep | 104.0 | 103.3 |

| 24-Sep | Conf Board Present Situation | Sep | N/A | 134.4 |

| 24-Sep | Conf Board Expectations | Sep | N/A | 82.5 |

| 24-Sep | Richmond Fed Manufacturing Index | Sep | (12) | (19) |

| 24-Sep | Richmond Fed Business Conditions | Sep | N/A | (13) |

| 25-Sep | New Home Sales | Aug | 700,000 | 739,000 |

| 25-Sep | New Home Sales MoM | Mar | -5.3% | 10.6% |

| 26-Sep | GDP Annualized QoQ | Q2 | 3.0% | 3.0% |

| 26-Sep | Personal Consumption | Q2 | 2.9% | 2.9% |

| 26-Sep | GDP Price Index | Q2 | 2.5% | 2.5% |

| 26-Sep | Durable Goods Orders | Aug P | -2.8% | 9.8% |

| 26-Sep | Durable Goods ex Transportation | Aug P | 0.1% | -0.2% |

| 26-Sep | Cap Goods Orders Nondef ex Aircraft | Aug P | 0.1% | -0.1% |

| 26-Sep | Initial Jobless Claims | 21-Sep | 225,000 | 219,000 |

| 26-Sep | Continuing Claims | 14-Sep | 1,833,000 | 1,829,000 |

| 26-Sep | Pending Home Sales MoM | Aug | 1.0% | -5.5% |

| 26-Sep | KC Fed Manufacturing Activity | Sep | N/A | (3) |

| 27-Sep | Personal Income | Aug | 0.4% | 0.3% |

| 27-Sep | Personal Spending | Aug | 0.3% | 0.5% |

| 27-Sep | Real Personal Spending | Aug | 0.1% | 0.4% |

| 27-Sep | PCE Deflator YoY | Aug | 2.3% | 2.5% |

| 27-Sep | PCE Core Deflator YoY | Aug | 2.7% | 2.6% |

| 27-Sep | Retail Inventories MoM | Aug | 0.6% | 0.8% |

| 27-Sep | Wholesale Inventories MoM | Aug P | 0.2% | 0.2% |

| 27-Sep | Consumer Sentiment | Sep F | 69.4 | 69.0 |

| 27-Sep | Current Conditions | Sep F | N/A | 62.9 |

| 27-Sep | Expectations | Sep F | N/A | 73.0 |

| 27-Sep | 1-yr inflation | Sep F | N/A | 2.7% |

| 27-Sep | 5-10-yr inflation | Sep F | N/A | 3.1% |

| 27-Sep | KC Fed Services Activity | Sep | N/A | 5 |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI