What is your financial condition? — Week of September 30, 2024

Essential Economics

— Mark Frears

Assessment

What is your financial condition? How do you determine that? Assets, net worth, emergency savings, credit score and giving, or just whether you have something left in your account at the end of the month?! Having a plan is first and foremost, then reviewing it at least annually. Probably good to include your wife/husband on those discussions as well; nice to both be on the same page.

The Fed and Federal Open Market Committee (FOMC) talk about the financial condition of the U.S. economy. How are they determining that?

Economic growth

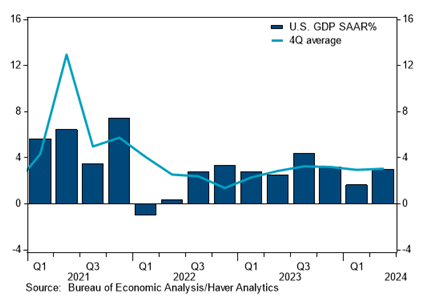

For the third week in a row, we will start off with a Gross Domestic Product (GDP) chart (see below). It is all about the economy, right? Last week, we had the “second guess” release for Q2 GDP, as well as revisions to prior quarters. Let’s just say the revisions were all higher. This economy is stronger than earlier stated, with the past four quarters averaging 3%.

As an indicator, albeit a historical view, that looks pretty good. We are never satisfied with that though; now it is time to get out the crystal ball.

Financial conditions index (FCI)

A metric that covers financial conditions sounds kind of vague, and it is. There are multiple ways to look at asset prices and interest rates, that are influenced by many things, including monetary policy, to see the impact on the real economy. Even the idea of it is confusing. First of all, you have to choose the variables that will impact the economy, out of the hundreds available. Second, you have to weight them appropriately, so they have a more realistic impact. Third, you would like to be able to understand it.

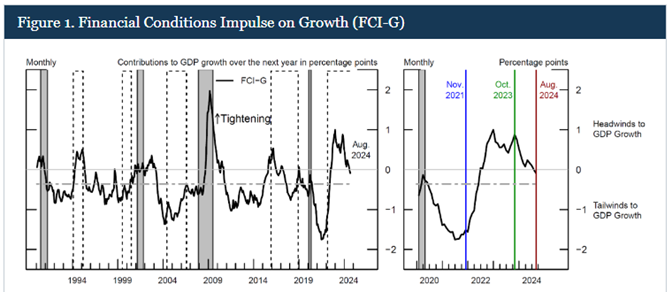

The Fed has a relatively new index that is worth looking at. It has seven financial variables, weighted according to households’ spending and business investment decisions.

The seven variables are the federal funds rate, the 10-year U.S. Treasury (UST) yield, the 30-year fixed mortgage rate, the triple-B corporate bond yield, the Dow Jones total stock market index, the Zillow house price index and the nominal broad dollar index. This new index will be called FCI-G, as shown below.

Source: Haver Analytics, Decennial Census of Population and Housing; CoreLogic; Fed calculations

Digging into the model

Historically, financial conditions are thought of as either tight or loose in terms of monetary policy; this is what FCIs have indicated. FCI-G’s output is in headwinds (tighter), or tailwinds (looser) to GDP growth, as seen above. This model also considers lags as to how much the change in the specific variable has an impact on GDP. As it has less impact over time, the weight of that variable is decreased.

Most importantly, this index is forward-looking as the results pertain to the year-ahead GDP.

Takeaways

Looking at the chart above, we can see the headwinds to growth during the gray-shaded past recessions. The right-hand side of the chart takes a closer look at the past four years. We have gone from a strong tailwind to growth in November 2021 to a peaking headwind in October of 2023. This is based on these seven variables, with the appropriate weights and lags.

At the current time, we are right about zero. This would indicate financial conditions are not pushing the economy toward recession, or a boom, but negligible impact.

In order to see the bigger picture, we must take a broader view. While financial conditions, as tracked by these variables, do not indicate a significant impact, there are other significant inputs. As we are well aware, fiscal stimulus (government spending) has had an outsized impact on the economy since the pandemic, and this does not seem to be slowing down. In addition, we know there are more than seven variables impacting the economy.

What this FCI-G model gives us is a new view as to how different inputs drive economic growth, and the tough task it is to determine the best variables to monitor.

Economic releases

Last week had multiple releases, with most of them showing an economy that was stronger than expected.

This week’s calendar is all about employment, and given the FOMC’s focus on this area, there will be much to digest. See below for more details.

Wrap-Up

The financial conditions of the U.S. economy are very important to all of us. Don’t forget to assess your own family’s financial conditions, and whether this is meeting your long-term goals.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 30-Sep | Dallas Fed Manuf Activity | Sep | (10.3) | (9.7) |

| 30-Sep | MNI Chicago PMI | Sep | 46.0 | 46.1 |

| 1-Oct | Construction Spending MoM | Aug | 0.2% | -0.3% |

| 1-Oct | JOLTS Job Openings | Aug | 7,660,000 | 7,673,000 |

| 1-Oct | ISM Manufacturing Index | Sep | 47.6 | 47.2 |

| 1-Oct | ISM Manufacturing Prices Paid | Sep | 53.8 | 54.0 |

| 1-Oct | ISM Manufacturing Employment | Sep | N/A | 46.0 |

| 1-Oct | ISM Manufacturing New Orders | Sep | N/A | 44.6 |

| 1-Oct | Dallas Fed Services Activity | Sep | N/A | (7.7) |

| 1-Oct | Ward's Total Vehicle Sales | Sep | 15,640,000 | 15,130,000 |

| 2-Oct | ADP Employment Change | Sep | 125,000 | 99,000 |

| 3-Oct | Challenger Job Cuts YoY | Sep | N/A | 1.0% |

| 3-Oct | Initial Jobless Claims | 28-Sep | 221,000 | 218,000 |

| 3-Oct | Continuing Claims | 21-Sep | 1,830,000 | 1,834,000 |

| 3-Oct | Factory Orders | Aug | 0.1% | 5.0% |

| 3-Oct | Factory Orders ex Transportation | Aug | N/A | 0.4% |

| 3-Oct | ISM Services Index | Sep | 51.6 | 51.5 |

| 3-Oct | ISM Services Prices Paid | Sep | N/A | 57.3 |

| 3-Oct | ISM Services Employment | Sep | N/A | 50.2 |

| 3-Oct | ISM Services New Orders | Sep | N/A | 53.0 |

| 4-Oct | Change in Nonfarm Payrolls | Sep | 146,000 | 142,000 |

| 4-Oct | Change in Private Payrolls | Sep | 125,000 | 118,000 |

| 4-Oct | Unemployment Rate | Sep | 4.2% | 4.2% |

| 4-Oct | Avg Hourly Earnings MoM | Sep | 0.3% | 0.4% |

| 4-Oct | Avg Hourly Earnings YoY | Sep | 3.8% | 3.8% |

| 4-Oct | Labor Force Participation Rate | Sep | 62.7% | 62.7% |

| 4-Oct | Underemployment Rate | Sep | N/A | 7.9% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI