Do you love your job or your paycheck? — Week of September 4, 2023

Essential Economics

— Mark Frears

Hours and Hours

Most of us have a job to provide for our families, and hopefully you are challenged and have a sense of fulfillment in your occupation as well. Working at a salmon cannery on Kodiak Island paid the bills, but betterment of humanity was lacking. Bottom line, are you making enough to cover your expenses, add some to savings, and feel confident that your paycheck will continue to arrive?

The labor market is the primary driver of growth in the economy. If you have a job, you are spending and influencing Gross Domestic Product (GDP). So, what is the current state of this essential area?

50,000-foot view

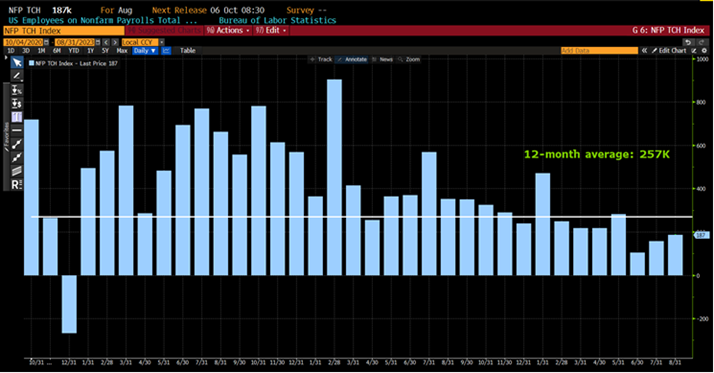

We just had the big monthly release on the labor market, Nonfarm Payroll, last week. This shows the number of jobs added to the economy in the last month. As you can see below, we are still adding a material number, although the trend is slowing.

Source: Bloomberg

Is this good news or bad news?! As with most things, it depends on your perspective. A solid labor market reflects strong economic growth, but given the current higher-than-desired inflationary environment, we don’t want it to run too hot. Too much strength fuels inflation, and the Fed is committed to fighting that battle.

From the Fed’s perspective, there were some favorable reports this week. If they see a slowing economy and improving price pressure, they will take a pause. The Fed Funds futures market now shows only a 7% chance they raise rates at their September 20 meeting, and a 38% chance in November. First, the Job Openings and Labor Turnover Survey (JOLTS) showed a decrease in job availability this week. If there are fewer job openings available, this potentially shows employers are not as confident about hiring. This metric does not have a lot of fans, in that it doesn’t seem realistic. Based on my son’s friends who have submitted hundreds of job applications, with few responses, there may be some sampling error involved. Second, if we have some confidence in this release, another point of weakness was the quits rate, the percentage of resignations relative to total employment. This fell to 2.3%, the lowest since January 2021 and matching the average for pre-pandemic levels in 2019. People are not as confident that they can quit and find another job easily. Third, while the 187,000 jobs added last month was strong, the revision for the previous two months came out at -110,000, so the strength is fleeting. Fourth, wages for August were up only 0.2% and up 4.3% on a year-over-year basis. This continues a downward trend that peaked at almost 6% in March of 2022.

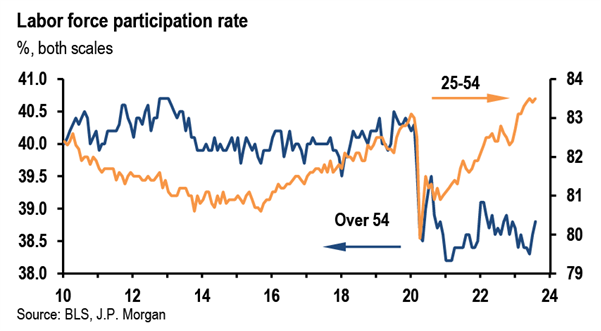

The unemployment rate also rose more than expected, to 3.8%. While still low, the increase was driven by more workers joining the workforce, with the participation rate improving to 62.8%. The addition of more workers helps employers fill openings, and more workers help to mitigate wage pressures. As you can see below, more of both young and old workers were added.

So, companies can find workers with wages starting to ease, and the Fed is content to see a slowing economy with less robust labor numbers.

Ground level

Enough about employers, how does the current labor market shape up for you and me? Let’s look at wages, expenses and your bargaining power.

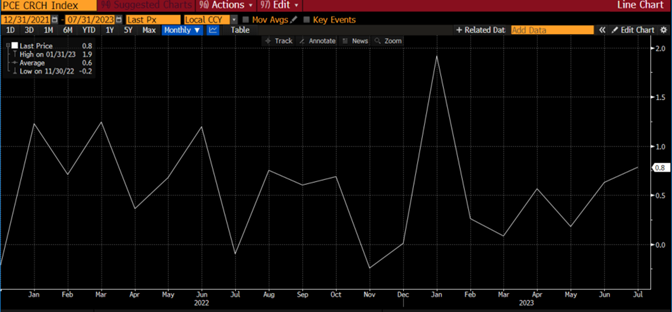

The Employment Cost Index (ECI) can be a good proxy for wages. As you can see below, while we are off the peak, wages are still above long-term trends.

Source: Bloomberg

Recently, wages have caught up with inflation, but for those living paycheck to paycheck, the increase in wages has still left them with lower living conditions due to continued higher prices.

ZipRecruiter reported that almost half of their posted jobs have seen reduced pay, helping explain some of the recent downturn seen in ECI.

While wages are perhaps at a high, people are not slowing down their spending. As you can see below in the Personal Spending Index, the last two months have seen an increase.

Source: Bloomberg

Expenses continue to stay higher than what people had become accustomed to. As you can see below, the cost of shelter continues to take an increasing percentage of families’ income.

While eggs may not be as expensive, overall food costs are also a significant part of the budget. In addition, student loan payments are kicking back in, and have a higher impact on low and middle-income families. The Fed acknowledges they are making progress at fighting inflation, but it is still running at a rate twice their long-term target.

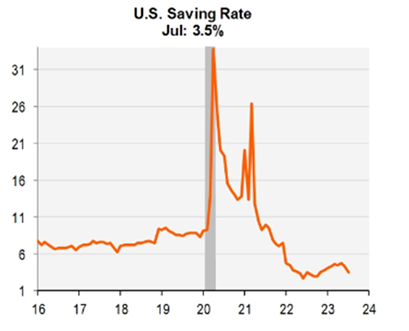

If the spending is continuing and income is not keeping up, how is the difference made up? First, consumers were using savings to fill this gap. As you can see below, the savings rate in July has taken another dip, staying below long-term trends.

Source: Piper/Sandler

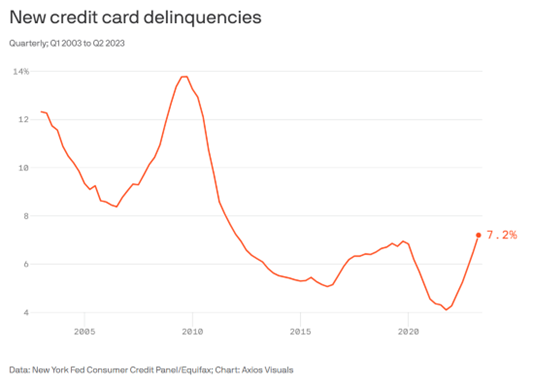

This trend cannot continue, as savings will be used up. The next alternative people use to fill the gap is credit cards. We have seen rising balances in credit card usage, and that can work for a while. The issue, as seen below, is that we are seeing rising delinquencies in payments.

In recent days, we have seen more focus on unions and organizations lobbying for higher wages. The employee’s bargaining power has increased in some industries, but this is not a widespread phenomenon. Workers also felt more in control with the ability to work from home (WFH). While many companies still offer this option, it is becoming less prevalent, as the productivity and synergies that come from collaboration in workspaces gains more value.

As the labor market continues to tighten with jobs less available and the need for wage increases abating, the economy will slow. The bigger question is whether markets and the Fed will have the patience to wait this out, or if the Fed will continue to raise short-term rates, increasing the high cost of doing business and pushing the US into recession.

Economic releases

Last week’s labor market releases showed a slowing trend. Other releases confirmed a moderating economy.

This week is very light with Institute of Supply Management’s Service Index, Productivity and Consumer Credit the highlights. See below for details.

Wrap-Up

Employment seems to be more transactional than career oriented. Less focus on good of the company and team, and more focus on “me.” Pay attention to trends as this perspective gains traction. I did hear there was a demand for beekeepers in Hamilton, Ontario; very temporary though.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 5-Sep | Factory Orders | Jul | -2.5% | 2.3% |

| 6-Sep | ISM Services Index | Aug | 52.5 | 52.7 |

| 6-Sep | ISM Services Prices Paid | Aug | N/A | 56.8 |

| 6-Sep | ISM Services Employment | Aug | N/A | 50.7 |

| 6-Sep | ISM Services New Orders | Aug | N/A | 55.0 |

| 6-Sep | Fed releases the Beige Book in preparation for the Sep 20 meeting | |||

| 7-Sep | Nonfarm Productivity | Q2 | 3.4% | 3.7% |

| 7-Sep | Unit Labor Costs | Q2 | 1.9% | 1.6% |

| 7-Sep | Initial Jobless Claims | 2-Sep | 234,000 | 228,000 |

| 7-Sep | Continuing Claims | 26-Aug | 1,715,000 | 1,725,000 |

| 8-Sep | Consumer Credit | Jul | $17.000B | $17.847B |

Mark Frears is an Investment Advisor, Executive Vice President, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.