The Fed’s balance sheet — Week of March 11, 2024

Essential Economics

— Mark Frears

Check-up

It is always a good idea to calculate your net worth on an annual basis. This helps you see changes and stay aware of trends, both positive and negative. It is a balance sheet, and you should examine both sides. While the assets may be impressive, you need to look at the big picture.

The Fed’s balance sheet is one of the tools they used to manage monetary policy.

Left side

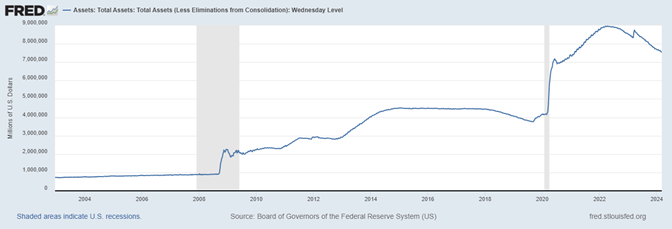

There has been a material increase in the size of the Fed’s assets, starting with the Great Financial Crisis (GFC) in the late 2000s. As you can see below, the increase has been sustained, and has only recently started to decline due to publicized sales.

Source: St. Louis Fed

The active use of the balance sheet as a monetary policy tool is a relatively new thing. The primary tool used to stimulate and slow the economy is the overnight Fed Funds (FF) rate target. As you can see below, when stimulus was needed during the GFC, FF rates were already essentially at zero. Some central banks around the world chose to use negative rates, while the Fed went to the balance sheet.

Source: Bloomberg

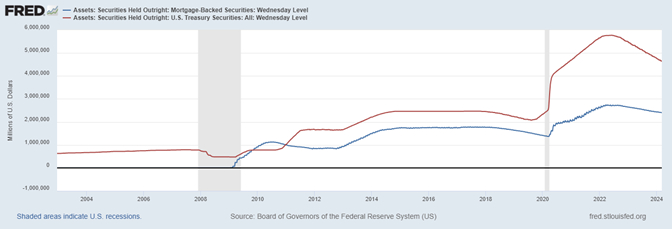

The thought process on using the balance sheet was to buy bonds from the market, as this would add cash, to be used to stimulate or sustain the economy. They bought both U.S. Treasuries (UST) and mortgage-backed bonds (MBS). You can see the makeup of these balances below.

Source: St. Louis Fed

You can see the decreasing balances starting in 2022, as this action pulled cash from the markets when these were sold, or allowed to mature. This was in coordination with the tightening emphasis of increasing short-term FF rates, in order to combat inflation.

Next steps

Most of the focus on the Fed is when and how much they will cut FF rates. A few inquiring minds are watching for what they will do with the balance sheet, perhaps as a pre-cursor to rate cuts. It does not make sense to continue selling securities, known as quantitative tightening (QT), when they lower rates, which would indicate easing or stimulating the economic conditions.

Chair Powell has stated that the discussion around balance sheet actions will ramp up starting with the March 19-20 meeting. Speculation is that if they reach a conclusion about QT during the May meeting, then the bond sales would end in June. Similarly, if they reach the conclusion at the June meeting, the sales would stop in July.

Bond market

While it does not get as much attention as the equity market, the fixed income arena bears watching as well. Even as the U.S. Treasury continues to issue more and more bills, notes and bonds, the Fed has to keep an eye on liquidity in the bond market as part of their stimulative/restrictive focus.

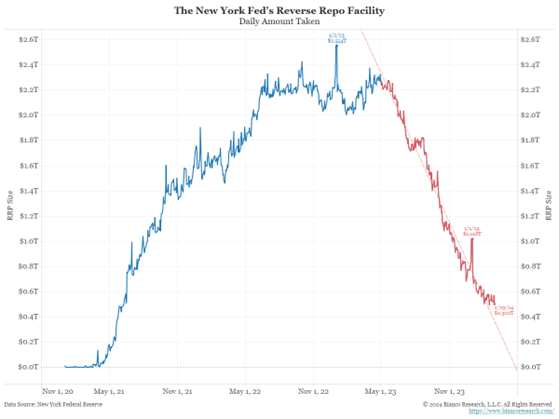

One closely watched area is the Reverse Repurchase Agreement Operations (RRPs) executed daily at the Federal Reserve Bank of New York. The structure of the trade is the Fed’s Desk will sell the security to the counterparty (usually a non-bank financial company, often a money market fund) and receive cash, taking the cash from the system. These transactions are usually for one night, with the agreement of the Desk to “re-purchase” the security the next day. Why would these transactions happen?

Non-bank financial institutions cannot deposit their excess funds at the Fed, as banks can. Banks can earn interest on these deposits, also known as reserves. Therefore, non-banks need a place to park cash on an overnight basis, and receive interest. They are depositing cash and receiving securities, so this is a secured deposit by the counterparty, as they hold the securities until the cash is received back.

As you can see below, the demand for this product/transaction is declining rapidly. This is telling the Fed that there is not as much excess liquidity in the system and this impact their monetary policy actions.

Source: New York Fed

Another consequence of the U.S. Treasury issuing more paper is that much of this is in short-term bills, and the non-banks are buying up the T-bills instead of using the RRP. This also has the impact of pulling liquidity from the market.

Accommodative or restrictive

As you can see, the Fed has a much more difficult task than just deciding whether to hike or cut short-term rates. The money markets and bond markets are many-splendored things that feed off each other and are very connected.

As the Fed attempts to bring the economy in for a soft landing, they are watching all these inputs. What doesn’t help their task is that while they are attempting to slow inflation by pulling money from the system, fiscal spending is pouring gasoline on the fire.

Economic releases

Last week was focused on the labor market and Chair Powell’s testimony on Capitol Hill. Payrolls came in about as expected and the perception of the testimony was that a rate cut will happen this year, probably starting in June.

This week’s calendar will be full of releases such as Retail Sales, PPI and the main attraction, CPI. See below for details.

Wrap-Up

It pays to watch the balance sheet, whether it is yours, or the Fed’s. They are allowed a few nuances in how they match up assets and liabilities, but you are not. Try to keep your assets greater than your liabilities, on your balance sheet, and in your life.

| Upcoming Economic Releases: | Period | Expected | Previous | |

| 11-Mar | NY Fed 1-yr inflation expectations | Feb | N/A | 3.00% |

| 12-Mar | NFIB Small Business Optimism | Feb | 90.2 | 89.9 |

| 12-Mar | Consumer Price Index MoM | Feb | 0.4% | 0.3% |

| 12-Mar | CPI ex Food & Energy MoM | Feb | 0.3% | 0.4% |

| 12-Mar | Consumer Price Index YoY | Feb | 3.1% | 3.1% |

| 12-Mar | CPI ex Food & Energy YoY | Feb | 3.7% | 3.9% |

| 12-Mar | Real Avg Hourly Earnings YoY | Feb | N/A | 1.4% |

| 12-Mar | Real Avg Weekly Earnings YoY | Feb | N/A | -0.1% |

| 12-Mar | Monthly Budget Statement | Feb | -$298.0B | -$21.9B |

| 14-Mar | Retail Sales MoM | Feb | 0.8% | -0.8% |

| 14-Mar | Retail Sales ex Autos MoM | Feb | 0.5% | -0.6% |

| 14-Mar | Producer Price Index MoM | Feb | 0.3% | 0.3% |

| 14-Mar | PPI ex Food & Energy MoM | Feb | 0.2% | 0.5% |

| 14-Mar | Producer Price Index YoY | Feb | 1.2% | 0.9% |

| 14-Mar | PPI ex Food & Energy YoY | Feb | 1.9% | 2.0% |

| 14-Mar | Initial Jobless Claims | 9-Mar | 219,000 | 217,000 |

| 14-Mar | Continuing Claims | 2-Mar | 1,903,000 | 1,906,000 |

| 14-Mar | Business Inventories | Jan | 0.2% | 0.4% |

| 15-Mar | Empire Manufacturing | Mar | (7.0) | (2.4) |

| 15-Mar | Import Price Index MoM | Feb | 0.3% | 0.8% |

| 15-Mar | Export Price Index MoM | Feb | 0.3% | 0.8% |

| 15-Mar | Industrial Production MoM | Feb | 0.0% | -0.1% |

| 15-Mar | Capacity Utilization | Feb | 78.5% | 78.5% |

| 15-Mar | UM Consumer Sentiment | Mar P | 77.1 | 76.9 |

| 15-Mar | UM Current Conditions | Mar P | N/A | 79.4 |

| 15-Mar | UM Expectations | Mar P | N/A | 75.2 |

| 15-Mar | UM 1-yr inflation | Mar P | 3.1% | 3.0% |

| 15-Mar | UM 5-10-yr inflation | Mar P | 3.0% | 2.9% |

Mark Frears is a Senior Investment Advisor, Managing Director, at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI