Not today — Week of August 12, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -0.02 | 12.96 | 21.35 | 8.05 | 14.68 | 5,344.16 |

| Dow Jones Industrial Average | -0.56 | 5.95 | 14.56 | 6.00 | 10.76 | 39,497.54 |

| Russell 2000 Small Cap | -1.32 | 3.47 | 9.83 | -1.06 | 7.99 | 2,059.52 |

| NASDAQ Composite | -0.17 | 12.01 | 23.02 | 5.08 | 17.02 | 16,745.30 |

| MSCI Europe, Australasia & Far East | -0.28 | 4.51 | 9.46 | 2.44 | 7.71 | 2,283.64 |

| MSCI Emerging Markets | 0.28 | 6.01 | 8.51 | -3.59 | 4.50 | 1,063.43 |

| Barclays U.S. Aggregate Bond Index | -0.82 | 2.36 | 6.94 | -2.16 | 0.07 | 2,213.02 |

| Merrill Lynch Intermediate Municipal | -0.37 | 0.69 | 4.32 | -0.44 | 1.00 | 317.04 |

As of market close August 9, 2024 . Returns in percent.

Investment Insights

— Steve Orr

In the eye

Four weeks ago, a very slightly weaker consumer price inflation report ramped up Wall Street demands for Fed rate cuts. The prospect of lower rates and spending on artificial intelligence not paying off anytime soon sent fast money to the exits. Selling in mega-cap tech and AI stocks ensued, along with buying in small cap stocks. Seeing the Fed teeing up rate cuts made the Bank of Japan and other central banks nervous about defending their currencies. At the end of July, the BoJ raised rates a quarter of a percent to defend the Yen. This made carry trades funded with ultra-low Yen rates like being long Mexican government debt or bitcoin suddenly less attractive.

The Japan rate hike accelerated the selling, culminating in last Monday’s 3% drop for the S&P 500 and 3.4% for the NASDAQ. Reassuring statements by Japanese officials that they wouldn’t make that mistake again touched off 2% jumps higher later in the week. By the time we were ready to watch the closing ceremonies, stocks had endured their two most volatile days in two years. A 3% drop followed by a 2% rise is not that impressive in typical market movements. Coming after three weeks of selling and new bricks in the Wall Street Wall of Worry, these moves put sentiment in the toilet.

Big cap stocks are roughly 5% below their all-time highs from mid-July. A very typical consolidation in price, but not in time. The speed of the selloff was exceptional, but understandable, given that most of the trade positions were levered off of the Yen.

Remember all the selling occurred after traders grew worried about financing costs for their trades, not changes in the economy. We view this last month as a technical change in markets, not a fundamental shift in the economy. None of the recent market action in stocks or bonds justifies a Fed rate cut. Recency bias also played a part. Fed bond buying and easy financial conditions suppressed volatility, so there have been few big move days. When one does come along, it surprises investors.

Comes around.

And now, four weeks later it’s CPI inflation week again. We expect inflation readings to stay flat from June, registering 3% gains for the headline and 3.3% for the core measure versus year-ago levels. A reminder that last month’s reading was negative month over month. The Fed, however, has shifted a good deal of its attention to job growth for the moment.

This makes the weekly jobless claims and the August payrolls report, due out September 6, foremost in traders’ minds. We expect the unemployment rate will drop slightly as the effects of Beryl and Debbie are reversed in the reporting period. The job openings report is reported on September 4. Job openings will continue to hover in the mid-eight million area. Recessions have not started when job opening numbers have been this high.

Without a doubt, our economy and others are slowing from year-ago activity levels. Recession Ravens continue to come out and squawk about impending doom. The recession starts when the yield curve uninverts. The recession starts when jobless claims cross their moving average. The recession starts when the Cowboys win two playoff games. And so on. We agree doom is ahead somewhere; the business cycle has not been repealed. As Maverick said, “Maybe so Sir, but not today.”

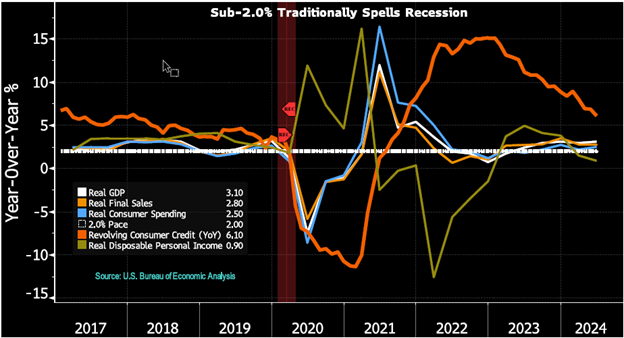

The late Richard Yamarone left us a reliable warning system. He identified three “real” series in the GDP data that, taken together, can signal a recession is developing up to a year away. The three are a mouthful, but remember, economists came up with the names. Real in this context means subtracting inflation from the nominal data. Real Final Sales to Domestic Purchasers, Real Disposable Personal Income and Revolving Consumer Credit are the heart of his analysis. We threw in Consumer Spending and GDP as a guide. As long as the three are above 2%, the economy is ticking along in at least first gear. Fall below that 2% threshold, and a recession could start in the next year. Note that these data series are based on actual transactions by businesses and consumers, not securities markets. Graphically:

Try to ignore the noise in the middle of the chart created by the shutdowns. The orange consumer credit line shows consumers are not borrowing as much for big purchases. This fits with rising recent delinquency data. When folks are falling behind on card payments, they either delay purchases or find some other means of obtaining credit. Real Disposable Income growth fell below the 2% in the first quarter of this year. This suggests that inflation continues to eat into purchasing power for consumers. For now, the other series are comfortably above the 2% “concern” line.

More please

Earnings season wraps this week. More than 90% of the S&P 500 have reported and earnings growth has topped 10% over last year’s second quarter. Nice to beat analyst expectations if even by just a little. Only about half of the members are reporting top-line revenue growth. This suggests a chunk of the earnings gains are coming from holding down expenses, layoffs or delayed hiring. That sort of income statement gamesmanship cannot continue for too long. It is likely a response to the inventory build we saw in the second quarter GDP numbers. Rising inventory from a lack of new orders would spur cost-cutting. Home Depot and Walmart report this week and will give us clues as to the consumer’s health and whether those lines up above will stay above 2%. John Deere rides the reporting caboose for Industrial names on Thursday.

Wrap-Up

Our second gear economy is about the best in the developed world at the moment. More on that next week. Key for investors is that this chop period is not over. The excitement has been washed out of AI. Rates and stocks have moved too far to the downside versus fundamentals.

These chop periods rarely rebound straight up. We would plan on retesting the lows over coming weeks. There will be more opportunities to put funds to work. Until then, patience is actually a virtue.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI